Sales of computers and tablets and LCD TVs won’t be hot on peoples’ holiday shopping lists in 2015. But smartwatches, health and fitness tech, and 4K Ultra HD TVs will be in peoples’ gift wish-lists and under homes’ holiday trees.

Sales of computers and tablets and LCD TVs won’t be hot on peoples’ holiday shopping lists in 2015. But smartwatches, health and fitness tech, and 4K Ultra HD TVs will be in peoples’ gift wish-lists and under homes’ holiday trees.

The Consumer Electronics Association (CEA) published its 2015 U.S. Consumer Electronics Sales and Forecasts report, and it shows a shifting retail picture where traditional consumer electronics categories — notably computers and mainstream TVs — are declining in demand. But new-new categories are expected to buoy 2015 retail sales.

The new categories of consumer electronics will generate about $10 bn (wholesale number) in 2015, doubling from the $5 bn spent in 2014. The largest revenue categories — tablets, LCD TV, laptops, and desktops (not including smartphones, one of the “dynamic duo” growth categories according to the CEA) — are flat-to-declining in sales. Smartphones are expected to grow about 5% from 2015 sales.

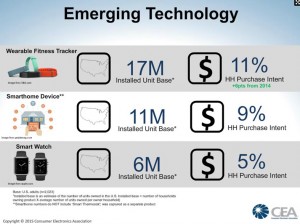

Digging into the wearables segment, CEA identifies three categories:

– Smart watches, worth $542 mm in 2014 rising to $2,370 in 2015 and forecasted to $2,370 in 2016.

– Smart eyewear, estimated at $151 mm in 2014 falling to $100 in 2015, but growing 5X in 2016 to $540.

– Health and fitness, gauged at $1.5 bn in 2014, growing to $1.8 bn in 2015 and forecasted to nearly $2 bn in 2016.

CEA calls out two key words in the trends toward the new tech categories driving overall consumer electronics growth: connected and mobile.

Health Populi’s Hot Points: Unit sales growth for health and fitness tech in 2014 was 16.8 mm units, expected to rise to 20.3 mm in 2015 and 22.8 mm in 2016. This calculates to unit-growth rate increases of 20.6% from 2014-15, and 12.7% between 2015-16. Thus, CEA expects the growth rate for purchases of wearable fitness tech to significantly fall between 2015 and 2016.

Does this mean that the likes of Fitbit, Jawbone, Basis, Garmin, et. al., will be irrelevant in 2017? Since its IPO last month, Fitbit has lots of cash to work with to reinvent what a wearable tracker is, and the other competitors in the space have opportunities to do the same. But the advent of Under Armour in the health-apps ecosystem, Apple and Google in their respective worlds, and Microsoft and Samsung, among other companies and collaborations — will change the very nature of what we “wear” to track our health.

For example, Proteus, known first for its medication adherence “smart pill,” is innovating a patch called Recover focusing on physiological metrics of athletes. My smart colleague Jonah Comstock scooped the story in late 2014 in MobiHealthNews, and talked about the patch and the trademark filing which defined the product as, “Downloadable software for monitoring physiological data; computer software for retrieving, saving, analyzing, displaying, graphing, annotating or exporting data collected by, or utilized in conjunction with, a physiological sensor, and for configuring the physiological sensor; computer program for analyzing physiological data in conjunction with game performance data to facilitate optimization of training, improvement, and recuperation of athletes and determining an individual athlete’s optimum training formula; electronic sensor for sensing, detecting, deriving, generating, collecting, storing, monitoring, transmitting and reporting physiological data related to personal health, nutrition, fitness, and wellness.”

New entrants we’ve not mentioned here will continue to morph and shape the nature of the health/care wearable. Watch this space; and stay mindful of CEA’s forecast. The plethora of wrist-banded health trackers has reached its peak.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...