August 8 is National CBD Day. Who knew? Well, now you do, and I’m going to explain how this three-letter-acronym is rolling into the retail health landscape, opportunities, risks, and other issues I like to cover when forecasting the future of a new-new thing in health/care.

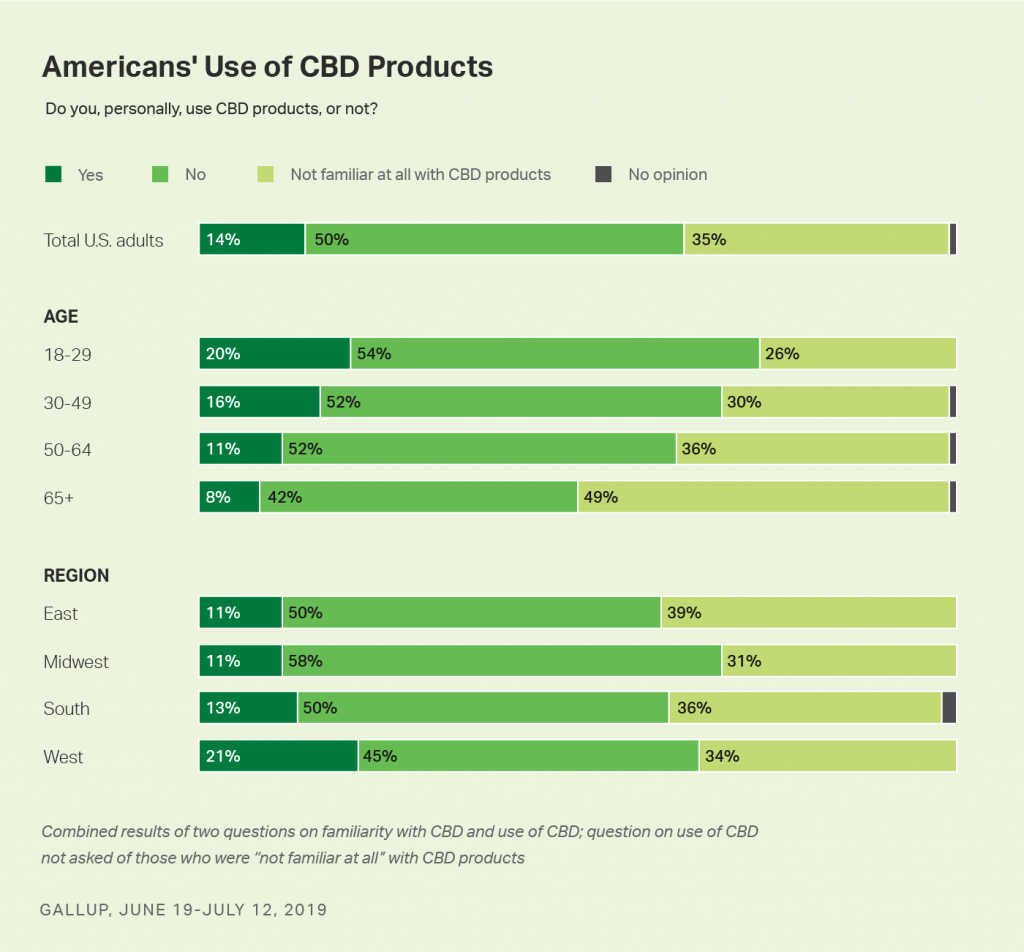

“CBD” stands for cannabidiol, which is a derivative of cannabis, marijuana and hemp plants. CBD is the non-psychoactive compound derived from cannabis plants. CBD is being fast-adopted by consumers in retail and regulated shopping channels. One in seven Americans (14%) use CBD products, according to Gallup‘s new well-being research. One-third of U.S. consumers weren’t familiar with CBD as of June 2019.

