How Ahold-Delhaize Connects the Grocery, Climate Change, ESG and Consumers’ Health

In the food sector, “the opportunity for us and the role that we play is to connect climate and health,” Daniella Vega of Ahold Delhaize told Valerio Baselli during the Morningstar Sustainable Investing Summit 2023. In a conversation discussing the importance of non-financial metrics in companies’ ESG efforts, Vega connected the dots between climate change, retail grocery, and consumers’ health and well-being. Vega is the Global Senior Vice President, Health & Sustainability, with Ahold Delhaize— one of the largest food retail companies in the world. Based in the Netherlands, the company operates mainly in

Post-Pandemic, U.S. Healthcare is Entering a “Provide More Care For Less” Era – Pondering PwC’s 2022 Forecast

In the COVID-19 pandemic, health care spending in the U.S. increased by a relatively low 6.0% in 2020. This year, medical cost trend will rise by 7.0%, expected to decline a bit in 2022 according to the annual study from PwC Health Research Institute, Medical Cost Trend: Behind the Numbers 2022. What’s “behind these numbers” are factors that will increase medical spending (the “inflators” in PwC speak) and the “deflators” that lower costs. Looking around the future corner, the inflators are expected to be: A COVID-19 “hangover,” leading to increased health care services utilization Preparations for the next pandemic, and

Value-Based Health Care Needs All Stakeholders at the Table – Especially the Patient

2021 is the 20th anniversary of the University of Michigan Center for Value-Based Insurance Design (V-BID). On March 10th, V-BID held its annual Summit, celebrating the Center’s 20 years of innovation and scholarship. The Center is led by Dr. Mark Fendrick, and has an active and innovative advisory board. [Note: I may be biased as a University of Michigan graduate of both the School of Public Health and Rackham School of Graduate Studies in Economics]. Some of the most important areas of the Center’s impact include initiatives addressing low-value care, waste in U.S. health care, patient assistance programs, Medicare

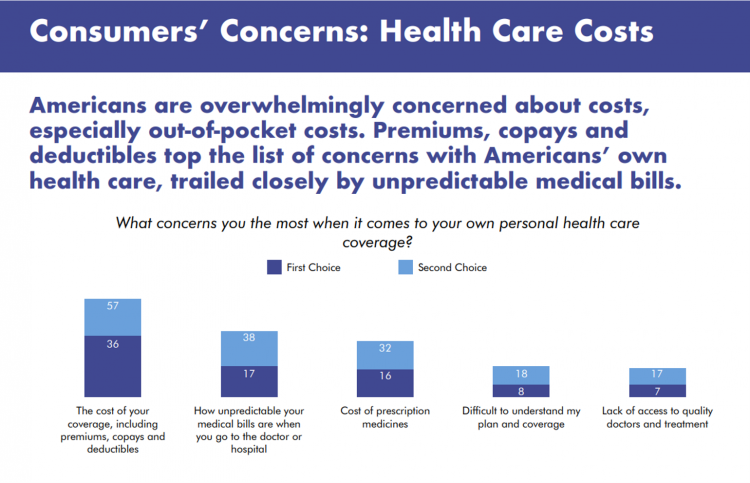

The Economics of the Pandemic Put Costs at the Top of Americans’ Health Reform Priorities

A major side-effect of the coronavirus pandemic in 2020 was its impact on the national U.S. economy, jobs, and peoples’ household finances — in particular, medical spending. In 2021, patients-as-health-consumers seek lower health care and prescription drug costs coupled with higher quality care, discovered by the patient advocacy coalition, Consumers for Quality Care. This broad-spanning patient coalition includes the AIMED Alliance, Autism Speaks, the Black AIDS Institute, Black Women’s Health Initiative, Center Forward, Consumer Action. Fair Foundation, First Focus, Global Liver Institute, Hydrocephalus Association, LULAC, MANA (a Latina advocacy organization), Myositis Association, National Consumers League, National Health IT Collaborative, National Hispanic

