Online shopping for health care can drive costs down, according to research conducted by HealthSparq, a company that works with health insurance companies to channel health cost information to plan members (that is, consumers).

Online shopping for health care can drive costs down, according to research conducted by HealthSparq, a company that works with health insurance companies to channel health cost information to plan members (that is, consumers).

Healthsparq partnered with one of the company’s health insurance company clients to conduct this study, which demonstrated that, over two years, consumers who used an online treatment cost estimator saved money on care for hernia conditions, digestive conditions, and women’s health issues.

It’s early days for health care price transparency in health care, but HealthSparq’s findings demonstrate positive evidence that when consumers are offered a tool they can use to shop for health care price and quality, some will engage and save money in the process.

My latest report for California HealthCare Foundation, Help Yourself: the Rise of Online Health Marketplaces, covered the landscape of online health care shopping and found a growing supply-side of transparency and shopping portals designed to serve this market. The underlying theory: that people who have more financial skin in the health care game — in the form of high deductibles and greater copays and co-sharing arrangements for care and supplies — will adopt consumer-shopping behaviors for health much as they do for other spending categories in the household budget.

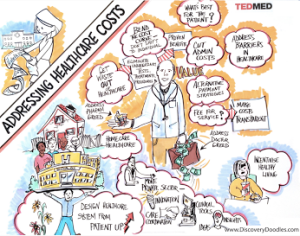

“Any kind of transparency play is great – but some are better than others.” Jeanne Pinder of ClearHealthCosts told TEDMED’s Google+ Hangout group yesterday when we met to brainstorm the growing and knotty role of price transparency in health care costs. Here’s The Leapfrog Group’s useful primer on the subject.

Whitney Zatzkin (@MsWZ) of TEDMED convened five informative experts with different (interestingly, all female) points of view on the topic:

– Jeanne Pinder (@CHCosts), quoted above, who founded ClearHealthCosts, an online portal that brings health care service prices to light

– Lisa Maki (@LisaMMaki) founder of PokitDoc, which provides an online health shopping marketplace for people to identify available providers and converge on an acceptable price for that service

– Professor Amy Edgar (@ProfAmyE) of Cedar Crest College, a nurse educator

– Maribeth Shannon, who leads California Healthcare Foundation‘s (CHCF) Market and Policy Monitor Program

– Jennifer Joynt, a healthcare consultant and author of a new report from CHCF on Quality of Care: Steps in the Right Direction.

Deanna Pogoreac (@DeannaJour231) covered the event here in MedCity News.

Health Populi’s Hot Points: My question to the group emanated from my research for the Help Yourself paper, inspired by Dr. Leslie Ramirez, founder of Leslie’s List in Chicago. Dr. Ramirez created her List to help guide her patients toward high quality, cost-effective services in her area. More patients were asking her how much referrals for various procedures and treatments would cost, and Dr. Ramirez took this task upon herself to bring transparency to her people. Her husband asked the $2.6 trillion question: do all people/patients know they have a health price transparency problem?

The answer is: yes, some do. But too many people don’t know (1) they’ve a problem or, if they do, (2) how to ask the right questions and (3) where to go to get trustworthy and valid answers to those questions. We face a four-layer cake of literacy hurdles:

- Basic literacy

- Health literacy

- Digital literacy – how to, first, access and then, second, use the internet for health searching

- Health financial literacy – how to understand one’s role in paying for health care – what kind of health plan one has, what’s our deductible, where are we on meeting the deductible, do we have co-payments for services or products (e.g., Rx drugs or physical therapy), are over-the-counter products covered within our health savings accounts, etc.

We’re in a marathon, not a sprint. This is the new retail health. Consumer engagement in price transparency requires health engagement and financial engagement: two areas of life (health and money) where people are least-likely to want to engage. Will greater financial skin in the health game compel people to engage? This is the question that will be answered over the coming months and years as more people enroll in high-deductible health plans or remain full-on retail customers in a direct-pay health environment.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...