Did you know that the Echo Dot was the top-selling gift on Amazon in the 2016 holiday shopping season? The family of Amazon’s Alexa devices was the most popular product across all categories on the ecommerce site.

As patients morph into health consumers, and consumers buy into wearable technologies and smart home devices through the growing Internet of Things (IoT), the home is becoming the new medical home.

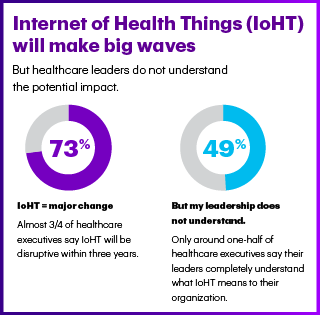

Most healthcare leaders believe that the Internet of Health Things (IoHT) will disruptive the healthcare industry within three years, noted in the Accenture 2017 Internet of Health Things Survey. But only one-half of these healthcare execs believe their leadership understands what this will mean for their organization.

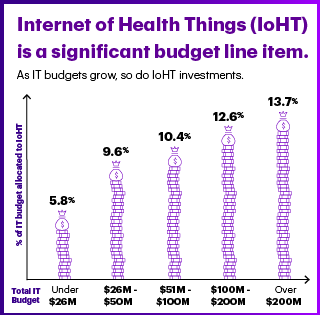

About 10% of healthcare organizations’ health IT budgets were allocated to healthcare this year. As health IT budgets grow, the proportion spent on IoHT also grows: for example, for organizations with a health IT budget between $26-50 mm, IoHT comprises 9.6% of the HIT investment; for organizations spending over $200 mm on HIT, 13.7% goes to IoHT, as shown in the second diagram.

Accenture identifies three areas generated value in the adoption of IoHT: remote patient monitoring (RPM), wellness and prevention, and operations.

Accenture identifies three areas generated value in the adoption of IoHT: remote patient monitoring (RPM), wellness and prevention, and operations.

When it comes to remote monitoring, both providers and payers derive value from using IoHT in this subset of telehealth programs. One-third of providers and 42% of payers report operational or medical cost savings through implementing IoHT for remote monitoring. Most providers and payers also believe that IoHT for RPM ca also help to attract and retain health consumers.

The key RPM programs deriving value relate to cardiac conditions such as congestive heart failure, followed by respiratory conditions (e.g., COPD and asthma), and cancer, the survey found. Seeing that cardiac conditions and respiratory issues ranked most highly in RPM value perceptions among healthcare execs may relate to their experience in managing readmission penalties that result from patients re-entering the hospital for heart failure, acute myocardial infarction, and pneumonia.

Roughly equal proportions of providers and payers (42% and 45% respectively) also see value in using IoHT for wellness and prevention programs. For operations, IoHT is seen as driving value among more payers (44%) than providers (31%). Here, patient/customer experience is seen as being greatly impacted for payers adopting IoHT for operations.

Consumer satisfaction is a key business driver, healthcare leaders said; patient satisfaction scores, such as HCAHPS, are important factors in being paid under value-based purchasing contracts. 82% of healthcare execs noted consumer satisfaction as an important business driver motivating the adoption of IoHT. Related to this was the second most popular driver, the shift to individualized market and patient demands, garnering 76% of healthcare execs’ interest in IoHT. Consumer experience is a major focus on IoHT adoption for both providers (64%) and payers (73%). Examples of using IoHT for driving consumer experience are wayfinding, scheduling, navigating hospital resources, improving service, and shortening queues (waiting times).

Accenture found a variety of barriers that prevent healthcare stakeholders from adopting IoHT, including:

- Privacy concerns (55%)

- Legacy systems and/or equipment challenges (55%)

- Security concerns (54%)

- Technology immaturity (53%)

- Lack of budget (53%)

- Lack of skilled workforce (52%)

- Lack of interoperability or standards (52%)

- Uncertain ROI (47%)

- Other IT priorities (46%)

- Unclear business need (43%).

The percentages ranging between 43% and 55% illustrate that healthcare executives see numerous challenges in adopting IoHT in their organizations, from security and privacy to technology and business case issues — along with budgetary constraints. These are all typical barriers that new health IT programs have faced for at least two decades.

Health Populi’s Hot Points: My friends at Institute for the Future developed this “Health Aware World” map, describing eight action-verbs that the IoHT can support. These include:

Health Populi’s Hot Points: My friends at Institute for the Future developed this “Health Aware World” map, describing eight action-verbs that the IoHT can support. These include:

- Diagnosing (say, by looking into a smart mirror while brushing one’s hair)

- Making (DIY healthcare)

- Escaping (e.g., using virtual reality technology, currently being researched by Dr. Brennan Spiegel’s team at UCLA)

- Relying (on everyday Things at home in the kitchen and living room, like connected TVs and smart refrigerators)

- Immersing (in digital and physical environments)

- Routing (to healthy places, like jogging paths and the closest pharmacy with the lowest-cost statin prescription)

- Responding (say, for on-demand access to an expert opinion or therapy encounter), and,

- Amplifying (from sensing to nudging actions, for example).

Many people working in healthcare stakeholder organizations are already recognizing value in these various workflows for IoHT. However, around half of these IoHT pioneers see some hesitation or lack of knowledge among their leadership. The evidence base is growing for IoHT, and especially for empowering consumers for self-care/DIY healthcare and for streamlining healthcare administrative tasks like scheduling appointments and filling/delivering prescriptions. That IoHT users identified the patient/consumer experience as a top ROI factor for IoHT adoption is gratifying for those of us designing products, services and experiences with the patient-consumer-caregiver at the center of healthcare.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...