Voting for Health in 2020

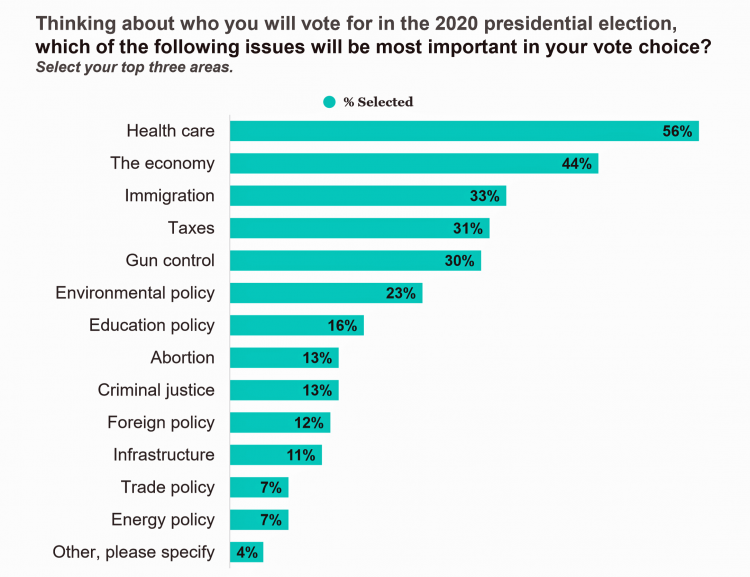

In the 2018 mid-term elections, U.S. voters were driven to polls with health care on their minds. The key issues for health care voters were costs (for care and prescription drugs) and access (read: protecting pre-existing conditions and expanding Medicaid). Issue #2 for 2018 voters was the economy. In 2020, as voting commences in-person tomorrow on 3rd November, U.S. voters have lives and livelihoods on their minds. It’s the pandemic – our physical lives looming largest in the polls – coupled with our fiscal and financial lives. Health is translating across all definitions for U.S. voters in November 2020: for

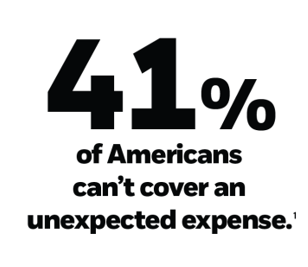

Saving Money as a Financial Vaccine: BlackRock Finds Consumer Savings Drain and Etsy Sellers Not Saving Much

“Americans are feeling incredible financial pressure as a result of the COVID outbreak,” John Thompson, Chief Program Officer with the Financial Health Network. One in three people in the U.S. has skipped or stopped paying a bill, and over half of Americans have used emergency savings, according to a survey from the BlackRock Emergency Savings Initiative (ESI). BlackRock, the investment firm, allocated $50 million in February 2019 to form the ESI, focused on helping people with lower incomes to bolster savings and financial health. BlackRock partners in the ESI with the Financial Health Network, CommonWealth, the Center for Advanced Hindsight Common

Will Trade Data for (Cheaper) Health Care – USC’s View of the Future

Patients are now front-line payors in the U.S. health care system. As such, American health consumers are wrestling with sticker shock from surgical procedures, surprise medical bills weeks after leaving the hospital, and the cost of prescription drugs — whether six-figure oncology therapies or essential medicines like insulin and EpiPens. To manage personal health finances, patients-as-payors are increasingly willing to face trade-offs and change personal behaviors to lower health care costs, based on research in The Future of Health Care Study from USC’s Center for the Digital Future. The Center analyzed the perspectives of 1,000 U.S. adults in August 2019 regarding

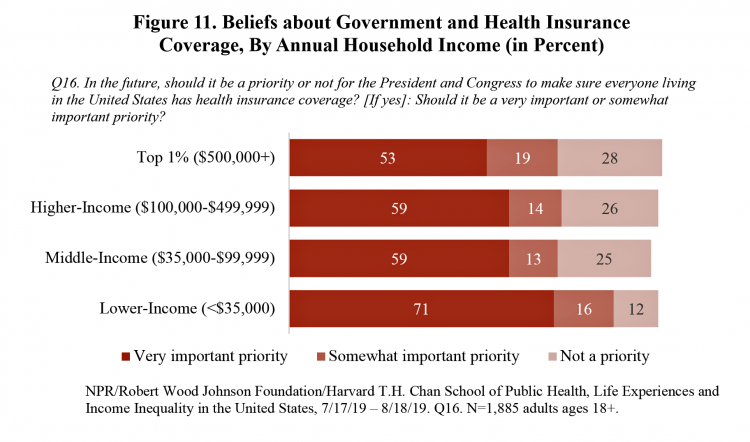

Most Americans Regardless of Income Say It’s Unfair for Wealthier People to Get Better Health Care

In America, earning lower or middle incomes is a risk factor for having trouble accessing health care and/or paying for it. But most Americans, rich or not, believe that it’s unfair for wealthier people to get better health care, according to a January 2020 poll from NPR, the Robert Wood Johnson Foundation and Harvard Chan School of Public Health, Life Experiences and Income Equality in the United States. The survey was conducted in July and August 2019 among 1,885 U.S. adults 18 or older. Throughout the study, note the four annual household income categories gauged in the research: Top 1%

Out-of-Pocket and Prescription Drug Costs – Connecting Digital Health Dots at CES 2020

The top two health care concerns facing Americans are out-of-pocket costs and prescriptions drug costs, according to a poll published today in Morning Consult. Apropos to my title of this post, the survey was sponsored by the Bipartisan Policy Center, whose mission is to promote, cross-party affiliations, “health, security and opportunity for all Americans.” Health care is the top issue driving voters’ choices in the 2020 elections for most Americans. The economy follows second with 44% of voters, then immigration with 33% of Americans keen on the issue. For overall healthcare reform, the plurality of Americans prefer improving the current system

The Internet of Teeth – The Growth of Oral Health at CES 2020

The presence of health and medicine is growing at CES, the annual conference of all-things-tech for consumers. At this week’s Show in Las Vegas, we see that the Internet of Healthy Things (a phrase coined by Dr. Joe Kvedar) has taken hold and gone mainstream in remote health monitoring, wearable tech, and heart rate tracking which is now embedded (and expected by health-seeking consumers) in wristbands. An expanding category in the Internet of Healthy Things is oral care. Let’s call this the Internet of Teeth, yet another riff on “IoT.” Of course, oral health goes well beyond teeth and toothbrushes.

