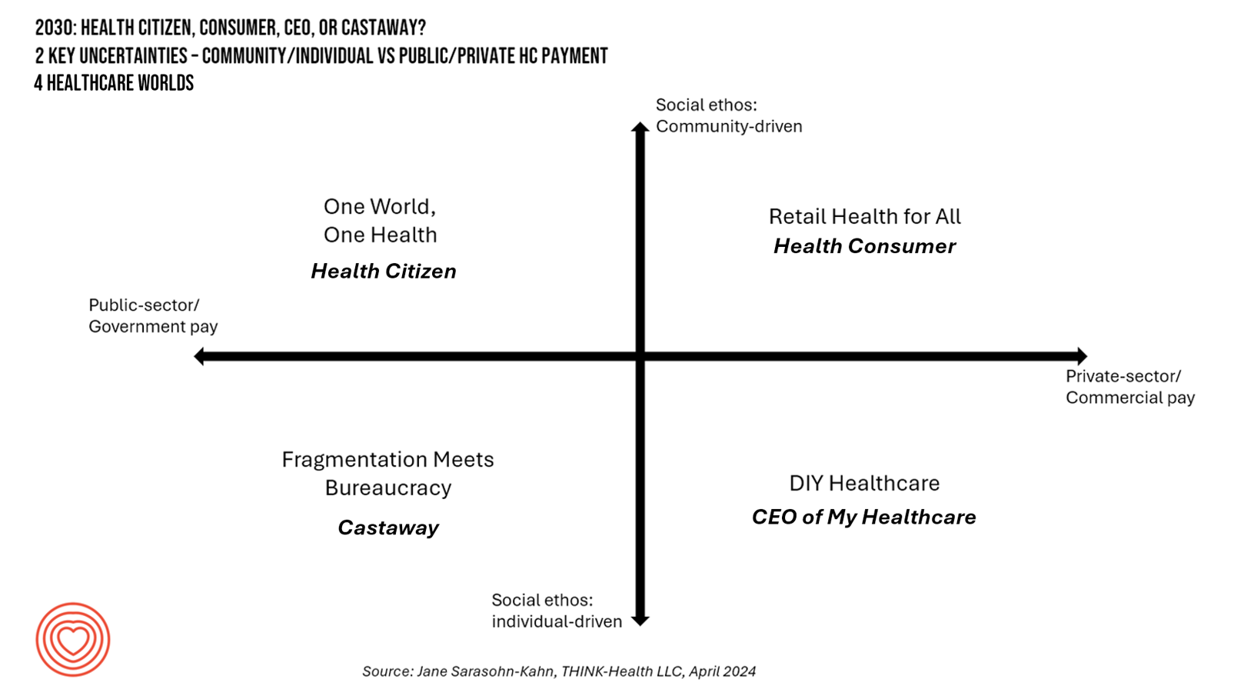

Healthcare 2030: Are We Consumers, CEOs, Health Citizens, or Castaways? 4 Scenarios On the Future of Health Care and Who We Are – Part 2

This post follows up Part 1 of a two-part series I’ve prepared in advance of the AHIP 2024 conference where I’ll be brainstorming these scenarios with a panel of folks who know their stuff in technology, health care and hospital systems, retail health, and pharmacy, among other key issues. Now, let’s dive into the four alternative futures built off of our two driving forces we discussed in Part 1. The stories: 4 future health care worlds for 2030 My goal for this post and for the AHIP panel is to brainstorm what the person’s

Healthcare 2030: Are We Consumers, CEOs, Health Citizens, or Castaways? 4 Scenarios On the Future of Health Care and Who We Are – Part 1

In the past few years, what event or innovation has had the metaphorical impact of hitting you upside the head and disrupted your best-laid plans in health care? A few such forces for me have been the COVID-19 pandemic, the emergence of Chat-GPT, and Russia’s invasion of Ukraine. That’s just three, and to be sure, there are several others that have compelled me to shift my mind-set about what I thought I knew-I-knew for my work with organizations spanning the health care ecosystem. I’m a long-time practitioner of scenario planning, thanks to the early education at the side of Ian

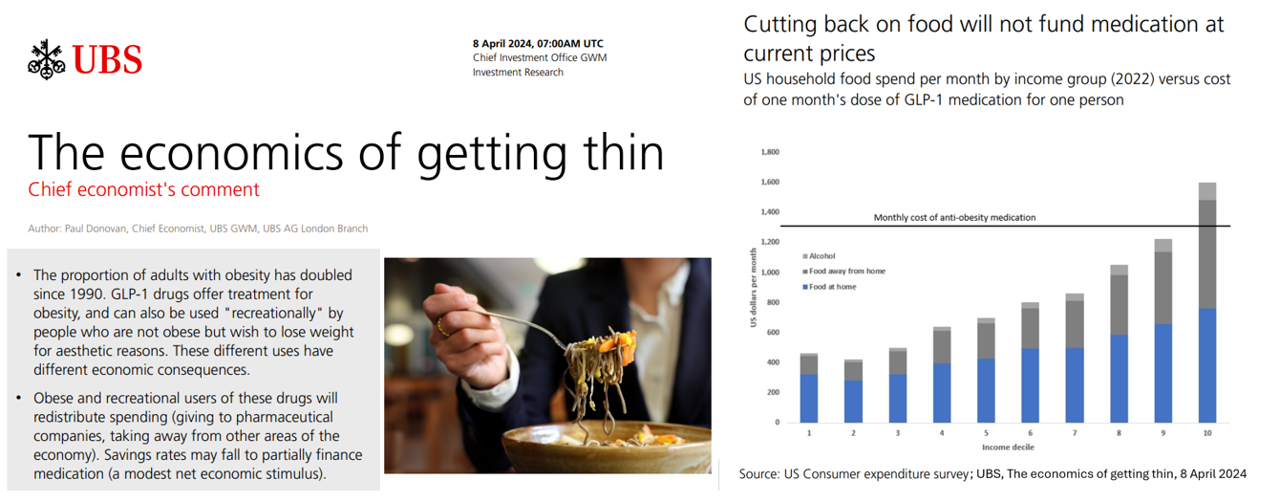

Considering Equity and Consumer Impacts of GLP-1 Drugs – A UBS Economist Weighs In

Since the introduction of GLP-1 drugs on the market, their use has split into two categories: for obesity and “recreationally,” according to the Chief Economist with UBS (formerly known as Union Bank of Switzerland). Paul Donovan, said economist, discusses The economics of getting thin in his regularly published comment blog. “These different uses have different economic consequences,” Donovan explains: Obese patients who use GLP-1s should become more productive employees, Donovan expects — less subject to prejudice, and less likely to be absent from work. While so-called recreational GLP-1 consumers may experience these

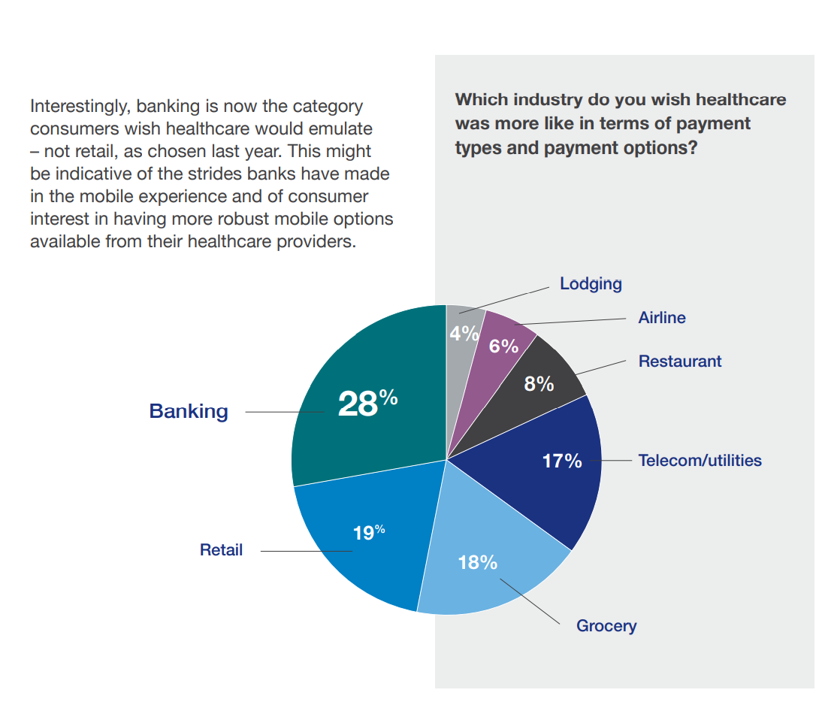

Consumers Are So Over Their Paper Chase in Health Care Payments

As we start the month of April 2024 in the U.S., it’s tax season in America with Federal (and other) income taxes due on the 15th of the month. This is also the time my research clock alarm goes off for an important annual report that describes the latest profile of the patient-as-payer in the U.S. ‘Tis the season for J.P. Morgan’s InstaMed team to analyze health care payments data, describing the experiences of consumers, providers and payers in the Trends in Healthcare Payments Fourteenth Annual Report. The overall takeaway for

The Self-Prescribing Consumer: DIY Comes to Prescriptions via GLP-1s, the OPill, and Dexcom’s CGM

Three major milestones marked March 2024 which compel us to note the growing role of patients-as-consumers — especially for self-prescribing medicines and medical devices. This wave of self-prescribed healthcare is characterized by three innovations: the Opill, GLP-1 receptor agonists, and Dexcom’s Continuous Glucose Monitoring (CGM) system that’s now available without a prescription. Together, these products reflect a shift in health care empowerment toward patients as consumers with greater autonomy over their health care when the products and services are accessible, affordable, and designed with the end-user central to the value proposition and care flows. Let’s take a look at each

Peering Into the Hidden Lives of Patients: a Manifesto from Paytient and Nonfiction

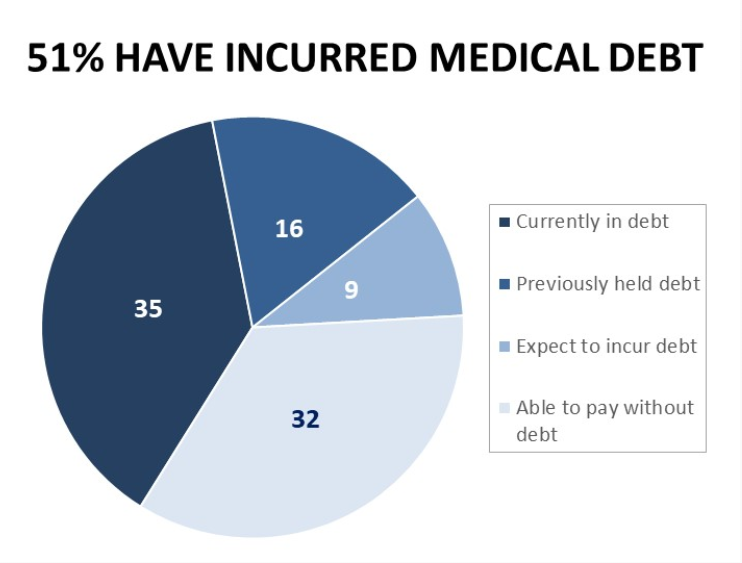

Having health insurance in America is no guarantee of actually receiving health care. It’s a case of having health insurance as “necessary but not sufficient,” as the cost of deductibles, out-of-pocket coinsurance sharing, and delaying care paint the picture of The Hidden Lives of Workplace-Insured Americans. That’s the title of a new report that captures the results of a survey conducted in January 2024 among 1,516 employed Americans who received employer-sponsored health insurance. The study was commissioned by Paytient, a health care financial services company, engaging the research firm Nonfiction to conduct the study

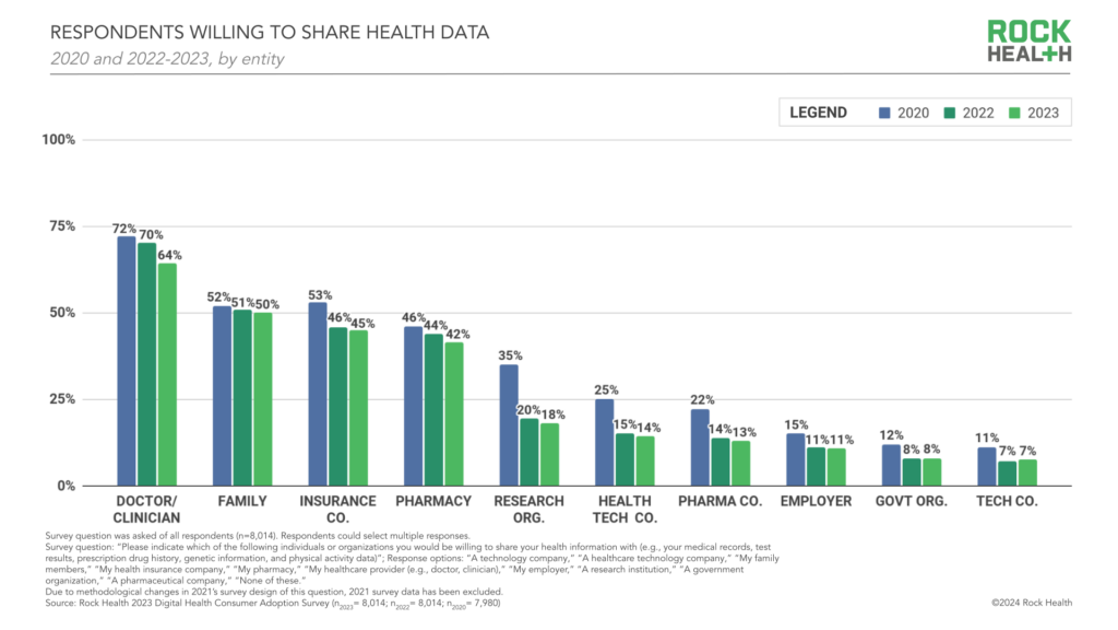

While Virtual Care is “Table Stakes” in Health Care, Consumers Are Growing More Protective About Data-Sharing

Three in four people in the U.S. have used virtual care, now, “Table-stakes…here to stay for patients and providers. However, that ubiquity comes with its own set of market pressures…shifting from pandemic-responsiveness to market- and consumer- responsiveness,” according to The new era of consumer engagement, Rock Health’s ninth annual Consumer Adoption Survey published 18 March. Convenience and waiting time are the top two reasons for choosing virtual over in-person care, Rock Health found. While virtual care is ubiquitous across the U.S. health care delivery landscape, patients-as-health care consumers are becoming more savvy and discriminating based

The Economic Contours of the Change Healthcare Cyber Attack: Taking Stock So Far

On February 22, 2024, I went to a CVS Pharmacy-Inside-Target in my community to fill a prescription for benzonatate 200 mg capsules. I had caught a bad case of the flu the week before, and subsequently suffered a very long tail of a cough. That’s TMI for me to write about in the Health Populi blog, but this story has a current-events twist: the pharmacist could not electronically link with my insurance company to transact my payment. He tried a few work-flows, and ended up using a discount card which in the moment worked for us, and I paid the

Americans Come Together in Worries About Medical Bills, the Cost of Health Care, and Prescription Drug Costs

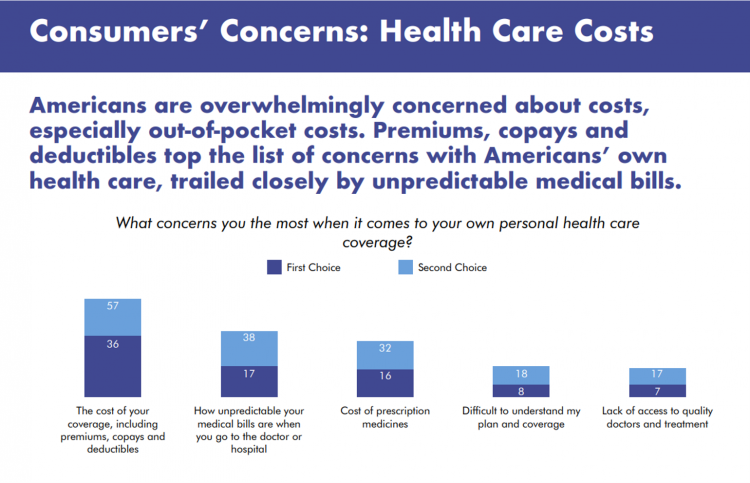

In the U.S., national news media, Federal statistics, dozens of business leaders and the Federal Reserve Bank have been talking about an historically positive American economy on a macro level. But among individual residents of the U.S., there is still a negative feeling about the economy in a personal context, revealed in the Kaiser Family Foundation Health Tracking Poll for February 2024. I’ve selected three figures of data from the KFF’s Poll which make the point that in peoples’ negative feelings about the national economy, their personal feelings about medical costs rank high

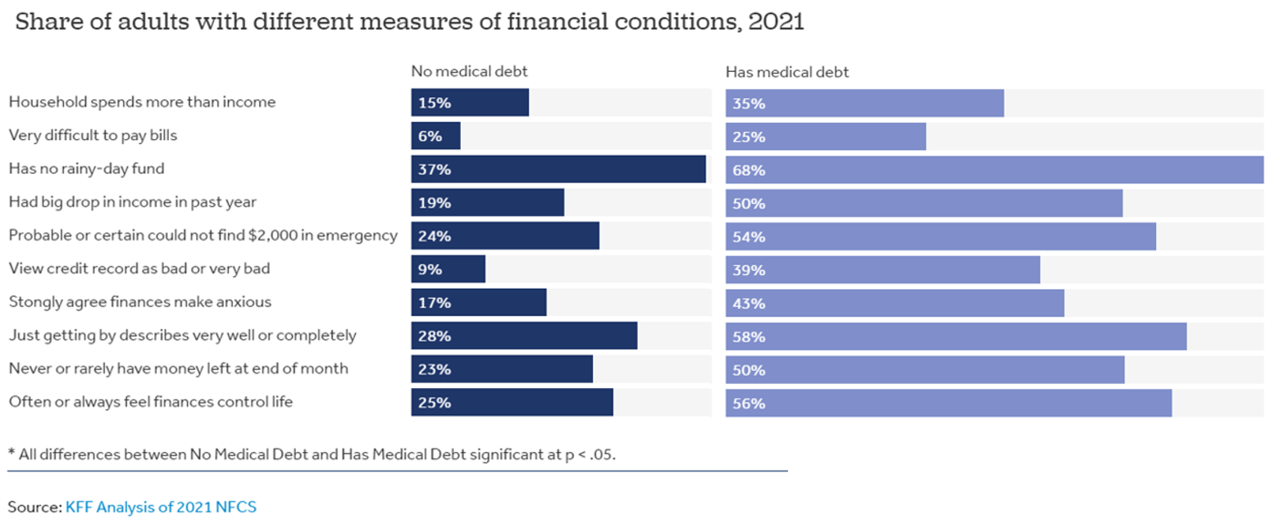

People With Medical Debt Are Much More Likely to Be in Financial Distress in America

How financially vulnerable are people with medical debt in the U.S.? Significantly more, statistically speaking, we learn from the latest survey data revealed by the National Financial Capabilities Study (NFCS) from the FINRA Foundation. The Kaiser Family Foundation and Peterson Center on Healthcare analyzed the NFCS data through a consumer health care financial lens with a focus on medical debt. Financial distress takes many forms, the first chart inventories. People with medical debt were most likely lack saving for a “rainy day” fund, feel they’re “just getting by” financially, feel their finances control their life, and

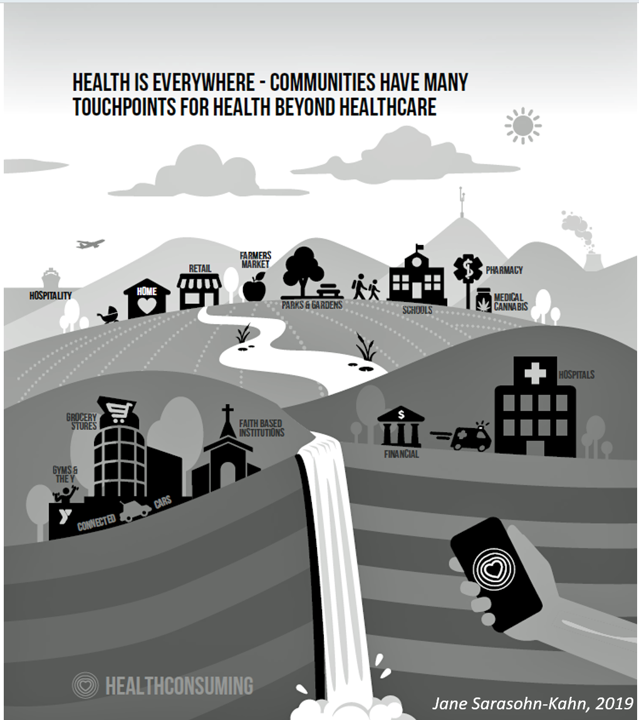

From Evolution to Innovation, from Health Care to Health: How Health Plans With Collaborators Are Re-Defining the Industry

As a constant observer and advisor across the health/care ecosystem, for me the concept of a “health plan” in the U.S. is getting fuzzier by the day. Furthermore, health plan members now see themselves as medical bill payers, seeking value and consumer-level services for their health insurance premium investment. Weaving these ideas together is my mission in preparing a session to deliver at the upcoming AHIP 2024 conference in June, I’m thinking a lot about the evolving nature of health insurance, plans, and the organizations that provide them. To help me define first principles, I turned to the American father

Why Elevance Health is “Prescribing” Phones for Members

You’ve heard of food-as-medicine and exercise-as-medicine. Now we see the emergence of telecomms-as-medicine — or more specifically, a driver of health, access, and empowerment. Elevance Health, the health plan organization serving 117 million members, launched a program to channel mobile phones and data plans into the hands of some Medicaid plan enrollees, explained in the organization’s press release on the program. To implement this program and get connectivity into consumers’ hands and homes, Elevance Health is collaborating with several telecomms companies including Verizon, AT&T, Samsung, and T-Mobile. Funding is supported by the FCC’s Affordable Connectivity Program.

