Health Consumers Are Now Amazon-Primed for Healthcare – HealthConsuming Explains, Part 2

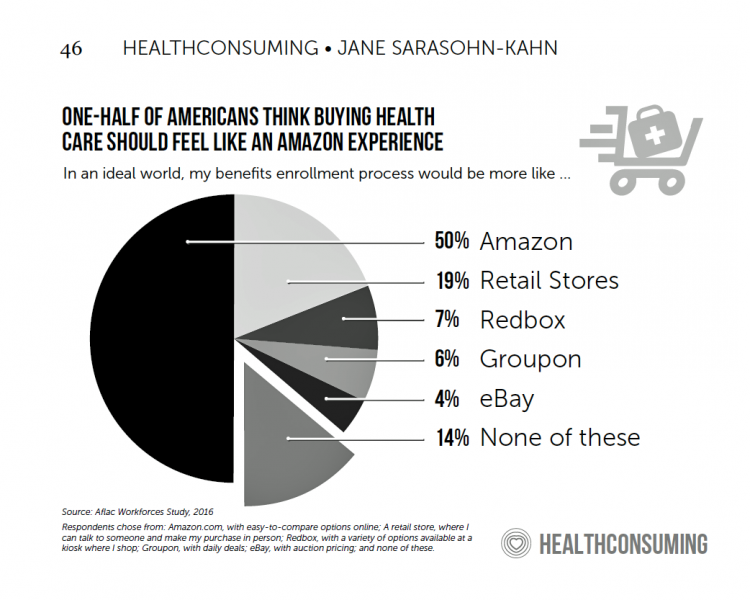

As patients now assume the role of health consumer, they rationally expect retail-level experiences with greater first-dollar payment for health insurance, health care services and medical products like prescription drugs. Consumers know what good retail looks and feels like, and are focusing that experiential lens on health care, Aflac found when their Workforces Survey polled Americans on their desirable health insurance shopping experience. One in two people said it should feel, “like Amazon,” and another 20% of folks said, “like retail.” Chapter 3 of HealthConsuming is titled, “How Amazon Has Primed Health Consumers,” and explains this re-shaping of patient expectations.

Patients Become Healthcare Payors, Now Consumers – HealthConsuming Explains, Part 1

We Are All Health Consumers Now. That’s the title of the first chapter of my new book, HealthConsuming: From Health Consumer to Health Citizen. I start this chapter quoting President Ronald Reagan in 1983, who recognized that health care costs were growing at three times the rate of inflation during the first term of his Presidency. It’s déjà vu in health care all over again, but 35 years later, it’s the patient now facing sticker-shock with first dollar payments in high-deductible health plans, six-figure prices on specialty drugs to treat cancers, and a poor return-on-investment for personal health spending. Thus

Across All Political Parties, Likely Voters Over 50 Favor Cutting Prescription Drug Prices

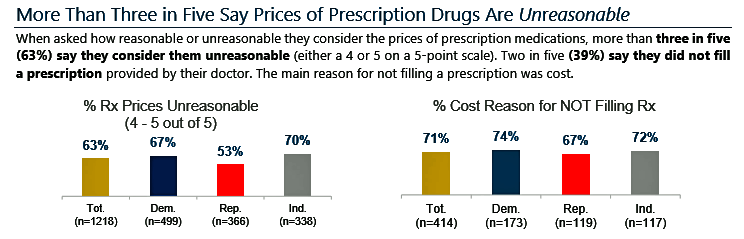

People over 50 in the U.S. that are likely to vote in the 2020 Presidential election are keenly interested in lowering the cost of prescription drugs, according to a survey conducted by AARP in February and March 2019. Most people over 50 take prescription drugs daily; one-third take two or three Rx’s regularly, and one in five older people take six or more prescription medicines regularly. Thus, prescription drugs are part of most older Americans’ daily life-flows and household spending considerations. About two-thirds of older people who are likely to vote say that Rx prices are “unreasonable,” including 67% of