Despite Greater Digital Health Engagement, Americans Have Worse Health and Financial Outcomes Than Other Nations’ Health Citizens

The idea of health care consumerism isn’t just an American discussion, Deloitte points out in its 2019 global survey of healthcare consumers report, A consumer-centered future of health. The driving forces shaping health and health care around the world are re-shaping health care financing and delivery around the world, and especially considering the growing role of patients in self-care — in terms of financing, clinical decision making and care-flows. With that said, Americans tend to be more healthcare-engaged than peer patients in Australia, Canada, Denmark, Germany, the Netherlands, Singapore, and the United Kingdom, Deloitte’s poll found. Some of the key behaviors

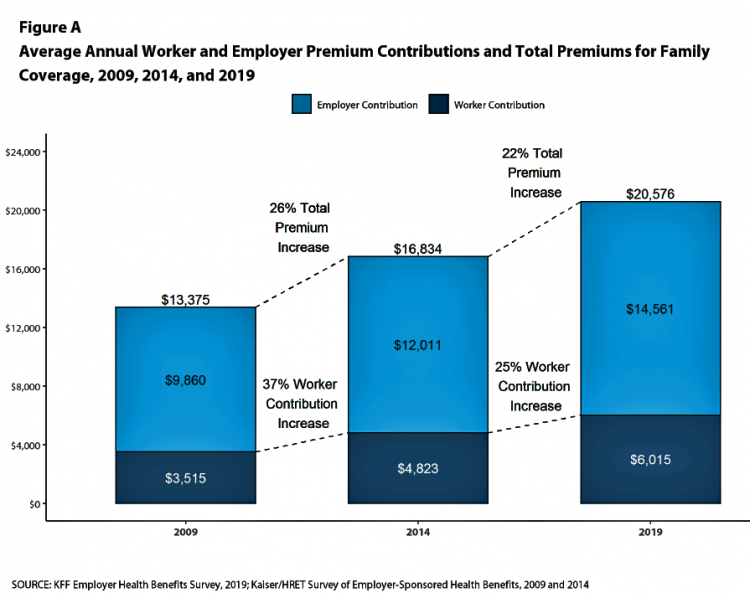

“It’s the Deductible, Stupid” – Health Premiums Reach $20,576 in 2019 for a Family

Here’s the latest arithmetic on American workers’ financial trade-off of wages for health care insurance coverage: in the ten years since 2009, family premiums have risen 54% and workers’ contribution to health care spending grew 71%. Wages? They rose 26%, and general price inflation by 20%, according to the Kaiser Family Foundation survey on employer-sponsored benefits for 2019 released yesterday. Survey details for this 21st annual encyclopedia on employer-sponsored health care are published in Health Affairs October 2019 issue in a paper titled, Health Benefits in 2019: Premiums Inch Higher, Employers Respond to Federal Policy. Because this

When Life and Health Insurance Blur: John Hancock, Behavioral Economics, and Wearable Tech

Most consumers look to every industry sector to help them engage with their health. And those companies include the insurance industry and financial services firms, we found in the 2010 Edelman Health Engagement Barometer. John Hancock, which covers about 10 million consumers across a range of products, is changing their business model for life insurance. Here’s the press release, titled, “John Hancock Leaves Traditional Life Insurance Model Behind to Incentivize Longer, Healthier Lives.” “We fundamentally believe life insurers should care about how long and well their customers live. With this decision, we are proud to become the only U.S. life insurance

Self-Care is Healthcare for Everyday People

Patients are the new healthcare payors, and as such, taking on the role of health consumers. In fact, health and wellness consumers have existed since a person purchased the first toothpaste, aspirin, heating pad, and moisturizing cream at retail. Or consulted with their neighborhood herbalista, homeopathic practitioner, therapeutic masseuse, or skin aesthetician. Today, the health and wellness consumer can DIY all of these things at home through a huge array of products available in pharmacies, supermarkets, Big Box stores, cosmetic superstores, convenience and dollar stores, and other retail channels – increasingly, online (THINK, of course, of Amazon — more on

