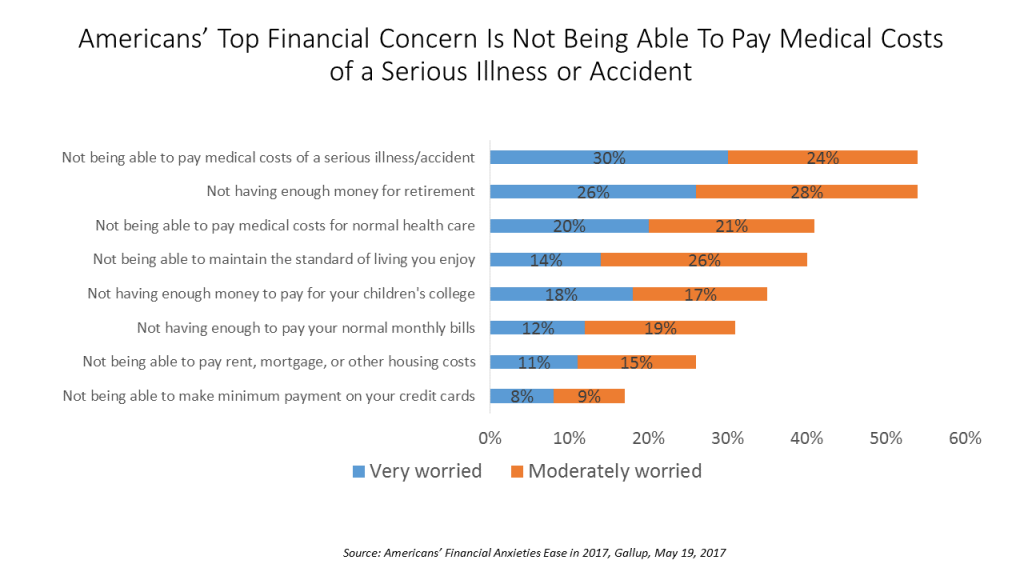

While Americans’ financial worries are softening in 2017, one issue tops the list of fiscal fears: not having enough money to pay the costs involved in a serious illness or accident, Gallup found in a consumer poll fielded in early April 2017.

54% of Americans fear an inability to cover healthcare costs in the event of an accident or serious illness. This percentage was 60% in 2016, and 55% in 2015.

This year’s data point ties with Americans financial worry about not having enough money for retirement, but healthcare cost concerns rank higher in terms of being “very worried” versus “moderately worried.”

Note that 41% of Americans are also worried about not being able to pay medical costs for “normal,” routine healthcare this year, as well.

Cost pressures have eased for other issues including paying for housing, for normal monthly bills, and for maintaining their desired standard of living.

Health Populi’s Hot Points: There’s an underlying issue this survey doesn’t address: growing levels of personal debt in the U.S. A new report from the Federal Reserve of New York published this month found that household debt in America surpassed the pre-Recession peak in the first quarter of 2017. Consumer debt totaled $12.73 trillion in Q12017, compared to the 2008 top of $12.68 trillion in Q12008.

Health Populi’s Hot Points: There’s an underlying issue this survey doesn’t address: growing levels of personal debt in the U.S. A new report from the Federal Reserve of New York published this month found that household debt in America surpassed the pre-Recession peak in the first quarter of 2017. Consumer debt totaled $12.73 trillion in Q12017, compared to the 2008 top of $12.68 trillion in Q12008.

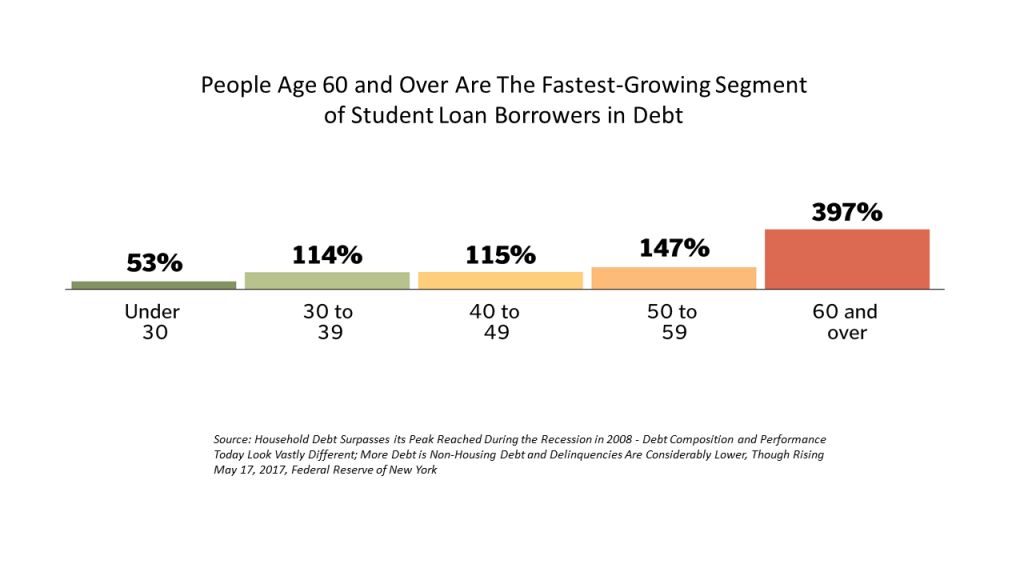

A major contributor to Americans’ debt loads is student loan debt. What’s surprising, perhaps shocking, is that a growing holder for student debt is Baby Boomers who have taken on the obligation on behalf of children or grandchildren, the NY Fed discovered.

Consider that Boomers are facing greater healthcare costs as they age. Chronic care burdens increase with age (over 50), which translates into more intense utilization of health care goods and services, and with them, higher costs.

Ironically, it’s healthcare costs that are a major contributor to the long-term deficit of the U.S. So American health citizens’ personal health economies have much in common with their nation’s macroeconomy.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...