A Dose of Optimism Is a Prescription for Financial Health, Says Frost Bank

People define their personal health and well-being broadly, well beyond physical health. Mental wellness, physical appearance, social connections, and financial wellness all add into our self-health definitions. Mind Over Money is a consumer study conducted by Frost Bank, working with FleischmanHillard, connecting the dots between optimism and financial health. The top-line of the study is that people who are optimists have roughly two-thirds fewer days of financial stress per year than pessimists. Put another way, pessimists stress about finances 62% of the year, shown in the first chart from the study. This translates into 62% of optimists having better financial

Americans’ Trust in U.S. Healthcare Lags Tech — and Women Are Particularly Cynical

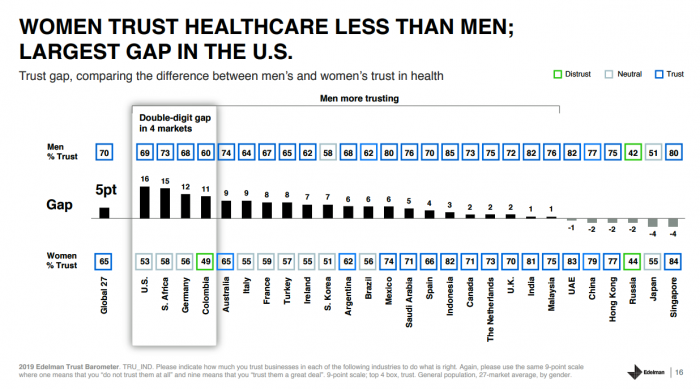

The 2019 Edelman Trust Barometer measured the biggest gap in trust for the healthcare industry between the U.S. “informed public” and the mass population. Fewer American women, too, trust the healthcare industry than men do. “This inequality of trust may be reflective of the mass population continuing to feel left behind as compared to others, even as they recognize the advances that are being made that could benefit them. Given tone and tenor of the day, and particularly among mass population, healthcare may continue to see increasing demands for change and regulation,” Susan Isenberg, Edelman’s head of healthcare, notes in

Telehealth In 2030 – Notes From the Future At #ATA19 with Safavi, Holt, Bathina and Swafford

What will telemedicine look like in 2030? imagined Kaveh Safavi, Accenture’s Senior Managing Director and Health of Global Healthcare Practice. Kaveh was brainstorming the future of telehealth a decade from “now,” with three innovators attending #ATA19: Deepthi Bathina of Humana, Matthew Holt of Catalyst Health (and Co-Founder of Health 2.0), and Kim Swafford of Providence St. Joseph. This week convened the ATA annual conference where healthcare industry stakeholders met up to deal with the current telehealth environment and imagine what the future prospects would/could be. As Kaveh invoked the futuristic theme, I couldn’t help thinking about Elroy Jetson, pictured here

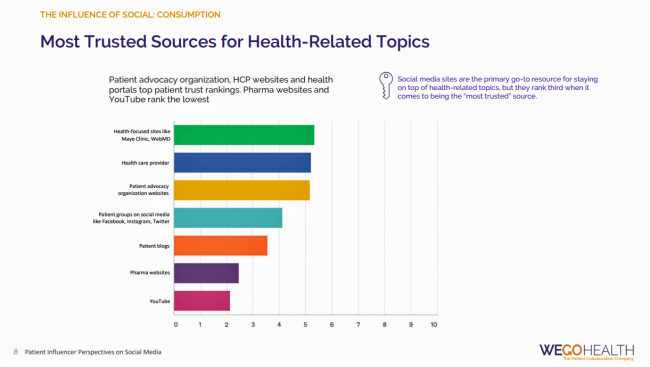

Listen Up, Healthcare: Hear The Patient’s Voice!