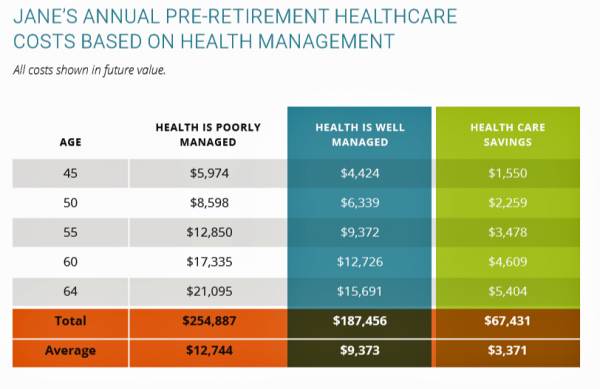

How Taking Care of Your Health Boosts Savings Accounts

It will cost about $275,000 for a couple retiring in the U.S. this year to cover their healthcare costs for the rest of their life in retirement, Fidelity estimated. But Americans are notoriously pretty undisciplined about saving money, compared with peers living in other developed countries. How to address this challenge? Show people what improving their personal health can do to boost their 401(k) plans. This tactic is discussed in Health & Retirement Savings: Leveraging Healthcare Costs to Drive 401(k) Contributions & Improve Health, from HealthyCapital, a joint venture of Mercy health systems and HealthView Services. The chart illustrates three

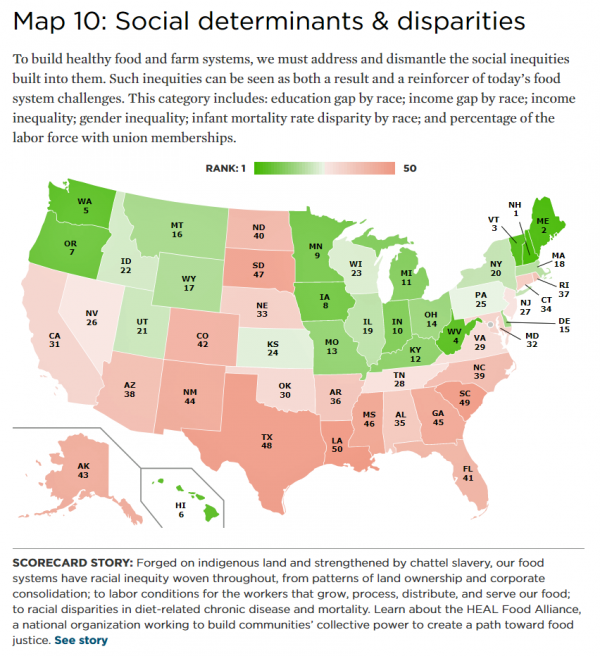

The Social Determinants of Food for Health, Farms, and the Economy

America’s agricultural roots go deep, from the native Patuxet tribe that shared maize with Mayflower settling Pilgrims in southern New England, to biodynamic and organic winemakers in Sonoma County, California, operating today. In 2016, 21.4 million full- and part-time jobs were related to agriculture and food sectors, about 11% of total U.S. employment. Farming is an integral part of a nation’s food system, so the Union of Concerned Scientists developed the 50-State Food System Scorecard to gauge the state of farming and food in the U.S. on several dimensions: diet and health outcomes, farming as an industry and economic engine,

Tweets at Lunch with Paul Krugman – Health IT Meets Economics

I greatly appreciated the opportunity today to attend a luncheon at the HX360 meeting which convened as part of the 2018 HIMSS Conference. The speaker at this event was Paul Krugman, who won the Nobel Prize for Economics 10 years ago and today is an iconic op-ed columnist at the New York Times And Distinguished Professor of Economics at the City University of New York (CUNY). I admit to being a bit of a groupie for Paul Krugman’s work. It tickles me to look at Rise Global’s list of the Top 100 Influential Economists:

Amazon’s Health Care Building Blocks

In the past few weeks, two announcements from Amazon point to a strategy, whether intended or my dot-connecting, that the ecommerce leader has the health of its customers in its sights. In late May, CNBC first published the news that Amazon was seeking out a candidate to be a general manager for a pharmacy business. Here’s the video telling the story. Getting into the retail pharmacy channel is in itself a huge message to this health industry segment, which is very competitive between chain pharmacies (led by CVS, Walgreens, and Rite-Aid), grocery pharmacies (the largest of which are Kroger and

