While working people in the U.S. are feeling better about the nation’s economy, Americans aren’t putting much money into savings for retirement. The reasons for this are many, but above all is what Mercer calls “the specter of health care costs in retirement” in the Mercer Workplace Survey for 2013.

While working people in the U.S. are feeling better about the nation’s economy, Americans aren’t putting much money into savings for retirement. The reasons for this are many, but above all is what Mercer calls “the specter of health care costs in retirement” in the Mercer Workplace Survey for 2013.

In addition to peoples’ concerns about future health care costs, reasons for not putting money away for the future include flat personal income, slow economic growth and financial literacy challenges around how much 401(k) savings can be tax-deferred. On the slow economic growth perception, Mercer found that, on the upside, people perceive rising home values; however, on the downside, more people anticipate flat employment prospects, not job growth.

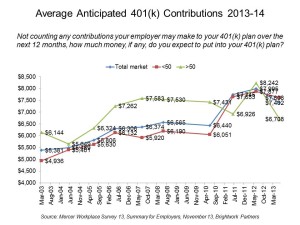

Pre-retirees are in fact slowing down on 401(k) contributions in the 2013-14 year by about 10%, according to the survey. The poll also found that these people pulling back on saving money for health in retirement via 401(k)’s also distrust the Affordable Care Act and expect to be made worse off by it by a factor of 6:1. Mercer asks whether people could be saving more outside of their 401(k) plans offered at the workplace to plan for the anticipated health expenses in retirement.

Mercer concludes that the pulling back of people saving in their 401(k) plans puts retirement savings “under stress.”

For all American workers, the biggest financial worries are

- Saving enough for retirement (for 20% of people)

- “Just” keeping up with monthly expenses (for 18% of people), and

- Health care expenses in retirement (for 12% of all people).

However, the proportion of people worried about health costs in retirement among people 50-64 is double (23%) that of people overall.

Overall, the percent of people saving for health care expenses in retirement has grown from 17% in 2007 to 34% in 2013. 45% of people 50 to 64 years of age save for health costs in retirement, double the level seen 6 years ago.

This study was conducted among 1,506 active 401(k) plan participants in the U.S., with interviews conducted online in May and June 2013.

Health Populi’s Hot Points: The takeaway quote from the Mercer report is that “Participants may be hearing about a recovery but it’s not obvious that they are living one.” There’s fear in them thar’ workplaces, with workers who have access to saving in tax-favored 401(k) plans not fully taking advantage of doing so.

Fear is found through looking into the survey question: “How do you expect President Obama’s health care reform to affect you personally when it comes to…” various health issues. The health care responses were:

- My situation overall, 45% say “worse off,” and more granularly,

- What I pay for care, worse off for 52% of people

- My health benefits at work, 52% say worse off

- My choice of doctors and hospitals, 41% say worse off

- The quality of care I receive, 41% say worse off

- My access to care, 40% say worse off.

People highly value their health benefits. 93% of those surveyed said that getting health benefits through work is just as important to me as getting a salary. However, the perceived benefits has eroded a big since a spike up in 2011, to a historic norm of around 32% of people saying the value of health benefits is “definitely worth it” and 47% of people saying, “probably worth it.”

The need for greater financial literacy is clear, with the deeper level of health financial literacy even more acute. It’s not for lack of availability of information available from providers, plan sponsors, and do-it-yourself sources: there’s plenty of that online, offline, at the workplace via human resources and benefits department, and financial planning seminars offered in every community. But there’s a psychological and/or emotional disconnect when it comes to valuing health and the health benefit, versus actively saving for future health costs.

Health citizens of American need a strong lesson on how the mixed public/private system of U.S. health care really works: and the fact that more health care costs, and not less, will be allocated to people – with or without Obamacare.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.