When we say the word “pharmacy,” we might picture the Main Street brick-and-mortar chain drugstore that dispenses medicines from behind the counter in the far back of the building, and sweet and salty snacks at the front by the cashier.

When we say the word “pharmacy,” we might picture the Main Street brick-and-mortar chain drugstore that dispenses medicines from behind the counter in the far back of the building, and sweet and salty snacks at the front by the cashier.

In fact, “pharmacy” is the jumping off point for the expanding and increasingly beloved retail health ecosystem, J.D. Power found in the company’s latest 2021 U.S. Pharmacy Study.

Each year, J.D. Power assesses consumers’ perceptions of pharmacies by category, including those retail chains along with supermarket operated, mass merchants, and mail order channels.

This is the 13th year of the study, which surveyed responses from 12,646 consumers who had filled a prescription in the 3 months prior to September 2020 through May 2021.

This year, J.D. Power believes that pharmacies are “setting the stage for the transformation of ambulatory care delivery,” in their words.

One in two retail pharmacy customers used at least one form of health and wellness service from the store, J.D. Power found. And with that use boosts the consumer’s Net Promoter Score, or satisfaction, with the pharmacy company. Vaccinations and routine health screenings were the two most-utilized services in the study.

Furthermore, those folks who used a health and wellness service at a pharmacy also spent $5 more per person at the store.

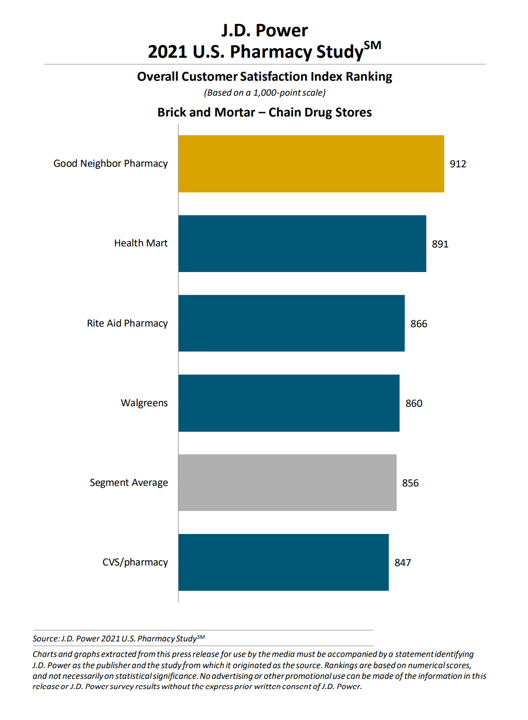

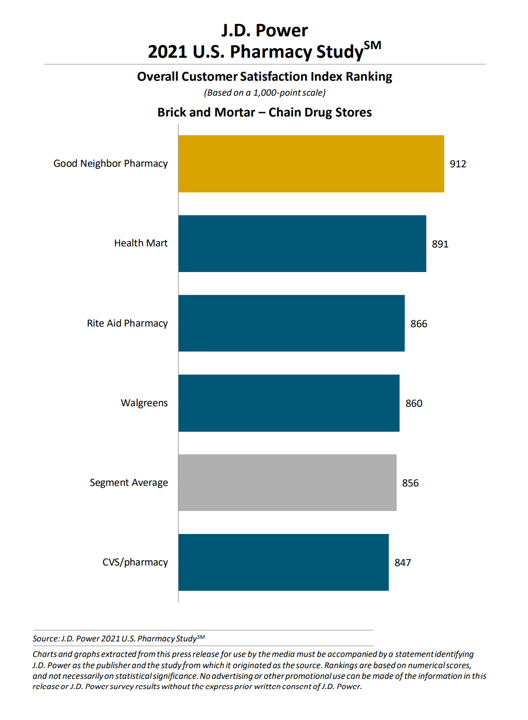

Overall across the four retail pharmacy segments, Good Neighbor Pharmacy achieved the highest customer satisfaction index rating at 912 points. This is six points higher than the mail order Humana Pharmacy program, garnering 906 points.

Third place overall was for the grocery chain H-E-B with an 896 index, followed by Wegmans closely trailing at 892.

Third place overall was for the grocery chain H-E-B with an 896 index, followed by Wegmans closely trailing at 892.

The top three places by retail pharmacy channel were:

Chain drug stores: Good Neighbor Pharmacy, Health Mart, Rite-Aide

Supermarket chains: H-E-B, Wegmans, Stop & Shop

Mass merchants: Sam’s Club, CVS/pharmacy inside Target, Costco

Mail order: Humana Pharmacy, Kaiser Permanente, Aetna Rx Home Delivery.

Note that CVS/pharmacy inside Target scored an 879 index within the mass merchant category, but CVS/Health pharmacy as a chain drug score reached only 847 — the lowest among the six chain pharmacies ranked.

It’s also interesting to compare the segment averages by pharmacy channel type: mail order scores highest on average at 877, followed by mass merchants with 866, supermarkets at 863, and chain drug stores at the bottom at 856.

Health Populi’s Hot Points: Taking the four average customer satisfaction indices across pharmacy channel type, we can infer that the “original” legacy format of the retail chain drugstore delivers the lowest average level of consumer-love compared with mail order, mass merchandisers, and grocery stores.

This is the sort of “disruption” we refer to thinking about new entrants to the health/care ecosystem, delivering convenience, access, and loyalty-inspired feelings among patients, now behaving as consumers.

The pandemic surely evolved patients into consumers, some of us health citizens taking on newer behaviors like more hand-washing and hygiene in home care, mask-wearing, vaccination seeking, and voting in elections with health on our minds.

As retail health care continues to morph in response to consumers’ health and wellness demands, we see grocery stores pivoting toward more health-and-wellness around the perimeter and in the center of the store; mass merchants delivering mental health through telehealth; retail pharmacies investing in housing and food security; and all developing a more “full-stack” vertically integrated approach to bringing streamlined, well-designed, cost-effective and even delightful experiences to health care.

We can also expect pharmacies, writ large, to be entering our households not only delivering to the front porch or mailbox, but getting inside for more acute care — think dialysis, medication monitoring and adherence, and marrying food-to-medicine.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...