Consider the voice of a patient before the advent of the Internet in the digital 1.0 world, and then the proliferation of social networks in v 2.0. One patient could talk with another over their proverbial neighborhood fence, a concerned parent at the PTA meeting with others dealing with a children’s health issue, or a recovering alcoholic testifying in person at an AA session. Today, the voice of the patient is magnified one-to-many, omnichannel and multi-platform — via video, blogs, podcasts, social networks, listservs….and, yes, still in live forums like AA meetings, church basements, Y-spaces, and the Frazzled Cafe meet-ups

Health/Care Everywhere – Re-Imagining Healthcare at ATA 2019

“ATA” is the new three-letter acronym for the American Telemedicine Association, meeting today through Tuesday at the Convention Center in New Orleans. Ann Mond Johnson assumed the helm of CEO of ATA in 2018, and she’s issued a call-to-action across the health/care ecosystem for a delivery system upgrade. Her interview here in HealthLeaders speaks to her vision, recognizing, “It’s just stunning that there’s such a lag between what is possible in telehealth and what is actually happening.” I’m so keen on telehealth, I’m personally participating in three sessions at #ATA19. On Monday 15th April (US Tax Day, which is relevant

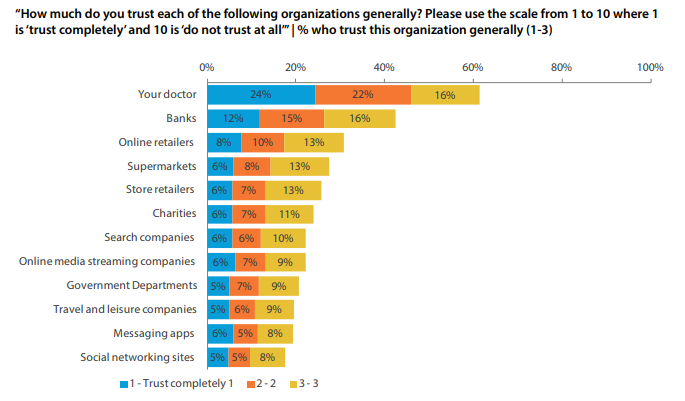

Trust In Data Stewardship Is Healthcare Providers’ To Lose

Trust is a precursor to health engagement, I learned way back in 2008 when I collaborated with Edelman on the first Health Engagement Barometer in 2008. This chart illustrated data from that survey, showing that trust, authenticity and satisfaction were the top three drivers among consumers looking to engage for health. I attended the annual 2019 HIMSS conference in February for nearly a week of meetings, interviews, education sessions, company private salons, and social media check-ins with my fellow and sister HIMSS Social Media Ambassadors. One of the SMA objectives is to consider the Conference in advance and offer thoughts