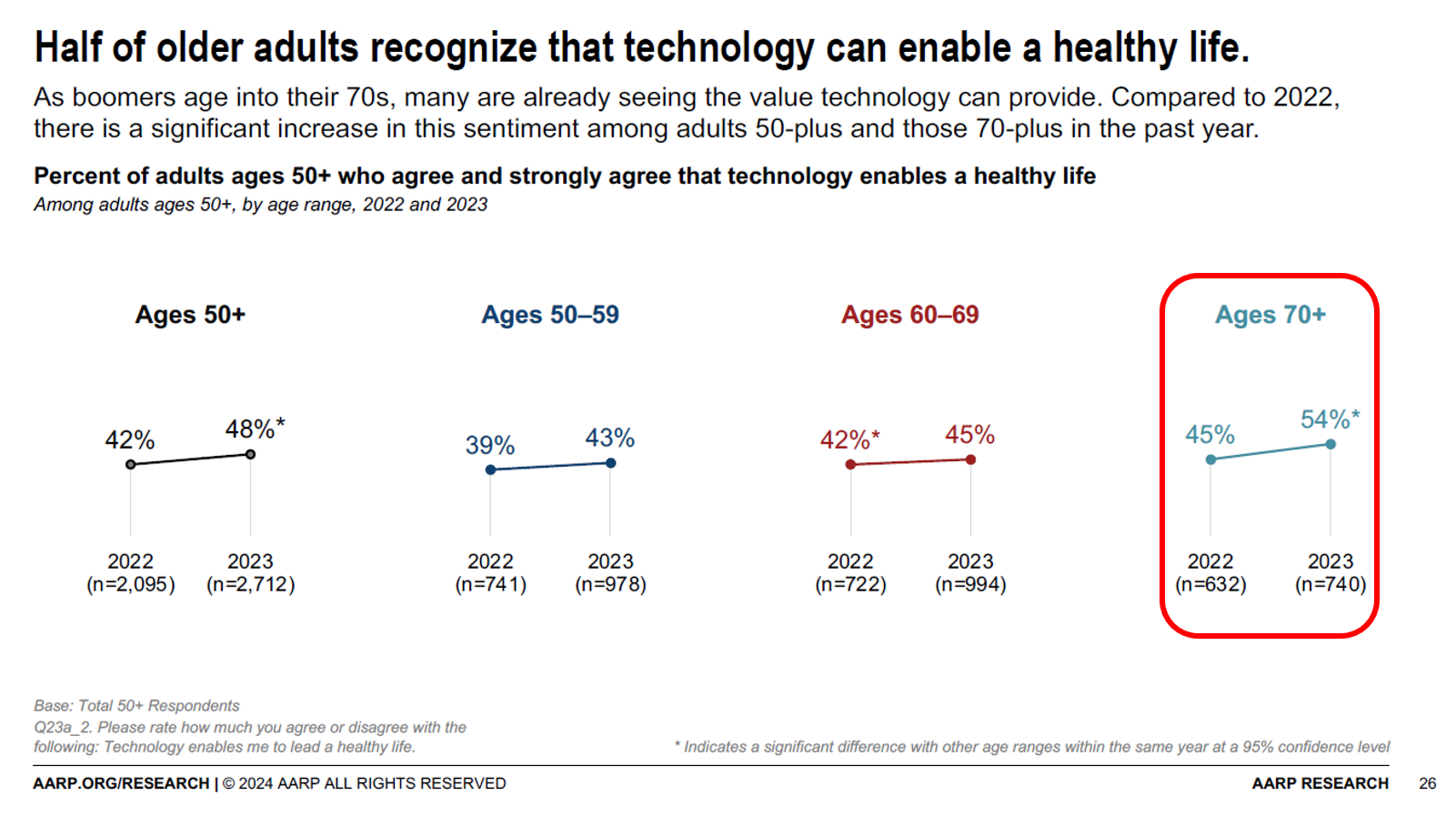

Technology Is Playing a Growing Role in Wellness and Healthy Aging – AARP’s Latest Look Into the 50+ Tech Consumer

Most people over 70 years of age recognize technology’s role in supporting peoples’ health, we learn from a new report on 2024 Tech Trends and Adults 50+ from AARP. But adoption and ongoing use of digital innovations among older people will be tempered without attending to four key barriers that carry equal weight in the minds of 50+ consumers: design and user experience, awareness and interest, cost and acquisition, and trust and privacy concerns. [Spoiler alert: in the Hot Points, below, I add a fifth consideration: health equity + dignity]. To gauge older Americans’ views on

The Health Consumer in 2024 – The Health Populi TrendCast

At the end of each year since I launched the Health Populi blog, I have put my best forecasting hat on to focus on the next year in health and health care. For this round, I’m firmly focused on the key noun in health care, which is the patient – as consumer, as Chief Health Officer of the family, as caregiver, as health citizen. As my brain does when mashing up dozens of data points for a “trendcast” such as this, I’ll start with big picture/macro on the economy to the microeconomics of health care in the family and household,

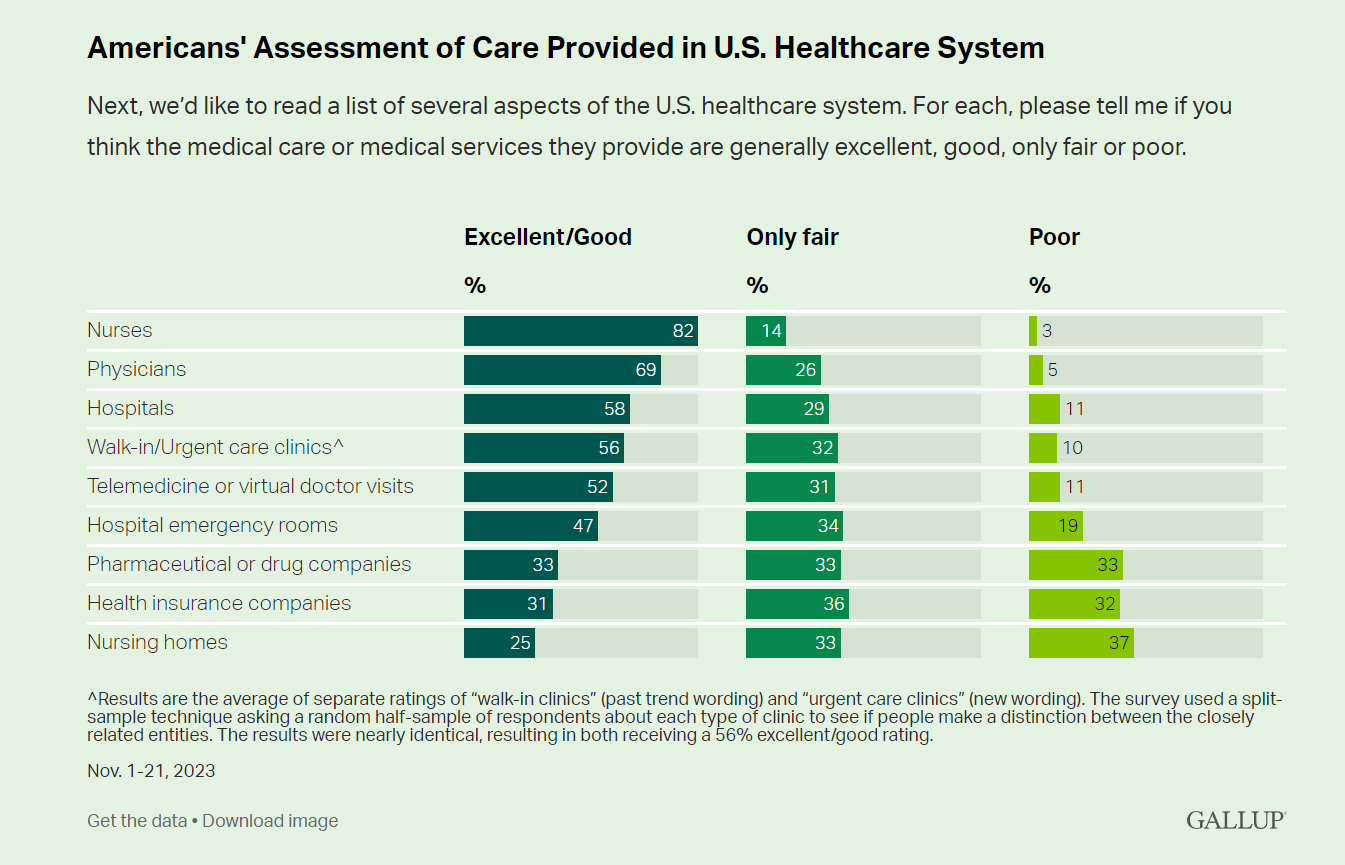

Nurses Earn Highest Grade for Care Far Above All Other Health Care Workers — Including Doctors — In Latest Gallup Poll

Nurses rank highest among various factors in the U.S. health system in the latest Gallup poll — earning a grade of “excellent” or “good” by American adults surveyed in November 2023. Further substantiation for nurses’ topping this poll of excellent care is that Gallup found historic low confidence in the U.S. health system among Americans earlier this year in a July study. Note that 8 in 10 consumers rate nurses excellent/good compared with 7 in 10 people ranking physicians this way, 6 in 10 for hospitals, 5 in 10 for telemedicine/virtual visits, and

In 2024 U.S. Consumers Will Mash Financial Resolutions With Those For Physical Health and Mental Health, Fidelity Finds

One-third of U.S. consumers feel in worse financial shape now than in 2022, with inflation a top concern, discovered in the 2024 New Year’s Financial Resolutions Study from Fidelity Investments. In this 15th annual update of Fidelity’s research into Americans’ New Year’s resolutions for financial health, we learn the mantra that 2024 will be the year of living practically, opening new chapters for saving and paying down debt. Fidelity conducted an online poll among 3,002 U.S. adults 18 and over in October 2023 to gauge peoples’ perspectives on personal finances, and well-being currently and into 2024. This

Healthcare Bills, Affordability, and Self-Rationing Care Will Continue to Challenge U.S. Health Consumers in 2024

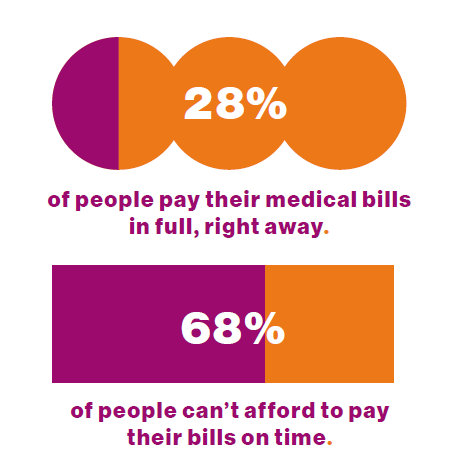

Two-thirds of U.S. consumers say they can’t afford to pay their medical bills on-time, based on the 2023 Consumer Survey from Access One, a financial services company focused on healthcare payments. The report’s title page asks the question, “What options do consumers really want for paying healthcare expenses?” The survey report responds to that question, finding out that nearly one-half of patients have taken some kind of action to reduce their medical expenses. Furthermore, one-third of consumers are not confident they could pay a medical bill of $500 or more. Access One fielded

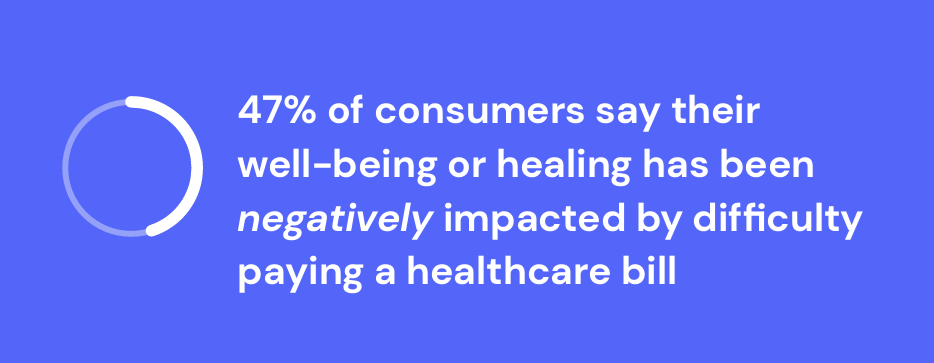

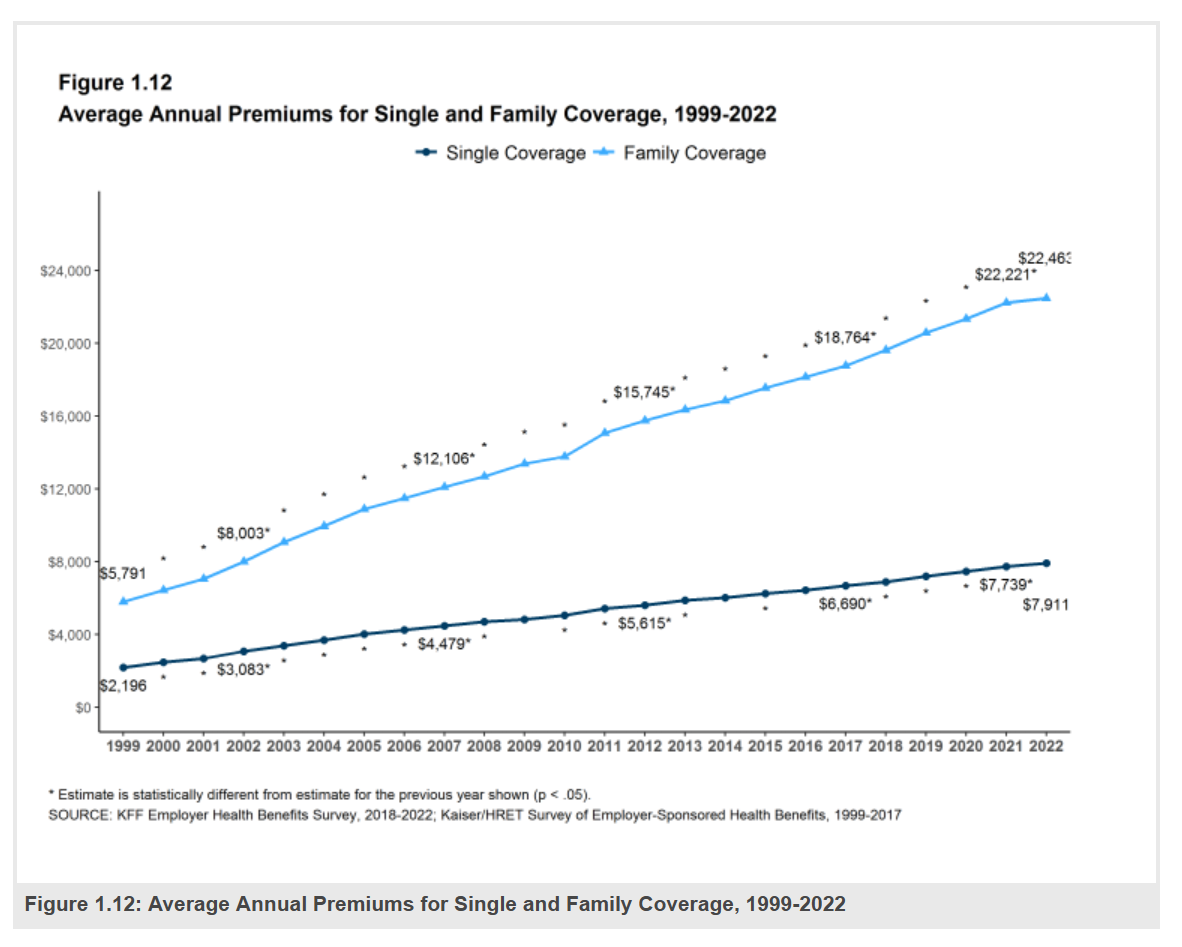

Money and Mental Health in the U.S. – How Difficulty Paying Medical Bills Can Hurt Healing and Well-Being

There is growing evidence on the connection between people’s financial health and their mental health, explored and explained in Understanding the Mental-Financial Health Connection, a study published by the Financial Health Network. Keep that relationship in mind in the context of a new forecast from Kaiser Family Foundation estimate the 2023 cost for employer-sponsored insurance for a family to reach nearly $24,000 in 2023. That cost is a 7% increase over last year, and is expected to be split with companies covering $17K (about 70%) and employees about $6600 (roughly 30%). KFF heard that

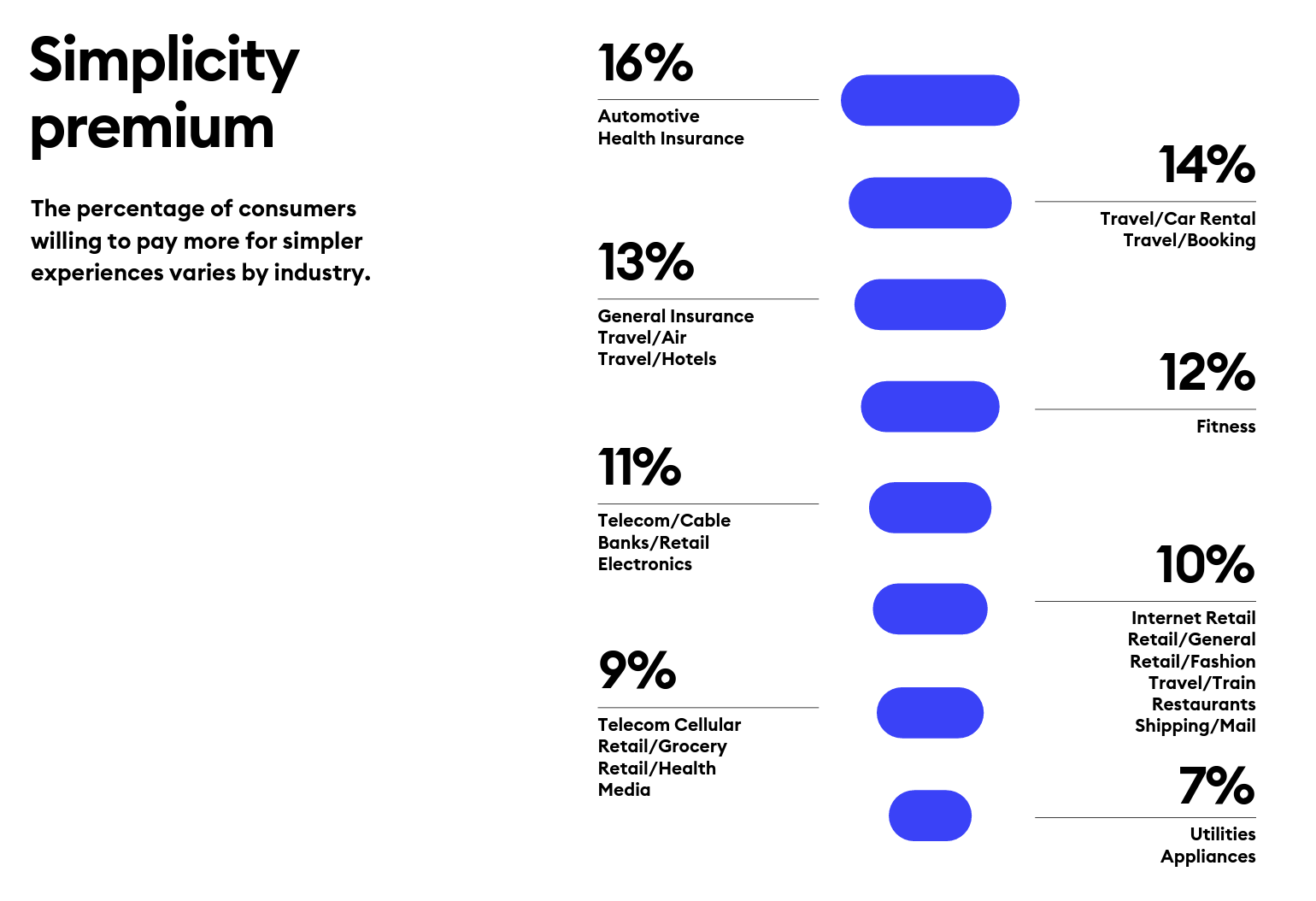

How Healthcare and Patients Can Benefit From a “Simplicity Premium”

“Simplicity is the ultimate sophistication,” Leonardo DaVinci wrote through his lens on innovation. Simplicity can be a transformational cornerstone of health/care innovation, we learn from Siegel+Gale’s report on the World’s Simplest Brands Tenth Edition (WSBX). Siegel+Gale found the most consumers are willing to pay more for simpler brand experiences and are more likely to recommend a brand for those simpler experiences, as well. Across the 15,000 consumers the firm polled globally (across nine countries), five key factors underpin peoples’ experiences with the enchantingly “simple” companies: they are, Easy to understand Transparent and honest Caring for

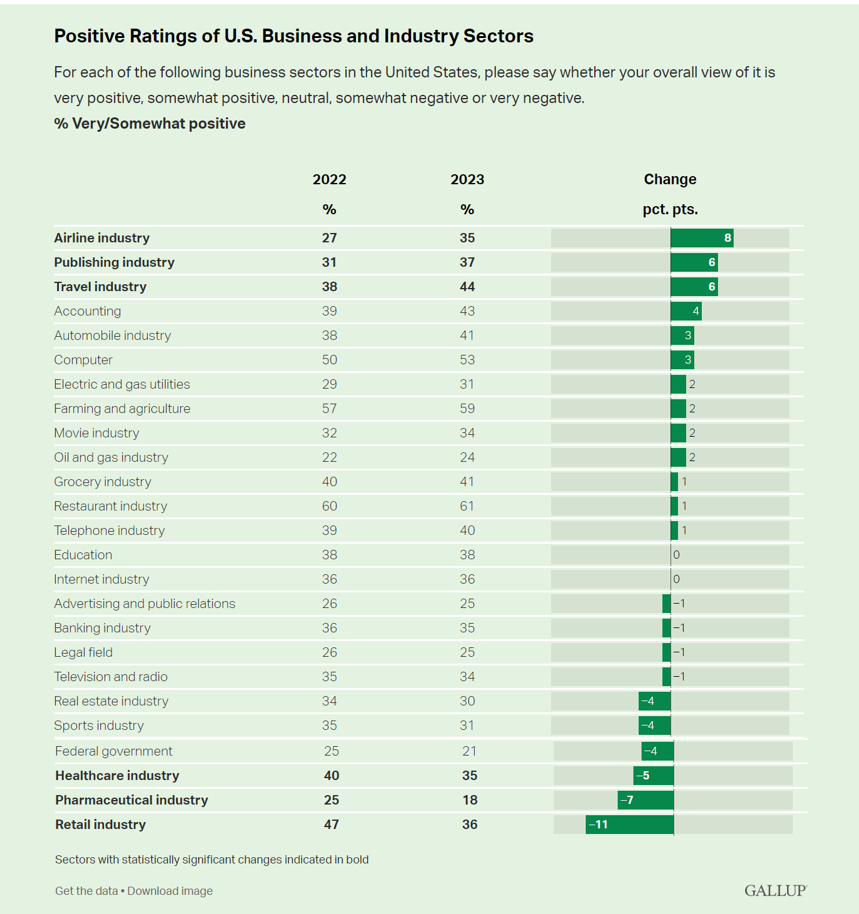

Slip Slidin’ Away: the Reputations of Pharma and Healthcare in the U.S. Decline in the Latest Gallup Poll

Oh, how quickly people forget…and slow to forgive. U.S. consumers’ positive views for healthcare, pharma and retail have significantly fallen in just one year, the latest annual Gallup poll of industry rankings in America found as of August 2023. This stat for the pharma industry was the lowest Gallup ever recorded for the sector since 2001. I can’t help hearing Paul Simon’s lyrics to Slip Slidin’ Away….”you know the nearer your destination, the more you’re slip slidin’ away” when it comes to health citizens’ perceptions of pharma and the healthcare

Personalizing Health Means Personalizing Health Insurance for Patient-Members – Learning from HealthEdge

As patients assume more financial skin in their personal healthcare, they take on the role of demanding consumer, or “impatient patients.” HealthEdge’s latest research into health consumers’ perspectives finds peoples’ satisfaction with their health insurance plans lacking, with members seeking easier access their personal health information, high levels of service, and rewards for healthy behaviors. Health plans would also boost consumers’ satisfaction by channeling patients’ access to the kinds of medical providers that align with consumers’ preferences and personal values, and by personalizing information to steer people toward lower-cost care.