“CBD” stands for cannabidiol, which is a derivative of cannabis, marijuana and hemp plants. CBD is the non-psychoactive compound derived from cannabis plants. CBD is being fast-adopted by consumers in retail and regulated shopping channels. One in seven Americans (14%) use CBD products, according to Gallup‘s new well-being research. One-third of U.S. consumers weren’t familiar with CBD as of June 2019.

Use of CBD varies by age, with one in five people 18-29 using CBD, and 16% of those 30-49 consuming CBD products, Gallup found. Use of CBD is highest in the Western U.S.

Gallup also found that the most common conditions or purposes people cite for using CBD include pain (40%), anxiety (20%), sleep or insomnia (11%), arthritis (8%), migraines and other headaches (5%), stress (5%) and other health and wellness reasons.

Gallup calls out the 2018 Farm Act which legalized the cultivation of hemp, which is one driving force behind the fast-growing supply side of CBD-based products.

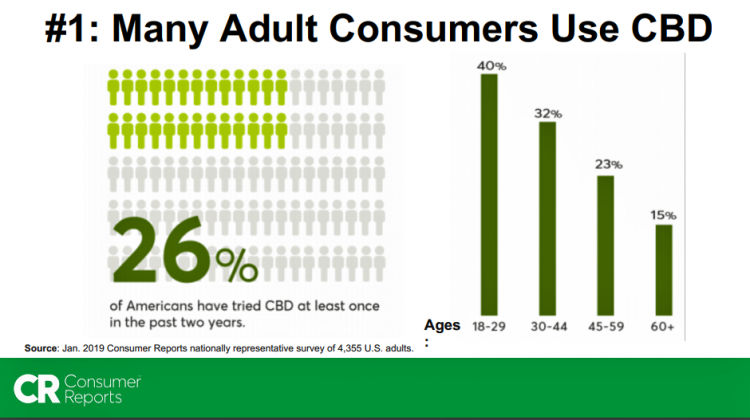

Lisa Gill of Consumers Union, publisher of Consumer Reports, was one of several dozen presenters at a recent FDA hearing on CBD regulatory issues (detailed below in the Hot Points). CU’s research identified that 26%, or one in four, U.S. adults used CBD, again finding that use decreased with age similar to Gallup’s research.

The top two reasons CU found that Americans cited for using CBD were reducing stress or anxiety among 37% of users, and to help with joint pain for 24% of users. Each of these reasons were different based on consumer’s age: 32% of Millennial-users of CBD cited “reducing stress or anxiety” as the primary reason for using CBD, and 42% of Baby Boomers cited “help with joint pain.”

The most common forms of CBD used were via edibles (for 35% of consumers) in food or drink, drops or spray (for 30% of users), vaping (among 30%), and topical rub/cream (21%).

People shop for CBD products typically in a cannabis dispensary (40%), a retail store (34%), or an online retailer (27%).