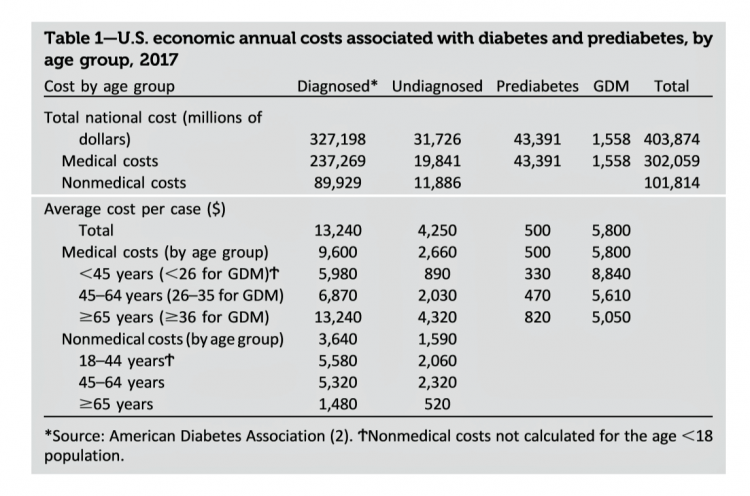

The United States of Diabetes: a $1,240 Tax on Every American

Pharmaceutical company executives are testifying in the U.S. Congress this week on the topic of prescription drug costs. One of those medicines, insulin, cost a patient $5,705 for a year’s supply in 2016, double what it cost in 2012, according to the Health Care Cost Institute. Know that one of these insulin products, Lilly’s Humalog, came onto the market in 1996. In typical markets, as products mature and get mass adoption, prices fall. Not so insulin, one of the many cost components in caring for diabetes. But then prescription drug pricing doesn’t conform with how typical markets work in theory.

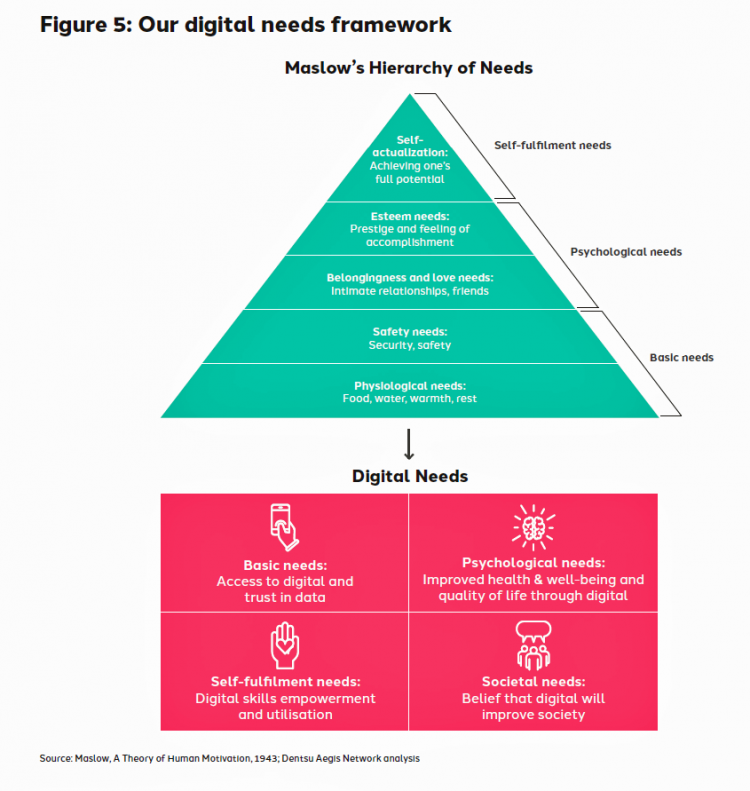

Digital Health As A Basic Human Need – the Dentsu Digital Society Index 2019

We are all Homo informaticus these days, multi-channel, multi-platform beings using digital platforms. “Computing is not about computers anymore. It is about living,” Nicholas Negroponte wrote in Being Digital. He said that in 1995. In that quarter-century since Negroponte made that prescient observation, we come to better understand that being a Digital Society has its upsides and downfalls, alike. We need a “new needs model” for the digital age, asserts a new report, Human Needs in a Digital World, the 2019 Digital Society Index report from the Dentsu Aegis network. Taking Maslow’s Hierarchy of Needs as a basic construct, the Index

