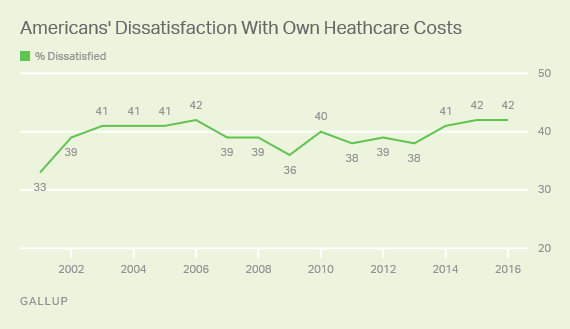

A plurality of Americans, 4 in 10, are dissatisfied with the healthcare costs they face. The level of dissatisfaction varies by a consumer’s type of health insurance, while overall, 42% of people are dissatisfied with costs…

- 48% of privately insured people are dissatisfied with thei healthcare costs

- 29% of people on Medicare or Medicaid are dissatisfied

- 62% of uninsured people are dissatisfied.

Gallup has polled Americans on this question since 2014 every November. Dissatisfaction with healthcare costs is up from 38% from the period 2011-2013.

As the line chart illustrates, the current levels of cost-dissatisfaction are similar to those felt ten years ago in 2006.

Cost-dissatisfaction has grown the most for people with private health insurance, increasing from 40% in the 2011-13 period to 49% in 2016.

Dissatisfaction isn’t directly related to health consumers’ income. It’s connected with how much people spend on their health insurance premiums: for workers who receive health insurance through their employers who pay 100% of premiums, only 27% are dissatisfied with their healthcare costs. But for workers who pay 100% for their premiums, 60% are dissatisfied.

As we’ve discussed since Health Populi first published nearly 10 years ago, consumers self-ration healthcare due to cost. This Gallup survey found that 50% of health consumers dissatisfied with their costs have a family member who has delayed medical treatment due to cost in the past year. Conversely, only 18% of people who are satisfied with their healthcare costs put off health care due to cost.

Gallup polled 800 U.S. adults 18 years of age or older via telephone in November 2016 for this survey.

Health Populi’s Hot Points: Gallup notes that the Affordable Care Act has insured millions of Americans, but that “Affordable” is, sadly, a misnomer. Whether uninsured or privately insured, healthcare costs are “squeezing” US health consumers “from all sides,” Gallup describes: from scaled-back employer benefit packages, growing health insurance plan premiums, and higher deductibles. All of these consumer-facing costs are rising faster than general price inflation in America, and have been faster-increasing than the CPI for many years.

The growing burden of healthcare costs on Americans and their families sets the stage for the new retail health landscape in the U.S. Traditionally, “retail health” has been what happened at the pharmacy: over-the-counter drug sales and prescription drugs sold from “behind-the-counter” with a pharmacist’s intermediation. Today, growing consumer out-of-pocket costs are exposing people to first-dollar payments that health plans won’t cover until deductibles are met. This puts the patient-consumer into the role of shopping for healthcare services and products, or simply opting out of seeking care — as the Gallup poll illustrates, where one-half of people dissatisfied with their healthcare costs have delayed getting care due to cost.

Expect a growing “consumer-directed” healthcare world, which a President Donald Trump talks about bolstering through promoting health savings accounts, tax deductibility, and greater consumer skin-in-the-game. Will such a scenario lower costs to become more “affordable?” Not if consumer-patients end up delaying care for (less expensive) primary care issues and seeking care, later, when sicker, in expensive emergency departments.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...