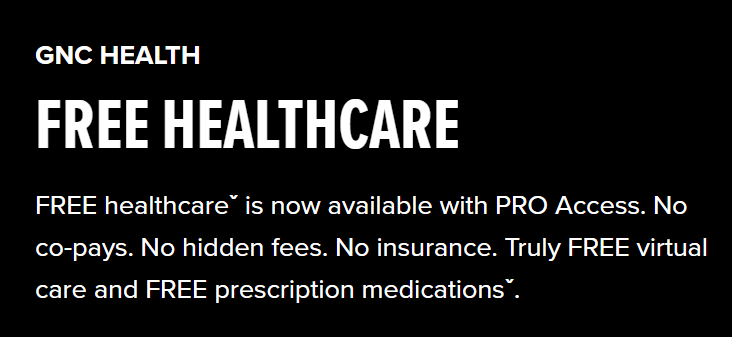

GNC Offers “Free Healthcare” — Telehealth, Generic Meds, and Loyalty in the Retail Health Ecosystem

The retail health landscape continues to grow, now with GNC Health offering a new program featuring telehealth and “curated set” of 40+ generic prescription drugs commonly used in urgent care settings. The services are available to members of GNC’s new-and-improved loyalty program, GNC PRO Access, which is priced at a fixed fee of $39.99 for one year’s membership. This is available to consumers 18 years of age and older. “As a trusted brand in the health and wellness space, we are thrilled to expand our efforts in helping our customers Live Well by offering

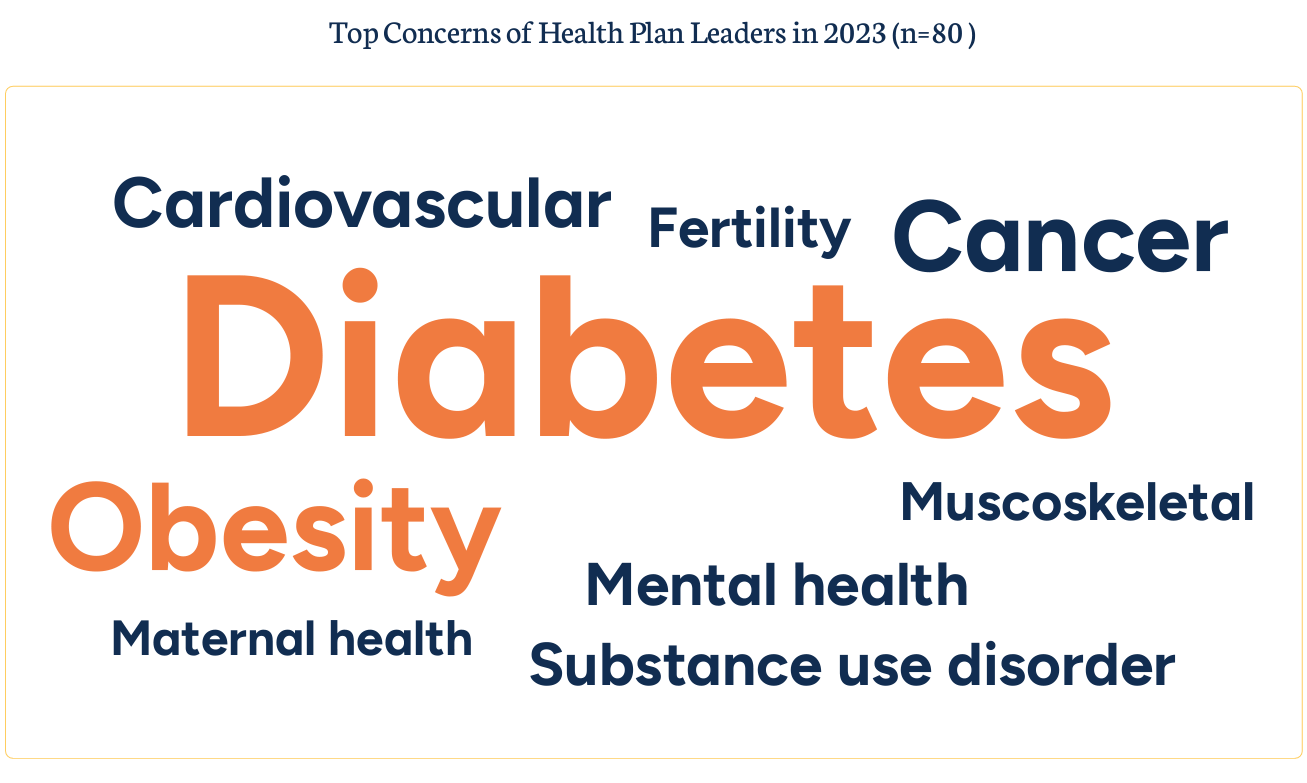

To Avert a GLP-1 Cost Tsunami, Add Lifestyle Interventions: Learning from Virta Health

With consumer and prescriber interest in GLP-1 receptor agonist drugs “soaring,” health plan managers have a new source of financial stress and clinical questions on their to-do list. A team of Virta Health leaders held a webinar on 13th July 2023 to explain the results of a study the company just completed assessing health plan execs’ current views on Ozempic and other GLP-1 medicines with a view on both clinical outcomes and cost implications for this growing category of drugs that address diabetes and obesity. Indeed, diabetes and obesity are top health concerns among the

Patients, Nurses and Doctors Blame Health Insurers for Increasing Costs and Barriers to Care

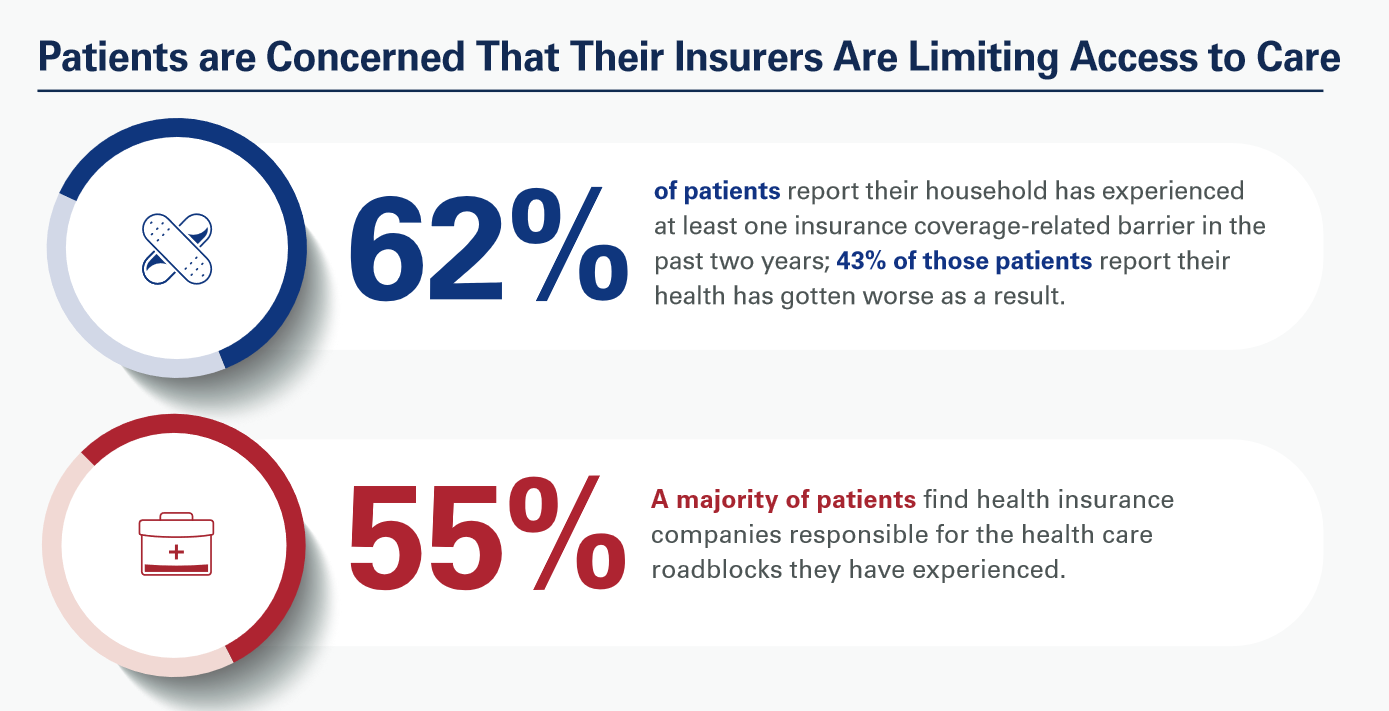

Most patients, nurses and doctors believe that health insurance plans reduce access to health care which contributes to clinician burnout and increases costs, based on three surveys conducted by Morning Consult for the American Hospital Association (AHA). Most patients have experienced at least one health insurance related barrier in the past two years, and 4 in 10 of those people said their health got worse as a result of that care-barrier. “These surveys bear out what we’ve heard for years — certain insurance companies’ policies and practices are reducing health care access and making

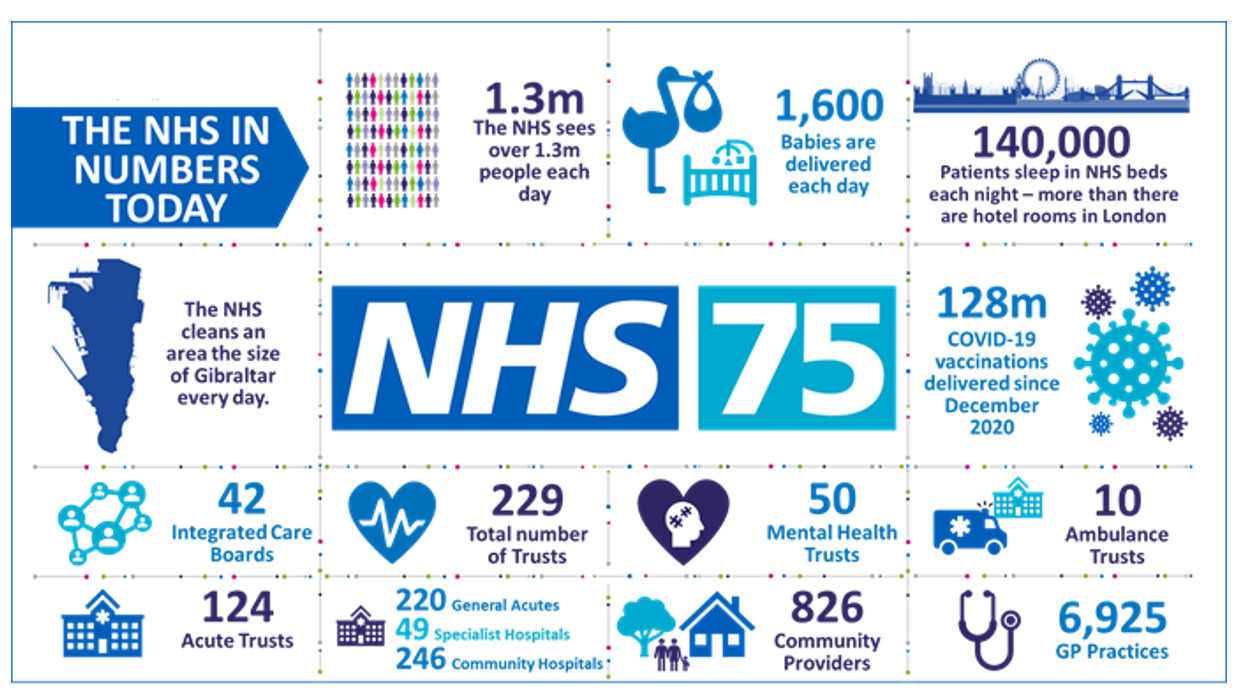

Happy 75th Birthday, NHS – Through A U.S. Health Care Lens

The UK’s National Health Service (NHS) turns 75 today. The NHS was the brainchild of Minister of Health Aneurin Bevan; he wrote in a statement to doctors and nurses in The Lancet on July 3, 1948, “My job is to give you all the facilities, resources, apparatus and help I can, and then to leave you alone as professional men and women to use your skill and judgement without hindrance.” This week in The Lancet, the editors assert, “The founding principles of the NHS put into practice 75 years ago are at risk of

The Cost of Treating Patients is On the Rise: PwC Goes What’s Behind the 2024 Medical Spending Numbers

Health care cost trend will spike up another percentage point to 7.0% in 2024, according to the annual report from the PwC Health Research Institute, Medical cost trend: Behind the numbers 2024. Every year, the PwC HRI team goes behind those numbers to assess cost inflators and deflators which underpin annual medical inflation. As the first line chart illustrates, the peak of medical trend in the last 18 years was in 2007 when the U.S. saw double-digit cost growth of nearly 12%. Here’s a link to PwC’s 2007 study looking behind the

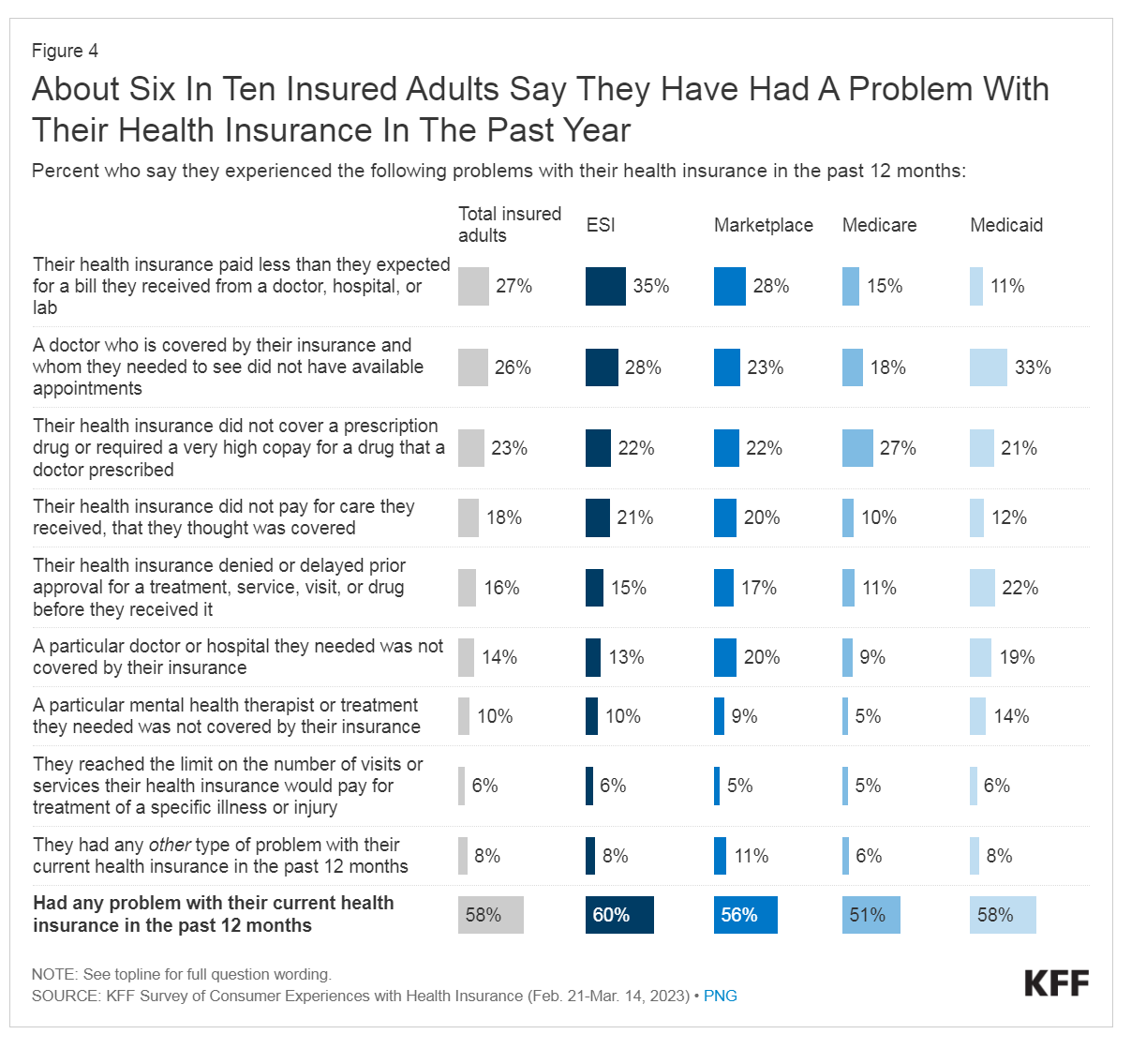

The Latest KFF Poll on Consumer Experiences with Health Insurance Speaks Volumes About Patients’ Administrative Burden

People love being health-insured, but their negative experiences with health plans create serious burdens on patients-as-consumers. And those burdens impact even more people who are unwell than healthier folks. The 2023 Kaiser Family Foundation Survey of Consumer Experiences with Health Insurance updates our understanding of and empathy for insured peoples’ Patient Administrative Burdens (PAB). For this study, KFF polled 3,605 U.S. adults 18 and over in February and March 2023 who had health insurance across different plan types. Over the past several years, I’ve come to appreciate the concept of PAB by listening to and learning from colleagues Dr, Grace

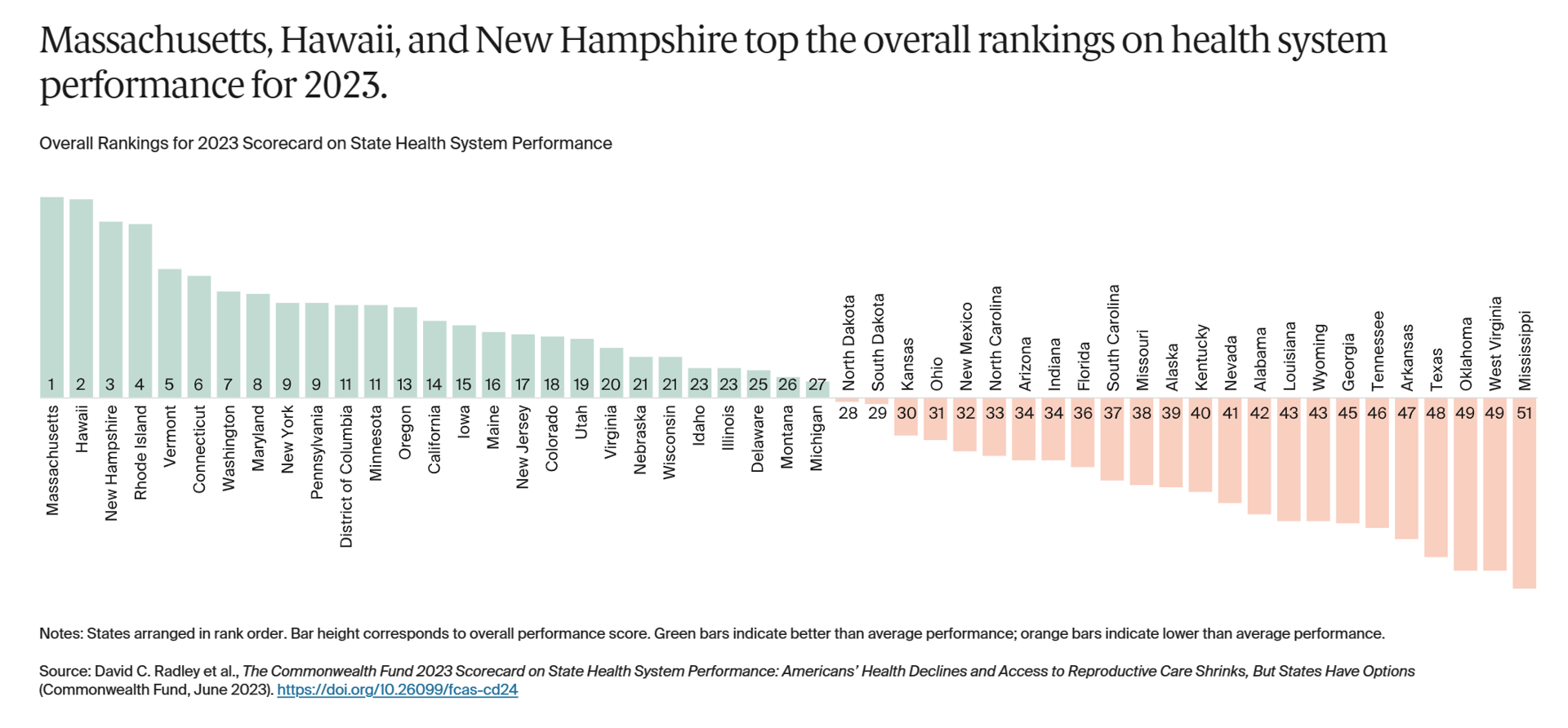

The State of Healthcare in America, State-By-State

If you live in Massachusetts, Hawaii, and New Hampshire, you win a kind of state lottery for public health and well-being, based on this year’s read of the 2023 Scorecard on State Health System Performance from The Commonwealth Fund. Here’s a picture of the annual study’s top-line findings, a roster of the fifty U.S. states ranked by a mash-up of health system indicators. As Annie Burkey of FierceHealthcare succinctly summed it up, the “Commonwealth Fund gives healthcare in southeastern states failing grades across the board.” I’ll give you more details about the Top and Bottom

Patients-As-Health Care Payers Define What a Digital Front Door Looks Like

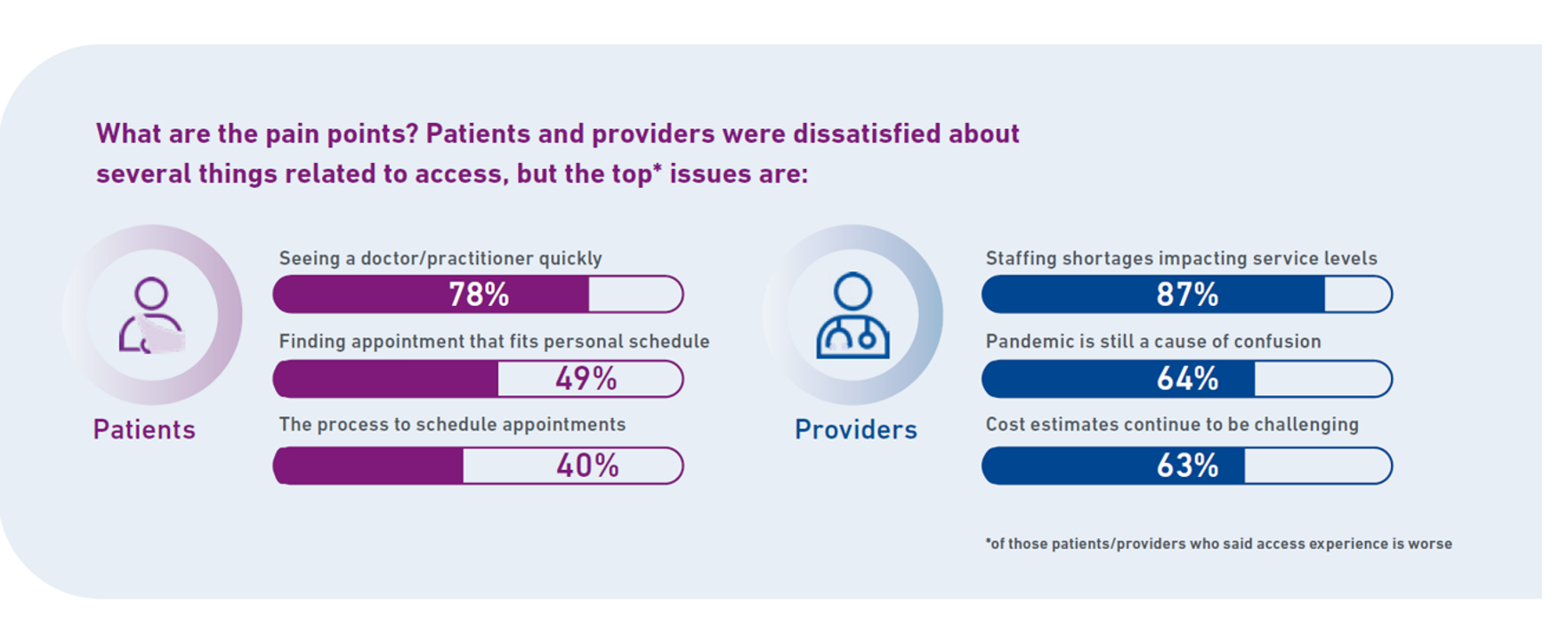

In health care, one of the “gifts” inspired by the coronavirus pandemic was the industry’s fast-pivot and adoption of digital health tools — especially telehealth and more generally the so-called “digital front doors” enabling patients to access medical services and personal work-flows for their care. Two years later, Experian provides a look into The State of Patient Access: 2023. You may know the name Experian as one of the largest credit rating agencies for consumer finance in the U.S. You may not know that the company has a significant footprint

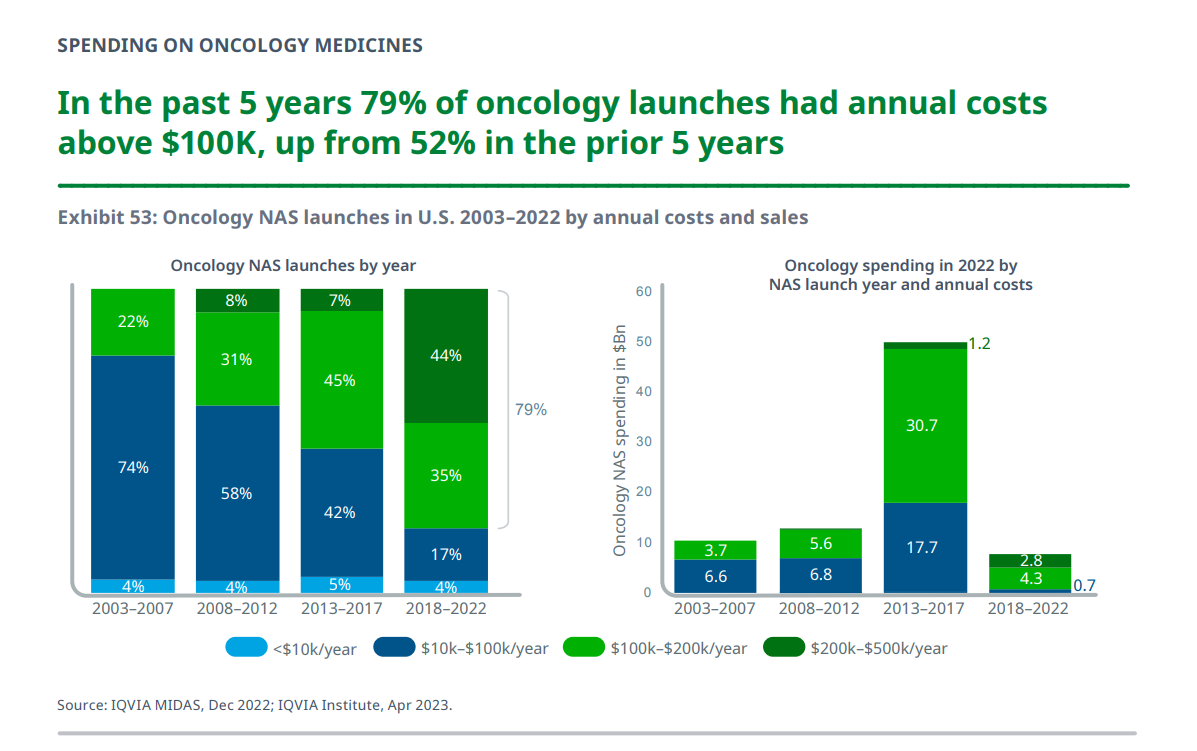

Consumers and Cancer: 3 Patient-Focused Charts From IQVIA on the State of the Oncology in 2023 – and Introducing CancerX

It’s time for the annual ASCO conference, currently convening the American Society for Clinical Oncology in Chicago. Starting 2nd June, there have been dozens of positive announcements updating research and therapies bringing hope to the 2 million new patients who will be diagnosed with cancer in the U.S. in 2023, and millions of more people worldwide. Just in time for #ASCO2023, the IQVIA Institute published their annual report on Global Oncology Trends 2023 – Outlook to 2027, an update featuring pipelines, therapy approvals, research updates, costs of oncology products, and patients.

