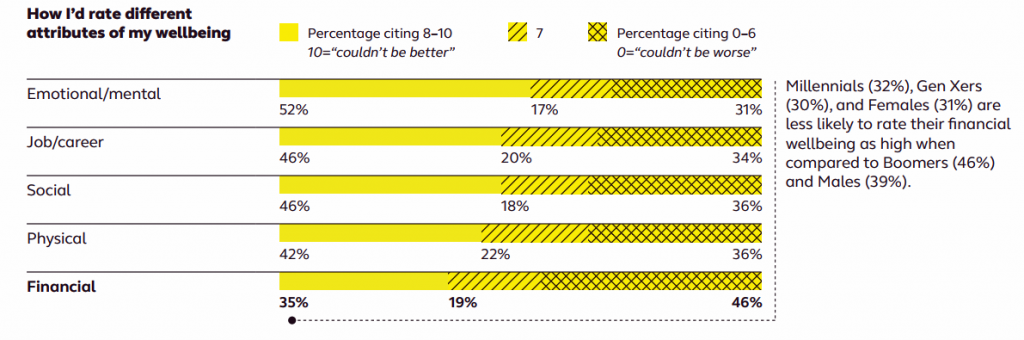

Nearly one-half of Americans are challenged by low financial well-being. Compared to emotional/mental, job/career, social, physical, and financial, it’s this last lens on personal health that gets the lowest ratings for the largest number of Americans. The second most worrying factor diminishing well-being is a tie between physical health and social health.

Nearly one-half of Americans are challenged by low financial well-being. Compared to emotional/mental, job/career, social, physical, and financial, it’s this last lens on personal health that gets the lowest ratings for the largest number of Americans. The second most worrying factor diminishing well-being is a tie between physical health and social health.

Welcome to The uncomfortable reality of financial wellbeing, a report on the 2017 Financial Mindset Study Highlights from Alight Solutions, an HR services company.

The first chart arrays the well-being rankings across the five factors, showing that just over one-half of Americans have more positive views on their emotional and mental health. Still, one-third of people say their emotional/mental status ranks on the low end, just below job/career wellness.

The so-called “uncomfortable reality” of well-being is also lower among women than men.

Finances are also a taboo-topic about which 3 in 4 people are uncomfortable discussing with people they know well. Only sex ranks lower in terms of discussion-comfort (at 20%, 1 in 5 people feeling comfortable discussing with people they know well).

Finances are also a taboo-topic about which 3 in 4 people are uncomfortable discussing with people they know well. Only sex ranks lower in terms of discussion-comfort (at 20%, 1 in 5 people feeling comfortable discussing with people they know well).

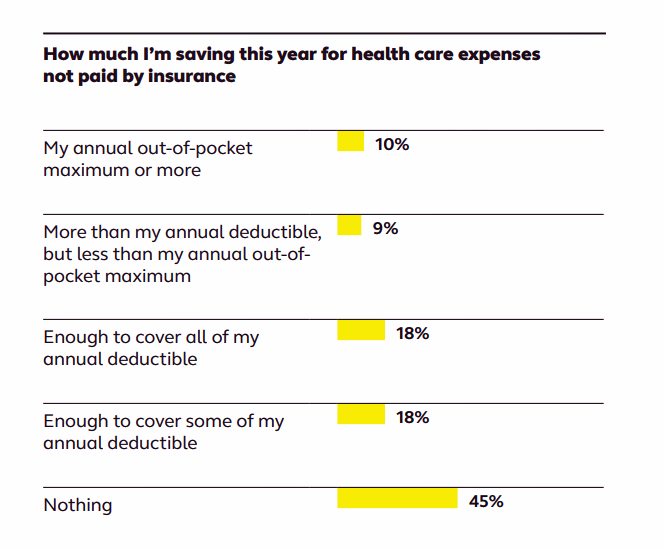

Given the fact that health care costs are the top pocketbook issues for U.S. families, it’s concerning that Americans “have two wallets:” one for health care and one for retirement, Alight learned.

The second chart illustrates a relatively low level of saving for health care expenses not paid by insurance. Nearly one-half of people aren’t saving anything for out-of-pocket health care expenses, shown on the bottom line of “Nothing.” Only two in five workers are saving up to their annual health care deductible; thus, 3 in 5 people are at significant financial risk in the event of an unexpected health event.

Even when armed with a health savings account (HSA), most employees aren’t taking advantage of them to save for medical expenses. One-third of workers have an HSA, but only 1 in 5 figure out how much they need to save into their account. One in five save the maximum amount allowed, one in five figure out what they can afford and put that away, and 1 in five don’t have a plan and “decide as they go along,” Alight discovered.