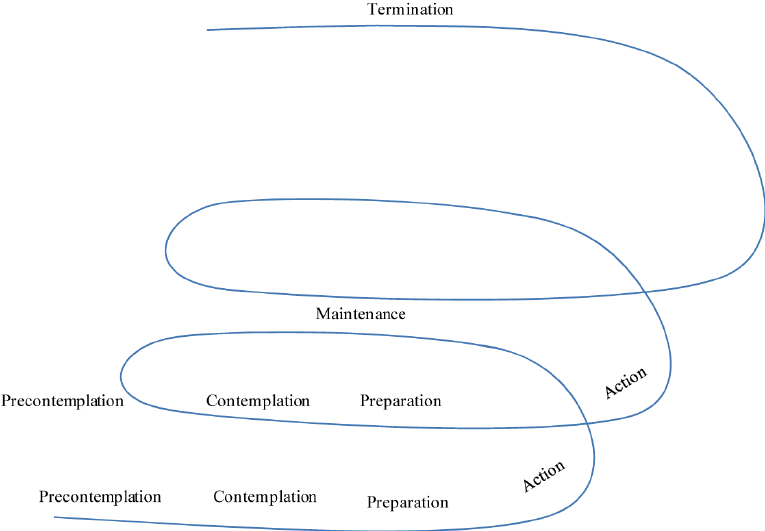

Learning Health Behavior Change From the Guru Prochaska

For us mere humans, behavior change is hard. Changing health behaviors is really tough. Enter Dr. James Prochaska, who has been at the forefront of researching and understanding human and health behavior for several decades. He’s the father of the Transtheoretical Model of Behavior Change (TTM). I have the honor today to listen live to Dr. Prochaska’s talk at the Health Integrated EMPOWER conference in St. Petersburg, Florida, where I’ll be addressing attendees on the new health consumer tomorrow. “Empower,” indeed. Dr. Prochaska is all about how people have good intentions to make good health decisions, but we all slip and

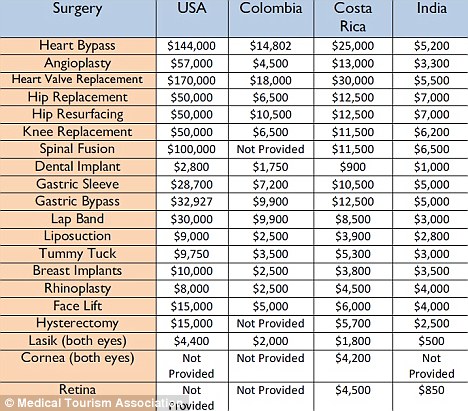

The Reshaping Medical Tourism Market: More US Patients Seek Lower-Priced Care Overseas

More U.S. patients are faced with spending more out-of-pocket for health care services, to meet high-deductible health plans and rationally spend their health savings account investments. As rational economic men and women, some are seeking care outside of the United States where many find transparently priced, high-value, lower-cost healthcare. Check out the table from the Medical Tourism Association, and you can empathize with cash-paying patients looking for, say, gastric bypass surgery or a heart valve replacement. My latest column in the Huffington Post discussed this trend, which points first to the Cleveland Clinic — a top-tier American healthcare brand that’s

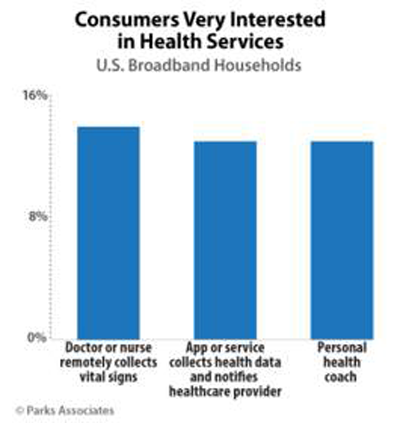

Consumers Show Low Demand For Connected Health, Parks Finds

People living in only 1 in 10 homes with broadband are “very interested” in connected health services, like a personal health coach, a remote health monitoring app that connects to and notifies a healthcare provider, or a clinician collecting vital signs virtually. This finding comes out of a survey from Parks Associates. This is a relatively low consumer demand statistic for digital health, compared with many other surveys we’ve mined here on Health Populi. While these are not apples-to-apples comparisons — note that Parks Associates focus on broadband households — a recent study to consider is Accenture’s consumer research published in March

Prescriptions for Food: the New Medicine

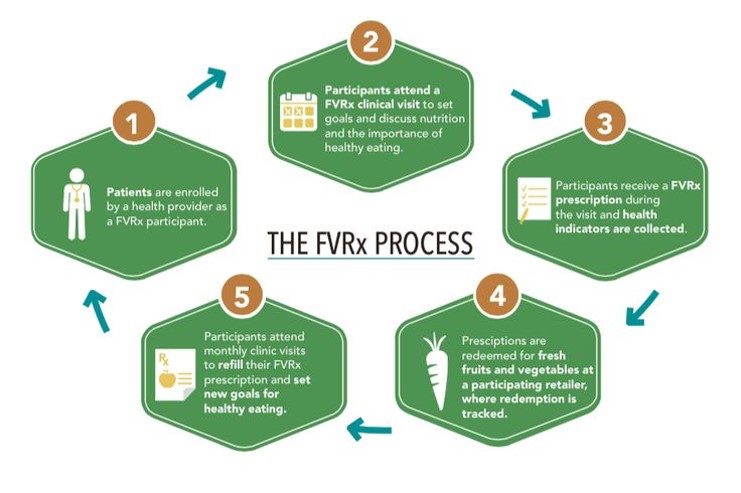

Hippocrates is often quoted as saying, “Let food be thy medicine and medicine be thy food.” While some researchers argue that Hippocrates knew the difference between ‘real’ medicine and clinical therapy, there’s no doubt he appreciated the social determinant of health and wellness that food was 1,000 years ago and continues to be today. Taking a page, or prescription note, from the good doctor’s Rx pad, food retailers, healthcare providers, local food banks, and State healthcare programs are working the food-as-medicine connection to bolster public health. One approach to food-as-medicine is promoting the purchase of fresh fruits and vegetables — the