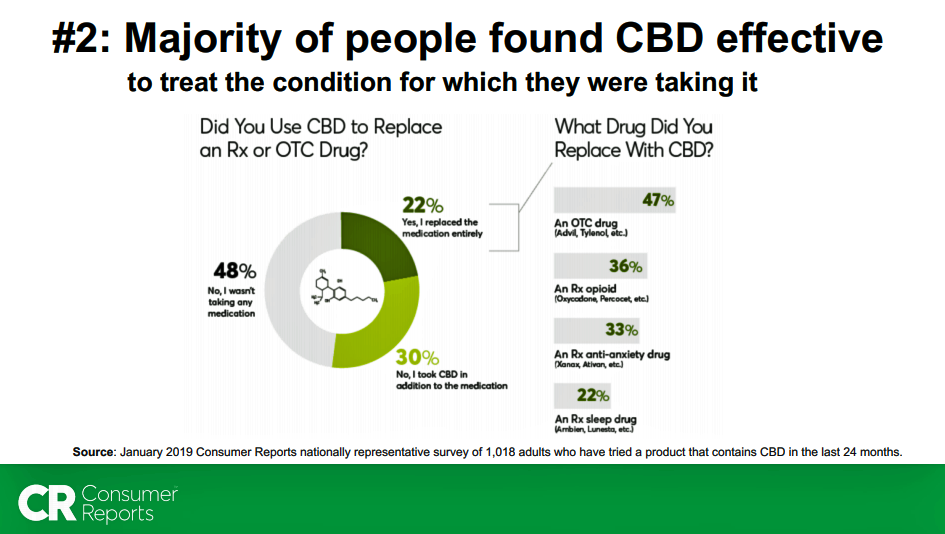

22% of consumers using CBD used the product to entirely replace a prescription medicine (Rx) or over-the-counter (OTC). Among these “replacers,”

- 47% replaced an OTC

- 36% replaced an Rx opioid

- 33% replaced an Rx anti-anxiety drug

- 22% replaced a prescription sleep medication.

One in three CBD users added the CBD product to their Rx or OTC regimen.

Some intriguing and heretofore strange bedfellows are coming together in CBD partnerships and marketing plans in the health-beauty-wellness world. A big driving force here is the fact that currently, one-third of CBD forms consumers turn to are “edibles,” so many of the most visible CBD partnerships are in the food category, seen in retail grocery and manufacturing deal-making. Food and beverage products infused with hemp and CBD ingredients are already found on store shelves well beyond your local health food store.

Kroger announced that it would stock over CBD-infused products to its health and beauty aisles in grocery stores to be shopped by mainstream Americans. And, convenience (C-) stores have already been channeling candy and snack sales in cannabis-legal states. Nielsen forecasts a 7.2% CAGR for candy and snack sales in states where cannabis has been legalized for recreational use, and 6% in states where cannabis is not legal.

For more insights on the medical cannabis part of the industry, you can read the chapter in which the phenomenon is featured, “The New Retail Health,” in my book, HealthConsuming.

Health Populi’s Hot Points: “The ‘Wild West’ of CBD” is how analysts at Rabobank have termed this phenomenon.

Health Populi’s Hot Points: “The ‘Wild West’ of CBD” is how analysts at Rabobank have termed this phenomenon.

Now that I’ve explained the bullish forecast and consumer race to adopt CBD, let’s hear from the FDA which, so far, hasn’t yet issued regulations about CBD.