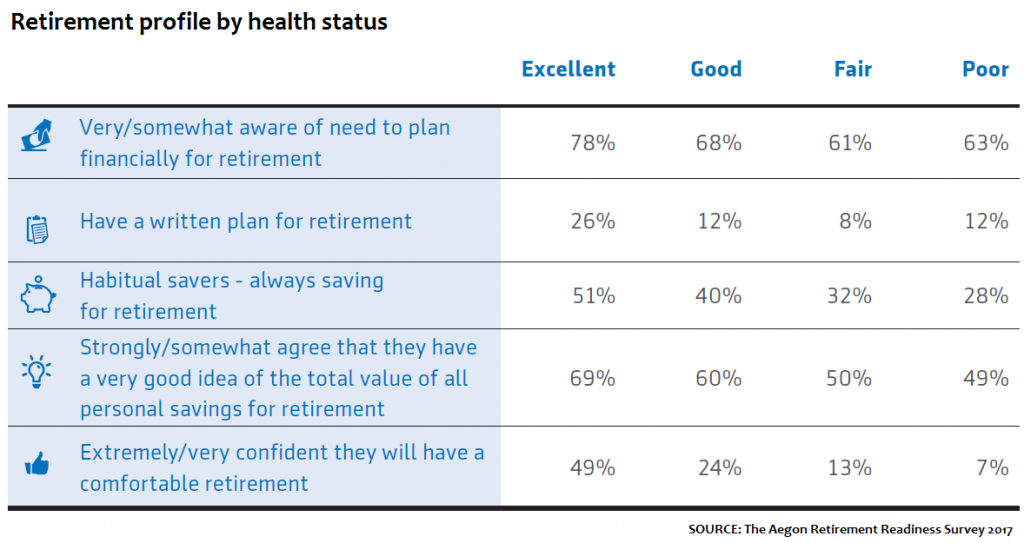

“Retirement is the ultimate intersection of financial security and healthy aging,” according to the 2017 Aegon Retirement Ready Survey on Healthy Aging and Financial Security, published this month, found a direct relationship between consumers mindful of the need to financially plan for retirement and save connected with positive health status. People less likely to save and be aware of those savings, and lack a written plan for retirement, are more likely to be in poor or fair health, shown in the third chart.

“Retirement is the ultimate intersection of financial security and healthy aging,” according to the 2017 Aegon Retirement Ready Survey on Healthy Aging and Financial Security, published this month, found a direct relationship between consumers mindful of the need to financially plan for retirement and save connected with positive health status. People less likely to save and be aware of those savings, and lack a written plan for retirement, are more likely to be in poor or fair health, shown in the third chart.

Globally, traditional views of retirement are changing, Aegon found, as more people plan to work to age 60 or older, or never retire. People are re-defining healthy aging is an active stage of life where they want to stay socially connected and community-involved; and, 57% envision working in some way.

