People enrolled in consumer-directed health plans (CDHPs) are more likely than enrollees in traditional health insurance products to be cost-conscious. In particular, CDHP members check prices before they receive health care services, ask for generic drugs versus branded Rx’s, talk to doctors about treatment options and their costs, and use online cost-tracking tools.

People enrolled in consumer-directed health plans (CDHPs) are more likely than enrollees in traditional health insurance products to be cost-conscious. In particular, CDHP members check prices before they receive health care services, ask for generic drugs versus branded Rx’s, talk to doctors about treatment options and their costs, and use online cost-tracking tools.

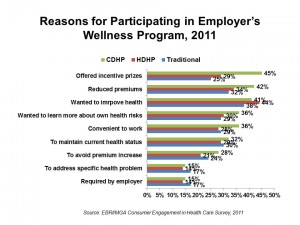

Furthermore, CDHP members are also more likely to use wellness programs offered by their employers, and are offered “carrots” to participate in them in the forms of financial rewards and other incentives, as well as reduced health care insurance premiums.

The 7th annual Employee Benefits Research Institute (EBRI)/MGA Consumer Engagement Survey finds that 7% of U.S. privately insured adults are enrolled in CDHPs, up from 5% in 2010. 16% are enrolled in High Deductible Health Plans (HDHPs).

Coverage in traditional health plans continues to fall: 78% of privately-insured people in the U.S. are covered in traditional health plans, dropping from 82% in 2010 and 84% in 2009.

The rationale behind offering CDHPs is to give plan enrollees more financial “skin in the game” so they become more cost-conscious “consumers” of health care services. Being a full-fledged, empowered consumer requires accessing useful information about plan and service offerings, quality and costs. It’s noteworthy that while CDHP and HDHP enrollees require such information as they must manage financial health accounts, they reported less access to such information from t heir health plans compared with traditional health plan members. Thus, those in CDHPs and HDHPs tend to find health information in sources provided outside of their health plans.

heir health plans compared with traditional health plan members. Thus, those in CDHPs and HDHPs tend to find health information in sources provided outside of their health plans.

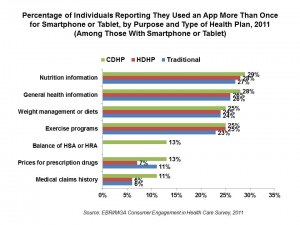

This 7th survey asked questions about consumers’ use of technology to engage in health-related activities. 40% of the privately insured use a smartphone, and 7% use a computer tablet, in this survey’s results. Within this subgroup, the most popular apps for health-related activities are nutrition information (just under 30%), general health information (about 27% overall), weight management (one-fourth), and exercise programs (about one-quarter). Use of apps is roughly similar across the 3 types of health plans, as shown in the chart.

Most of those privately insured people without a smartphone or tablet are most interested in using an app to see their HSA/HRA balance (60% interested), checking prices for Rx drugs (50%), accessing general health information (48%), and seeing nutrition information (49%) and weight management (48%).

EBRI polled 4,703 privately insured U.S. adults ages 21-64 to probe their opinions on consumer0-driven health plans, high-deductible plans, and their impact on consumer engagement and health behaviors.

Health Populi’s Hot Points: Health consumers are all exhibit cost-conscious behaviors, with those enrolled in CDHPs somewhat more likely to do so. Still, the patient/plan enrollee is searching for useful information to make rational decisions on providers, products and services in health as their shared burden of costs continues to grow in all forms of health plans.

The irony revealed in the EBRI survey is that CDHPs — the very plans that require people to take on more decision-making responsibility for their health care — don’t provide enrollees with the information people need to be informed, engaged health consumers. Consumers are spending dear amounts of rare disposable income on sophisticated smartphones and tablets in the ongoing Great Recession, and they’re using these devices to project-manage their lives…including health and health care. That CDHPs aren’t engaging with these very consumers who want to engage in their health is a missed opportunity to connect the right health information to their right person at the right time.

What also stands out from these data is the role that financial incentives plays in motivating people to participate in an employer’s wellness program. 45% of those in CDHPs say it was the incentive prizes that motivated them to participate in a wellness program, versus 29% of people in HDHPs and 25% of those in traditional health plans. The next most motivating incentives were reduced premiums (another financial carrot), cited by 42% of CDHP members, and the wish to improve personal health, cited by 41% of CDHP enrollees.

Looking at the issue of financial incentives more granularly, EBRI found that a $50 cash incentive would be attractive to 53% of CDHP members compared with 67% of traditional plan members. However, increase the incentive to $250, and 74% of CDHP and HDHP members would probably participate in a wellness program, compared with 69% of traditional plan members. So roughly the same percentage of people in traditional health plans would participate in a wellness program, given either a $50 or $250 cash incentive. This is a fascinating statistical finding, differentiating the financial sensitivity between the CDHP and traditional plan consumer segments.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...