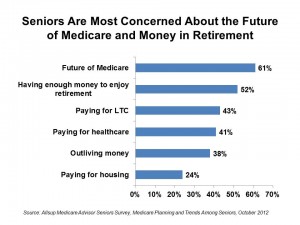

What’s keeping seniors up at night when it comes to retirement? #1, according to 6 in 10 seniors, is the future of Medicare, followed by having enough money to enjoy retirement. In particular, 61% of seniors are concerned about future out-of-pocket health care costs. It’s all about Medicare and money for U.S. seniors, found in the Allsup Medicare Advisor Seniors Survey, Medicare Planning and Trends Among Seniors, published in October 2012. Medicare could be the most beloved government program ever, as 89% of seniors say they’re satisfied with Medicare coverage. Given the program’s shaky financial future, Allsup wanted to get a sense of seniors’ willingness-to-pay more for current coverage. Medicare is so beloved among seniors that 32% of them told Allsup they’d pay 20% more for their coverage; 19% said they’d pay 10% more. In fact, only 23% of seniors would “pay nothing more” for Medicare. While most seniors would not change their doctors or Medicare plans to save money, they would change certain other health behaviors, among them:

What’s keeping seniors up at night when it comes to retirement? #1, according to 6 in 10 seniors, is the future of Medicare, followed by having enough money to enjoy retirement. In particular, 61% of seniors are concerned about future out-of-pocket health care costs. It’s all about Medicare and money for U.S. seniors, found in the Allsup Medicare Advisor Seniors Survey, Medicare Planning and Trends Among Seniors, published in October 2012. Medicare could be the most beloved government program ever, as 89% of seniors say they’re satisfied with Medicare coverage. Given the program’s shaky financial future, Allsup wanted to get a sense of seniors’ willingness-to-pay more for current coverage. Medicare is so beloved among seniors that 32% of them told Allsup they’d pay 20% more for their coverage; 19% said they’d pay 10% more. In fact, only 23% of seniors would “pay nothing more” for Medicare. While most seniors would not change their doctors or Medicare plans to save money, they would change certain other health behaviors, among them:

- 79% have switched to generics, and an additional 9% would consider doing so

- 60% have used preventive screenings

- 34% have asked for an alternate treatment or medication

- 25% have changed the frequency of their doctor’s visit

- 24% have switched their provider

- Only 11% have switched their Medicare plan to save money.

71% of retirees believe they’ll have enough money saved for health care costs in retirement, according to the Employee Benefits Research Institute (EBRI). However, EBRI estimates that a man (with median prescription drug expenditures) would need $65,000 for health costs in retirement in addition to Medigap and Part D, and a woman, $93,000. Seniors are right to be concerned about the future of Medicare — but it’s also the savings required for filling in the gaps of Medicare and the Part D prescription drug program that they should be quite specifically worried about.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.