Just as people go online for travel planning. photo development. and financial transactions. they’re looking for health engagement with their doctors and health records online, too. Harris Interactive heralds this as The Age of the Healthcare Consumer.

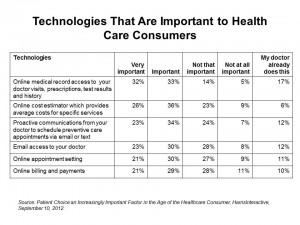

Harris Interactive polled U.S. adults and found that people are interested in a range of technologies for engaging in their health, arrayed in the chart: when asked which would be important for health providers to implement, consumers said (NET = very important + important):

– Online medical record access to visits, Rx, test results, and history, 65%. 17% of consumers said their doctor already provides this.

– Online cost estimator calculating average costs for specific services, 62%

– Proactive communication to schedule preventive care via email or text, 57%

– Email access to doctor, 53%

– Online appointment scheduling, 51%

– Online billing and payments, 50%.

Harris Interactive also gauged consumers’ satisfaction with various retail experiences. Most satisfying experiences were the last visit to a restaurant, with 90% of people feeling satisfied with the overall experience. Restaurants were followed by department stores (86%), banks (85%), online purchases (84%), health providers (83%), hotels (78%), auto purchase (72%), health insurance (61%), and mobile phone stores (59%).

Thus, 4 in 5 consumers were generally satisfied with their most recent visit to a health care provider — although 17% were dissatisfied, a fairly high level of dissatisfaction tied with people’s last visit to a mobile phone store. The only higher negative level of satisfaction was with health insurance companies, with which 18% of consumers were dissatisfied.

Harris Interactive surveyed 2,311 U.S. adults online in July 2012.

Health Populi’s Hot Points: Harris Interactive’s survey provides a snapshot of where U.S. adults are on the healthcare consumer spectrum: looking for high levels of customer service akin to those people find in other retail settings like banks, car dealerships, and department stores. THINK: hospital, Nordstrom style, or doctor-meets-American Express.

One of the most retail-facing health venues is the retail clinic, for which Harris surveyed asking the question, “New options for healthcare services are starting to be available in shopping environments…how likely would you be to go to one of these places instead of your regular doctor?” The most likely reason consumers would go to a retail clinic included to get a flu shot (65%), presenting with cold or flu symptoms (53%), to attend to a cut or puncture wound (49%), with a rash (47%), for a check up for cholesterol or blood pressure (47%), or for a screening or lab service (such as blood glucose testing (47%). For regular checkups and wellness visits, fewer than one-third of people would use a retail clinic – but still at least one-fourth of consumers polled.

It’s clear that American health citizens are looking for more retail “feel” in U.S. health care. In the accountable care era, those providers that act more like Nordstrom and Amex will garner favor among the growing cadre of health consumers.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.