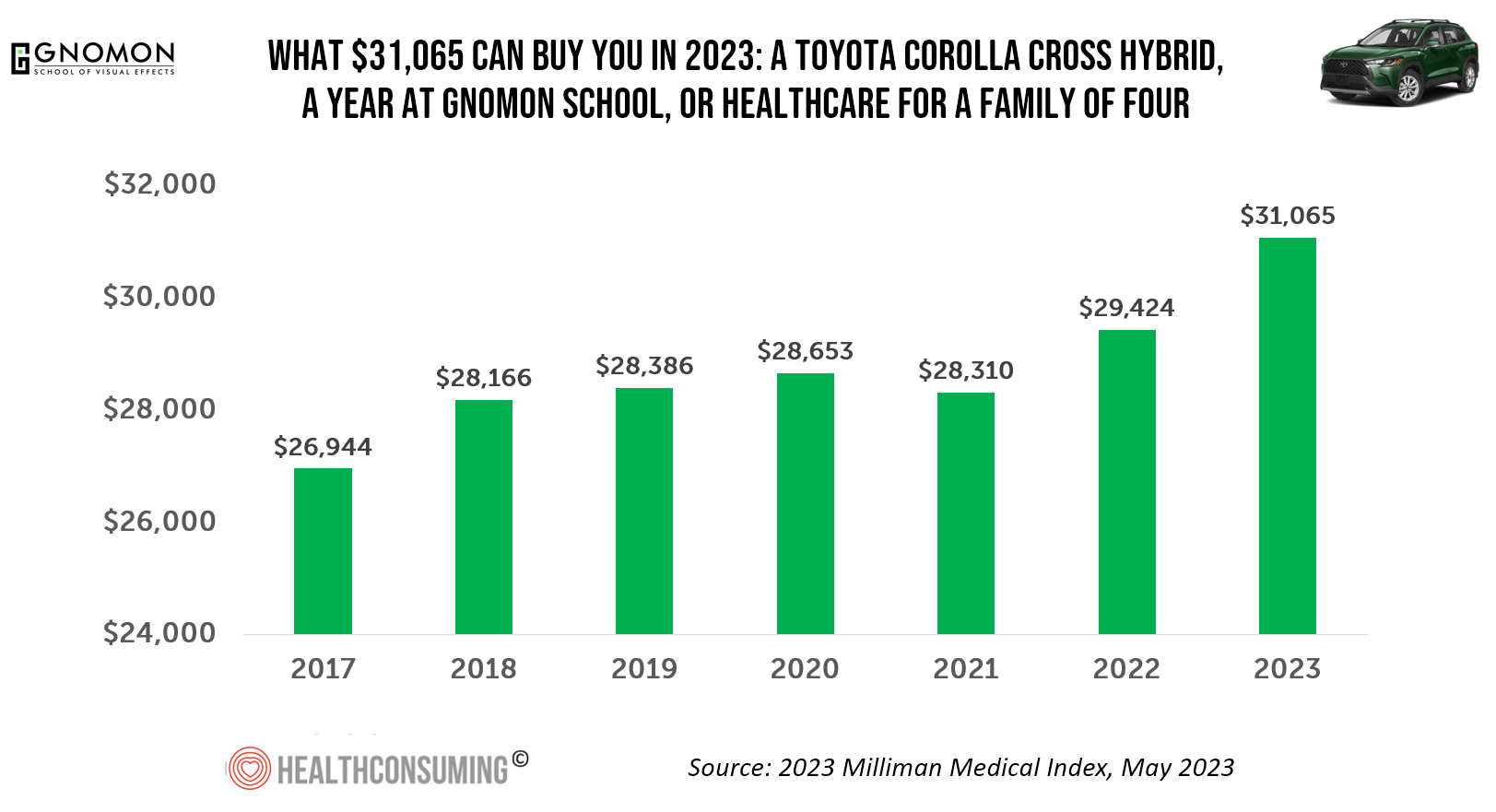

What $31,065 Can Buy You: a Toyota Corolla Cross Hybrid, a Year at Gnomon School, or Healthcare for a Family of 4 in America

“Healthcare costs came roaring back in 2021” after falling in 2020. In 2023, that roaring growth in health care costs continues with expected growth of 5.6%. For 2023, you could take your $31K+ and buy a Toyota Corolla Cross Hybrid auto, fund a year at the Gnomon School in Hollywood toward a degree in animation or game design, or buy healthcare for your family of 4. Welcome to this year’s annual look at health care costs for a “typical” U.S. family explained in the 2023 Milliman Medical Index (MMI).

Medical Debt: “The Debt of Necessity” – A Current U.S. Picture from the CFPB

On April 11, 2023, three of the largest U.S. consumer credit rating companies — Equifax, Experian and TransUnion — planned to remove medical bill collections that were under $500 from consumers’ credit reports. The Consumer Financial Protection Bureau (CFPB) calculated that these medical bill “erasures” under $500 impacted nearly 23 million consumers and eliminated medical collections totally for 15.6 million people in the U.S. according to CFPB’s recently-published Data Point report. For some context, it’s useful to know that the CFPB was created as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act passed by Congress and signed

A Public Health Wake-Up Call: Reading Between the Lines in IQVIA’s 2023 Use of Medicines Report

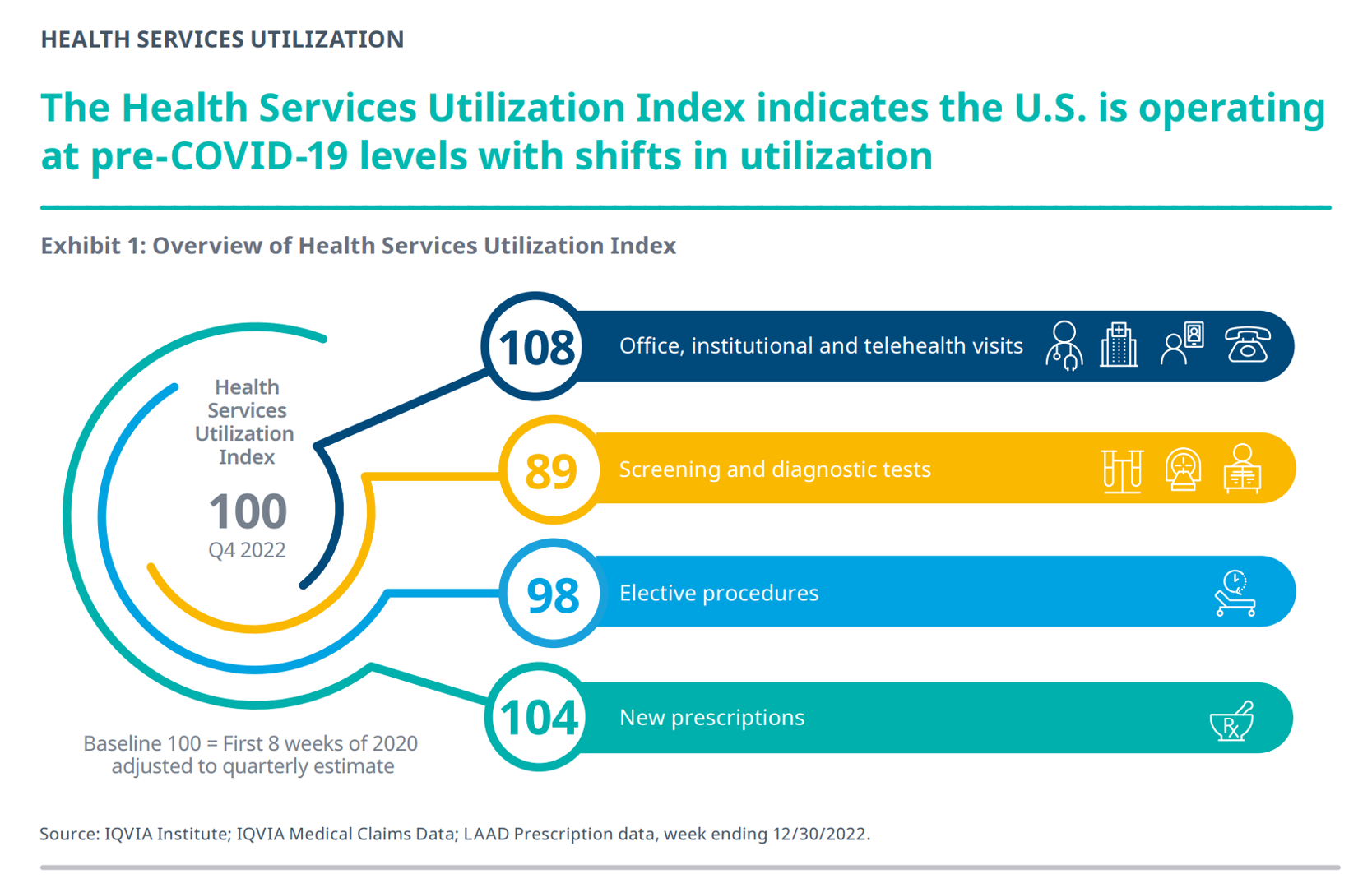

Reviewing the annual 2023 report from the IQVIA Institute for Human Data Science discussing The Use of Medicines in the U.S. is always a detailed, deep, and insightful dive into the state of prescription drugs. It’s a volume speaking volumes on the current picture of prescribed meds, spending and revenues, health care utilization trends, and a forecast looking out to 2027. In my read of this year’s review, I see a flashing light for U.S. health care: “Wake up, public health!” I’ve pulled out a few of the data points that speak to me about population health, prevention and early

Don’t Mess with Medicare and Medicaid, Washington: They Remain Popular with Americans Across Party ID

A majority of the U.S. public does not want politicians to “up-end” government-funded health programs, according to the Kaiser Family Foundation’s March 2023 Health Tracking Poll. Social Security, Medicare, and Medicaid all garner most partisans’ support whether identifying as Democrat, Independent, or Republican, KFF found in their monthly poll of U.S. voters ages 18 and over. The survey was conducted online and by telephone among 1,271 U.S. adults between March 14-23, 2023. Among all the important findings in this well-timed poll, I’ll point to the issue of public

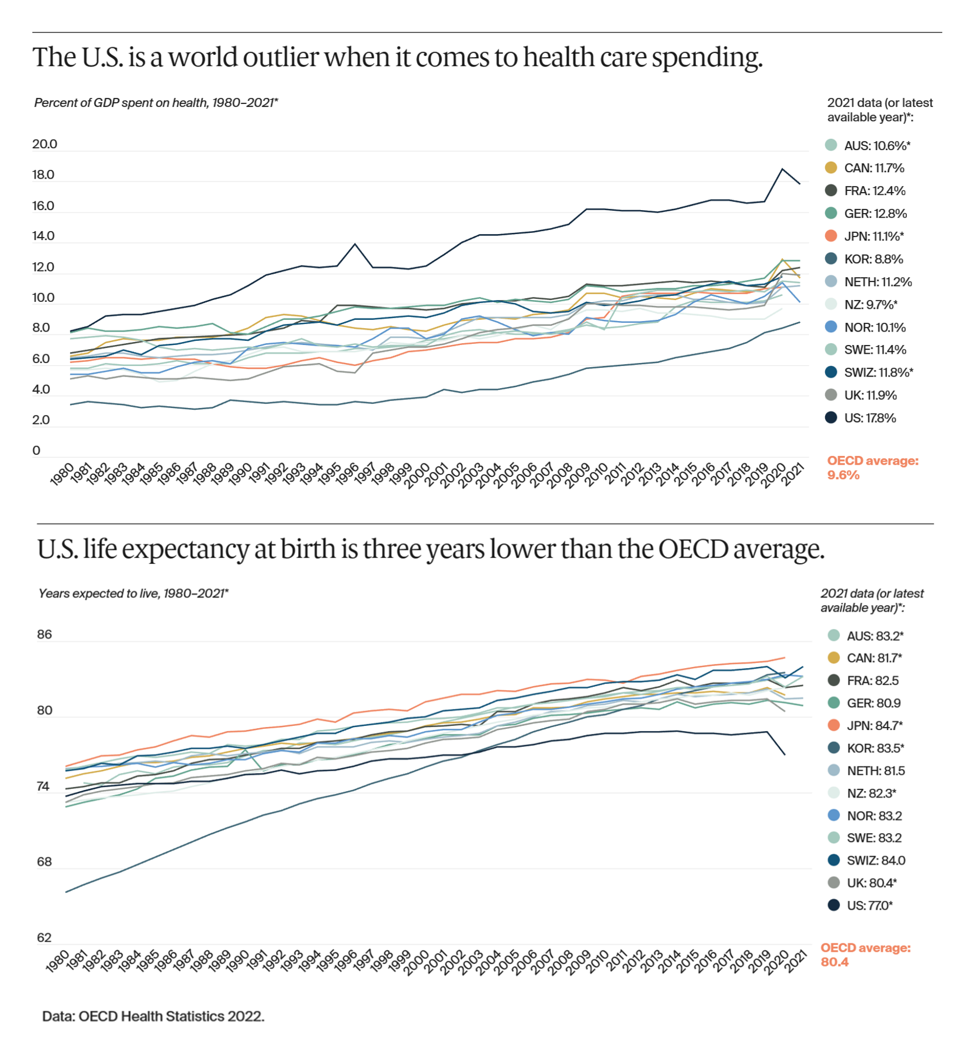

The US Healthcare System Outspends and Underperforms While Most People Live Paycheck to Paycheck

The U.S. is an outlier in the world for high health care spending, as well as in low achievement for life expectancy at birth — 3 years less than that in peer OECD countries — discussed in U.S. Health Care from a Global Perspective, 2022: Accelerating Spending, Worsening Outcomes, the latest look into American health system performance in a global context from The Commonwealth Fund. Another study published in JAMA this week talks about the Organization and Performance of US Health Systems, calling out the fact that, “Small quality differentials combined with large price differentials suggests that health systems have

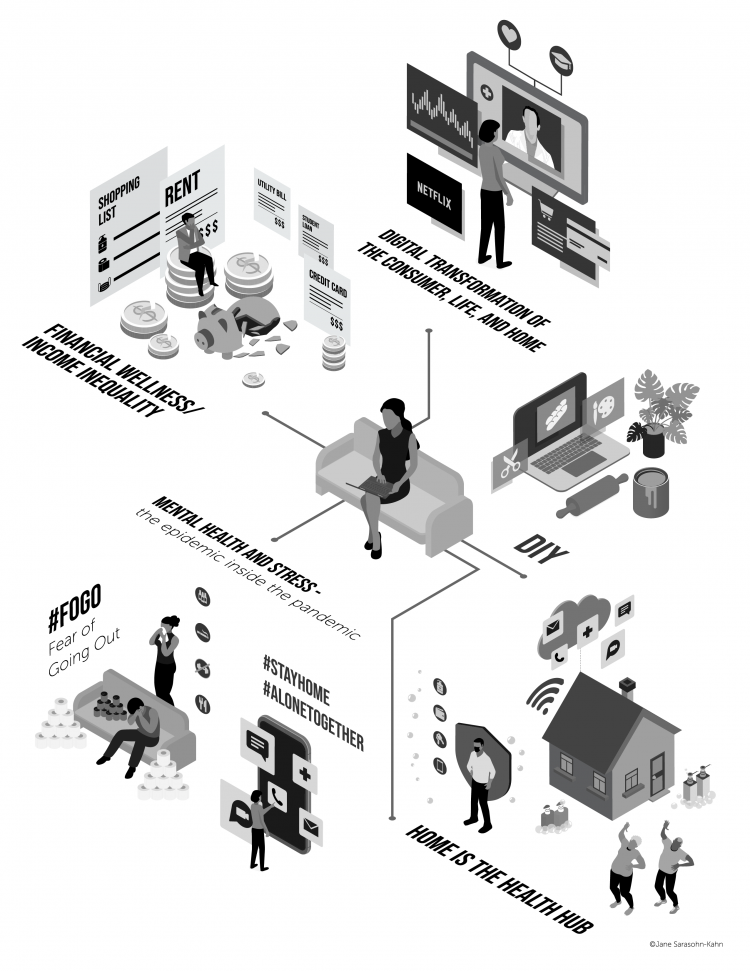

When Household Economics Blur with Health, Technology and Trust – Health Populi’s 2023 TrendCast

People are sick of being sick, the New York Times tells us. “Which virus is it?” the title of the article updating the winter 2022-23 sick-season asked. Entering 2023, U.S. health citizens face physical, financial, and mental health challenges of a syndemic, inflation, and stress – all of which will shape peoples’ demand side for health care and digital technology, and a supply side of providers challenged by tech-enabled organizations with design and data chops. Start with pandemic ennui The universal state of well-being among us mere humans is pandemic ennui: call it languishing (as opposed to flourishing), burnout, or

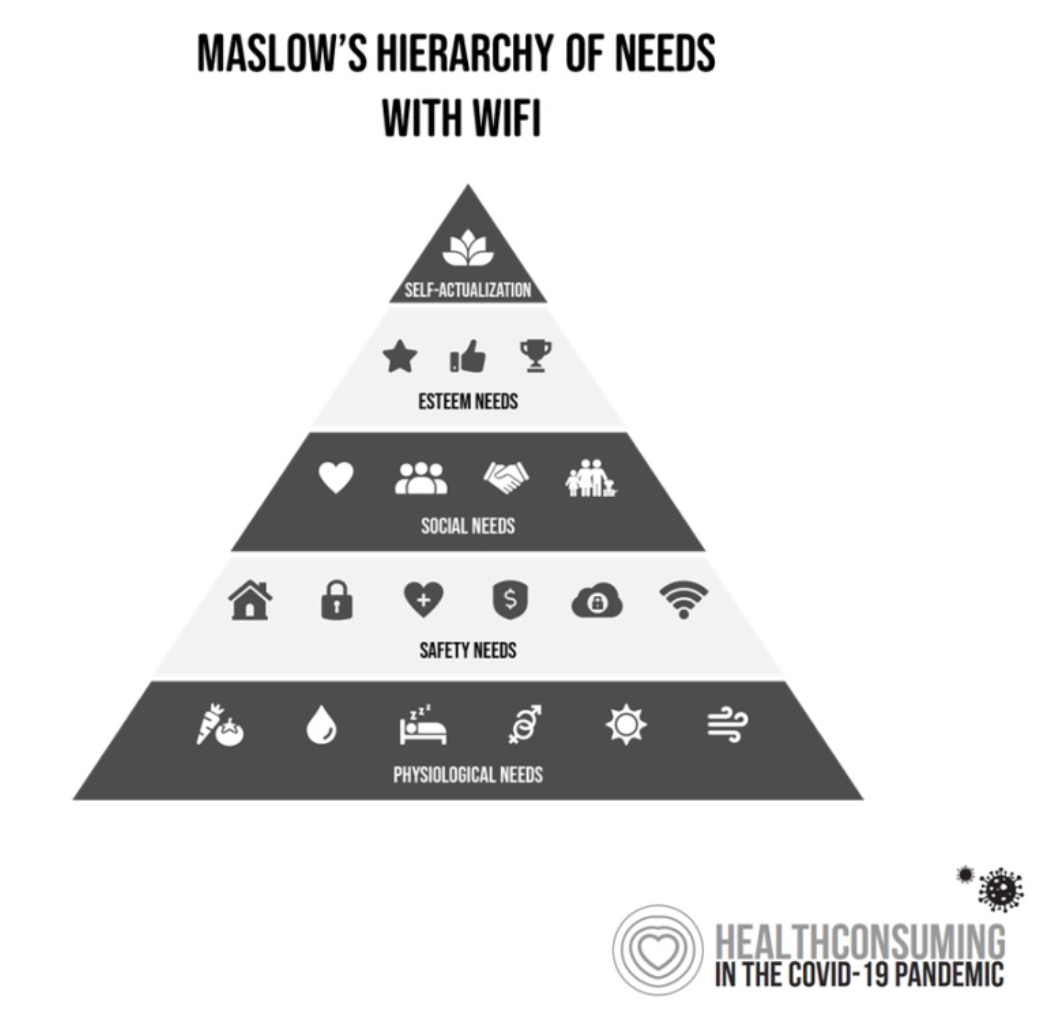

Thinking Value-Based Health Care at HLTH 2022 – A Call-to-Action

The cost of health insurance for a worker who buys into a health plan at work in 2022 reached $22,463 for their family. The average monthly mortgage payment was $1,759 in mid-2022. “When housing and health both rank as basic needs in Maslow’s hierarchy, what’s a health system to do?” I ask in an essay published today on Crossover Health’s website titled Value-Based Care: Driving a Social Contract of Trust and Health. The answer: embrace value-based care. Warren Buffett wrote Berkshire Hathaway shareholders in 2008, asserting that, “Price is what you pay. Value

A Call to Embrace Civic Engagement (Including Voting Access) as a Driver of Health

“Two intersecting and interdependent systems comprise democracy in the United States,” Eileen Salinsky, Program Advisor with Grantmakers in Health, wrote in a compelling essay in April 2022. Those systems are, Eileen described, “A political system of representative government, which includes the legislative, executive, and judicial branches at the federal, state, and local levels; and, A collective system of self-governance, which includes how individuals interact with each other and their political system through many forms of civic engagement.” Civic Engagement is a Social Determinant of Health, Eileen titled this piece in which she discusses philanthropy’s role in both strengthening democracy and

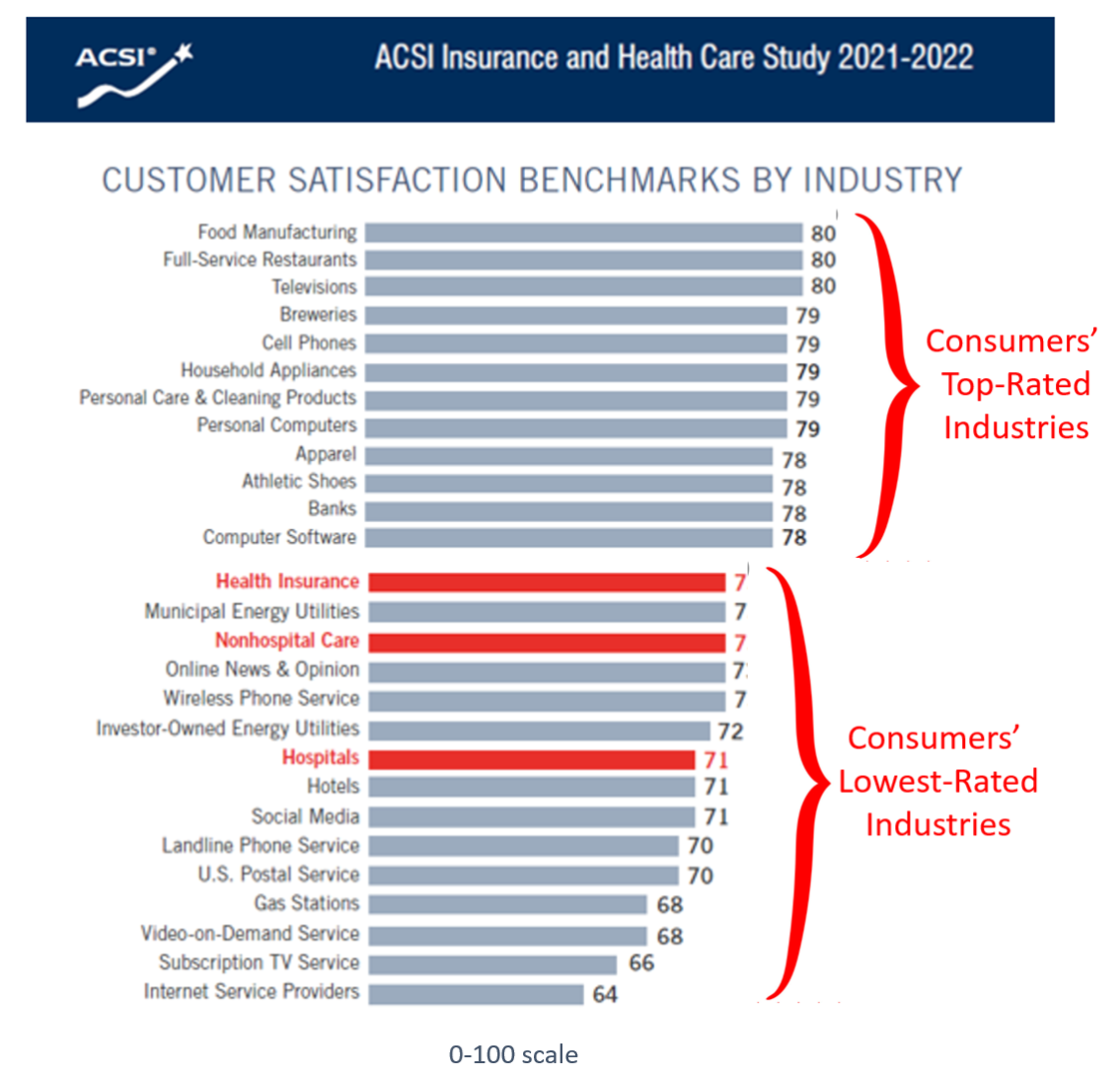

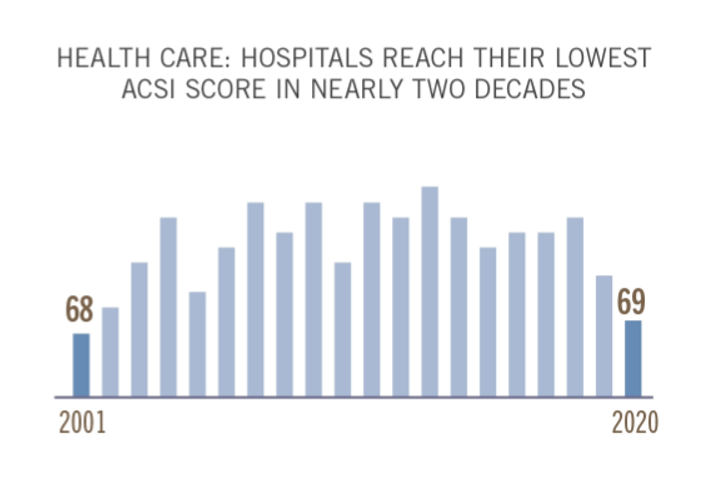

Consumers Rank Healthcare Experiences in the Bottom-Third of All Industries – the ACSI 2021-2022 Index

While consumers’ satisfaction with inpatient care experiences improved a few points over the past year, health insurance and hospitals still fall in the bottom-third of all industries with which people interact, according to the American Customer Satisfaction Index (ACSI) Insurance and Health Care Study 2021-2022. “With visitor restrictions relaxing and more elective procedures going forward, hospitals are slowly coming out of a COVID-induced satisfaction slump,” the study press released quoted Forrest Morgeson, Assistant Professor of Marketing at Michigan State University. This year’s ACSI Insurance and Health Care Index was developed through 12,840 consumer interviews

$22,463 Can Get You a Year of College in Connecticut, a Round of Ref Work in the Stanley Cup Playoffs, or Health Benefits for a Worker’s Family

Employers covering health insurance for workers’ families will face insurance premiums reaching, on average, $22,463. That is roughly what a year at an independent college in Connecticut would cost, or a round of pay for a ref in the Stanley Cup playoffs. With that sticker-shock level of health plan costs, welcome to the 2022 Employer Health Benefits Survey from Kaiser Family Foundation, KFF’s annual study of employer-sponsored health care. Each year, KFF assembles data we use all year long for strategic and tactical planning in U.S. health care. This mega-study looks at

How Will the “New” Health Economy Fare in a Macro-Economic Downturn?

