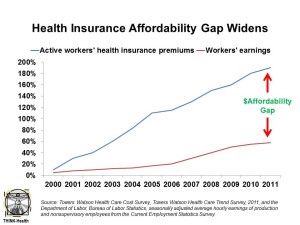

Health care costs for workers lucky enough to receive health insurance at work nearly doubled since 2002. Wages in that decade grew by 33%. This growing affordability gap between health costs vs. wages is shown in the chart.

Health care costs for workers lucky enough to receive health insurance at work nearly doubled since 2002. Wages in that decade grew by 33%. This growing affordability gap between health costs vs. wages is shown in the chart.

Health consumers in America sharply perceive this gap, according to an analysis of eight focus groups, Consumer Attitudes on Health Care Costs: Insights from Focus Groups in Four U.S. Cities from the Robert Wood Johnson Foundation. To health-covered workers, though, health care “costs” are defined as out-of-pocket health spending for insurance premiums, co-payments and deductibles that come out of paychecks and pocketbooks — not the total costs of providing health care services to the individual for what services “really” cost.

RWJF met with health consumers of various stripes: some had insurance via work with deductibles of $500 or more, some were Medicare beneficiaries, some purchased insurance on the private market, and some people were uninsured. Nearly all of these people have experienced higher health costs, and universally everyone didn’t understand why health costs continue to rise.

This round of focus groups yielded a new finding for RWJF researchers: in the past, consumers surveyed couldn’t estimate their out-of-pocket costs. In this round, participants knew their costs “practically to the penny,” RWJF writes.

As a result of knowing their costs, health consumers said rising costs affect daily lives and purchasing behaviors. They’re getting engaged in several respects, both positive (for health) and no-so-healthy ones: some people are questioning their doctors’ recommendations more frequently; some deny care for themselves and their family. This latter point is new, too, in that in other studies, it’s been found that parents take care of children’s health (visits to pediatricians, for example) while postponing care for themselves. In this round of focus groups, more people are denying children care.

Focus groups were conducted in Charlotte, Chicago, Denver and Philadelphia.

Health Populi’s Hot Points: It’s not surprising that U.S. health consumers in these groups expressed senses of anger with respect to health costs crowding out other household spending from family budgets, and denying their family necessary care. The issue is personal: although people recognize that growing health costs could negatively impact the national economy, they’re more concerned about health costs’ negative impact on household spending.

To lower their personal health costs, some people said they’re living “healthier lifestyles” addressing nutrition, activity and smoking cessation. Some pointed to generic drugs as a cost-saver.

Ultimately, most folks in the focus groups pointed to the government as having the most power to do something to stem the rise of health care costs, but weren’t confident in the government’s ability to do so.

The chart illustrating the affordability gap of health costs vs. wages has been drawn by Arnold Milstein, Professor of Medicine at Stanford, with graphic “shark jaws” in the gap between costs and wages. That these health consumers are fully cognizant of their personal health costs “to the penny” — acute feeling the shark-cost “bite” — is a sign that people are getting engaged in the financial aspects of health. My working hypothesis is that the financial pinch people are feeling is the nudge that’s moving many of them/us toward healthier lifestyles and greater consumerism in the health of our families and ourselves.

Thanks to Jennifer Castenson for

Thanks to Jennifer Castenson for  Jane joined host Dr. Geeta "Dr. G" Nayyar and colleagues to brainstorm the value of vaccines for public and individual health in this challenging environment for health literacy, health politics, and health citizen grievance.

Jane joined host Dr. Geeta "Dr. G" Nayyar and colleagues to brainstorm the value of vaccines for public and individual health in this challenging environment for health literacy, health politics, and health citizen grievance.  I'm grateful to be part of the Duke Corporate Education faculty, sharing perspectives on the future of health care with health and life science companies. Once again, I'll be brainstorming the future of health care with a cohort of executives working in a global pharmaceutical company.

I'm grateful to be part of the Duke Corporate Education faculty, sharing perspectives on the future of health care with health and life science companies. Once again, I'll be brainstorming the future of health care with a cohort of executives working in a global pharmaceutical company.