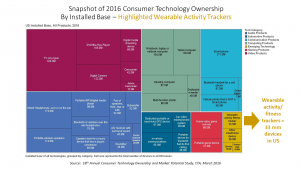

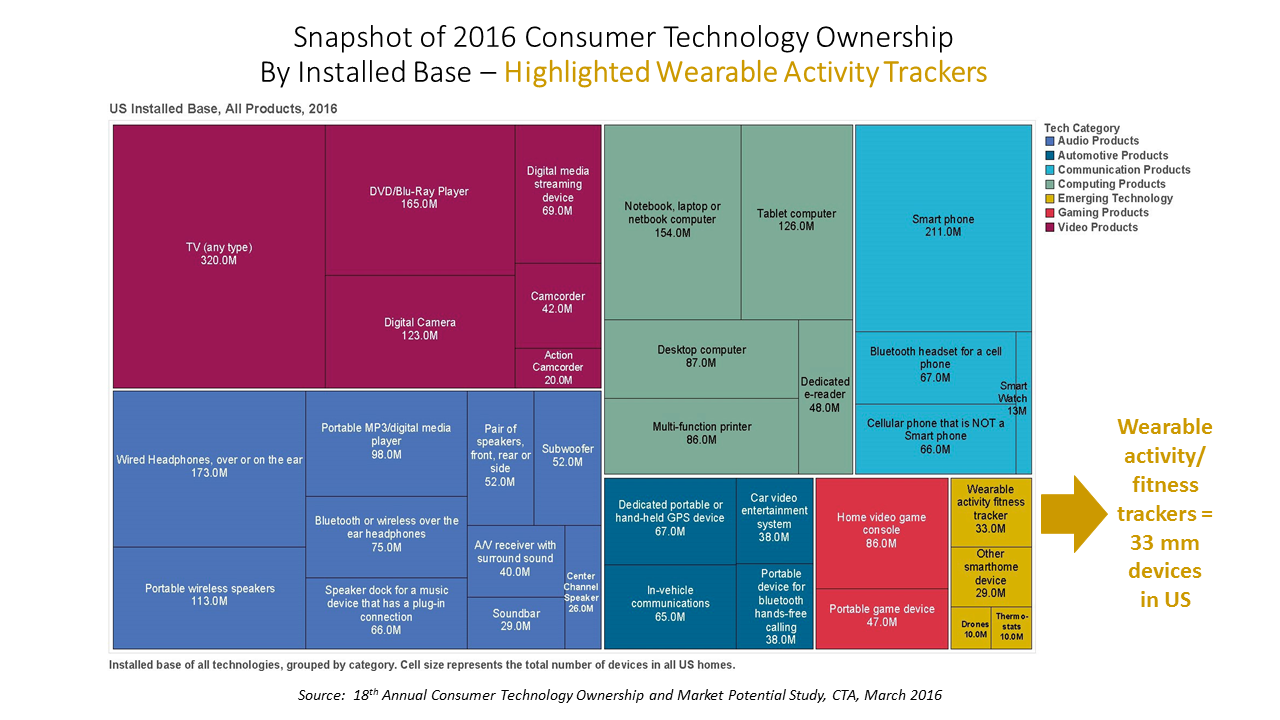

At the start of 2016, the current installed base of wearable activity tracking devices was just over 33 million in the U.S. This consumer market penetration is expected to grow by 11% in 2016, according to the Consumer Technology Association (CTA) forecast published in the 18th Annual Consumer Technology Ownership and Market Potential Study.

At the start of 2016, the current installed base of wearable activity tracking devices was just over 33 million in the U.S. This consumer market penetration is expected to grow by 11% in 2016, according to the Consumer Technology Association (CTA) forecast published in the 18th Annual Consumer Technology Ownership and Market Potential Study.

Wearable tech comprises a very small piece of the larger consumer technology market, led by TVs, smartphones, headphones (wired), DVD players, and notebook/laptop/netbook computers, the four largest rectangles in the graphic. However, there is growth momentum for emerging consumer tech segments such as portable wireless speakers, fitness trackers, and wireless/Bluetooth headphones.

Across all emerging consumer tech categories, wearable fitness trackers have the highest anticipated household purchase intent, at 11%, for 2016.

In contrast, smartwatches have an installed base of 13 million, with an 8% household purchase intent for 2016, CTA projects.

The installed base of wearable fitness trackers nearly doubled over the past year, with 20% of U.S. households owning a tracker as of March 2016. The average owner has 1.4 trackers (meaning that nearly 1 in every 2 wearable tracker owners has more than 1 device). 58% of those intending to purchase in 2016 will be first-time owners (defined as consumers who never owned a device).

CTA gauged that 55% of households “never intend to buy” a wearable fitness tracker, with the caveat that, “emerging technologies often show a high ‘never buy’ percentage among households, often due to lack of awareness or understanding of the product in question.”

Health Populi’s Hot Points: Two major market forces should fan demand and use of wearable activity trackers in the U.S.: the growth of value-based purchasing in a new financial era (highlighted in a new report from the StuderGroup); and, American patients’ enrollment in high-deductible health plans with financial risk shifting to patients, now a growing cadre of health consumers paying first-dollar out-of-pocket.

In the context of growing population health, where financial risks are increasingly borne by health care providers (doctors, hospitals, ACO and other risk-bearing organizations), there is an incentive for clinicians to “prescribe” or otherwise recommend the use of remote health monitoring and virtual health care. The simplest of these devices and processes is a wearable activity tracking device, which could be seen a useful for managing or preventing heart disease. The outcome for a patient recently admitted to an emergency room at Our Lady of Lourdes Medical Center (Camden, NJ) with irregular heart function was enhanced by the fact that he was wearing a Fitbit Charge; clinicians analyzed data streaming from the device over the hours previous to the admission, allowing them to positively diagnose the patient with atrial fibrillation.

Apple’s recently-launched CareKit hopes to address this market segment, bringing healthcare to consumers’ self-care lives.

Research conducted by the Society for Participatory Medicine found that consumers would more likely adopt and use wearable tech when recommended by a physician. Expect more of this kind of shared decision-making and collaboration for making health in and beyond 2016.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...