What happens to a health care ecosystem when the volume of patients and revenues they generate decline? Add to that scenario a growing consensus for a likely recession in 2023. How would that further impact the micro-economy of health care? A report from Trilliant on the 2022 Trends Shaping the Health Economy helps to inform our response to that question. Start with Sanjula Jain’s bottom-line: that every health care stakeholder will be impacted by reduced yield. That’s the fewer patients, less revenue prediction, based on Trilliant’s 13 trends re-shaping the U.S. health

The Patient as Prescription Drug Payer – The GoodRx Playbook

Patients have more financial skin-in-their-healthcare-games facing high-deductibles and direct out-of-pocket costs for medical bills…including prescription drugs. I collaborated with GoodRx on a “yellow paper” discussing The Health Consumers as Payer, with implications and calls-to-action for pharma and life science companies. You can download the paper at this link. The report is intended to be a playbook for understanding patients’ growing role as consumers and health care payers, providing insights into peoples’ home economic mindsets and how these impact a patient’s adherence to medication based on cost and perceived value. With inflation facing household

Home Is Where the Health Is: An Update on Connectivity, Food, and Retail

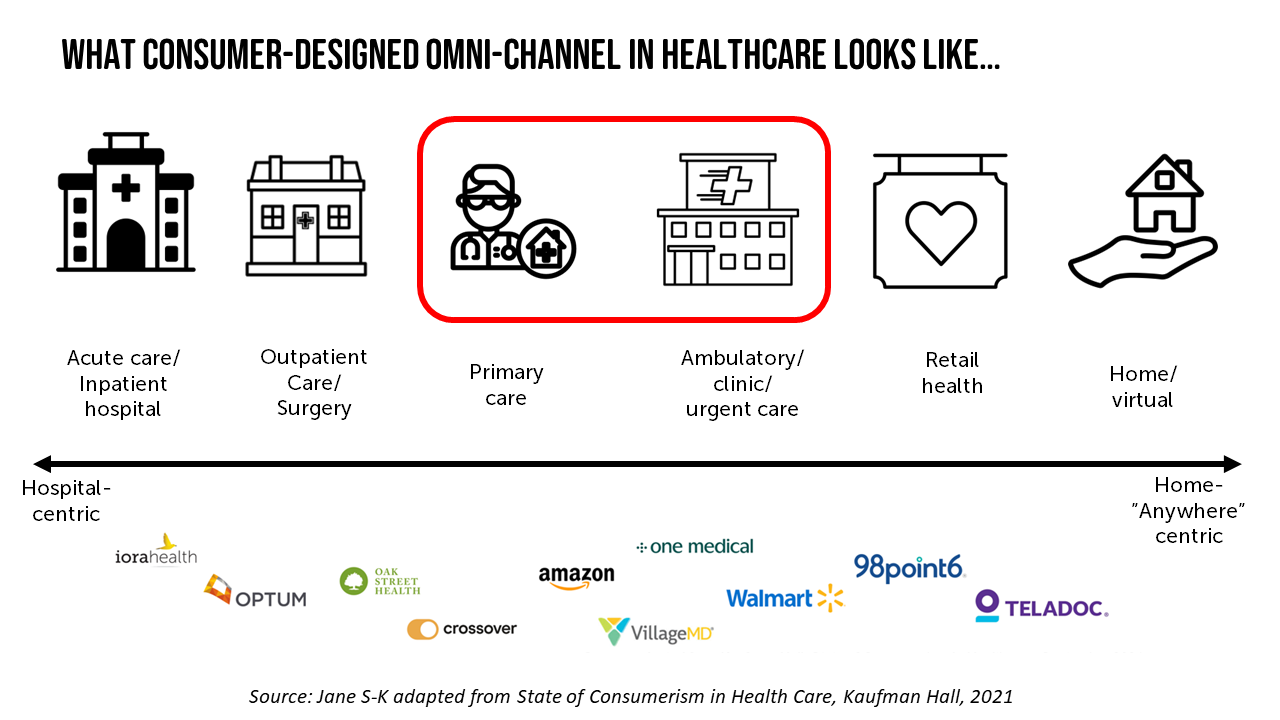

Virtually every closed-door meeting I have had in the U.S. with a client group in the past several months has had a line item on the agenda to brainstorm the impact and opportunity of care-at-home, hospital-to-home, or Care Everywhere. This has happened across many stakeholders in the evolving health/care ecosystem of suppliers, including hospital systems, health plans, grocery chains, retail pharmacy, consumer technology, digital health and tech-enabled providers, pharma and medical supply companies. On October 10, Dr. Robert Pearl, former CEO of The Permanente Medical Group, published a provocative post on Forbes noting that Amazon, CVS, Walmart Are Playing Healthcare’s

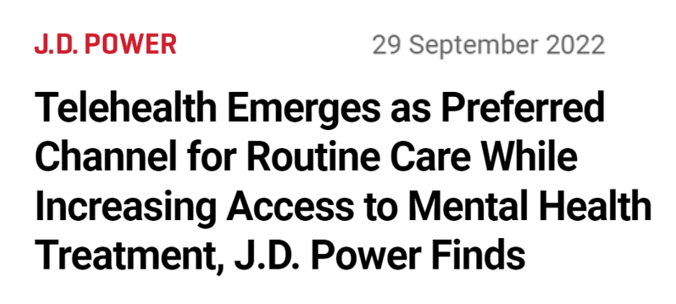

Telehealth-As-Healthcare Is a Mainstream Expectation Among Consumers, J.D. Power Finds

Telehealth has increased access to mental health services, I’ve highlighted this Mental Illness Awareness Week here in Health Populi. But telehealth has also emerged as a preferred channel for routine health care services, we learn from J.D. Power’s 2022 Telehealth Satisfaction Study. Among people who had used virtual care in the past year, telehealth-as-healthcare is now part of mainstream Americans’ expectations as a normal part of their medical care. That’s because 9 in 10 users of telehealth in the U.S. would use virtual care to receive medical services in the future, J.D. Power found in

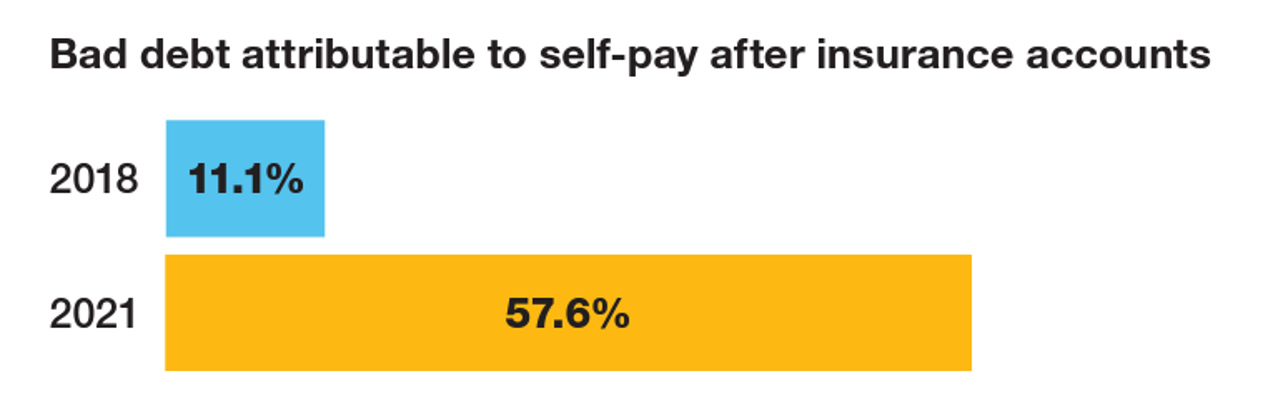

The Patient As the Payer: Self-Pay, Bad Debt, and the Erosion of Hospital Finances

“The odds are against hospitals collecting patient balances greater than $7,500,” the report analyzing Hospital collection rates for self-pay patient accounts from Crowe concludes. Crowe benchmarked data from 1,600 hospitals and over 100,00 physicians in the U.S. to reveal trends on health care providers’ ability to collect patient service revenue. And bad debt — write-offs that come out of uncollected patient bill balances after “significant collection efforts” by hospitals and doctors — is challenging their already-thin or negative financial margins. The first chart quantifies that bad debt attributable to patients’ self-pay payments

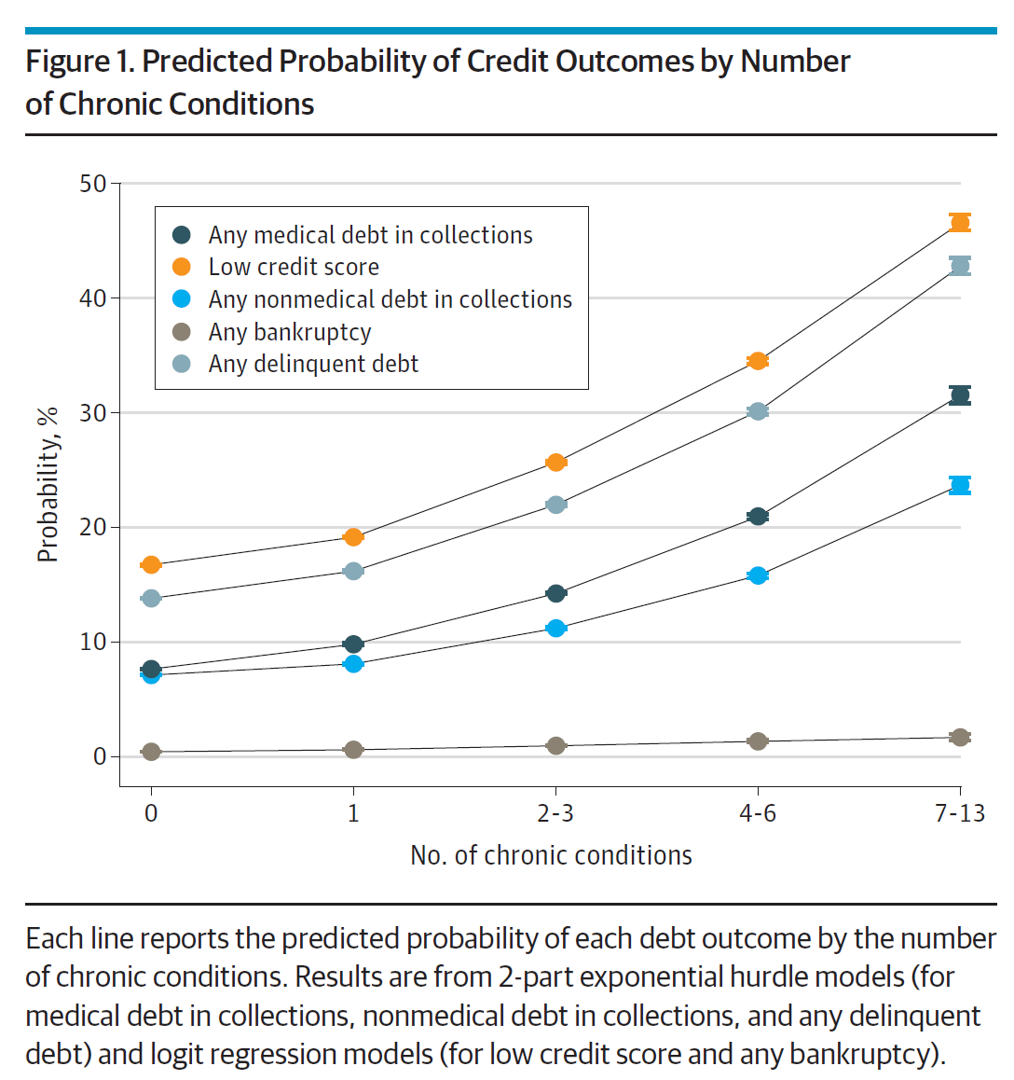

The More Chronic Conditions, the More Likely a Patient Will Have Medical Debt

There is a direct association between a person’s health status and patient outcomes and their financial health, quantified in original research published this week in JAMA Internal Medicine. Researchers from the University of Michigan (my alma mater) Medical School and Institute for Healthcare Policy and Innovation analyzed two years of commercial insurance claims data generated between January 2019 and January 2021, linking to commercial credit data from January 2021 for patients enrolled in a preferred providers organization in Michigan. The first chart illustrates the predicted probability of credit outcomes based on the

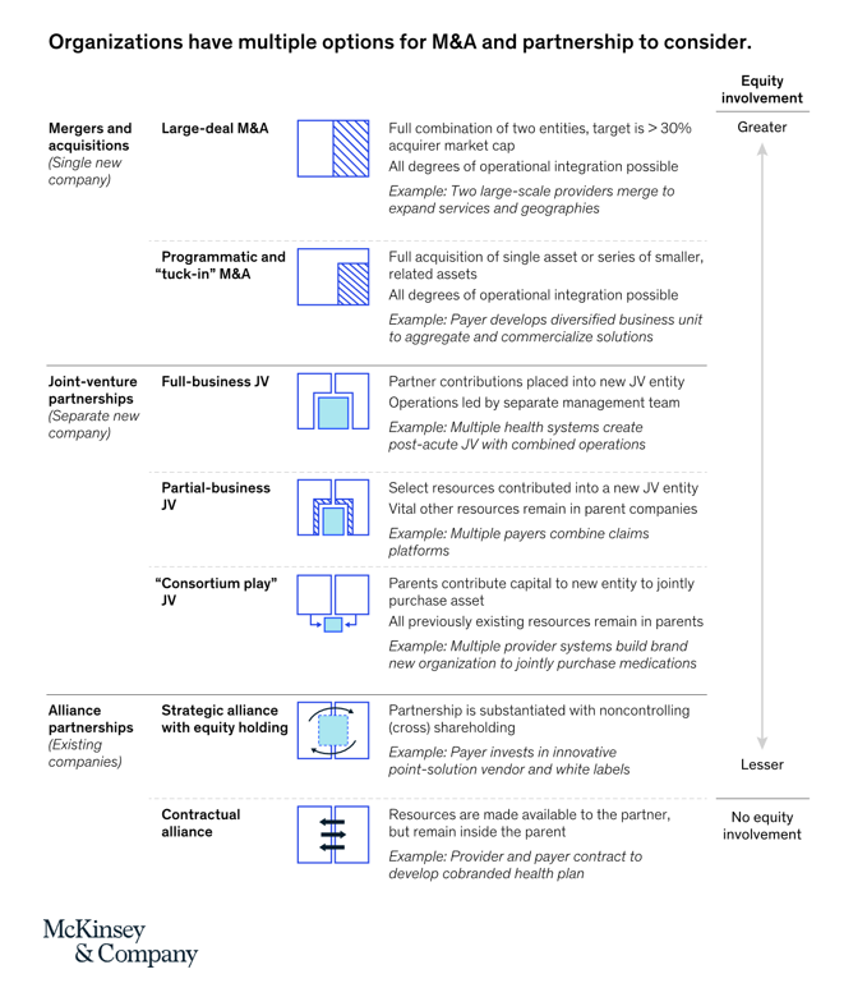

Partnering Up in the Health Care Ecosystem to Drive Transformation – for Organizations and Health Consumers Alike

“Partnerships, including JVs and alliances with other healthcare organizations and with new entrants, are just one way to access new capabilities, unlock speed to market, and achieve capital, scale, and operational efficiencies” in health care transformations. “In an environment with continued competition for attractive assets and significant capital in play from institutional investors, these partnerships may also be the most accessible way for organizations to capture value in expanding healthcare services and technology value pools,” we learn in Overcoming the cost of healthcare transformation through partnerships from a team of health care folks with McKinsey & Company.

The Retail Health Battle Royale, Day 5 – Consumer Demands For a Health/Care Ecosystem (and What We Can Learn from Costco’s $1.50 Hot Dog)

In another factor to add into the retail health landscape, Dollar General (DG) the 80-year old retailer known for selling low-priced fast-moving consumer goods in peoples’ neighborhoods appointed a healthcare advisory panel this week. DG has been exploring its health-and-wellness offerings and has enlisted four physicians to advise the company’s strategy. One of the advisors, Dr. Von Nguyen, is the Clinical Lead of Public and Population Health at Google….tying back to yesterday’s post on Tech Giants in Healthcare. Just about one year ago, DG appointed the company’s first Chief Medical Officer, which I covered here in

The Retail Health Battle Royale in the U.S. – A Week-Long Brainstorm, Day 2 of 5 – Amazon and One Medical

Today we review the various viewpoints on Amazon’s announced acquisition of One Medical (ONEM, aka 1life Healthcare) which has been a huge story in both health care trade publications, business news, and mainstream media outlets. Welcome to Day 2 of The Retail Health Battle Royale in the U.S., my week-long update of the American retail health/care ecosystem weaving the latest updates from the market and implications and import for health care consumers. The deal was announced on 21 July, with Amazon striking the price at about $3.9 billion. Goldman Sachs and Morgan Stanley put the deal together,

Gas ‘N Healthcare – How Transportation Links to Health Care Access and Financial Health

Some patients dealing with cancer at Mercy Health’s Lourdes Hospital have been supplied with gas cards. This gesture is enabling families to get to medical appointments around Paducah, Kentucky where, this week, car drivers faced regular gas priced at an average of $4.16 a gallon compared with $2.92 one year ago. Here’s the Hospital’s Facebook page featuring their gratitude to FiveStar Food Mart, the American Cancer Society, and the Mercy Health Foundation. “By providing cancer patients with gas cards, the cancer care team at Mercy Health Lourdes Hospital in Paducah hopes to mitigate financial challenges

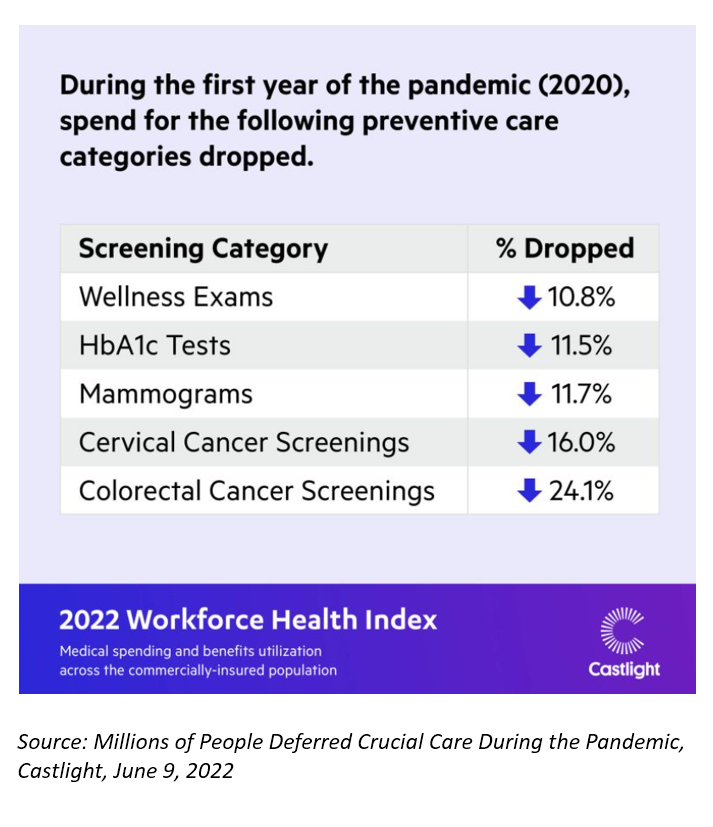

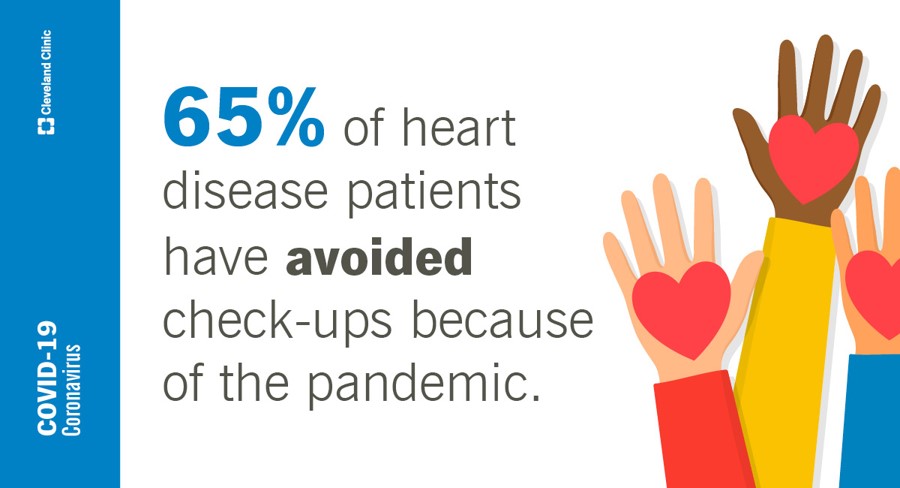

Use of Preventive Health Services Declined Among Commercially Insured People – With Big Differences in Telehealth for Non-White People, Castlight Finds

Declines in preventive care services like cancer screenings and blood glucose testing concern employers, whose continued to cover health insurance for employees during the pandemic. “As we enter the third year of the COVID-19 pandemic, employers continue to battle escalating clinical issues, including delayed care for chronic conditions, postponed preventive screenings, and the exponential increase in demand for behavioral health services,” the Chief Medical Officer for Castlight Health notes in an analysis of medical claims titled Millions of People Deferred Crucial Care During the Pandemic, published in June. The

