While 50% of Americans feel they have a sound financial position, the other half is living paycheck to paycheck. 8% say they can’t even pay for essentials.

While 50% of Americans feel they have a sound financial position, the other half is living paycheck to paycheck. 8% say they can’t even pay for essentials.

The second annual Allstate “Life Tracks” Poll finds American adults split between have’s and have not’s, with even the “have’s” feeling less than financially literate.

There is an equal split between people who feel they’re in an “excellent” or “good” financial position compared with those who feel they’re in financially “fair” or “poor” shape. Men feel more financially secure than women; 3 in 4 single parents feel less well-off compared to the average U.S. adult. College grads feel they’re doing better financially those non-grads in the “living from paycheck to paycheck” scenario.

One-half of Americans say they are paying off credit card debt, and 65% of those with credit card debt say that debt has grown or stayed even the past year. Only 15% of people say their long-term savings and investment has increased. Thus, one-half of U.S. adults admit they’re saving less than they “should” be doing.

Even with this less-than-sanguine financial picture, most U.S. adults (9 in 10) feel confident they could manage their personal finances. 4 in 10 believe they could pay for a car, 4 in 10 feel “very” confident they could pay for their kids’ education, and half think they could buy a new house. 91% of Americans told Allstate they believe personal financial management skills can be learned.

You can view a video of “Hank,” the baby who’s marketing financial literacy in Allstate’s campaign, here.

Allstate conducted the survey via phone (landline and cell) among 1,000 American adults 18 and over in December 2012.

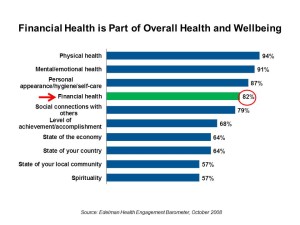

Health Populi’s Hot Points: Financial health is integral to overall health and wellness, as the chart shows. In fact, our feelings about money-in-the-bank as part of our whole health are nearly as important to our personal health equations as our physical health, mental health, and physical appearance, learned via the Edelman Health Engagement Barometer.

health is integral to overall health and wellness, as the chart shows. In fact, our feelings about money-in-the-bank as part of our whole health are nearly as important to our personal health equations as our physical health, mental health, and physical appearance, learned via the Edelman Health Engagement Barometer.

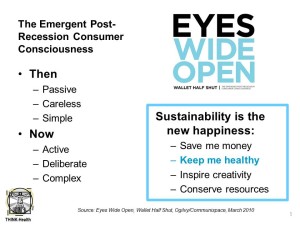

In the post-recession era, we’ve learned that health is also part of our relationships with companies beyond hospitals, pharmas, and over-the-counter consumer medical suppliers. The Ogilvy study, Eyes Wide Open, Wallet Half Shut, looked at how U.S. consumers saw their lives in the advent of the Great Recession of 2008. Their research learned that American consumers were looking for companies to save them money, inspire creativity (THINK: Maker Faire and DIY), conserve resources (THINK: energy/stress reduction), and to “keep me healthy.”

In the post-recession era, we’ve learned that health is also part of our relationships with companies beyond hospitals, pharmas, and over-the-counter consumer medical suppliers. The Ogilvy study, Eyes Wide Open, Wallet Half Shut, looked at how U.S. consumers saw their lives in the advent of the Great Recession of 2008. Their research learned that American consumers were looking for companies to save them money, inspire creativity (THINK: Maker Faire and DIY), conserve resources (THINK: energy/stress reduction), and to “keep me healthy.”

Health is wealth, and wealth, health, in the eyes of U.S. consumers. Most people don’t have the tools to take on saving more, planning for retirement, and grappling with debt. But the Allstate survey found that people feel like they could learn to do so. It will take more than information and a cute video to inspire this sort of sea-change within the hearts and wallets of U.S. health citizens. Connecting the dots between health and wealth could help trigger activation.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...