When a person dons a piece of wearable technology, they first look to engage with some aspect of health or fitness before they seek entertainment. To satisfy that demand side of the market equation, we’re seeing a stream of devices, platforms, and corporate strategies trying to reach the wearable tech consumer.

Today, Philips announced its expanding strategy for digital health, launching devices to help people, in Philips’ words, measure, monitor, and stay motivated for personal health. The company is offering a health smartwatch, a weight scale, an ear thermometer, and two blood pressure monitors (for wrist and upper arm), all connected to the Philips Health Suite digital platform, a data ecosystem. Retail prices range from $249.99 for the watch to $59.99 for the thermometer.

https://youtu.be/FIh5L3tdWDs

Just as Apple’s products have spawned businesses to serve Apple users, from battery covers to Bluetooth keyboards, Fitbit is inspiring entrepreneurs to serve the activity tracking company with the largest market share. Fitabase, founded in 2012, claims that it has participated in over 200 studies with researchers including Arizona State University, Northwestern University, University of Texas MD Anderson Cancer Center, among other institutions, with consumers and patients using Fitbit’s portfolio of devices.

These studies together reached a milestone of 2 billion minutes of activity and measurement, as reported in the company’s blog on 28 July 2016. Here is Fitbit’s press release on the news. Note that Fitabase’s platform works with other wearable tech devices beyond Fitbit’s products. Indicating it’s doubling down on digital health, today Fitbit announced the appointment of Adam Pellegrini as head of digital health at the company. Adam leaves Walgreens in a key digital health post there to join Fitbit.

In retail news for wearables, Target added MonBaby to the store’s ever-expanding selecting of wearable tech. Note that Target’s corporate strategy looks increasingly aimed at moms with young children, expanding the healthy food grocery section with its “healthful” branding of foodstuffs like Annie’s Organic and WhiteWave products (recently acquired by Danone/Dannon for $10 bn).

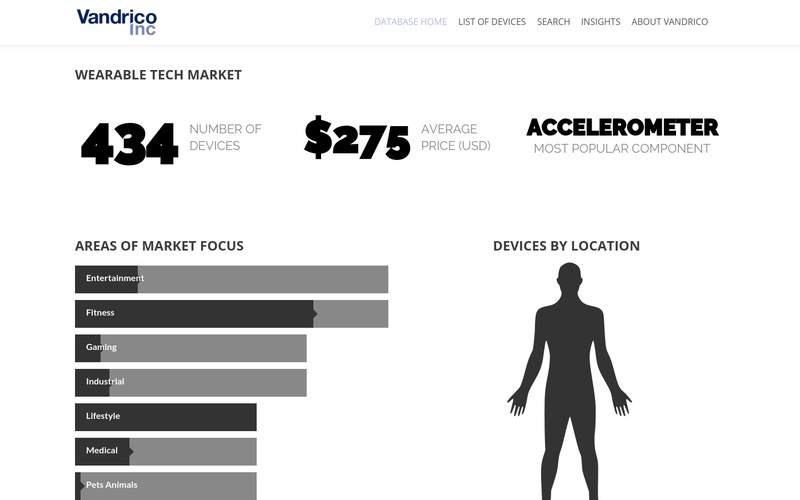

Health Populi’s Hot Points: To keep up with the fast-changing wearable tech market entrants, Vandrico and Deloitte are partnering to curate a database of companies in the space. They have identified over 400 devices charging an average retail price of $275, wearable, literally, from head to toe.

The wrist is the most crowded site of human real estate for wearable health tracking, as I discussed here on Health Populi during the 2013 Consumer Electronics Show . Note that a new report from IDTechEx claims that we’re getting past wearable hype with products that are better designed and more differentiated. Specifically, it’s the de-coupling of some new health tracking devices from the smartphone that will bring more value, by working with platforms….like the Philips new line of medical-grade products.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...