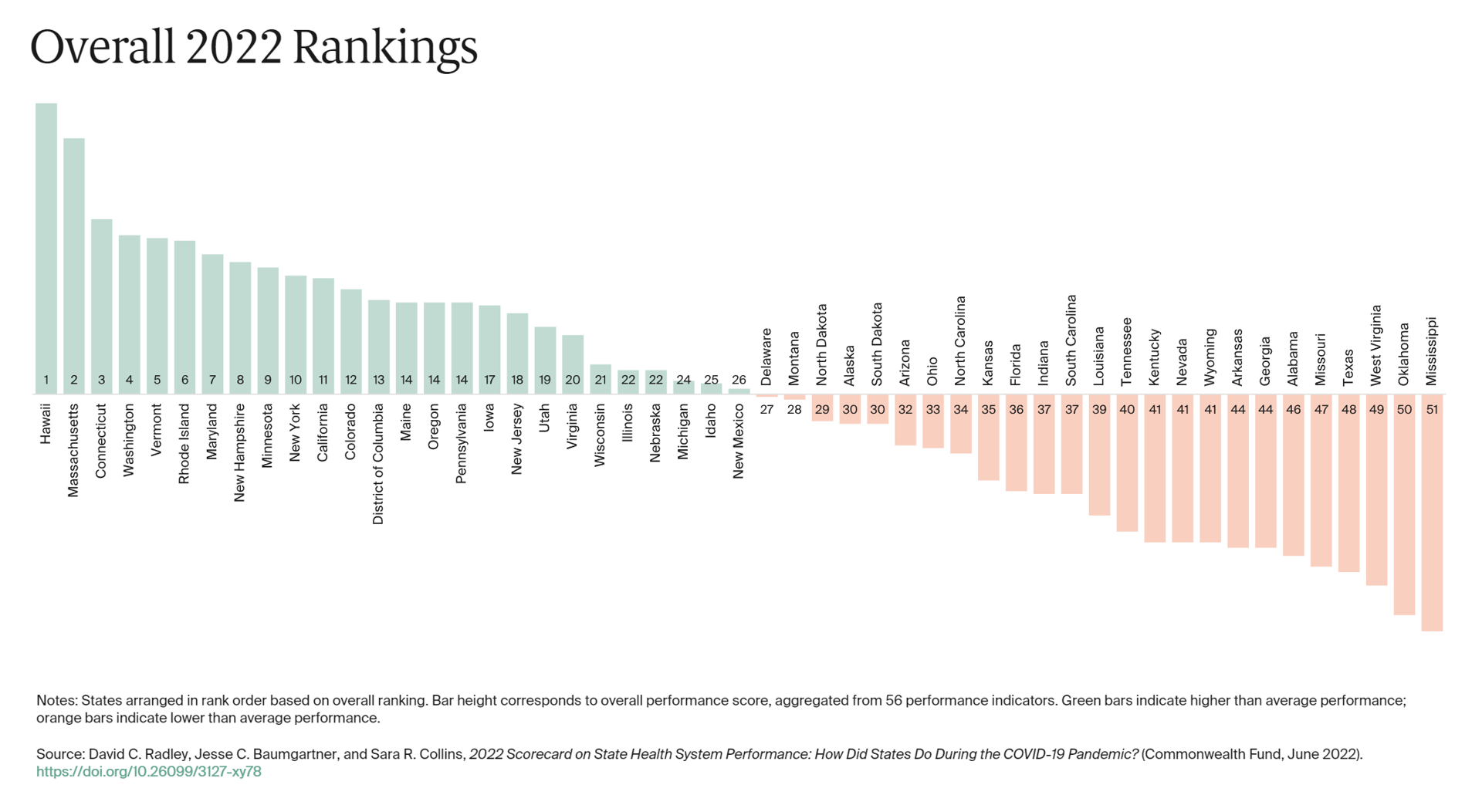

The 2022 US Health System Report Card: Pretty Terrific If You Live in Hawaii or Massachusetts

The best U.S. states to live in for health and health care are Hawaii, Massachusetts, Connecticut, Washington, Vermont, Rhode Island, and Maryland… Those are the top health system rankings in the new 2022 Scorecard on State Health System Performance annual report from the Commonwealth Fund. If you live in Mississippi, Oklahoma, West Virginia, Texas, Missouri, Alabama, Georgia, or Arkansas, your health care and outcomes are less likely to be top-notch, the Fund’s research concluded. The Commonwealth Fund has conducted this study since 2006, assessing a range

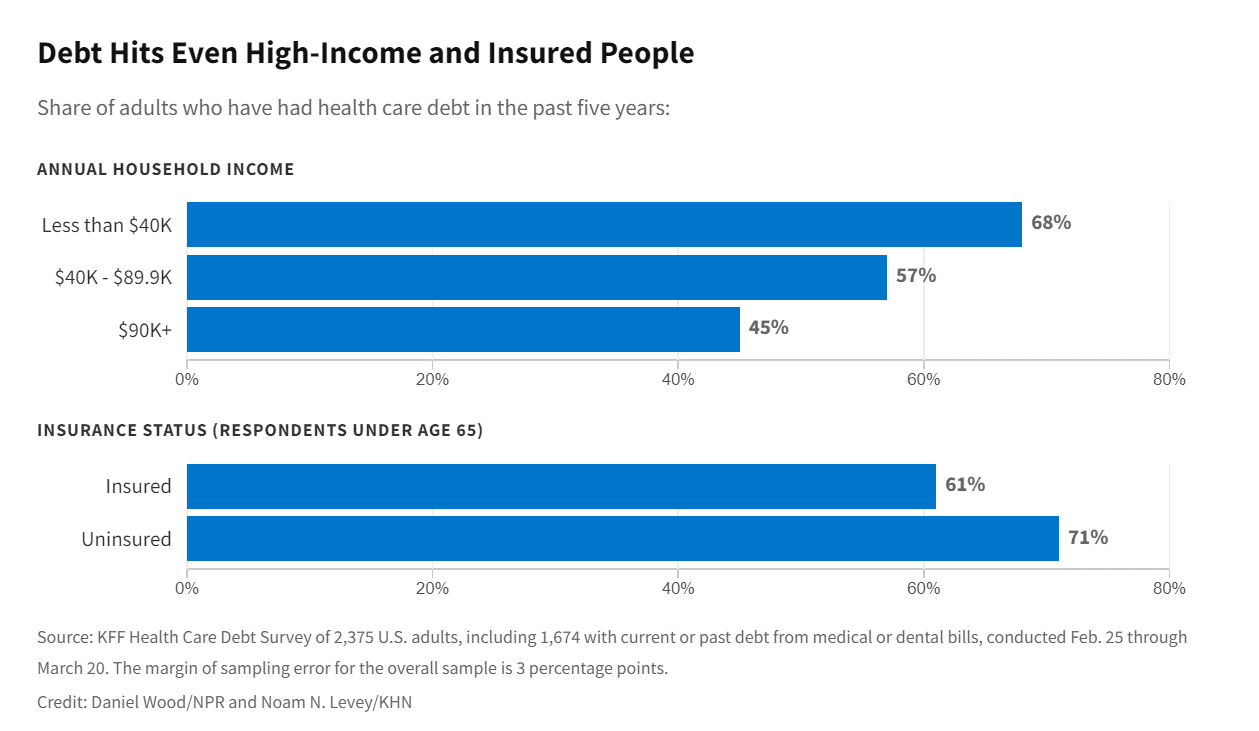

Only in America: Medical Debt Is Most Peoples’ Problem, KHN and NPR Report

When high-deductible health plans became part of health insurance design in America, they were lauded as giving patients “more skin in the game” of health care payments. The theory behind consumer-directed care was that patients-as-consumers would shop around for care, morph into rational consumers of medical services just as they would do purchasing autos or washing machines, and shift the cost-curve of American health care ever downward. That skin-in-the-game has been a risk factor for .some patients to postpone care as well as take on medical debt — the strongest predictor of which is dealing with multiple chronic conditions. “The

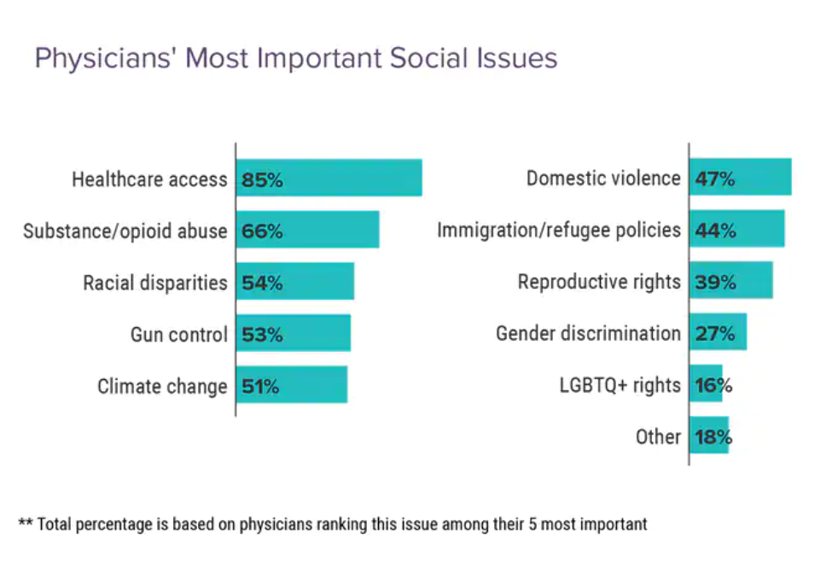

Healthcare access, racial disparities, guns and climate – U.S. doctors are worried about some big social issues

Doctors heads and hearts are jammed with concerns beyond curing patients’ medical conditions: U.S. physicians are worried about big social issues, according to a Medscape survey report, Physicians’ Views on Today’s Divisive Social Issues 2022. Topping physicians’ list of their top-five most important social issues, far above all others ranked healthcare access. Underneath that top-line statistic, it’s important to note that: 52% of doctors are “very concerned” about healthcare access, 28% are “concerned,” and 13% are “somewhat concerned.” Medscape underscores that in 2020, 31 million U.S. residents had no health insurance coverage, and

The Evolution of a Patient Ambassador – Learning from Stacy Hurt

“I am a health care executive who happens to be a patient, caregiver, and advocate,” Stacy Hurt explained to me in a Zoom chat we shared on 31 May. I asked her to meet with me to discuss her professional news update: being appointed Parexel’s first Patient Ambassador. My Zoom invitation to Stacy was a very convenient excuse for me to catch up with a friend in the field: we have known each other since Stacy started to grow her health-social media presence on Twitter. And that involvement in

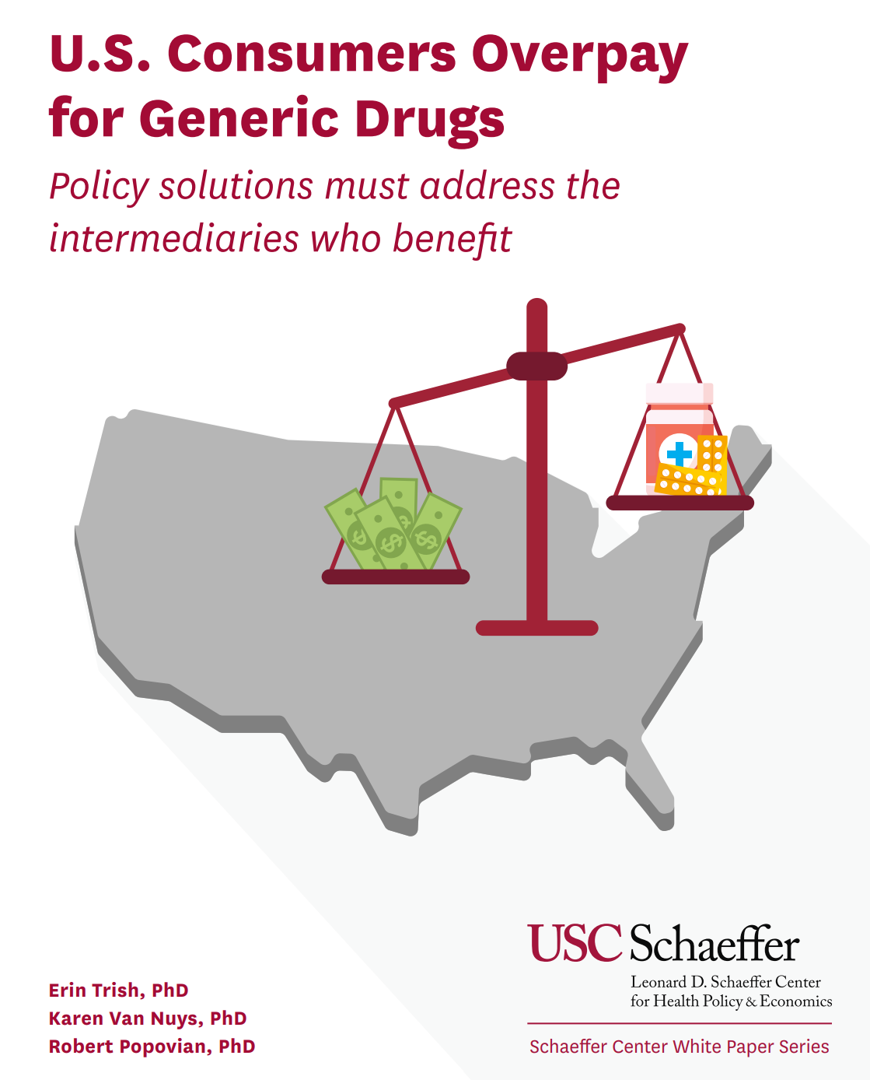

What If Costco Designed the Prescription Drugs Sales Model?

The good news about prescription drugs, in the context of medical spending in the U.S., is that 9 in 10 medicines prescribed are generics. They comprise only 3% of all U.S. healthcare spending. But there’s bad news about prescription drugs in the context of medical spending in America. U.S. Consumers Overpay for Generic Drugs, a new paper from the Leonard Schaeffer Center for Health Policy & Economics asserts, with recommendations to address the intermediaries who benefit from the way Americans currently pay for medicines. Generics are “an American success story,” the authors call out, bringing

The Health of Older Americans in 2022 – Risks from the Pandemic, Isolation, and Social Determinants

For millions of older people in America, health and well-being got worse in the wake of the COVID-19 pandemic. Physical, mental and behavioral health took hits, depending on one’s living situation, social determinants of health risks, and even health plan, I write in the Medecision Liberate Health blog. In this essay on health disparities and equity for older adults, I weave together new data from, The United Health Foundation’s study on seniors’ health status in America’s Health Rankings for 2022 RAND and CMS research into seniors health disparities among Medicare Advantage

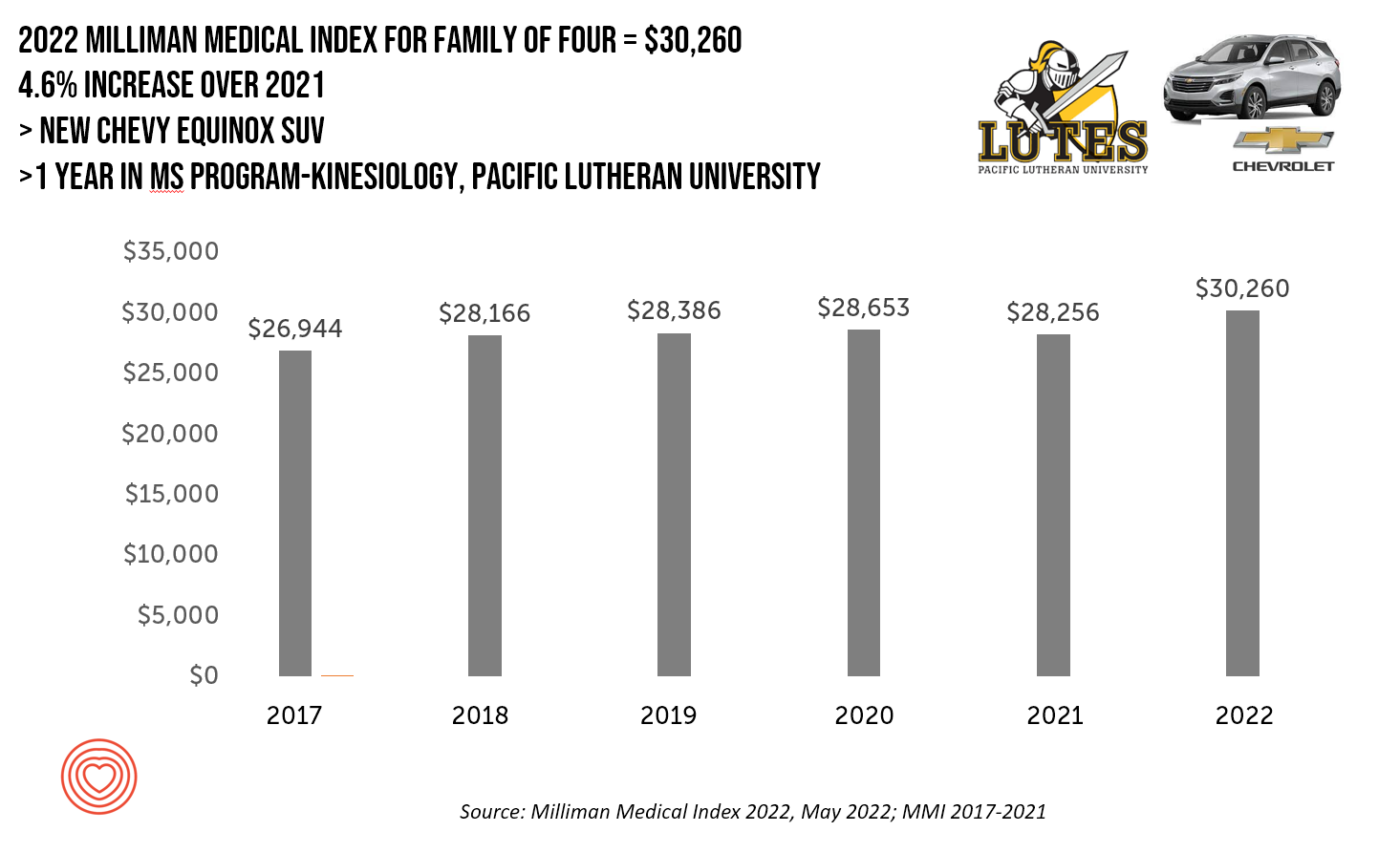

A New Chevy Equinox SUV, a Year in Grad School, or Health Care for Four – The 2022 Milliman Medical Index

A new Chevy Equinox SUV, a year in an MS program in kinesiology at Pacific Lutheran U., or health care for a family of four. At $30,260, you could pick one of these three options. Welcome to this year’s 2022 Milliman Medical Index, which annually calculates the health care costs for a median family of 4 in the U.S. I perennially select two alternative purchases for you to consider aligning with the MMI medical index. I have often picked a new car at list price and a year’s tuition at a U.S. institution of

The Patient as Consumer and Payer – A Focus on Financial Stress and Wellbeing

Year 3 into the COVID-19 pandemic, health citizens are dealing with coronavirus variants in convergence with other challenges in daily life: price inflation, civil and social stress, anxiety and depression, global security concerns, and the safety of their families. Add on top of these significant stressors the need to deal with medical bills, which is another source of stress for millions of patients in America. I appreciated the opportunity to share my perspectives on “The Patient As the Payer: How the Pandemic, Inflation, and Anxiety are Reshaping Consumers” in a webinar hosted by CarePayment on 25 May 2022. In this

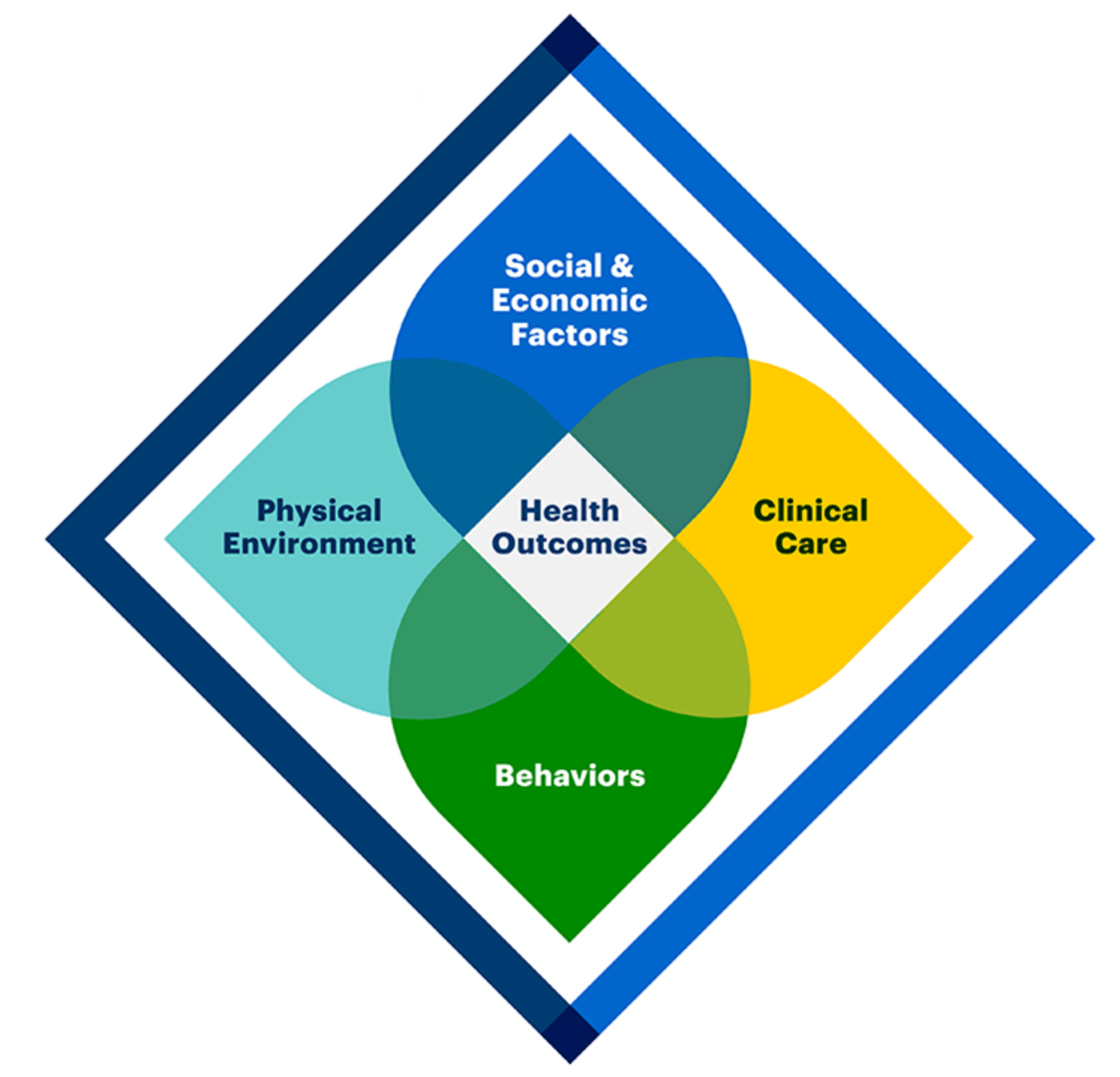

How Business Can Bolster Determinants of Health: The Marmot Review for Industry

“Until now, focus on….the social determinants of health has been for government and civil society. The private sector has not been involved in the discussion or, worse, has been seen as part of the problem. It is time this changed,” asserts the report, The Business of Health Equity: The Marmot Review for Industry, sponsored by Legal & General in collaboration with University College London (UCL) Institute of Health Equity, led by Sir Michael Marmot. Sir Michael has been researching and writing about social determinants of health and health equity for decades, culminating publications

The Financial Toxicity of Health Care Costs: From Cancer to FICO Scores

The financial toxicity of health care costs in the U.S. takes center stage in Health Populi this week as several events converge to highlight medical debt as a unique feature in American health care. “Medical debt is the most common collection tradeline reported on consumer credit records,” the Consumer Financial Protection Bureau called out in a report published March 1, 2022. CFPB published the report marking two years into the pandemic, discussing concerns about medical debt collections and reporting that grew during the COVID-19 crisis. Let’s connect the dots on: A joint announcement this week from three major credit agencies,

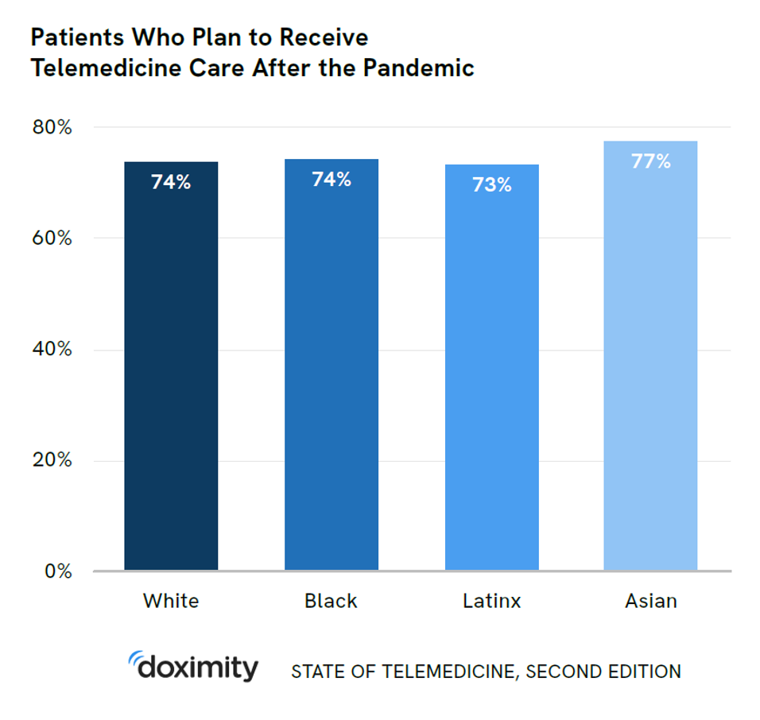

Doximity Study Finds Telehealth Is Health for Every Day Care

There’s more evidence that doctors and patients, both, want to use telehealth after the COVID-19 pandemic fades. Doximity’s second report on telemedicine explores both physicians’ and patients’ views on virtual care, finding most doctors and health consumers on the same page of virtual care adoption. For the physicians’ profile, Doximity examined 180,000 doctors’ who billed Medicare for telemedicine claims between January 2020 and June 2021. Telemedicine use did not vary much across physician age groups. Doctors in specialties that manage chronic illnesses were more likely to use telehealth: endocrinology (think: diabetes), gastroenterology, rheumatology, urology, nephrology, cardiology, ENT, neurology, allergy, and

Will “Buy Now, Pay Later” Financing Help Health Consumers Pay Their Medical Bills?

