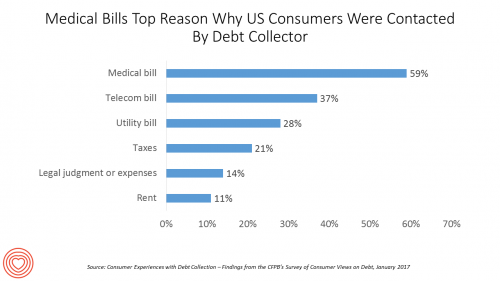

The top reason US consumers hear from a debt collector is due to medical bills, for 6 in 10 people in Americans contacted regarding a collection. This month, the Consumer Financial Protection Bureau (CFPB) published its report on Consumer Experiences with Debt Collection.

Medical bill collections are the most common debt for which consumers are contacted by collectors, followed by phone bills, utility bills, and tax bills.

The prevalence of past-due medical debt is unique compared with these other types because healthcare cost problems impact consumers at low, middle, and high incomes alike. Specifically:

- 62% of consumers earning $20,000 to $39,000 annual household income a year have medical debt

- 58% of consumers earning $40,000 to $69,999 a year have medical debt

- 54% of households with at least $70,000 income a year have past-due medical bills.

Other forms of past-due bills hit younger people harder, and people with lower incomes under $40,000 a year.

The study’s other key findings were that:

- 1 in 3 consumers with a credit record had been contacted by at least one creditor to collect at least one debt in the past year.

- Past-due medical bills, credit cards, and student loans were among the most frequently cited debts about which people were contacted.

- Consumers take a more favorable view of creditors seeking to collect debt versus debt collectors taking on the task.

The CFPB surveyed consumers’ experiences with debt collection, and the survey sample was derived from credit records maintained by one of the top three nationwide credit repositories. The total survey sample included 2,132 respondents.

Loan types considered in the study included car loans, student loans, and past-due bills such as a doctor’s bill or phone bill. Collectors were both the original creditor or a collector contracted to collect the debt on behalf of the creditor.

The CFPB was created as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010, consolidating most Federal consumer financial protection authority in one place. The goal of the Bureau is to protect American consumers in the market for consumer financial products and services.

Health Populi’s Hot Points: The challenge of medical debt has been an American healthcare disparity for over ten years, when an analysis of the problem was published in Health Affairs called, Bankruptcy Is The Tip Of A Medical-Debt Iceberg.

This was published in 2006, when the authors talked about medical debt being “surprisingly common.” Then, medical debt was more concentrated among people who lacked health insurance.

Today, medical bills can take a toll on people and families who have health insurance coverage due to meeting annual high-deductibles that can cost more than the savings accrued in peoples’ bank accounts.

One way for people to manage the risk of medical debt is to avoid health care services altogether: a Physicians Foundation survey published in May 2016 found that one in four patients avoided care because of the difficulty in paying for the treatment. 27% of patients skipped filling prescriptions due to cost.

Overall, two-thirds of consumers were concerned about paying a medical bill, Physicians Foundation learned.

The implications for self-rationing health care due to cost are expensive: a study from the American College of Emergency Physicians learned that one in four patients who forgo medical care due to cost saw their conditions deteriorate over time.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...