Health care consumers face a fragmented and complicated payment landscape after receiving services from hospitals and doctors, and paying for insurance coverage. People want to “view their bills, make a few clicks, pay…and be done,” according to Jamie Kresberg, product manager at Citi Retail Services, a unit of Citibank. He’s quoted in Money Matters: Billing and payment for a New Health Economy from PwC’s Health Research Institute.

Health care consumers face a fragmented and complicated payment landscape after receiving services from hospitals and doctors, and paying for insurance coverage. People want to “view their bills, make a few clicks, pay…and be done,” according to Jamie Kresberg, product manager at Citi Retail Services, a unit of Citibank. He’s quoted in Money Matters: Billing and payment for a New Health Economy from PwC’s Health Research Institute.

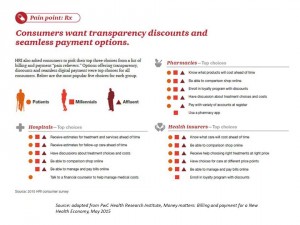

The healthcare service segment most consumers are satisfied with when it comes to billing and payment is pharmacies, who score well on convenience, affordability, reliability, and seamless transactions – with only transparency being more problematic.

The observation that health consumers seek the kind of contemporary, retail payment experience from healthcare, is highlighted by PwC’s consumer survey in Money Matters which found that:

- People in poor or fair health are more dissatisfied with hospital billing: fewer of these unwell folks understand costs before receiving services, find medical bills affordable, didn’t find bills simple to pay, and had poorer images of the hospital – 1 in 2 consumers in poor or for health rated hospitals poorly for price transparency and affordability.

- Affluent people are most unhappy with insurance companies’ billing and payment practices: these consumers, with household incomes exceeding $100,000 a year, are more likely to say insurance bills are not affordable than the general population, and more affluent people tend to not find it easy to find details of their benefits or the portion of the bill owed to the company.

- Health consumers are consumers – they want mobile and digital options, and multiple versions of these – from pre-service price comparison shopping tools through to flexible payment plans.

While Citibank is an example of a mature bank working to streamline health care payments from consumers with the Money for Health portal, the report notes several of the new entrants in this space including such as alli Healthcare, Apple Pay working with InstaMed, athenahealth, CarePayment, Castlight Health, HealthSparq, SpendWell and Wellero, among others.

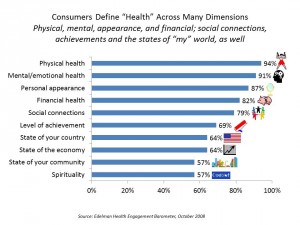

Health Populi’s Hot Points: People , encompassing physical and mental health, appearance, and financial health. The growth of high-deductible health plans finds consumers between the physical-and-physical-health rock-and-hard-place, making decisions about spending dollars out-of-pocket for health care in the context of “when” they need the care and how much that care costs.

Health Populi’s Hot Points: People , encompassing physical and mental health, appearance, and financial health. The growth of high-deductible health plans finds consumers between the physical-and-physical-health rock-and-hard-place, making decisions about spending dollars out-of-pocket for health care in the context of “when” they need the care and how much that care costs.

PwC’s choice of the two words in the title, “Money Matters,” has at least two levels of meaning. For those of us who are focused on the microeconomics of health in 2015 toward 2020, Money Matters for health consumers because people need to spend the right amount of money in the right locus of care at the right time and for the right services. Transparency across these four dimensions is complicated: price, quality, service choice availability and locations to receive those services is heavy lifting for anyone faced with an elective health care choice — say, for an arthroscopic procedure, with time to consider choices, weigh alternatives vis-à-vis out-of-pocket costs and physicians’ surgical qualifications.

While Money Matters, so does retail-style convenience and accessibility that fits into peoples’ lives. So the Value Proposition of Retail Clinics, a report from the Robert Wood Johnson Foundation and Manatt, talks about the potential role for these facilities to extend primary care to people where they live, work and shop. Consumers told PwC that pharmacies do a much better job at filling their service expectations than hospitals and health plans do. “The astonishing foot traffic that these retailers generate can serve as a platform for offering services not traditionally delivered in retail setting,” the report states, from nutrition and housing support to help in enrolling in health plans.

These two legacy players, hospitals and health insurance, can ally/align with retail health providers to meet health consumer demands but also drive health outcomes in the community. “The key is coordination and linkage back to the medical home,” says Shawn Martin of the American Academy of Family Physicians, quoted in the RWJF report.

But that definition of the medical home, too, may change, as some patients may begin to wrestle control of their health records in new ways. This weekend, a petition was launched at GetMyHealthData.org to promote Americans’ self-interests and rights in getting access to their medical records. This information, when married with health finance information, will give people a more complete picture of their overall health and wellness, and inform and empower people to take more charge of both physical and fiscal health for themselves and the families.

But that definition of the medical home, too, may change, as some patients may begin to wrestle control of their health records in new ways. This weekend, a petition was launched at GetMyHealthData.org to promote Americans’ self-interests and rights in getting access to their medical records. This information, when married with health finance information, will give people a more complete picture of their overall health and wellness, and inform and empower people to take more charge of both physical and fiscal health for themselves and the families.

In the high-deductible world, the new medical home for many will be their home, and their ability to access their data will enable greater self-care and self-determination for their own health and the health of those for whom they care.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...