Aflac, our favorite duck-mascot-representing company, has launched the Close the Gap initiative featuring spokesman Deion Sanders, one of the good guys in the Football Hall of Fame. Recognizing the fact that nearly one-half of insured Americans don’t have enough in savings to pay for medical expenses, the company established the Aflac Care Index to educate and advocate for peoples’ health and financial security — including those people who have health care coverage. While U.S. consumers are facing historically high levels of inflation for household spending on food, petrol, and home goods, health consumers will be dealing with greater out-of-pocket spending based

The 2022 Health Populi TrendCast for Consumers and Health Citizens

I cannot recall a season when so many health consumer studies have been launched into my email inbox. While I have believed consumers’ health engagement has been The New Black for the bulk of my career span, the current Zeitgeist for health care consumerism reflects that futurist mantra: “”We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run,” coined by Roy Amara, past president of Institute for the Future. That well-used and timely observation is known as Amara’s Law. This feels especially apt right “now” as we enter 2022,

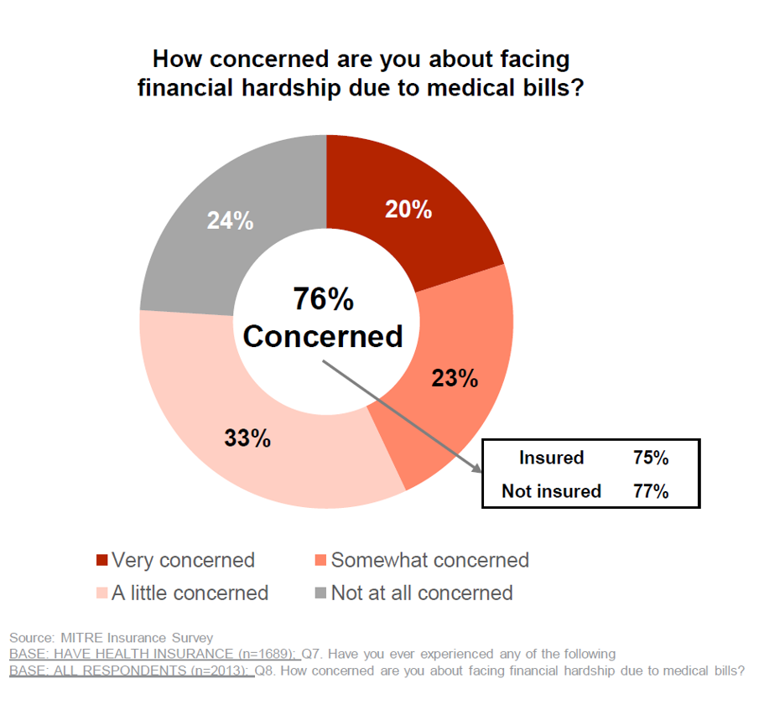

3 in 4 Insured Americans Worried About Medical Bills — Especially Women

In the U.S., being covered by health insurance is one of the social determinants of health. Without a health plan, an uninsured person in America is far more likely to file for bankruptcy due to medical costs, and lack access to needed health care (and especially primary care). But even with health insurance coverage, most health-insured people are concerned about medical costs in America, found in a MITRE-Harris Poll on U.S. consumers’ health insurance perspectives published today. “Even those fortunate to have insurance struggle with bills that result from misunderstanding or underestimating costs of treatments and procedures,” Juliette Espinosa of

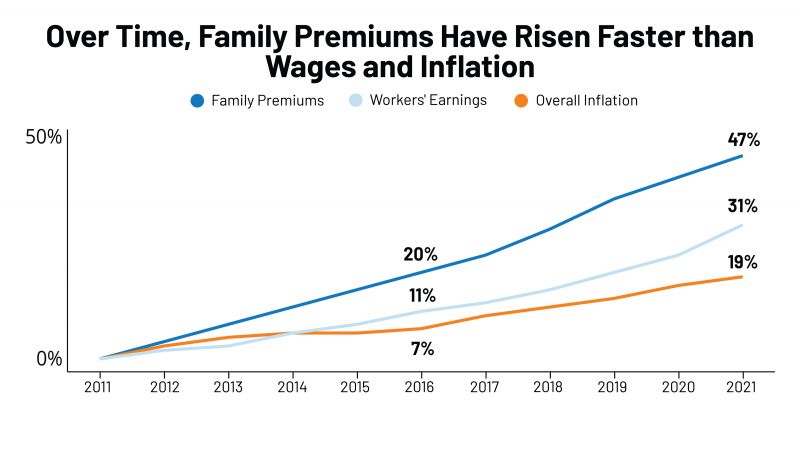

The Cost to Cover Health Insurance for a Family in America Is $22,221

Even with growing inflation in the U.S. and post-pandemic job growth in 2021, the cost of health insurance premiums rose faster than either the price of goods or wages. That family health plan premium reached $22,221, an increase of 22% since 2016, we learn in the annual report from Kaiser Family Foundation, 2021 Employer Health Benefits Survey. This report is our go-to encyclopedia of statistics on health insurance year-after-year, surveying companies’ annual health insurance strategies for coverage and tactics for managing spending and workers’ health outcomes. This 2021 update takes into account the impacts and influence of COVID-19 on workers’

How Healthcare Experience Ranks Versus Other Industries (Not So Great)

The coronavirus pandemic put health care at the top of peoples’ minds all over the world. As important as health became to humans at the base of our Hierachies of Needs, in the U.S., health care industries fell to their lowest consumer satisfaction scores in two decades, we learn in the latest evaluation by the American Consumer Satisfaction Index report. I explore consumer-patient experience for hospitals, health plans and ambulatory care compared with other industries in the November 2021 Medecision Liberation blog, calling out the importance of two key factors that drove peoples’ positive perceptions of brands and products in

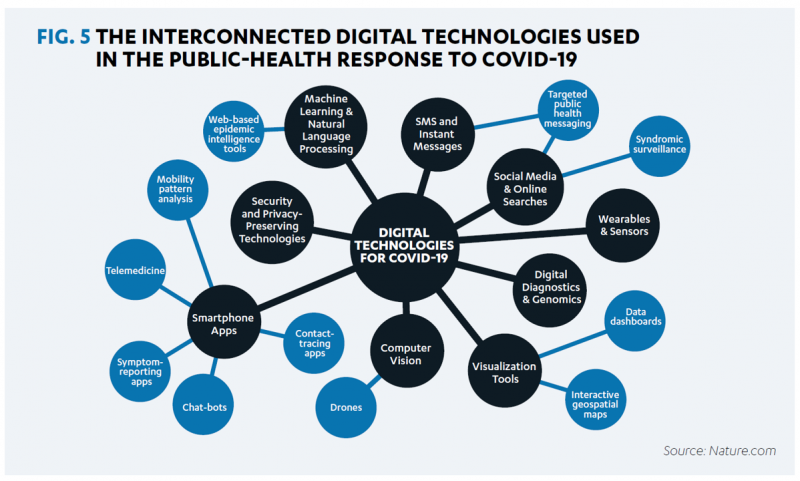

Designing Digital Health for Public Health Preparedness and Equity: the Consumer Tech Association Doubles Down

A coalition of health care providers, health plans, technology innovators, NGOs, and medical societies has come together as the Public Health Tech Initiative (PHTI), endorsed by the Consumer Technology Association (CTA) with the goal of advancing the use of trustworthy digital health to proactively meet the challenge of future public health emergencies….like pandemics. At the same time, CTA has published a paper on Advancing Health Equity Through Technology which complements and reinforces the PHTI announcement and objective. The paper that details the PHTI program, Using Heath Technology to Response to Public Health Emergencies, identifies the two focus areas: Digital health

Still Struggling with Stress in America in 2021

“Americans remain in limbo between lives once lived and whatever the post-pandemic future holds,” the American Psychological Association observes in their latest read into Stress in America 2021, with this phase of the perennial study focused on Stress and Decision-Making During the Pandemic. The top-line: people face a daily web of risk assessment, up-ended routines, and endless news about the coronavirus locally and globally. While most people in the U.S. believe that “everything will work out” after the pandemic ends, the mental, emotional, and logistical daily distance between “now” and “then” brings uncertainty and indeed, prolonged stress. More Millennials, who

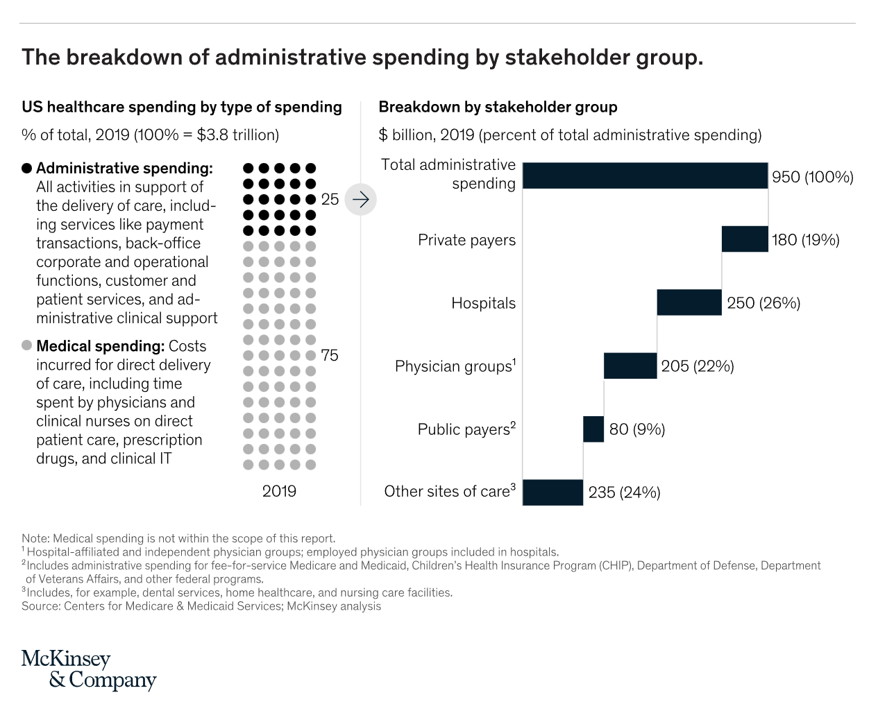

“Complexity is Profitable” in U.S. Healthcare – How to Save a Quarter-Trillion Dollars

In the U.S., “Health care is complicated because complexity is profitable.” So explain Bob Kocher, MD, and Anuraag Chigurupati, in a viewpoint on Economic Incentives for Administrative Simplification, published this week in JAMA. Dr. Kocher, a physician who is a venture capitalist, and Chigurupati, head of member experience at Devoted Health, explain the misaligned incentives that impede progress in reducing administrative spending. This essay joins two others in the October 20, 2021 issue of JAMA which highlight administrative spending in American health care: Administrative Simplification and the Potential for Saving a Quarter-Trillion Dollars in Health Care by Nikhil Sahni, Brandon

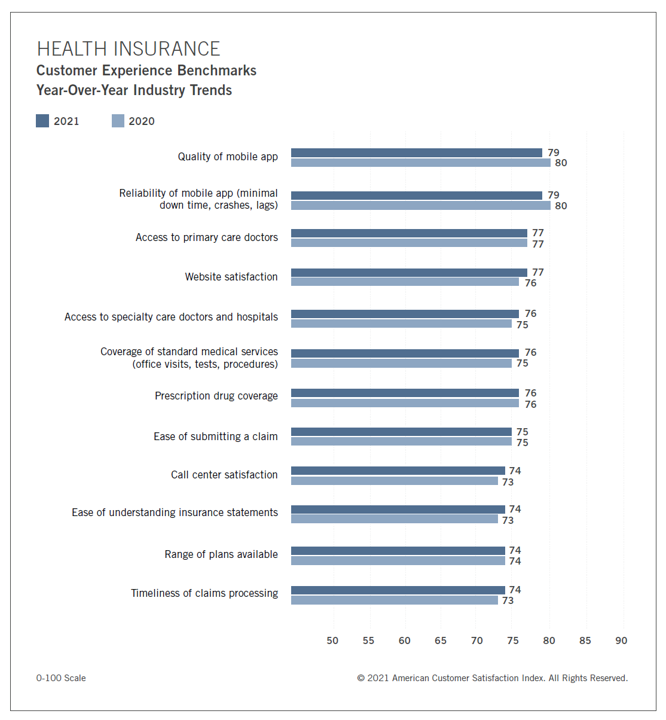

Health Plan Consumer Experience Scores Reflect Peoples’ Digital Transformation – ACSI Speaks

In the U.S., peoples’ expectations of their health care experience is melding with their best retail experience — and that’s taken a turn toward their digital and ecommerce life-flows. The American Customer Satisfaction Index Insurance and Health Care Study 2020-2021 published today, recognizing consumers’ value for the quality of health insurance companies’ mobile apps and reliability of those apps. Those digital health expectations surpass peoples’ benchmarks for accessing primary care doctors and specialty care doctors and hospitals, based on ACSI’s survey conducted among 12,274 customers via email. The study was fielded between October 2020 and September 2021. Year on year,

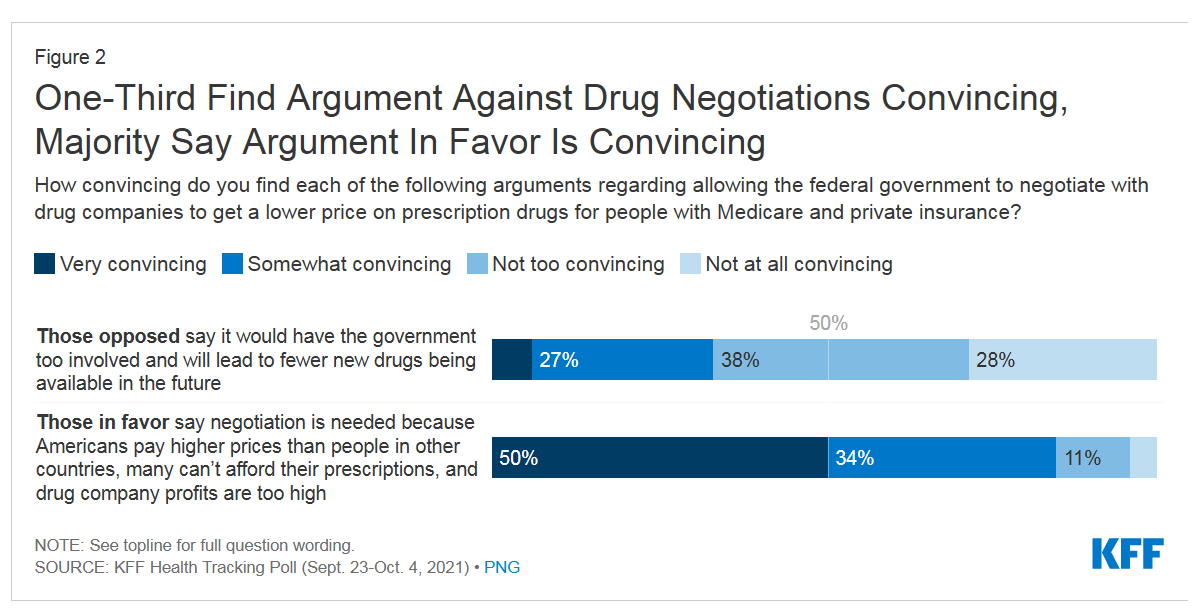

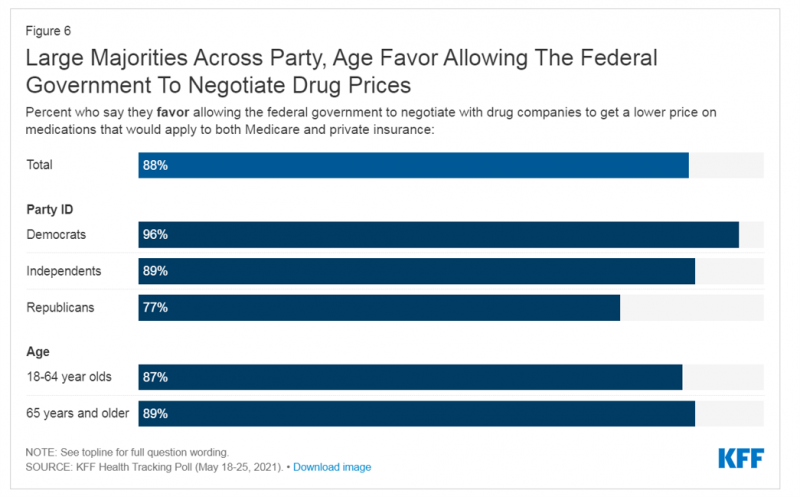

Support for Drug Price Negotiation Brings Partisans Together in the U.S.

Most U.S. adults across political parties favor allowing the Federal government authority to negotiate for drug prices — even after hearing the arguments against the health policy. Drug price negotiation, say by the Medicare program, is a unifying public policy in the current era of political schisms in America, based on the findings in a special Kaiser Family Foundation (KFF) Health Tracking Poll conducted in late September-early October 2021. Overall, 4 in 5 Americans favor allowing the Federal government negotiating power for prescription drug prices, shown in the first chart from the KFF report. By party, nearly all Democrats agree

Consider Mental Health Equity on World Mental Health Day

COVID-19 exacted a toll on health citizens’ mental health, worsening a public health challenge that was already acute before the pandemic. It’s World Mental Health Day, an event marked by global and local stakeholders across the mental health ecosystem. On the global front, the World Health Organization (WHO) describes the universal phenomenon and burden of mental health on the Earth’s people… Nearly 1 billion people have a mental disorder Depression is a leading cause of disability worldwide, impacting about 5% of the world’s population People with severe mental disorders like schizophrenia tend to die as much as 20 years earlier

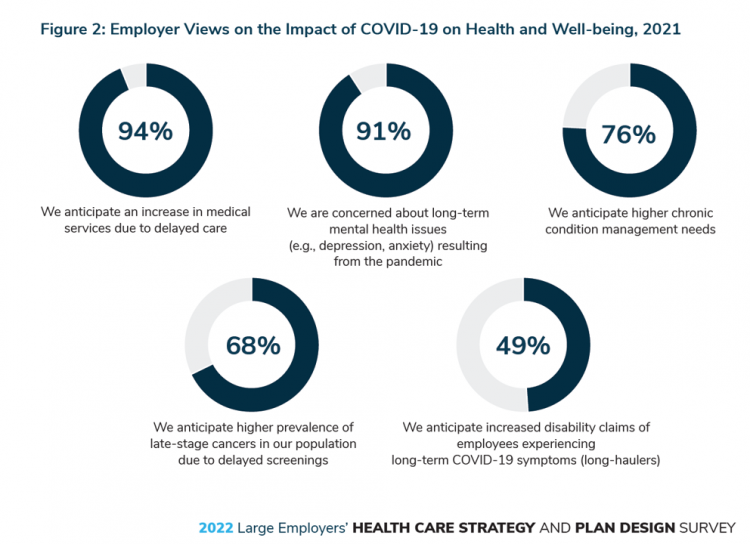

Chronic Medical Conditions, Mental Health, and Equity On Employers’ Minds for 2022 – Employee Health in the Wake of COVID-19

One in two people in the U.S. receive health insurance through employers. As large employers tend to be on the vanguard of benefit plan design, it’s useful to understand how these companies are thinking ahead on behalf of their employees. With that objective, it’s always instructive to explore the annual study from the Business Group on Health, the 2022 Large Employers’ Health Care Strategy and Plan Design Survey. As a result of the COVID-19 pandemic, large employees have many concerns about worker and dependents’ health. The biggest firms in America providing health insurance for workers are expecting an increase in

Why Is So Much “Patient Experience” Effort Focused on Financial Experience?

