Two mega-trends are driving down branded pharmaceutical sales in the U.S.: switches from branded to generic prescription drug products for major chronic conditions; and, the lack of new-new branded Rx products that (could) command higher prices.

Two mega-trends are driving down branded pharmaceutical sales in the U.S.: switches from branded to generic prescription drug products for major chronic conditions; and, the lack of new-new branded Rx products that (could) command higher prices.

A down-market picture emerges from The Use of Medicines in the United States: Review of 2010, based on market data analyzed by the IMS Institute for Healthcare Informatics (IMS). While U.S. market growth for pharma overall ranges from 3% to 5%, IMS says, protected Rx brands were negatively impacted through the switch to cheaper generic substitutes. Generics now comprise 78% of pharma market share.

The key sentence in the report that underlies this dark snapshot is: “The number of patients starting treatment for a chronic therapy was down 3.4Mn from 2009 levels, and increasingly these patients are starting therapy with a generic drug.”

A second key point is that generics capture 80% of a brand’s volume within 6 months of market entry.

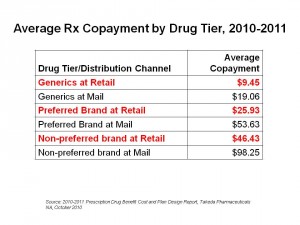

What’s driving generics are both the available supply of them in big therapeutic categories, along with managed care plans (public and private sector) creating incentives for patients to make the switch from brand to the cheaper alternative. Larger co-payment spreads ‘nudge’ health consumers to pay lower prices at the point-of-purchase, or via mail order, which benefits payors who sponsor drug benefit programs saving them money — but drains the coffers of pharma industry CFOs sitting on the patent cliff.

A key example is Plavix, now worth $5 to $6 billion to BMS. That drug will be available in generic form in 2012. Even if BMS has a new-new product in the pipeline this or next year, it won’t be able to replace the $5 bn hole left by Plavix.

Health Populi’s Hot Points: As the chart shows, co-pay tiers are wider between preferred and non-preferred brands, with generics at the lowest tier. This financial incentive is a key driver for market adoption of generics, which are now well-accepted among most consumers as much as store-labels for consumer products have also been embraced by the post-recession consumer.

Health Populi’s Hot Points: As the chart shows, co-pay tiers are wider between preferred and non-preferred brands, with generics at the lowest tier. This financial incentive is a key driver for market adoption of generics, which are now well-accepted among most consumers as much as store-labels for consumer products have also been embraced by the post-recession consumer.

Value-based purchasing is the paradigm that suppliers to the U.S. health marketplace must adopt. If a product that’s cheaper can perform as well as, or nearly as well as, one that’s much more expensive at the margin, then payors will design strategies that motivate users to choose them. In a health environment that’s entering the new comparative effectiveness era, suppliers will need to attend to another aspect beyond price and efficacy — that is, cost-effectiveness. This value proposition goes beyond price itself. For example, a novel delivery mechanism or app that helps patients be more compliant on a therapeutic regimen could bolster a patient’s health outcome compared with an existing product. If the company collects data that demonstrates this improvement, then an argument could be made to persuade payors to adopt the new product into a formulary at a favorable co-pay tier.

Pharma, life science, medical device and other suppliers in the health value chain will be operating in this environment soon (in life science R&D forecast terms). Companies in the space will need to develop new muscles (competencies) to play in that world, along with a more service-oriented and “whole health” culture.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.