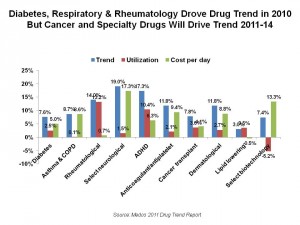

In the 2011 Medco Drug Trend Report, there’s good news and bad news depending on the lens you wear as a health care stakeholder in the U.S. On the positive side of the ledger, for consumers, payers and health plan sponsors, drug trend in 2010 stayed fairly flat at 3.7% growth. That’s due in major part to the increasing roster of generic drugs taking the place of aging branded prescriptions products. More than $100 billion (with a ‘b’) worth of branded drugs will go off-patent between 2010 and 2020, and the generic dispensing rate could reach 85% by 2020, Medco expects, especially looking at high-cost categories like statins. So generics are dramatically slowing drug cost increases overall.

In the 2011 Medco Drug Trend Report, there’s good news and bad news depending on the lens you wear as a health care stakeholder in the U.S. On the positive side of the ledger, for consumers, payers and health plan sponsors, drug trend in 2010 stayed fairly flat at 3.7% growth. That’s due in major part to the increasing roster of generic drugs taking the place of aging branded prescriptions products. More than $100 billion (with a ‘b’) worth of branded drugs will go off-patent between 2010 and 2020, and the generic dispensing rate could reach 85% by 2020, Medco expects, especially looking at high-cost categories like statins. So generics are dramatically slowing drug cost increases overall.

However, there’s another side of the drug cost coin known as specialty drugs: for rheumatoid arthritis and autoimmune diseases, multiple sclerosis, and cancer. The great news here is that, if you’re a patient who can benefit from one of these therapies, they exist. If you’re the bean-counter responsible for simply managing health costs, you’d note that this category of drugs accounted for 16.3% of health plan costs in 2010, but was responsible for 70% of drug trend.

RA/autoimmune drugs contributed 29.4% to 2010 drug trend; MS drugs, 24.2%; and cancer, 20.3%

Medco projects for 2013 that annual trend with specialty drugs will be 2.5% to 4.5%. Annual trend without specialty drugs will be 0-1%.

Looking at the pipeline for drugs in development by therapeutic class, the largest category is cancer with a deep drug pipeline: 907 drugs in development. The second largest category is much smaller, with 337 drugs in development.

Medco writes that as of 2007, nearly 65% of cancer survivors had lived at least 5 years beyond their diagnosis. Furthermore, some cancers have become curable or manageable and can now be deemed chronic conditions. In 2010, cancer accounted for $125 bn in medical spending in the U.S., and will cost $207 bn in 2020 when cancer incidence will have grown by 22%.

Health Populi’s Hot Points: “Oncology drugs are becoming more effective and less affordable,” Medco’s report asserts. Cancer drugs had 11.5% inflation in 2010, and made up one-third of drug spending in 2009. Cancer will be a leading driver of drug trend by 2015.

Avalere Health published research on May 18, 2011, showing that 10% of cancer patients on oral medications abandoned the drugs (i.e., stopped taking the drugs), largely due to cost.

The cancer therapy cost picture is clear. The access picture — that is, who (what patients) will have access to these very expensive, and increasingly personalized, treatments — is not. While Medco’s national practice leader for oncology said, “It’s an exciting time in the area of cancer treatment,” there’s a lot of uncertainty about what health plan designs will do to manage utilization and access to these potentially life-saving treatments.

It will be a tight health economy between now and 2015…and beyond. Life science companies in the oncology space will need to prove their value-case to payors. They will also need to ramp up and be creative about their patient assistance programs to help patients access these products where their therapeutic value is appropriate for those individuals. For patients diagnosed with cancers, they’ll need to be activated and may have to face an uphill battle to get drugs they believe will benefit them. This is where empowered cancer patients at WEGO Health, PatientsLikeMe, ACOR and other online social networks can band together to inform each other, support each other, and take their case to manufacturers, policymakers, and health plan designers.

We are entering a tug-of-war about who will pay for medical innovation: in this case, very expensive cancer therapy.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...