As the annual meeting of the American Telemedicine Association convenes this week in Orlando, there’s a lot of telehealth news to curate. The topline of it all: virtual healthcare is mainstreaming, with more providers, payors, and patients aligning in support of virtual health care delivery. Three-quarters of providers have some form of basic telemedicine or telehealth in place.

One-third of healthcare providers use some flavor of virtual care technology in their workflow, according to research from KPMG and HIMSS Analytics summarized in the first graphic. KPMG sees virtual care options — remote patient monitoring, enhanced portals, and web interactions for patient-provider administrative tasks (scheduling, referrals) — as tools to enhance patient experiences, improve access and support continuity-of-care.

The future is coming fast (remember, as my colleagues at Institute for the Future taught me many years ago, based on founder Roy Amara’s insights, we tend to over-forecast technology adoption in the short-run, and under-forecast in the long-run. We’re in that “long -run” phase now for telehealth). Beyond the current 31% of providers who use video-based services and the 34% who offer remote patient monitoring, another 44% of healthcare providers plan to offer video and 48%, remote patient monitoring.

The American Telemedicine Association’s Executive Leadership Survey is out (published March 2017), and found that a vast majority of respondents plan to invest in telehealth this year. 88% of health care providers and stakeholders are likely to invest in technology related to telehealth. The key selling points for adoption were using telehealth as a competitive advantage in local healthcare markets, and to prove patient access and reach.

According to ATA’s survey, the three top factors that will “propel” telehealth (ATA’s verb) in the next three years will be:

- Increasing consumer demand for virtual, convenient care, 48%

- Shift to value-based payment, 26%

- Reduced cost of deliver, 11%.

What could slow adoption of telehealth in the next 3 years would be the long-time classic reasons — reimbursement, coverage, and payment — along with licensure and privileges. In addition, organizations’ resistance to change, lack of ROI and evidence, bandwidth limitations (which I cover passionately here in Health Populi and Huffington Post), and legal liability round out the key challenges.

While the ATA survey sample was relatively small with 171 respondents, it provides insights into directional “enthusiasm” for telehealth.

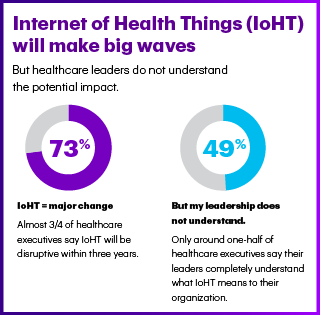

A study conducted by Accenture with input from Dr. Joe Kvedar of the Center for Connected Health was conducted in February 2017 and also informs my telehealth-mainstreaming trend-cast. Three in four healthcare stakeholders say the Internet of Health Things (IoHT) will have a disruptive impact on healthcare by 2020. But, on the right side of the chart, note a similar finding to the ATA’s “organizational resistance” line item: one-half of healthcare execs say their leadership does not yet understand the value of IoHT for their organization.

A study conducted by Accenture with input from Dr. Joe Kvedar of the Center for Connected Health was conducted in February 2017 and also informs my telehealth-mainstreaming trend-cast. Three in four healthcare stakeholders say the Internet of Health Things (IoHT) will have a disruptive impact on healthcare by 2020. But, on the right side of the chart, note a similar finding to the ATA’s “organizational resistance” line item: one-half of healthcare execs say their leadership does not yet understand the value of IoHT for their organization.

Still, Accenture forecasts that IoHT investments will increase over the next three years; as IT budgets grow, so do IoHT investments, Accenture observes. Over one-third of healthcare stakeholders plan to invest over $51 million dollars in IoHT (nearly 37%), according to the Accenture poll.

Three areas have proven value in IoHT in this phase of adoption for payers and providers: remote patient monitoring, wellness and prevention, and operations.

A key business driver for adopting IoHT is consumer and patient satisfaction: HCAHPS scores, and consumer-driven healthcare trends for decision-making, are a major factor for adopting IoHT among payers and providers.

Health Populi’s Hot Points: Rounding of the research in my telehealth trend-cast, I’ll point to a GAO report published this month, Telehealth and remote Patient Monitoring Use in Medicare and Selected Federal Programs.

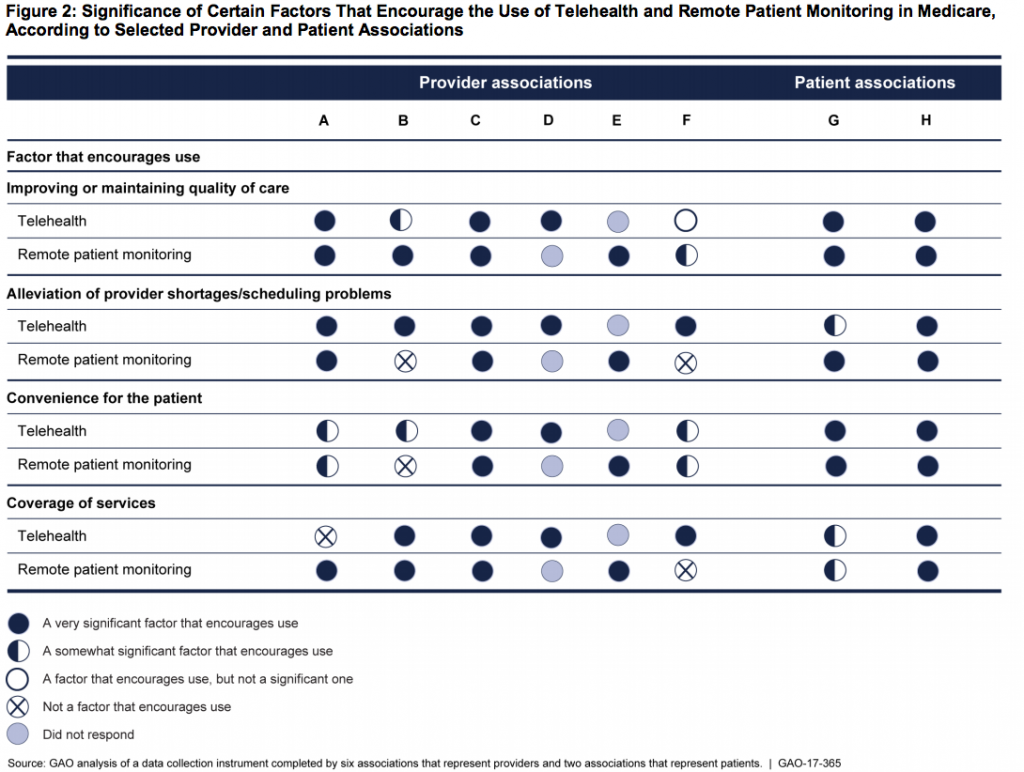

The third graphic illustrates the factors that the GAO researchers learned encourage use of telehealth and RPM for providers and patients.

For providers, these include improving and maintaining the quality of care, improving workflow (provider shortages and scheduling challenges), and coverage (payment) of services.

For patients, it’s about quality of care, workflow (think: scheduling and access to providers), and convenience. Note that convenience to the patient was not a top driver encouraging the use of telehealth among providers in this study.

This week at the ATA, telehealth stakeholders will learn that virtual care is becoming, simply, health care. It is the de-platforming of mobile and hardware-dependent remote patient monitoring that has been liberated due to the adoption of broadband and cloud computing, coupled with consumer/patient demand for convenience and providers’ growing financial risk in healthcare payments.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...