Behavioral Economics in Motion: UnitedHealthcare and Qualcomm

What do you get when one of the largest health insurance companies supports the development of a medical-grade activity tracker, enables data to flow through a HIPAA-compliant cloud, and nudges consumers to use the app by baking behavioral economics into the program? You get Motion from UnitedHealthcare, working with Qualcomm Life’s 2net cloud platform, a program announced today during the 2016 HIMSS conference. What’s most salient about this announcement in the context of HIMSS — a technology convention — is that these partners recognize the critical reality that for consumers and their healthcare, it’s not about the technology. It’s about

From Pedometers to Premiums in Swiss Health Insurance

A Switzerland-based health insurance company is piloting how members’ activity tracking could play a role in setting premiums. The insurer, CSS, is one of the largest health insurance companies in the country and received a “most trusted general health insurance” brand award in 2015 from Reader’s Digest in Switzerland. The company is conducting the pilot, called the MyStep project, with volunteers from the Federal Institute of Technology in Zurich and the Unviersity of St. Gallen. According to an article on the program published in the Swiss newspaper The Local, “the pilot aims to discover to what extend insured people are

The Internet of Things in Health: McKinsey Sees $1.6 T Value

‘Tis the summer of big, smart reports covering the Internet of Things (IoT) impact on health and fitness. Just this month, three of these missives have come to my inbox, and they all contribute sound thinking about the topic. Today, tomorrow and Friday, I’ll cover each of these here in Health Populi. We begin with McKinsey Global Institute’s The Internet of Things: Mapping the Value Beyond the Hype. [In full disclosure, I was an outside adviser to the MGI team members who focused on the human/health and fitness aspects of this report, and thank MGI for the opportunity to provide

The Consumer in the New Health Economy: Out-of-Pocket

The costs of healthcare in the U.S. have trended upward since 2000, with a slowdown in cost growth between 2009 to 2013 due to the impact of the Great Recession. That’s no surprise. What stands out in the new U.S. News & World Report Health Care Index is that people covered by private health insurance through employers are bearing more health care costs while publicly-covered insureds (in Medicare and Medicaid) are not. Blame it on the fast-growth of high-deductible health plans, the Index finds, resulting in what U.S. News coins as a “massive increase in consumer cost.” U.S. News &

John Hancock flips the life insurance policy with wellness and data

When you think about life insurance, images of actuaries churning numbers to construct mortality tables may come to mind. Mortality tables show peoples’ life expectancy based on various demographic characteristics. John Hancock is flipping the idea life insurance to shift it a bit in favor of “life” itself. The company is teaming with Vitality, a long-time provider of wellness tools programs, to create insurance products that incorporate discounts for healthy living. The programs also require people to share their data with the companies to quality for the discounts, which the project’s press release says could amount to $25,000 over the

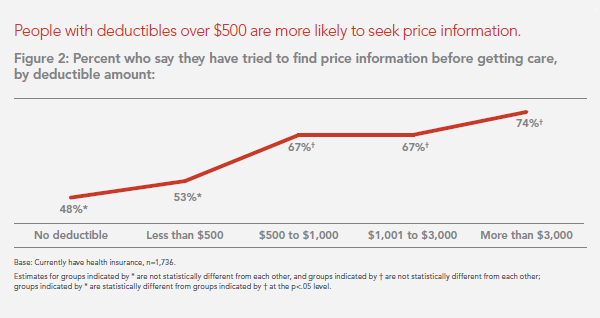

Transparency in health care: not all consumers want to look

Financial wellness is integral to overall health. And the proliferation of high-deductible health plans for people covered by both public insurance exchanges as well as employer-sponsored commercial (private sector) plans, personal financial angst is a growing fact-of-life, -health, and -healthcare. Ask any hospital Chief Financial Officer or physician practice manager, and s/he will tell you that “revenue cycle management” and patient financial medical literacy are top challenges to the business. For pharma and biotech companies launching new-new specialty drugs (read: “high-cost”), communicating the value of those products to users — clinician prescribers and patients — is Job #1 (or #2,

