Affluent Baby Boomers in the U.S. foresee a retirement with a more active lifestyle, with a better standard of living and engagement in work. 1 in 4 see continuing their education or learning a new trade, and 1 in 5 anticipate starting or furthering their business.

Affluent Baby Boomers in the U.S. foresee a retirement with a more active lifestyle, with a better standard of living and engagement in work. 1 in 4 see continuing their education or learning a new trade, and 1 in 5 anticipate starting or furthering their business.

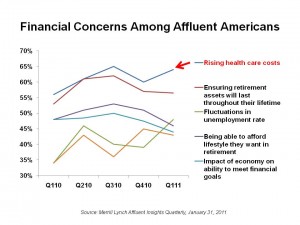

These aspirations are tempered with many financial concerns — top among them being rising health care costs and expenses (a concern for 2 in 3 affluent Boomers), and ensuring that retirement assets will last throughout their lifetime (a worry among 1 in 2 Boomers).

Merrill Lynch surveyed affluent U.S. adults on their retirement concerns and lifestyle aspirations, and employers’ role in helping people live well longer. The results of the survey are in the Merrill Lynch Affluent Insights Quarterly, published January 31, 2011.

Affluent Boomer women are more concerned than men about rising health expenses: 70% of women are worried about growing health costs, compared with 57% of men sharing that concern.

Merrill Lynch, a financial services company, also explored how affluent Boomer workers saw their employers’ role in assuring their financial security in retirement. 62% of affluent Boomers said they rely solely or heavily on their 401(k) and 403(b) retirement plan vehicles when saving and investing for retirement. Furthermore, 70% of affluent Boomers take advantage of the financial advice available in their workplaces; 49% of affluent Boomers would take advantage of such advice were it offered by their employers. 1/3 of the Boomers would like employers to provide more intuitive online tools to help them manage all their banking and investment needs.

Merrill Lynch’s survey was done from December 8, 2010-January 1, 2011, among 1,000 affluent respondents (defined as individuals with investable assets of $250,000 or more). In addition, the poll included an oversample of 300 affluent respondents in 15 individual markets.

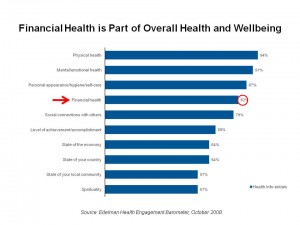

Health Populi’s Hot Points: Financial health is a key component of overall health, according to 4 in 5 people (shown in the chart built on data from the 2008 Edelman Health Engagement Barometer). Merrill Lynch survey illustrates the fact that health care costs and financial well-being are intertwined in the minds of most health citizens.

Most Boomers haven’t saved nearly enough money for health care in retirement, based on forecasts from the Employee Benefits Research Institute’s Retirement Confidence Survey from 2010. It is a good thing that so many affluent Boomers look to continue working in retirement; they will need to in order to meet health costs in their golden years. But what of the less-affluent? Suffice it to say that many of them may not ‘want’ to work when they seek retirement; they’ll have to work to cover health expenses.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...