This week ALDI, the global food discount group, announced they would acquire Winn-Dixie and Harveys Supermarket stores.

In response to the deal, Supermarket News said that ALDI “is shaking up the grocery sector with its acquisition” of the Winn-Dixie chain. That statement was focused on the overall food chain landscape, where Winn-Dixie has played a significant role in the traditional brick-and-mortar grocery business. ALDI has generally served a value-oriented segment of consumers, which industry analyst have categorized as a separate food channel based on consumer segmentation.

In addition to the overall “shaking up” of the grocery store industry, might ALDI’s purchase the major food chain also expand the company’s footprint in health care?

Not likely through the pharmacy channel, which was not part of the ALDI deal: Winn-Dixie has sold the pharmacy operations to CVS and Walgreens, according to this story in the Florida Times-Union. The newspaper reported that Winn-Dixie’s pharmacy operations will wind down by the end of 2023, but assures the grocery store’s customers that, “The company remains committed to protecting the health and wellness of our customers and communities until the (pharmacy sales} transactions are finalized, and our pharmacy customers will be provided sufficient advance notice prior to the transfer.”

ALDI’s position in health that, thus far, has focused largely on some nutritious food stocked in the store’s simple aisles and value-priced for consumers. Their mantra has been “healthy living made easier with healthy groceries,” from “heart healthy breakfast options to fresh, organic dinner items.”

This makes ALDI’s value-pricing an important player for families’ financial well-being, part of the larger health/care ecosystem in the Health Populi broad tent for health citizens. For six years in a row, dunnhumby has ranked ALDI the #1 low-price grocery chain (aka “the best grocery for inflationary times”).

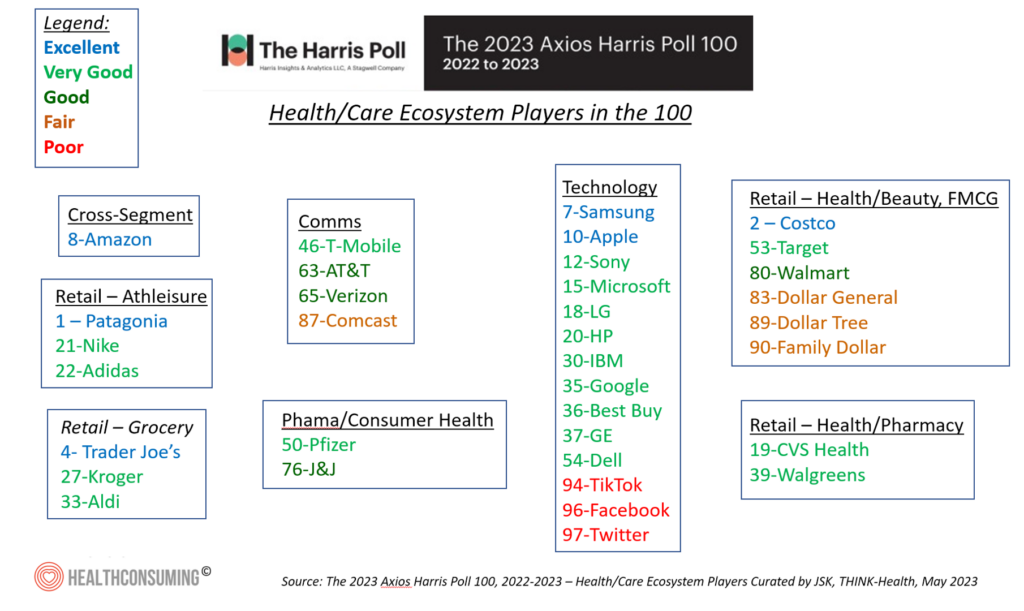

The Axios-Harris Poll 100 for 2023 also identified ALDI as a top grocery store brand based on reputation, with only Trader Joe’s and Kroger ahead of ALDI in their assessment. You can see other health ecosystem players’ curated in that research in the chart here which I assembled when Axios/Harris’s research was published in May 2023.

Putting on our health/care lens, we realize that ALDI stocks many health-ful and nutritious products accessible to families. The store also accepts EBT for SNAP benefits, a food channel for families enrolled for nutrition assistance in the U.S.

Health Populi’s Hot Points: Check out Albertson’s video, here, which animates their new program called Sincerely Health Eating Better.

Albertson’s also just published its 2023 ESG Report, following up several years of such manifestoes outlining the company’s environmental, social, and governance goals. This year’s has a strong focus on “Recipes for Change,” Albertson’s commitment to “Planet, People, Product, and Community.”

Kroger and its Kroger Health subsidiary are also growing their health care portfolios, most recently expanding Medicare offerings through Intermountain’s Select Health program in four mountain region states. The health plans will channel through Kroger stores branded as Smith’s, King Soopers, City Market and Fred Meyer.

Discussing Kroger’s expanding lens on health for its grocery stores, Marcum’s Food & Beverage leader Louis Biscotti wrote in Forbes,

On one level, this is just a greater merging of pharmacy and supermarket functions, but more is at work. Kroger reportedly plans to add another 15,000 “healthier items” by 2025 and to continue rolling out OptUp scores for items. It’s also encouraging suppliers to reduce sodium and sugar, hoping to hook shoppers on health even as some companies try to hook shoppers on sweets.

Most other large food chains also have health and well-being embedded in operations and missions in various ways. For example,

- Giant’s latest news announcing the company’s Healthy Living progran is marketing nutrition and health services to employers’ wellness programs

- The Hy-Vee Healthy You wellness tour kicked off, and

- Stop & Shop and Montefiore Children’s Hospital began collaborating in NYC to channel fresh produce to families in the Bronx.

As Winn-Dixie carved out a sale of its pharmacies to CVS and Walgreens, those retail pharmacies grow their geographical base in the southeastern U.S. where Winn-Dixie has been focused.

For now, ALDI remains sticking to its knitting as a dominant low-cost grocery purveyor, where it can add to its healthy food offerings but stay out of health care services and programs for the time being through its 2800 storefronts by the end of 2024.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...