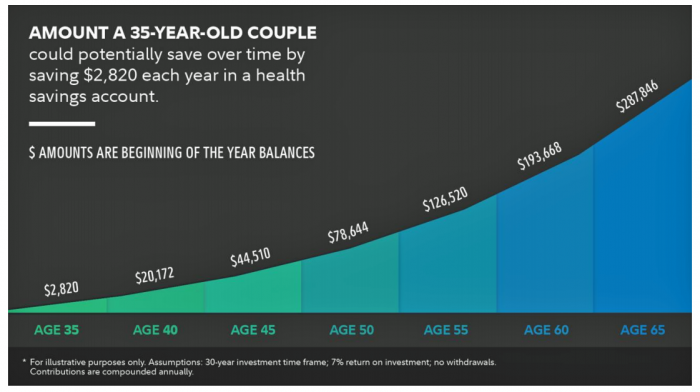

What $285,000 Can Buy You in America: Medical Costs for Retirees in 2019

The average 65-year old couple retiring in 2019 will need to have a cash nest-egg of $285,000 to cover health care and medical expenses through retirement years, Fidelity Investments calculated. Fidelity estimates the average retiree will allocate 15% of their annual spending in retirement on medical costs. As if that top-line number isn’t enough to sober one up, there are two more caveats: (1) the $285K figure doesn’t include long-term care, dental services and over-the-counter medicines; and, (2) it’s an after-tax number. So depending on your tax bracket, you have to earn a whole lot more to net the $285,000

World Health Day 2019: Let’s Celebrate Food, Climate, Insurance Coverage and Connectivity

Today, 7 April, is World Health Day. With that in mind, I devote this post to three key social determinants of health (SDOH) that are top-of-mind for me these days: food for health, climate change, and universal health coverage. UHC happens to be WHO’s focus for World Health Day 2019. [As a bonus, I’ll add in a fourth SDOH in the Hot Points for good measure and health-making]. Why a World Health Day? you may be asking. WHO says it’s, “a chance to celebrate health and remind world leaders that everyone should be able to access the health care they need,

Finding Healthy Food and Things At Amazon Go In Chicago

Health is everywhere, I find in my travels and in my community. I’m in Chicago at the Becker’s health care conference with VisitPay this week, and had the opportunity to take a walk around the corner from the Hyatt Regency to the Illinois Center to visit one of the few Amazon Go stores operating in the U.S. Here’s what I found in my search for all-things-healthy at retail. You cannot enter an Amazon Go store without downloading the app that’s freely available in your operating system’s appstores for Apple, Google and, yes, Amazon. The app was quick to download, but

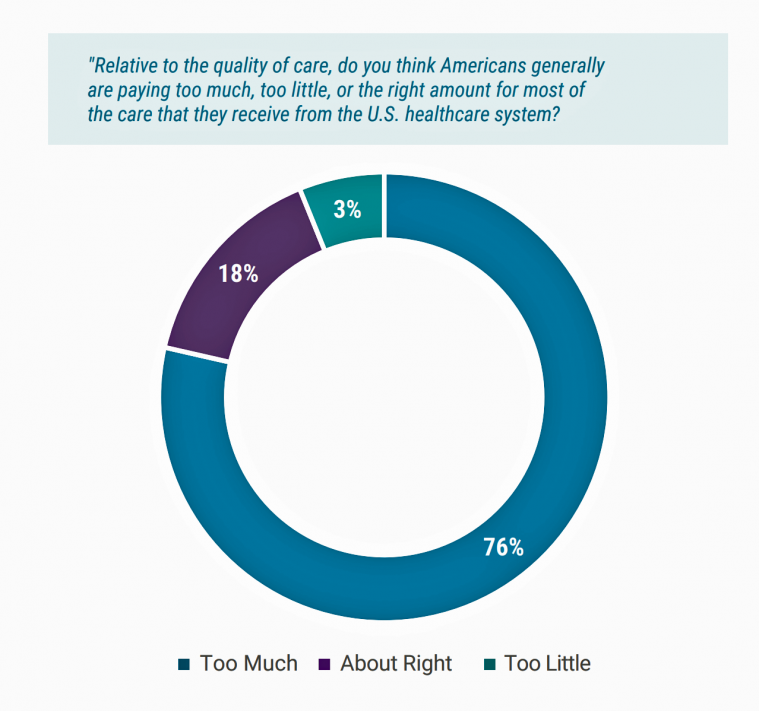

Medical Costs Are Consuming Americans’ Financial Health

Spending on medical care costs crowded out other household spending for millions of Americans in 2018, based on The U.S. Healthcare Cost Crisis, a survey from West Health and Gallup. Gallup polled 3,537 U.S. adults 18 and over in January and February 2019. One in three Americans overall are concerned they won’t be able to pay for health care services or prescription drugs: that includes 35% of people who are insured, and 63% of those who do not have insurance. Americans borrowed $88 billion in 2018 to pay for health care spending, West Health and Gallup estimated. 27 million Americans