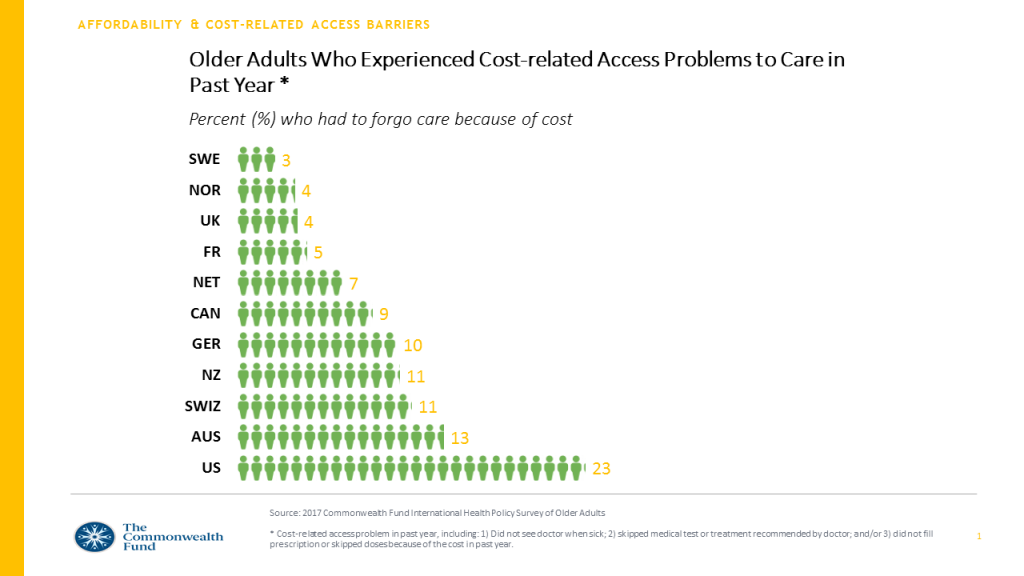

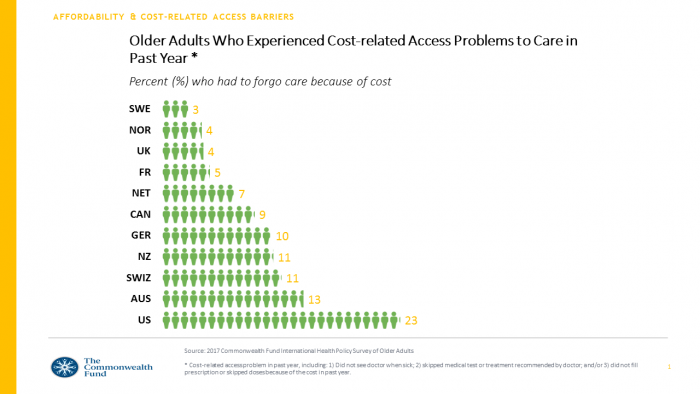

While active aging is a globally-shared vision among people in wealthy countries, a new report from The Commonwealth Fund learned that the health of older Americans ranks relatively low compared with older peers living in developed nations.

While active aging is a globally-shared vision among people in wealthy countries, a new report from The Commonwealth Fund learned that the health of older Americans ranks relatively low compared with older peers living in developed nations.

The headline of this study is that U.S. seniors are more likely to be sick and have trouble affording care than those in peer nations.

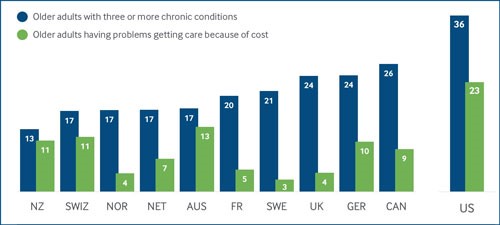

U.S. seniors are sicker, more economically vulnerable, and deal with greater financial barriers to health and social care than older people living in other wealthy countries, as the fourth chart shows. One in 3 American elders also has three or more chronic conditions, the highest proportion among the eleven nations studied.

U.S. seniors are sicker, more economically vulnerable, and deal with greater financial barriers to health and social care than older people living in other wealthy countries, as the fourth chart shows. One in 3 American elders also has three or more chronic conditions, the highest proportion among the eleven nations studied.

One in 3 older Americans who is considered at high-need for medical care faces greater cost barriers to receiving health services, again the highest percentage found across the comparative nations.

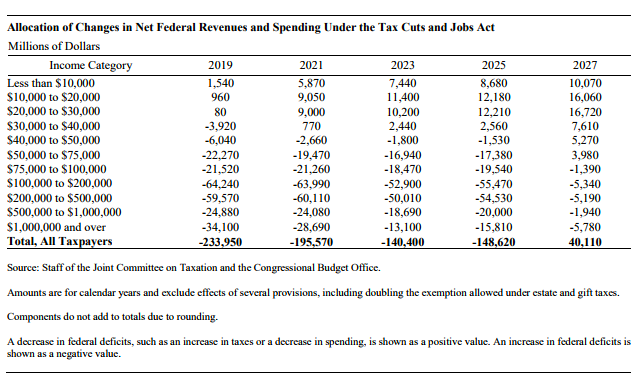

Health Populi’s Hot Points: As US tax reform efforts come to a vote in the coming days, Congressional legislators should be mindful of the direct correlation between financial wellness and overall health – both individual health at the taxpayer level and through the macro public health lens. An analysis from The Commonwealth Fund published today notes that By Reducing the Income of Poorer Americans, the Senate Tax Bill May Worsen Health Outcomes. The worsening of health outcomes would be the result of repealing the ACA’s individual mandate and reducing the income of the poor, which the CBO calculated in their scoring of the Senate bill as detailed in the last chart.

It is useful to note that the countries providing a stronger social safety net, coupled with resilient primary care backbone, drive better outcomes for their health citizens. As Congress debates cuts to the social safety net coupled with health care access erosion, the risks to individual and public health would be particularly acute for people already in high-need scenarios with multiple chronic conditions. These are largely older people, whom AARP calculated would bear much greater health care costs under the Senate tax proposal.

It is useful to note that the countries providing a stronger social safety net, coupled with resilient primary care backbone, drive better outcomes for their health citizens. As Congress debates cuts to the social safety net coupled with health care access erosion, the risks to individual and public health would be particularly acute for people already in high-need scenarios with multiple chronic conditions. These are largely older people, whom AARP calculated would bear much greater health care costs under the Senate tax proposal.

That’s a recipe for eroding financial wellness for the oldest health citizens of America.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...