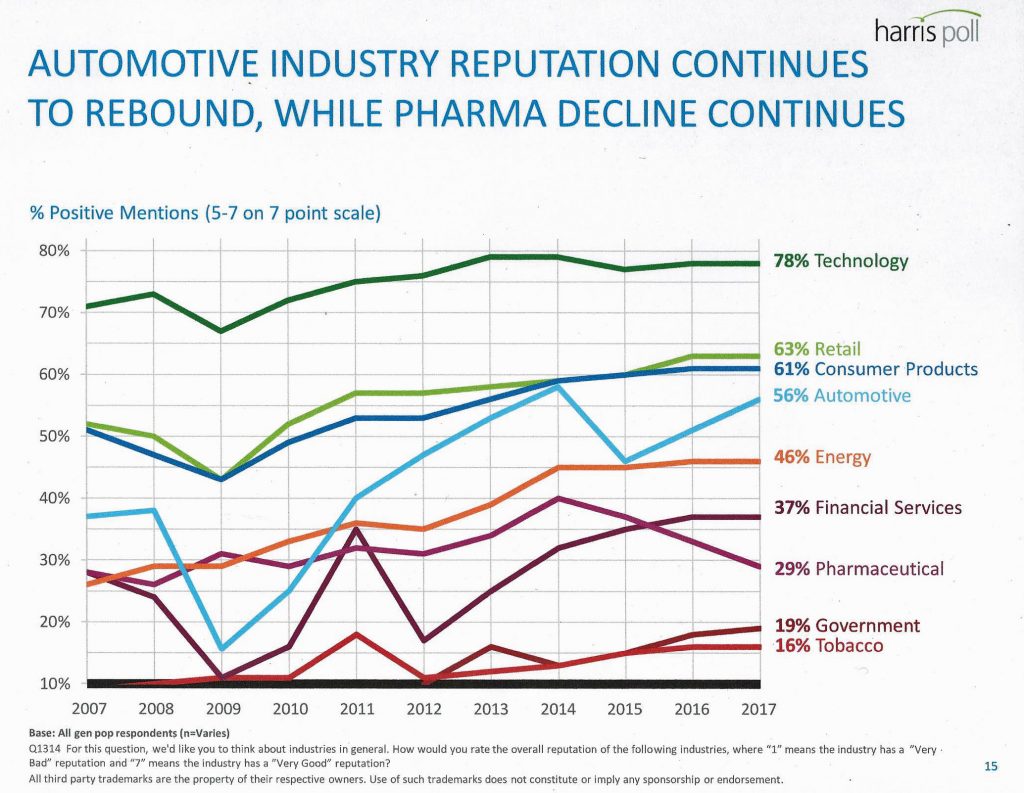

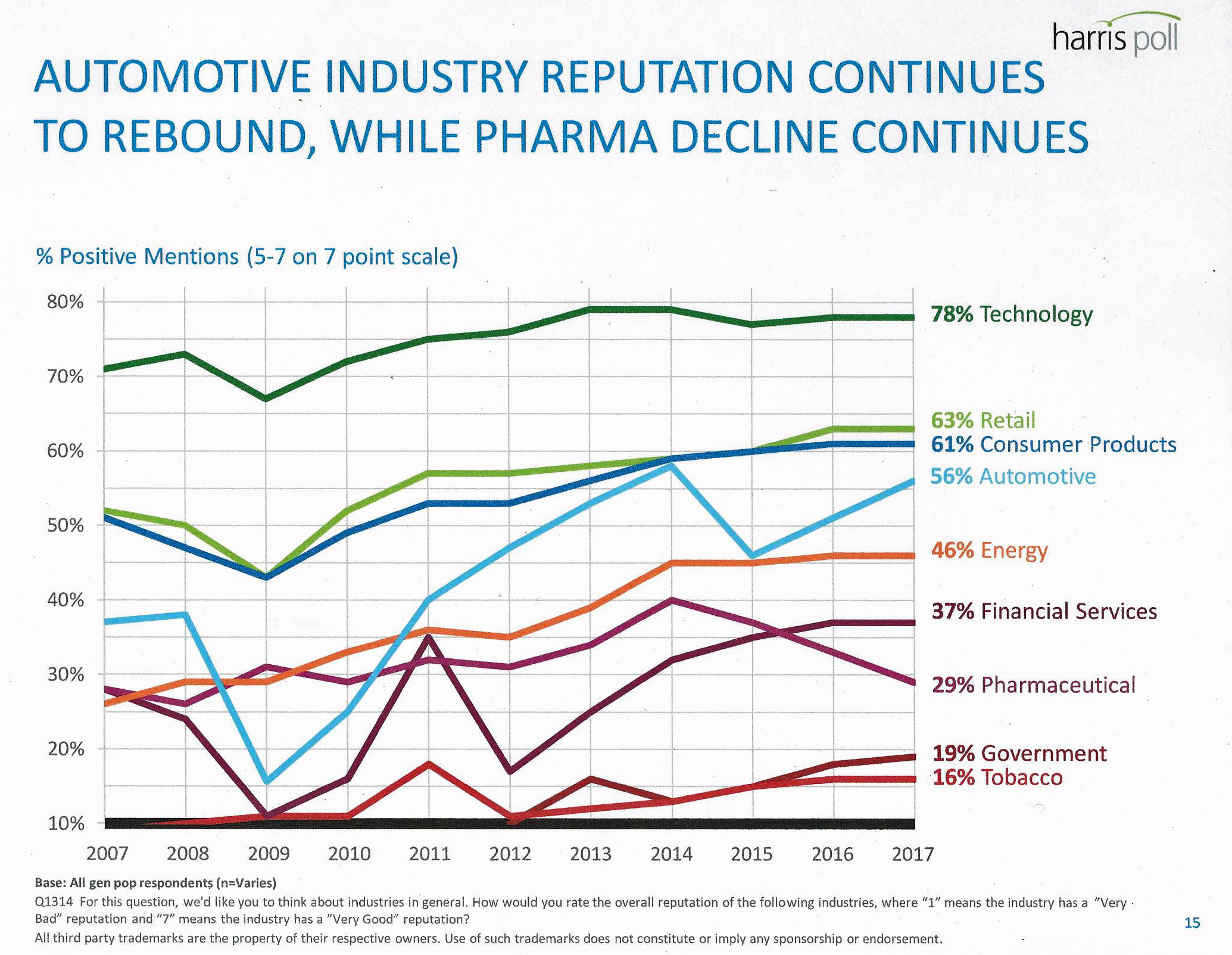

U.S. consumers love technology, retail, and consumer products; automotive company reputations are improving, even with Volkswagen’s emission scandal potentially tarnishing the industry segment.

The only corporate sector whose reputation fell in 2016 was the pharmaceutical industry’s, according to the Harris Poll’s 2017 Reputation Quotient report.

The line chart illustrates the decline of pharma’s reputation, which puts it on par with its consumer perceptions in 2010 — just before Medicare Part D was legislated and implemented, which improved pharma’s image among American health citizens (especially older patients who tend to be more frequent consumers of prescription drugs).

Pharma’s reputation quotient is back in the bottom tier with Big Tobacco and Government, and below Financial Services which had its own PR challenges with the Wells Fargo fake accounts scandal in 2016.

The top 10 companies by reputation for 2017 were:

- Amazon.com

- Wegmans

- Publix

- Johnson & Johnson

- Apple

- UPS

- The Walt Disney Company

- Tesla Motors, and

- 3M Company.

Harris Poll has conducted the Reputation Quotient study annually since 1999. The “RQ” is based on consumers’ perceptions of companies and industries across 20 attributes along six dimensions including social responsibility, vision and leadership, financial performance, products and services, emotional appeal, and workplace environment.

Some interesting observations about the top-performing companies by reputation are that:

- UPS entered the top 10 for the first-time ever, building on its connection to e-commerce (namely, #1 Amazon.com)

- Wegmans and Publix, two grocers, are top in the study, leveraging intimate connections with consumers in the marketplace as engaged community stakeholders, Harris Poll believes

- Amazon earned an “excellent” reputation for the seventh year in a row, essentially crossing a broad range of sectors from grocery to personal care and media.