Financial Experience (let’s call it FX) is the next big thing in the world of patient experience and health care. Patients, as health consumers, have taken on more of the financial risk for health care payments. The growth of high-deductible health plans as well as people paying more out-of-pocket exposes patients’ wallets in ways that implore the health care industry to serve up a better retail experience for patients. But that just isn’t happening. One of the challenges has been price transparency, which is the central premise of this weekend’s New York Times research-rich article by reporters Sarah Kliff and

Health Insurance in Aisle 3: Why a Grocery Chain is Working on Medicare

“You can trust us to help you find the right Medicare coverage for you and your lifestyle,” the tagline reads. What kind of organization would be behind this campaign: a healthcare navigator company, an insurance company, or a social services agency? In fact, it’s a grocery store called Hy-Vee, which launched the “Medicare Aisle” to help consumers living in the eight states in which the chain’s 240+ stores operate to sort through the daunting labyrinth of Medicare choices. “Hy-Vee is a trusted leader in the health and wellness space, and as a retail and specialty pharmacy provider, we are deeply

Doctors’ Offices Morph into Bill Collectors As Patients Face Growing Out-Of-Pocket Costs

In the U.S., patients have assumed the role of health care payors with growing co-payments, coinsurance amounts, and deductibles pushing peoples’ out-of-pocket costs up. This has raised the importance of price transparency, which is based on the hypothesis that if patients had access to personally-relevant price/cost information from doctors and hospitals for medical services, and pharmacies and PBMs for prescription drugs, the patient would behave as a consumer and shop around. That hypothesis has not been well proven-out: even though more health care “sellers” on the supply side have begun to post price information for services, patients still haven’t donned

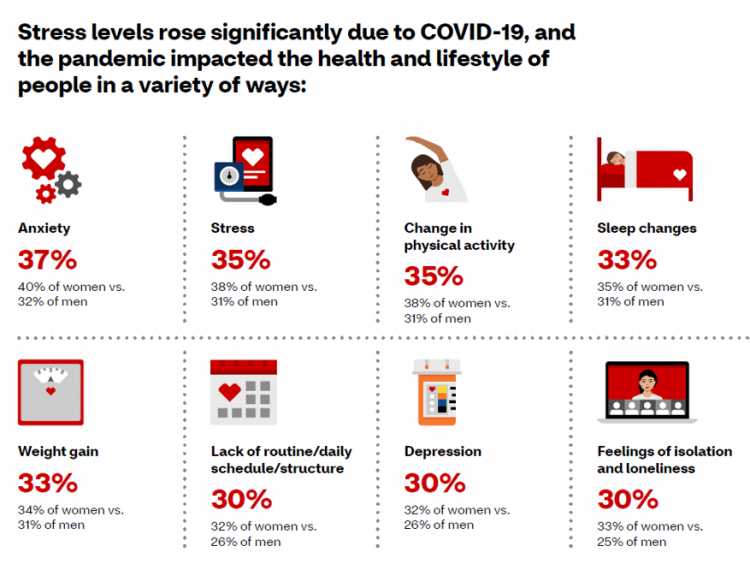

CVS Finds Differences in Mental and Behavioral Health Among Men Vs. Women in the Pandemic

As the COVID-19 pandemic shifts to a more endemic phase — becoming part of peoples’ everyday life for months to come — impacts on peoples’ mental health will persist, according to new research from CVS Health in the company’s annual Health Care Insights Study. CVS conducted the annual Health Care Insights Study among 1,000 U.S. adults in March 2021. To complement the consumer study, an additional survey was undertaken among 400 health care providers including primary care physicians and specialists, nurse practitioners, physician assistants, RNs and pharmacists. CVS has been tracking the growing trend of health care consumerism in the

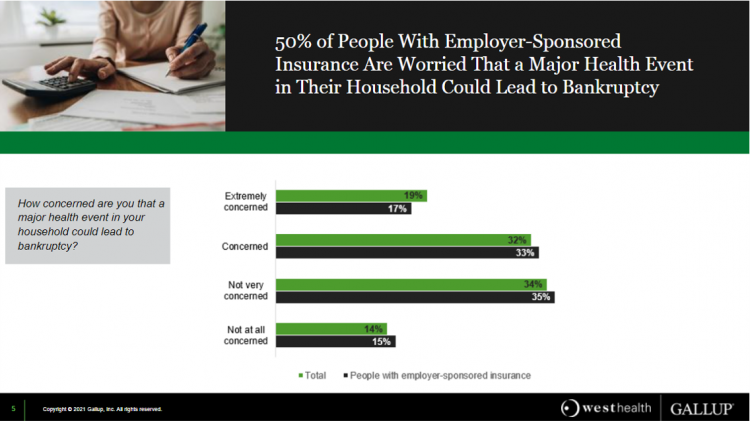

One in Two Americans with Work-Based Insurance Worries That Healthcare Costs Could Lead to Bankruptcy

One in two people in the U.S. with employer-sponsored health insurance worry that a major health event in their household could lead to bankruptcy, according to research gathered by West Health and Gallup in Business Speaks: The Future of Employer-Sponsored Insurance. Gallup and West Health presented their study in a webinar earlier this week; in today’s post, I feature a few key data points that particularly resonate as I celebrate/appreciate yesterday’s U.S. Supreme Court’s ruling on the Affordable Care Act (i.e., California v. Texas) combined with a new study published in JAMA Network Open, discussed below the digital fold in

Post-Pandemic, U.S. Healthcare is Entering a “Provide More Care For Less” Era – Pondering PwC’s 2022 Forecast

In the COVID-19 pandemic, health care spending in the U.S. increased by a relatively low 6.0% in 2020. This year, medical cost trend will rise by 7.0%, expected to decline a bit in 2022 according to the annual study from PwC Health Research Institute, Medical Cost Trend: Behind the Numbers 2022. What’s “behind these numbers” are factors that will increase medical spending (the “inflators” in PwC speak) and the “deflators” that lower costs. Looking around the future corner, the inflators are expected to be: A COVID-19 “hangover,” leading to increased health care services utilization Preparations for the next pandemic, and

What Do Democrats and Republicans Agree On? Allowing Negotiations to Lower Rx Prices

People living in the U.S. have weathered over fifteen months of life-shifts for work, school, prayer, fitness, and social lives. So you might think that the most important public priority for Congress might have something to do with COVID-19, vaccines, or health insurance coverage. But across all priorities, it turns out that prescription drug costs rank higher in Americans’ minds than any other issue in the Kaiser Family Foundation Health Tracking Poll for May 2021. Two-thirds of U.S. adults said that allowing the federal government and private insurance plans to negotiate for lower prices on Rx drugs was their top

Wearables Are Good For Older People, Too — The Latest From Laurie Orlov

The COVID-19 pandemic accelerated a whole lot of digital transformation for people staying home. For digital natives, that wasn’t such an exogenous shock. For older people who are digital immigrants, they will remember their initial Zoom get-together’s with much-missed family, ordering groceries online in the first ecommerce purchase, and using telemedicine for the first time as a digital health front-door. Laurie Orlov, tech industry veteran, writer, speaker and elder care advocate, is the founder of the encyclopedic Aging and Health Technology Watch website. She takes this propitious moment to assess The Future of Wearables and Older Adult in a new report.

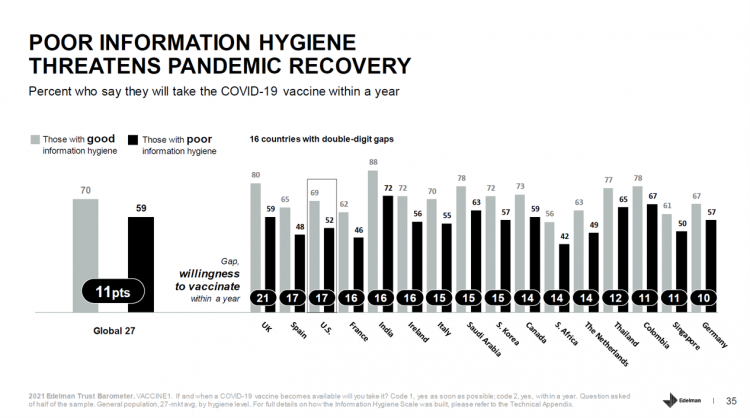

Healthcare, Heal Thyself! How the Industry Can and Should Play the Trust Card

The emergence of the COVID-19 vaccine “infodemic” has slowed the ability for nations around the world to emerge out of the public health crisis. Growing cynicism among some health citizens facing the politicization of public health tactics like vaccines and facial masks is what we’re talking about. At the root is peoples’ lack of trust across a range of information providers, including government, media, business, and even peers. The 2021 Edelman Trust Barometer spotlighted the infodemic and eroding trust in the U.S. in the voices of public health, the public sector, and media. This is a global challenge as well,

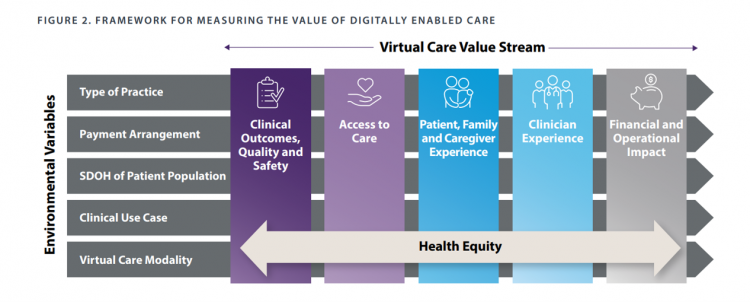

The ROI on Virtual Care – Thinking About Value and Future Prospects With the AMA

When a new technology or product starts to get used in a market, it follows a diffusion curve whose slope depends on the pace of adoption in that market. For telehealth, that S-curve has had a very long and fairly flat front-end of the “S” followed by a hockey stick trajectory in March and April 2020 as the COVID-19 pandemic was an exogenous shock to in-person health care delivery. The first chart from the CDC illustrates that dramatic growth in the use of telehealth ratcheting up since the first case of COVID-19 was diagnosed in the U.S. Virtual care has

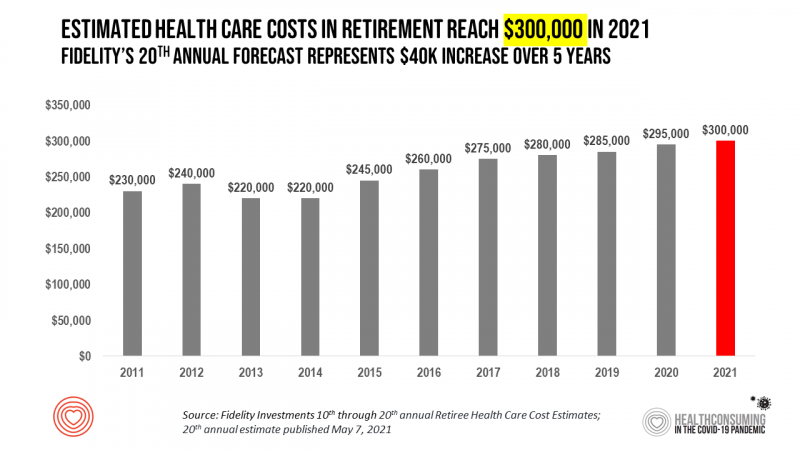

Health Care Costs for a Couple in Retirement in the U.S. Reach $300,000

To pay for health care expenses, the average nest-egg required for a couple retiring in the U.S. in 2021 will be $300,000 according to the 20th annual Fidelity Investments Retiree Health Care Cost Estimate. I’ve tracked this survey for over a decade here on Health Populi, and updated the annual chart shown here to reflect a $40,000 increase in retiree costs since 2016. While the rate of increase year-on-year since then has slowed, the $300,000 price-tag for retiree health care costs is a huge number few Americans have saved for. That $300K splits up unequally for an opposite-gender couple (in

And the Oscar Goes To….Power to the Patients!

Health care has increased its role in popular culture over the years. In movies in particular, we’ve seen health care costs and hassles play featured in plotlines in As Good as it Gets [theme: health insurance coverage], M*A*S*H [war and its medical impacts are hell], and Philadelphia [HIV/AIDS in the era of The Band Played On], among dozens of others. And this year’s Oscar winner for leading actor, Anthony Hopkins, played The Father, who with his family is dealing with dementia. [The film, by the way, garnered six nominations and won two]. When I say “Oscar” here on the Health

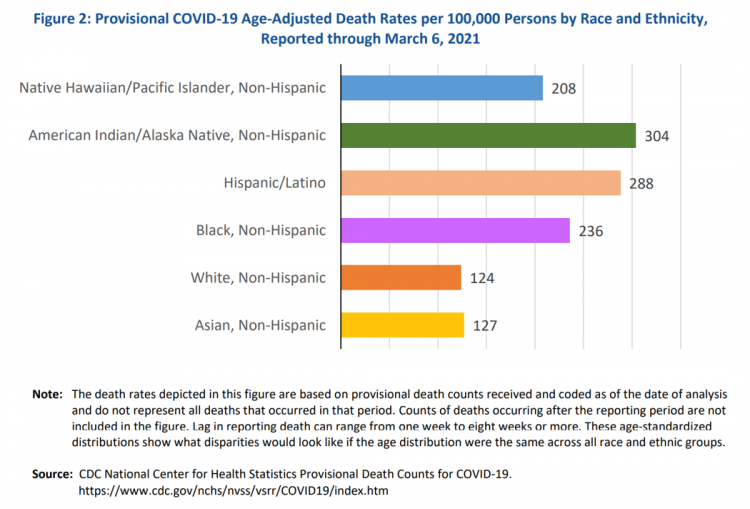

Health Disparities and the Risks of Social Determinants for COVID-19 – 14 Months of Evidence

In April 2020, the U.S. Centers for Disease Control issued a report featuring evidence that in the month of March 2020, the coronavirus pandemic was not an equal-opportunity killer. Within just a couple of months of COVID-19 emerging in America, it became clear that health disparities were evident in outcomes due to complications from the coronavirus. An update from that early look at differences in COVID-19 diagnoses and mortality rates was published in Health Disparities by Race and Ethnicity During the COVID-19 Pandemic: Current Evidence and Policy Approaches, In this report, the Assistant Secretary for Planning and Evaluation, part of

Health, the Great Unifier (For Most)

As the COVID-19 expanded peoples’ consciousness about infectious disease and opportunities to keep a tricky virus at bay, consumers grew new muscles about public and individual wellness…now, “more invested in achieving it,” according to In Health We Trust, a survey report from Healthline Media. To gauge Americans changing perspectives on personal health, HealthLine conducted surveys among 1,533 U.S. consumers age 18 and over in February 2020 (just about the time the coronavirus pandemic was emerging in the U.S.) and 1,577 consumers in December 2020. One of the subtle shifts in health care consumerism concerns cost, which before the pandemic has

How to Restore Americans’ Confidence in U.S. Health Care: Deal With Access and Cost

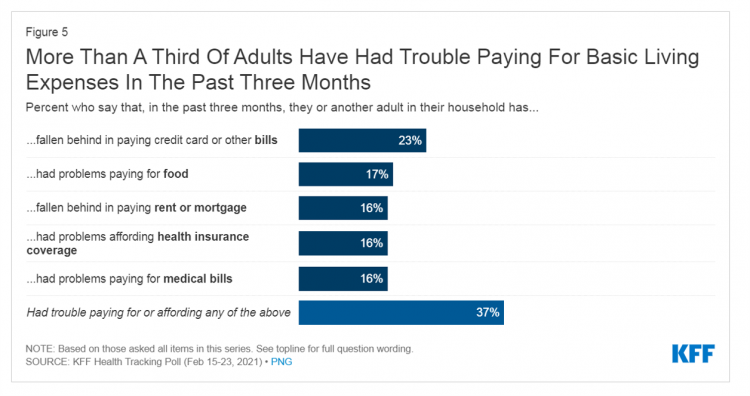

With a vaccine supply proliferating in the U.S. and more health citizens getting their first jabs, there’s growing optimism in America looking to the next-normal by, perhaps, July 4th holiday weekend as President Biden reads the pandemic tea leaves. But that won’t mean Americans will be ready to return to pre-pandemic health care visits to hospital and doctor’s offices. Now that hygiene protocols are well-established in health care providers’ settings, at least two other major consumer barriers to seeking care must be addressed: cost and access. The latest (March 2021) Kaiser Family Foundation Tracking Poll learned that at least one

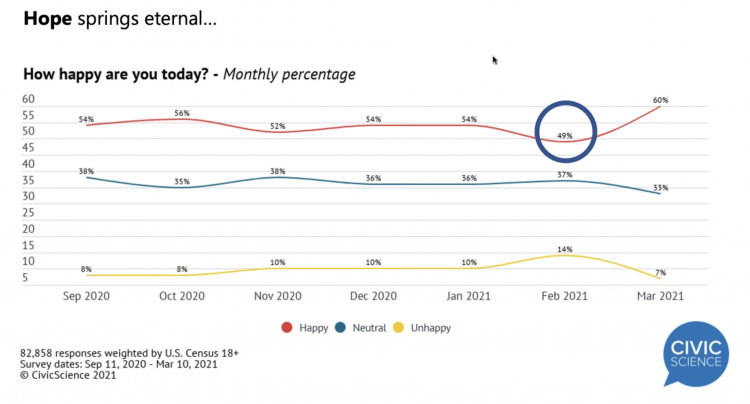

“Hope Springs Eternal” With the COVID Vaccine for Both Joe Biden and Most People in the U.S.

More Americans are happier in March 2021 than they’ve been for a year, based on consumer research from Civic Science polling U.S. adults in early March 2021. For the first time, a larger percent of Americans said they were better off financially since the start of the pandemic. This week, Civic Science shared their latest data on what they’re seeing beyond the coronavirus quarantine era to forecast trends that will shape a post-COVID America. Buoying peoples’ growing optimism was the expectation of the passage of the American Cares Act, which President Biden signed into effect yesterday. The HPA-CS Economic Sentiment Index

Value-Based Health Care Needs All Stakeholders at the Table – Especially the Patient

2021 is the 20th anniversary of the University of Michigan Center for Value-Based Insurance Design (V-BID). On March 10th, V-BID held its annual Summit, celebrating the Center’s 20 years of innovation and scholarship. The Center is led by Dr. Mark Fendrick, and has an active and innovative advisory board. [Note: I may be biased as a University of Michigan graduate of both the School of Public Health and Rackham School of Graduate Studies in Economics]. Some of the most important areas of the Center’s impact include initiatives addressing low-value care, waste in U.S. health care, patient assistance programs, Medicare

The Economics of the Pandemic Put Costs at the Top of Americans’ Health Reform Priorities

A major side-effect of the coronavirus pandemic in 2020 was its impact on the national U.S. economy, jobs, and peoples’ household finances — in particular, medical spending. In 2021, patients-as-health-consumers seek lower health care and prescription drug costs coupled with higher quality care, discovered by the patient advocacy coalition, Consumers for Quality Care. This broad-spanning patient coalition includes the AIMED Alliance, Autism Speaks, the Black AIDS Institute, Black Women’s Health Initiative, Center Forward, Consumer Action. Fair Foundation, First Focus, Global Liver Institute, Hydrocephalus Association, LULAC, MANA (a Latina advocacy organization), Myositis Association, National Consumers League, National Health IT Collaborative, National Hispanic

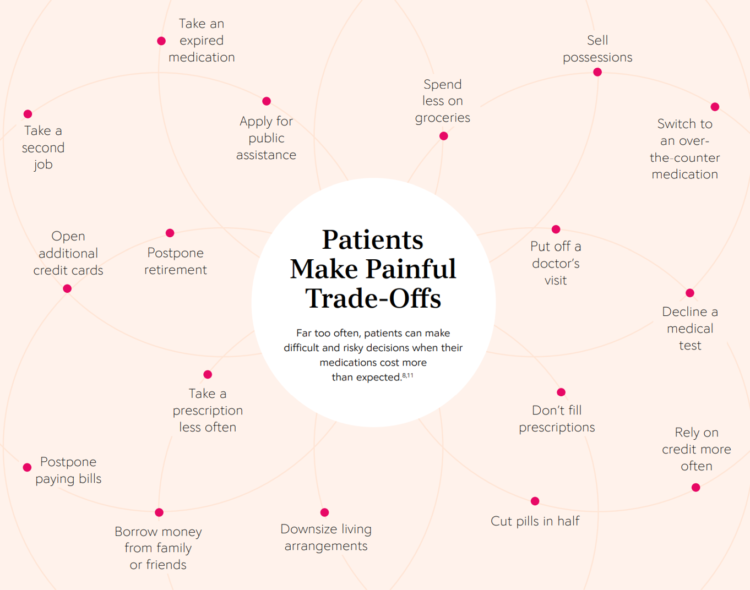

The Social Determinants of Prescription Drugs – A View From CoverMyMeds

The COVID-19 pandemic forced consumers to define what were basic or essential needs to them; for most people, those items have been hygiene products, food, and connectivity to the Internet. There’s another good that’s essential to people who are patients: prescription drugs. A new report from CoverMyMeds details the current state of medication access weaving together key health care industry and consumer data. The reality even before the coronavirus crisis emerged in early 2020 was that U.S. patients were already making painful trade-offs, some of which are illustrated in the first chart from the report. These include self-rationing prescription drug

Ten In Ten: Manatt’s Healthcare Priorities to 2031

The coronavirus pandemic has exposed major weaknesses in the U.S. health care system, especially laying bare inequities and inertia in American health care, explained in The Progress We Need: Ten Health Care Imperatives for the Decade Ahead from Manatt Health. The report details the ten objectives that are central to Manatt’s health care practice, a sort of team manifesto call-to-action and North Star for the next decade. Their ten must-do’s for bending the cost curve while driving constructive change for a better health care system are to: Ensure access Achieve health equity Stability the safety net and rebuild public health

Call It Deferring Services or Self-Rationing, U.S. Consumers Are Still Avoiding Medical Care

Patients in the U.S. have been self-rationing medical care for many years, well before any of us knew what “PPE” meant or how to spell “coronavirus.” Nearly a decade ago, I cited the Kaiser Family Foundation Health Security Watch of May 2012 here in Health Populi. The first chart here shows that one in four U.S. adults had problems paying medical bills, largely delaying care due to cost for a visit or for prescription drugs. Fast-forward to 2020, a few months into the pandemic in the U.S.: PwC found consumers were delaying treatment for chronic conditions. In October 2020, The American Cancer

The COVID Healthcare Consumer – 5 Trends Via The Medecision Liberation Blog

The first six months into the coronavirus pandemic shocked the collective system of U.S. consumers for living, learning, laboring, and loving. I absorbed all kinds of data about consumers in the wake of COVID-19 between March and mid-August 2020, culminating in my book, Health Citizenship: How a virus opened hearts and minds, published in September on Kindle and in print in October. In this little primer, I covered the five trends I woven based on all that data-immersion, following up the question I asked at the end of my previous book, HealthConsuming: when and how would Americans claim their health

The COVID-19 Era Has Grown Health Consumer Demand for Virtual Care

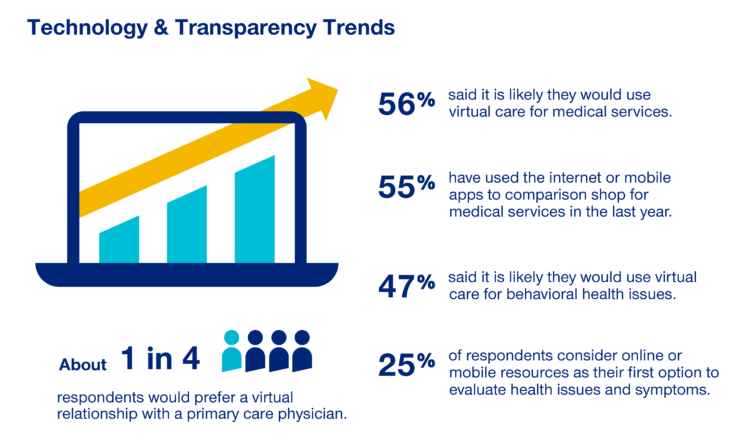

Over one-half of Americans would likely use virtual care for their healthcare services, and one in four people would actually prefer a virtual relationship with a primary care physician, according to the fifth annual 2020 Consumer Sentiment Survey from UnitedHealthcare. What a difference a pandemic can make in accelerating patients’ adoption of digital health tools. This survey was conducted in mid-September 2020, and so the results demonstrate U.S. health consumers’ growing digital health “muscles” in the form of demand and confidence in using virtual care. One in four people would consider online options as their first-line to evaluating personal health

Health Care Providers Are More Politically Engaged in the 2020 Elections

Until 2016, physicians’ voting rates in U.S. elections had not changed since the late 1970s. Then in 2018, two years into President Donald Trump’s four-year term, the mid-term elections drove U.S. voters to the election polls…including health care providers. Based on the volume and intensity of medical professional societies’ editorials on the 2020 Presidential Election, we may be in an inflection-curve moment for greater clinician engagement in politics as doctors and nurses take claim of their health citizenship. A good current example of this is an essay published in the AMA’s website asserting, “Why it’s okay for doctors to ask

Healthcare Costs, Access to Data, and Partnering With Providers: Patients’ Top User Experience Factors

As patients returned to in-person, brick-and-mortar health care settings after the first wave of COVID-19 pandemic, they re-enter the health care system with heightened consumer expectations, according to the Beryl Institute – Ipsos Px Pulse report, Consumer Perspectives on Patient Experience in the U.S. Ipsos conducted the survey research among 1,028 U.S. adults between 23 September and 5 October 2020 — giving consumers many months of living in the context of the coronavirus. This report is a must-read for people involved with patient and consumer health engagement in the U.S. and covers a range of issues. My focus in this

Women’s Health Policy Advice for the Next Occupant of the White House: Deal With Mental Health, the Pandemic, and Health Care Costs

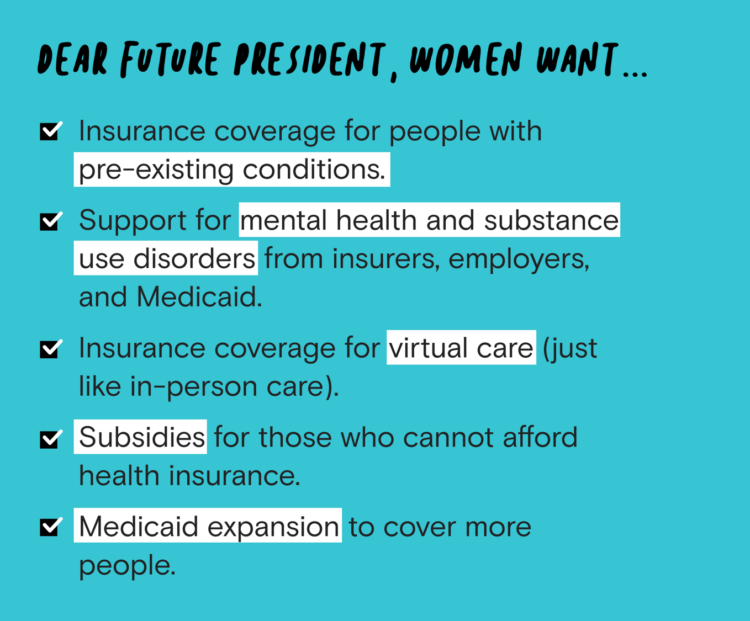

2020 marked the centennial anniversary of the 19th Amendment to the U.S. Constitution, giving women the right to vote. In this auspicious year for women’s voting rights, as COVID-19 emerged in the U.S. in February, women’s labor force participation rate was 58%. Ironic timing indeed: the coronavirus pandemic has been especially harmful to working women’s lives, the Brookings Institution asserted last week in their report in 19A: The Brookings Gender Equality Series. A new study from Tia, the women’s health services platform, looks deeply into COVID-19’s negative impacts on working-age women and how they would advise the next occupant of

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.