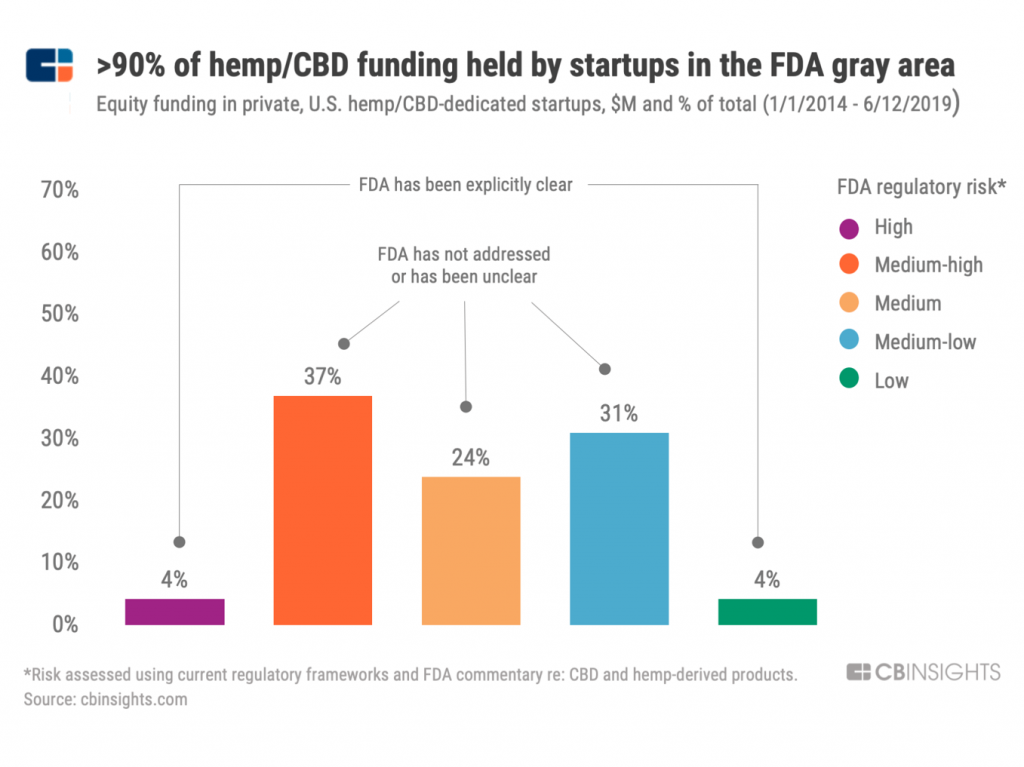

First, see the bar chart showing that the vast majority of equity-backed CBD startups fall within FDA-regulated “gray areas,” according to CB Insights.

Here’s a link to the FDA’s FAQs on CBD. The FDA is looking to develop “sound, science-based” policy on CBD, and has held hearings and heard testimony from dozens of stakeholders to consider. The FDA’s most recent hearing on the issues was on May 31, 2019, and the Agency took in comments through July 16, 2019. Presentations were delivered by academicians, agricultural experts, consumer advocates, health professionals, manufacturers, patients, public safety officials, and retailers. The topics they covered were wide-ranging, including drug interactions, electronic cigarette impacts, cannabis-as-medicine, labeling, and even hemp-infused tampons.

Why is consumers’ fast-adoption of CBD one of the future of health care scenario “wild cards” I discussed with Marc Iskowitz in our podcast for MM&M this week?

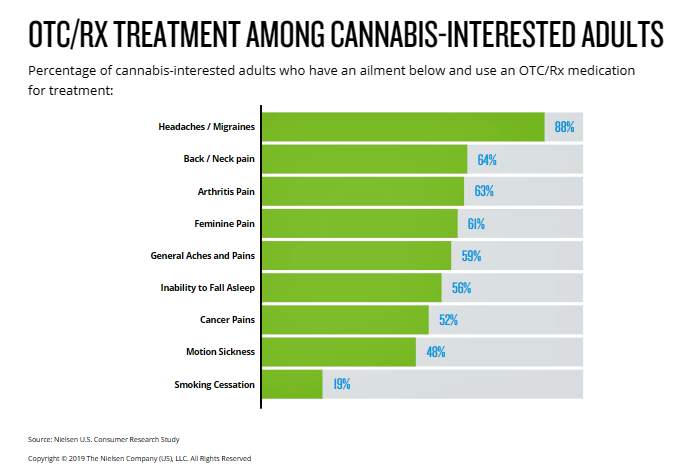

The core of my reason for including CBD in my scenarios for clients in 2019-2020 is suggested by this last bar chart, from Nielsen’s consumer research. Already, we know from the Consumer Reports FDA testimony from May 2019 that one in five U.S. adults said they are choosing to replace prescription and OTC drugs with CBD products.

Nielsen’s chart here shows us that 9 in 10 “cannabis-interested” consumers are dealing with migraines; two-thirds of cannabis-interested Americans have back or neck pain, arthritis pain, “feminine pain,” and general aches and pains. Over half of people interested in cannabis deal with sleep issues and cancer pain.

If legally available, 85% of Americans would consume cannabis to treat chronic pain, and 82% to deal with mental health.

Watch this space. I am with Consumers Union and Nielsen in keenly doing so — and particularly, how the FDA will respond in the coming months to what is, for now, a CBD-Wild West for suppliers and consumers in the evolving retail health ecosystem.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...