“Banks and insurance companies that cannot keep pace will find their customers, busy pursuing flawless service models and smart solutions, have moved on without them and they are stranded on the wrong side of the digital divide — from which there will be no return,” according to a report on The Future of Retail Financial Services from Cognizant, Marketforce, and Pegasystems.

“Banks and insurance companies that cannot keep pace will find their customers, busy pursuing flawless service models and smart solutions, have moved on without them and they are stranded on the wrong side of the digital divide — from which there will be no return,” according to a report on The Future of Retail Financial Services from Cognizant, Marketforce, and Pegasystems.

You could substitute “healthcare providers” for “banks and insurance companies,” because traditional health industry stakeholders are equally behind the consumer demand for digital convenience.

This report has important insights relevant to health providers, health plans and suppliers (especially for pharma and medical device firms) as health care delivery in the U.S. moves further toward a consumer/retail-facing model.

Here are some of the most pertinent key findings in the report for health care:

Customer experience: staying relevant. Organizations are “scrambling” to remain relevant to new customers, especially those aged 18-25.

Customer experience: omnichannel. Consumers expect a “flawless, end-to-end experience” across all channels. Multi-channel platforms are in a state of flux: 73% of financial services organizations expect to integrate wearables into their straegies within five years, and 70% expect video chat to replace branch appointments. Six in 10 organizations believe a digital-only channel model is viable.

Internet of things: moving from price to value. IoT could provide opportunities for organizations to better understand and service their customers: 93% agree that finding innovative ways to provide value-added services based on data-driven insights will be crucial to long-term success. 86% agree that once consumer see the data potential of the IoT they will seek to benchmark their own behavior against their peers.

Wearables: payments on the go. 91% of organizations see that wearables will facilitate payments within five years. 87% believe it will be common for consumers to make financial transactions using Smart TVs and 68% via home appliances

Insurance Rebooted: from “grudge purchase” to long-term partnership: Over half of organizations expect most insurance politics in Household and Health lines to be “dynamically priced” based on data from connected devices within five years. The potential is to rethink the relationship between insured people and the insurer, with “data providing the bedrock of a partnership where both parties work together to make life better,” the report says. 80% of organizations believe most insurers will regularly provide personalized risk information to their customers for pre-emptive risk management, which would become a core value proposition by 2020. This leads to another key insight,

Personalization: the customer of one, expecting that personal data stores will be commonplace within five years, enabling consumers to monetize their own data. Finally,

Self-service customers going DIY and connecting with self-service options will be mainstream. Holding this vision back are legacy systems, seen by organizations as the “main bottleneck” in meeting customer demand for a full-service continuum.

Each one of these findings directly relates to new consumer demands for the health care system.

Graham Lloyd, Director and Industry Principal of Financial Services at Pegasystems, said: “We live in an age where ‘Generation Selfie’ is king, and the expectations of customers across all sectors are increasingly influenced by the experiences they get from digital leaders such as Amazon and Netflix.”

Health Populi’s Hot Points: “Nearly a quarter (24 percent) of global financial services organizations run the risk of falling behind competitors because legacy systems are preventing them from offering customers fully personalized services,” the report notes. At least as large a proportion of health care providers are in the same situation as financial services organizations, who have much to teach healthcare.

Health Populi’s Hot Points: “Nearly a quarter (24 percent) of global financial services organizations run the risk of falling behind competitors because legacy systems are preventing them from offering customers fully personalized services,” the report notes. At least as large a proportion of health care providers are in the same situation as financial services organizations, who have much to teach healthcare.

98% of the financial services companies polled in this study say that they need to think beyond traditional industry boundaries to identify new ways of meeting consumer needs.

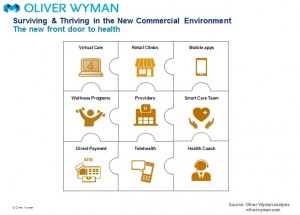

Health care consumers are already pushing the boundaries for their own health care, beyond bricks-and-mortar doctors’ offices and hospital ambulatory clinics. Drug stores, mass market retailers, and grocers have become “the new front doors” for healthcare, coined by Oliver Wyman in their report, The New Front Door to Healthcare is Here. Most people who are frequent shoppers at drug stores and mass stores are willing to receive health and wellness services in those locations, and 48% of those frequently shopping grocery stores are willing to do so. Furthermore, a growing cohort of health consumers is keen to receive care and advice remotely, via virtual services.

In the immediate term. the pharmacy – co-located in retailers (whether drugstore, Big Box or food purveyor) — is well-positioned to serve the new health consumer seeking a convenient, streamlined experience. That is, as long as pharmacies continue to allocate strategic and smart investments in their digital programs (both online and virtual services). Note that CVS/health striked an agreement with three telehealth companies last year — American Well, Doctor on Demand and Teladoc — to provide more health”care” services to the pharmacy’s customers.

The New Front Door to both banking and healthcare is “everywhere.”

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...