Value is in the eye of the shopper for health insurance

While shopping is a life sport, and even therapeutic for some, there’s one product that’s not universally attracting shoppers: health insurance. McKinsey’s Center for U.S. Health System Reform studied people who were qualified to go health insurance shopping for plans in 2015, covered by the Affordable Care Act. McKinsey’s consumer research identified six segments of health insurance plan shoppers — and non-shoppers — including 4 cohorts of insured and 2 of uninsured people. The insureds include: Newly-insured people, who didn’t enroll in health plans in 2014 but did so in 2015 Renewers, who purchased health insurance in both 2014 and

Most people want to go digital for health – especially the un-well

2 in 3 people in the U.S. would use a mobile app to manage their health, especially for diet and nutrition, medication reminders, tracking symptoms, and recording physical activity. The fifth annual Pulse of Online Health survey from Makovsky finds that digital health is blurring into peoples’ everyday lives. We’ve covered previous Makovsky digital health surveys here on Health Populi; last year, we focused on consumers managing risk in digital health platforms, and in 2013, the state of seeking health information online. That most consumers would go beyond health information search to the more engaging pursuit of managing health over

Physicians and mobile health – moving from “mobile” to simply “care”

February may be American Heart Month, African-American History Month, and Marfan Syndrome Awareness Month. But based on the volume of studies and reports published in the past two weeks, ’tis also the season for talking mobile health and doctors. This Health Populi post trend-weaves the findings. The big picture for mobile in health is captured by Citrix in its Mobile Analytics Report, dated February 2015. Everyday people are using mobile in work and daily living, blurring the distinctions between the various hats people wear. These roles, whether business or pleasure or life, happen 24×7, enabling through mobile platforms, Citrix found.

Health care costs still top financial problems for Americans

“Health care spending grows at lowest-ever rate,” USA Today celebrated in their December 3, 2014 headline. The announcement was drawn from national health spending data gleaned from an annual report from the Centers for Medicare and Medicare Services (CMS), which tallied U.S. health spending at $2.9 trillion. From the bird’s-eye view, slowing healthcare cost growth is indeed good news. But from the point-of-view of consumers’ own pockets, health care costs are rising. And, a survey published today by Gallup points to this reality: that people in American say the most important financial problem they face is healthcare costs, tied for first place

People in consumer-directed health plans are — surprise! — getting more consumer-directed

People with more financial skin in the health care game are more likely to act more cost-consciously, according to the latest Employee Benefits Research Institute (EBRI) poll on health engagement, Findings from the 2014 EBRI/Greenwald & Associates Consumer Engagement in Health Care Survey published in December 2014. Health benefit consultants introduced consumer-directed health plans, assuming that health plan members would instantly morph in to health care consumers, seeking out information about health services and self-advocating for right-priced and right-sized health services. However, this wasn’t the case in the early era of CDHPs. Information about the cost and quality of health care services was scant,

Irrational exuberance in mobile health? Live from the mHealth Summit 2014

Mobile and digital technologies will bend the health care cost curve, drive individual and population health, and solve the nagging challenge of health disparities. Mobile and digital technologies will increase costs to health providers, disrupt work flows and lower clinicians’ productivity, and hit a market bubble. Depending on your lens into mHealth, and what product categories and user segments you’re looking at, all of the above can be true. The plenary session of the 2014 mHeath Summit kicked off with Dr. Harry Leider, Chief Medical Information Officer of Walgreens, who spoke of the pharmacy’s evolving role across the entire continuum of care,

Live from the 11th annual Connected Health Symposium – Keeping Telehealth Real

Dr. Joseph Kvedar has led the Center for Connected Health for as long as I’ve used the word “telehealth” in my work – over 20 years. After two decades, the Center and other pioneers in connected health have evidence proving the benefits, ROI (“hard” in terms of dollars, and “soft” in terms of patient and physician satisfaction), and technology efficacy for connecting health. The 11th Annual Connected Health Symposium is taking place as I write this post at the Seaport Hotel in Boston, bringing health providers, payers, plans and researchers together to share best practices, learnings and evidence supporting the

Rationing health care, driven by high deductibles

Concerns about Death Panels and government restricting health services for people that have been key arguments used against the Affordable Care Act’s (ACA) detractors and, even before the advent of the ACA, proposed health reforms under President Clinton. But it’s peoples’ self-rationing in the U.S. health system that’s causing true rationing — driven by high deductible health plans (HDHPs) that are fast-growing in the health insurance market, and by the high cost of specialty drugs and prescriptions. There are plenty of data demonstrating the consumer health rationing trend being collected and reviewed by think tanks like RAND here, and by The

Health-wear – at Health 2.0, health met fashion, function and care

Wearables met health and medicine at the 8th annual Health 2.0 Conference in Santa Clara, CA, last week. I had the real pleasure of shepherding a wearables panel of five innovators during the conference, in a well-attended session followed by an energetic Q&A. The organizations who demonstrated their tools and brainstormed the wearables market included, in alphabetical order, Atlas Wearables, Heartmath, MySugr, SunSprite and Withings. I hasten to add that among the five presenters, two were women: that 2 in 5 = 40% gender representation is, happily to my way of thinking about women’s roles in health-making, a very good