![]() Health Populi’s Hot Points: Consumers are being asked, by health plans, prescription benefit management companies, and the pharmaceutical industry to reach into family pocketbooks to pay for higher-cost specialty drugs in this growing era of high-deductible health plans. [For insights into the rise-and-rise of specialty drug prices, see my post here on the issue].

Health Populi’s Hot Points: Consumers are being asked, by health plans, prescription benefit management companies, and the pharmaceutical industry to reach into family pocketbooks to pay for higher-cost specialty drugs in this growing era of high-deductible health plans. [For insights into the rise-and-rise of specialty drug prices, see my post here on the issue].

Yesterday ushered in a new drug called Dupixent from Regeneron and Sanofi to treat chronic eczema; the initial price of $37,000 for an annual course of treatment may be “fluid,” according to Regeneron’s press release. Here is the New York Times coverage on the $37K pricing strategy.

Consumers are looking for more regulation by government on pharma companies’ pricing policies, based on a survey from Kaiser Family Foundation conducted in September 2016 (results shown here).

8 in 10 Americans favor allowing the Federal government to negotiate with drug companies to get a lower price on medicines for people enrolled in Medicare. In addition, 8 in 10 people also would like to see limits on the amount drug companies charge for high-cost drugs for diseases like Hepatitis C and cancer.

Support for drug price regulation garners bipartisan interest, with a majority of Democrats, Independents and Republicans supporting these policies. [This survey was conducted in September 2016 among 1,204 U.S. adults via landline and cellphone.]

Postscript 30 March 2017 – Axios published a report that President Trump has chatted with Rep. Elijah Cummings at least three times to discuss an approach to dealing with drug prices. The bottom-line in the article: “He understands the policy, he gets it,” Cummings said. (Democrats introduced a new bill with those policies and others.)

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...