Large employers are taking more control over health care costs and quality by pressuring changes to how care is actually delivered, based on the results from the 2017 Health Plan Design Survey sponsored by the National Business Group on Health (NBGH).

Large employers are taking more control over health care costs and quality by pressuring changes to how care is actually delivered, based on the results from the 2017 Health Plan Design Survey sponsored by the National Business Group on Health (NBGH).

Health care cost increases will average 5% in 2017 based on planned design changes, according to the top-line of the study. The major cost drivers, illustrated in the wordle, will be specialty pharmacy (discussed in yesterday’s Health Populi), high cost patient claims, specific conditions (such as musculoskeletal/back pain), medical inflation, and inpatient care.

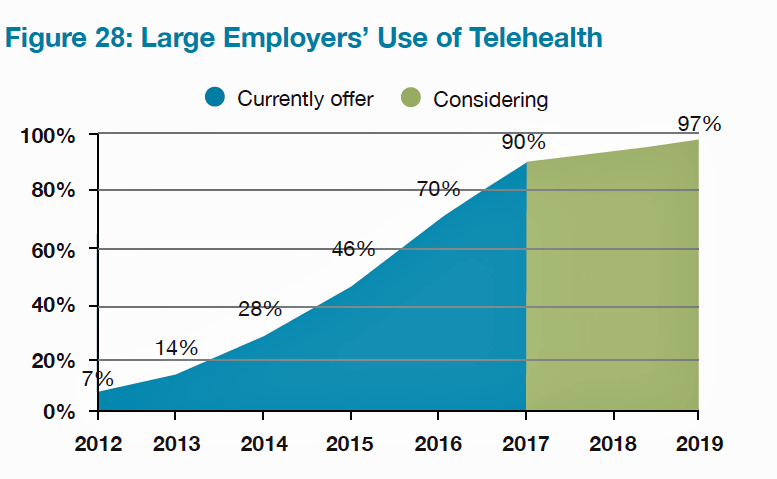

To temper these medical trend increases, large employers are looking to change the way health care is accessed and delivered through funding telehealth (for 90% of companies), providing price transparency tools (among 85% of companies), building and referring workers to Centers of Excellence (in 85% of firms, focused most on transplants, bariatric surgery, joint surgery, heart care, and cancers), and to a lesser extent, promoting accountable care organizations (among about one-fourth of employers).

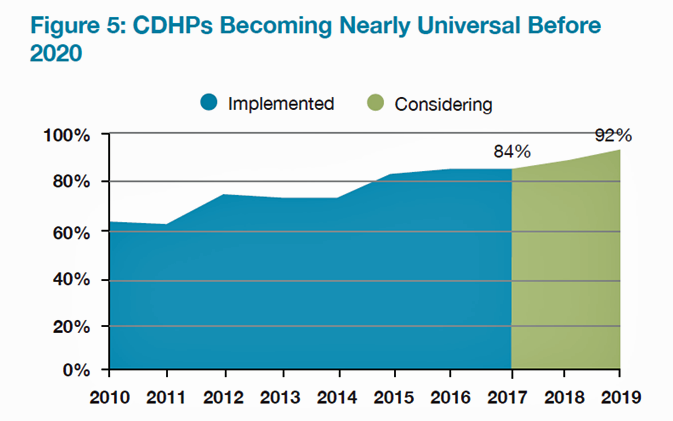

Consumer-directed health plans (CDHPs) will be a universal health insurance plan design by 2020, shown in the second chart. At least 84% of large employers will offer a CDHP option in 2017, and one-third will offer only a CDHP. Most high-deductible health plans in 2017 (92%) will be accompanied by a health savings account (HSA)

The median employee cost-sharing amount this year was a $1,600 deductible for employee (single) coverage in a CDHP, and in-network out-of-pocket maximum payments were $4,000. For families, the out-of-pocket max was $7,200 with a $3,200 deductible.

Telehealth is expected to be a universally-sponsored service among large employers by 2019, and most companies already use virtual care. One-third of large employers directly contract with telehealth vendors, according to NBGH’s survey. While most employers are offering telehealth services, in the first half of 2016, only 3% of employees had utilized this benefit.

Telehealth is expected to be a universally-sponsored service among large employers by 2019, and most companies already use virtual care. One-third of large employers directly contract with telehealth vendors, according to NBGH’s survey. While most employers are offering telehealth services, in the first half of 2016, only 3% of employees had utilized this benefit.

Looking to the future, employers are bolstering investments in mental and behavioral health, and in the financial wellbeing of their workforce. Influence physical well-being is a top-three priority among 85% of employers, followed by improvement employee engagement in healthcare decision making (that is, consumerism) for 65% of companies, emotional/mental wellbeing among 59%, and financial security and wellbeing for 58% of employers.

Health Populi’s Hot Points: Large employers are emboldened to drive changes in health care delivery — especially for virtual care via telehealth channels and narrowing networks for high-cost specialty care like transplantation and bariatric surgery via Centers of Excellence.

Health Populi’s Hot Points: Large employers are emboldened to drive changes in health care delivery — especially for virtual care via telehealth channels and narrowing networks for high-cost specialty care like transplantation and bariatric surgery via Centers of Excellence.

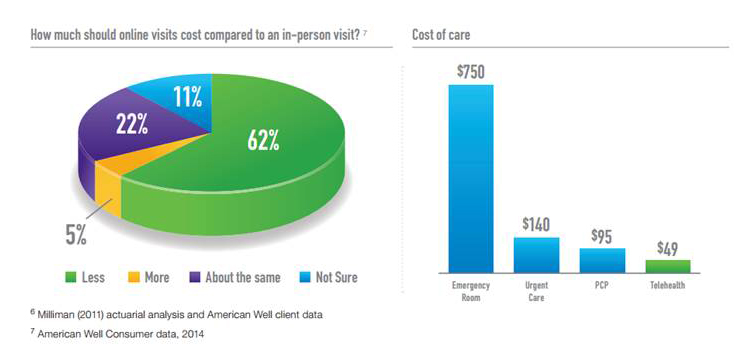

Most employers are also deploying at least one cost transparency tool to support employees’ healthcare consumerism and decision-making chops. However, only 3% of employees have used telehealth services that have been available in the first half of 2016; this is an important proxy for understanding just how “consumerist” employees are with respect to saving money in deductible spending. The consumer-patient’s cost difference between a virtual vs. in-person visit is significant: a telehealth visit with American Well is currently priced at a low of $49 compared with a face-to-face primary care visit for $95, urgent care for $140, or emergency department admission for $750.

NBGH identifies employer tools and programs more companies are offering in 2017, including nurse coaching for care condition management, disease management, lifestyle management, self-service decision support tools, price transparency tools (fast-growing in 2017), and medical decision support/second opinion services. Large employers clearly understand the importance of these tools to support their mass adoption of high-deductible health plans. There’s no consumer-direction without such programs, and less optimal ROI on employers’ significant investments in health insurance without them.

This week’s announcement of Accolade receiving a $70 million investment to further scale the company’s healthcare concierge services is an example of the market’s recognition of the importance of these employer-sponsored programs. This is health reform, playing out in the private sector.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...