Health info disconnect: most people view accessing online records important, but don’t perceive the need to do so

There’s a health information disconnect among U.S. adults: most people believe online access to their personal health information is important, but three-quarters of people who were offered access to their health data and didn’t do so didn’t perceive the need to. The first two graphs illustrate each of these points. When people do access their online health records, they use their information for a variety of reasons, including monitoring their health (73%), sharing their information with family or care providers (44%), or downloading the data to a mobile device or computer (39%). In this context, note that 1 in 3

Health economics in the exam room: doctors and patients discussing the costs of health care

A new conversation has begun between doctors and patients: talking about money and health care, and what treatments cost — specifically, what a particular treatment will cost a patient, out-of-pocket. Over a dozen physician professional societies are proponents of these discussions, and are providing support to doctors in their networks. Doctors already engaging in the topic of the cost of care with patients aren’t being altruistic about spending this precious time in the already-time-constrained patient encounter: these discussions are increasingly relevant to physicians’ financial outcomes. I’ll be addressing this new feature in the doctor’s office at the upcoming Point-of-Care conference,

We are all self-insured until we get sick – especially if we are women

During my conversation with a prominent pharma industry analyst yesterday, he observed, “As a consumer, you are self-insured until you get sick.” My brain then flashed back to a graph from the 2013 Employer Health Benefits Survey conducted annually by the Kaiser Family Foundation (KFF). The chart is shown here. It illustrates the upward line indicating that in 2013, 4 in 5 workers were enrolled in a health plan that included an annual deductible. That’s the “self-insurance” part of the observation my astute conversationalist noted. Simply put, when you are enrolled in a high-deductible health plan, You, The Consumer, are responsible for

The Season of Healthcare Transparency – Consumer Payments and Tools, Part 4

“The surge in HDHP enrollment is causing patients to become consumers of healthcare,” begins a report documenting the rise of patients making more payments to health providers. Patients’ payments to providers have increased 72% since 2011. And, 78% of providers mail paper statements to patients to collect what they’re owed. “HDHPs” are high-deductible health plans, the growing thing in health insurance for consumers now faced with paying for health care first out-of-pocket before their health plan coverage kicks in. And those health consumers’ expectations for convenience in payment methods is causing dissatisfaction, negatively affecting these individuals and their health providers’

The Season of Healthcare Transparency – Shopping in a World of High Cost and High Variability – Part 2

Yesterday kicked off this week in Health Populi, focusing on the growing role of transparency in health care in America. Today’s post discusses the results from Change Healthcare’s latest Healthcare Transparency Index report, based on data from the fourth quarter of 2013, published in May 2014. Charges for health services — dental, medical and pharmacy – varied by more than 300% in Q42013 — even within a single health network. Change Healthcare found this, based on their national data on 7 million health-covered lives. The company analyzed over 180 million medical claims. The company built the Healthcare Transparency Index (HCTI)

The Season of Healthcare Transparency – HFMA’s Price Transparency Manifesto – Part 1

As Big Payors continue to shift more costs onto health consumers in the U.S., the importance of and need for transparency grows. 39% of large employers offered consumer-directed health plans (CDHPs) in 2013, and by 2016, 64% of large employers plan to offer CDHPs. These plans require members to pay first-dollar, out-of-pocket, to reach the agreed deductible, and at the same time manage a health savings account (HSA). In the past several weeks, many reports have published on the subject and several tools to promote consumer engagement in health finance have made announcements. This week of posts provides an update on

The retailization of digital health: Consumer Electronics Association mainstreams health

The Consumer Electronics Association (CEA) has formed a new Health and Fitness Technology Division, signalling the growing-up and mainstreaming of digital health in everyday life. The CEA represents companies that design, manufacture and market goods for people who pay for stuff that plugs into electric sockets and operate on batteries — like TVs, phones, music playing and listening, kitchen appliances, electronic games, and quite prominent at the 2014 Consumer Electronics Show, e-cigarettes (rebranding “safe smoking” as “vaping” technology). In its press release announcing this news, CEA President and CEO Gary Shapiro says, “Technology innovations now offer unprecedented opportunities for consumers to

Wearable tech + the workplace: driving employee health

Employer wellness programs are growing in the U.S., bundled with consumer-directed plans and health savings accounts. A wellness company’s work with employee groups is demonstrating that workers who adopt mobile health technologies — especially “wearables” coupled with smartphone apps — helps change behavior and drive health outcomes. Results of one such program are summarized in Wearables at Work, a technical brief from Vitality, a joint venture of Humana and Discovery Ltd., published April 23, 2014. Vitality has been working in workplace wellness since 2005, first using pedometers to track workers’ workouts. In 2008, Vitality adopted the Polar heart rate monitor for

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.