“Employers and health insurers, through benefit design and medical management, are now playing a larger role in curbing use of healthcare services….spurring a more permanent cultural shift in consumer behavior,” Moody’s writes in a special comment dated February 16, 2011. “This will continue to constrain healthcare demand even as the economy recovers.”

“Employers and health insurers, through benefit design and medical management, are now playing a larger role in curbing use of healthcare services….spurring a more permanent cultural shift in consumer behavior,” Moody’s writes in a special comment dated February 16, 2011. “This will continue to constrain healthcare demand even as the economy recovers.”

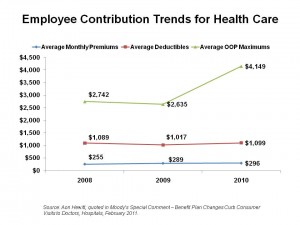

The chart illustrates one of the main reasons for the so-called “constrained healthcare demand:” increasing costs on health consumers.

Look at the slope of the line on average out-of-pocket maximum costs for an employee receiving health insurance at work: the raw number grew from $2,742 in 2008 to $4,149 in 2010. That’s a 51% increase. Do you know anyone whose compensation package increased by one-half over the past two years?

Health care is eating up a larger share of American workers’ salaries, while those salaries have largely stagnated in the past several years. Deductibles appear to have stayed flat between 2008 and 2010; premiums are slightly up. It’s the out-of-pocket costs that hurt.

It’s also the out-of-pocket costs that represent a kind of sticker-shock to the health consumer. These are the payments made in retail mode for prescription drugs at the pharmacy, visits to doctors when one feels ill, and co-payments for diagnostic imaging and lab tests. The phrase “out-of-pocket” means exactly that: monies consumers spend out of their own wallet, expenditures that compete with other consumer goods like food, petrol for cars, and house payments. Some 56% of employers plan to increase the share of total healthcare costs borne by employees, based on a survey from the National Business Group of Health/Towers Watson (compared with 43% in 2010).

“Employers have been partnering more with insurers to modify benefit plans and create incentives to slow down the growth of healthcare costs,” Moody’s observes. One positive adaptation here is employers’ promoting healthier lifestyles among insured workers.

Moody’s notes that this trend is a “negative” for most health providers (hospitals, doctors, other ancillary services) and medical device manufacturers, and may also hurt pharmaceutical products. However, it could be a boon for health care insurance companies for whom premium payments preserved are profitable.

Health Populi’s Hot Points: A more permanent cultural shift is underway, Moody’s says, where demand for health care is structurally reducing. This structural shift in the health microeconomy goes beyond consumers self-rationing care due to higher OOP costs. The era of cost-effectiveness and comparative-effectiveness analysis is upon us in the U.S. Our brethren across the pond in the U.K. and in Europe know more about living under these constraints than Americans do. How will people in the U.S. react when they are refused treatments that may not demonstrate cost-effectiveness to a payer, but the individual health citizen still wants access to that treatment?

Health citizens are greatly empowered now through expert clinical information and social networks. Patients are often better connected than their physicians to very specific information about clinical trials and emerging treatments. Sources like ACOR, the Association of Cancer Online Resources, and networks like Patients Like Me and MedHelp, give empowered patients the promise of access.

If health plans, employers and the Federal Government are ready to implement cost-effectiveness judgments, they need to sell the concept to people. It’s not an easy one to explain. But the sooner, the better, as the Affordable Care Act includes provisions for implementing comparative effectiveness research in Medicare.

“We…expect advances in medical devices and drugs to make new treatments available to a larger portion of the population,” concludes Moody’s. While Moody’s points out that aging Boomers will be a positive driver for health demand in the U.S., a question remains: who will pay for these innovations, if not Medicare in a cost-constrained market? And what new forms might patient access programs take at pharmaceutical, biotech, and medical device companies?

Another take on Moody’s report worth reading is in the Wall Street Journal blog of February 16, 2011.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...