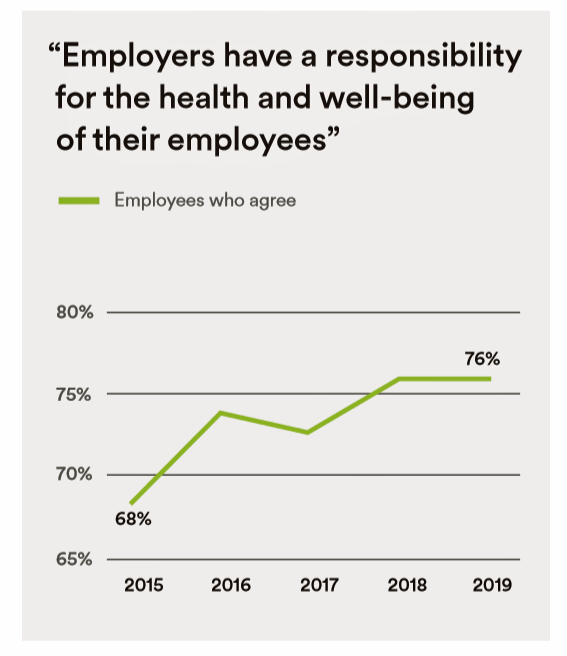

In the Modern Workplace, Workers Favor More Money, New Kinds of Benefits, and Purpose

Today, April 2nd, is National Employee Benefits Day. Who knew? To mark the occasion, I’m mining an important new report from MetLife, Thriving in the New Work-Life World, the company’s 17th annual U.S. employee benefit trends study with new data for 2019. For the research, MetLife interviewed 2,500 benefits decision makers and influencers of companies with at least two employees. 20% of the firms employed over 10,000 workers; 20%, 50 and fewer staff. Companies polled represented a broad range of industries: 11% in health care and social assistance, 10% in education, 9% manufacturing, 8% each retail and information technology, 7%

In the U.S., Patients Consider Costs and Insurance Essential to Their Overall Health Experience

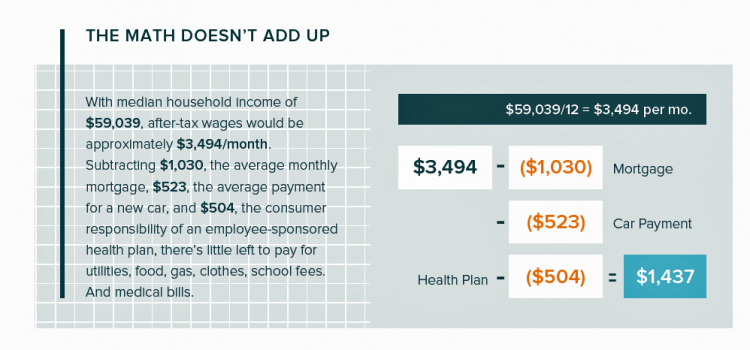

Patients in the U.S. assume the role of payor when they are enrolled in high-deductible health plans. People are also the payor when dealing with paying greater co-payments for prescription drugs, especially as new therapeutic innovations come out of pipelines into commercial markets bearing six-digit prices for oncology and other categories. For mainstream Americans, “the math doesn’t add up” for paying medical bills out of median household budgets, based on the calculations in the 2019 VisitPay Report. Given a $60K median U.S. income and average monthly mortgage and auto payments, there’s not much consumer margin to cover food, utilities, petrol,

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.