While trust in major institutions is eroding the world over, peoples’ trust in healthcare is on the rise, according to the 2017 Edelman Trust Barometer. Still, compared to other industry sectors, healthcare is still barely positive — and just one spot ahead of financial services.

While trust in major institutions is eroding the world over, peoples’ trust in healthcare is on the rise, according to the 2017 Edelman Trust Barometer. Still, compared to other industry sectors, healthcare is still barely positive — and just one spot ahead of financial services.

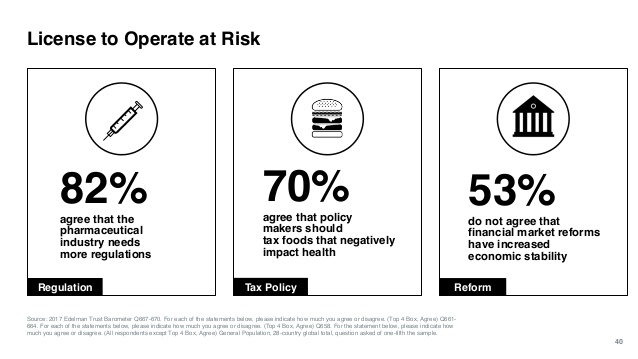

When it comes to trust, “the healthcare industry is making slow but steady progress,” notes Kym White who leads Edelman’s healthcare practices. Consumers’ trust in the five healthcare segments of pharmaceutical/drug companies, consumer health/over the counter, biotech/life sciences, insurance and hospitals/clinics is improving over 2016. In the U.S., for pharma and biotech, trust is reversing a backwards trend seen in 2016, according to White’s observations in Trust in Healthcare: Making Progress.

Despite slow gains in trust, pharma, consumer health and health insurance sit in consumers’ “neutral” versus “trusted” perceptions. “Pharma may be up four points in the U.S., but that gives it a score of just 51, squeaking into the ‘neutral’ range by only one point,” White recognized.

Despite slow gains in trust, pharma, consumer health and health insurance sit in consumers’ “neutral” versus “trusted” perceptions. “Pharma may be up four points in the U.S., but that gives it a score of just 51, squeaking into the ‘neutral’ range by only one point,” White recognized.

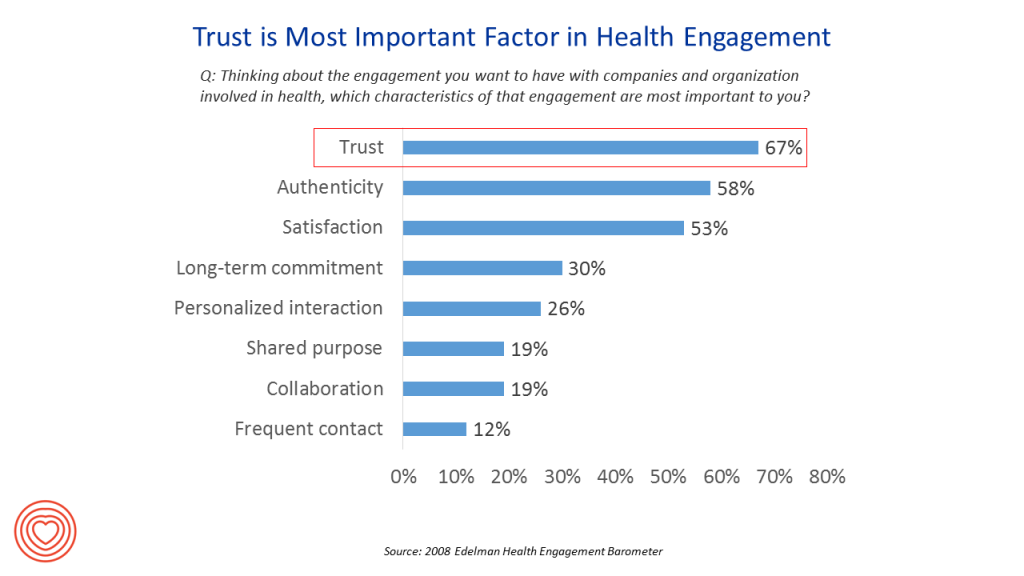

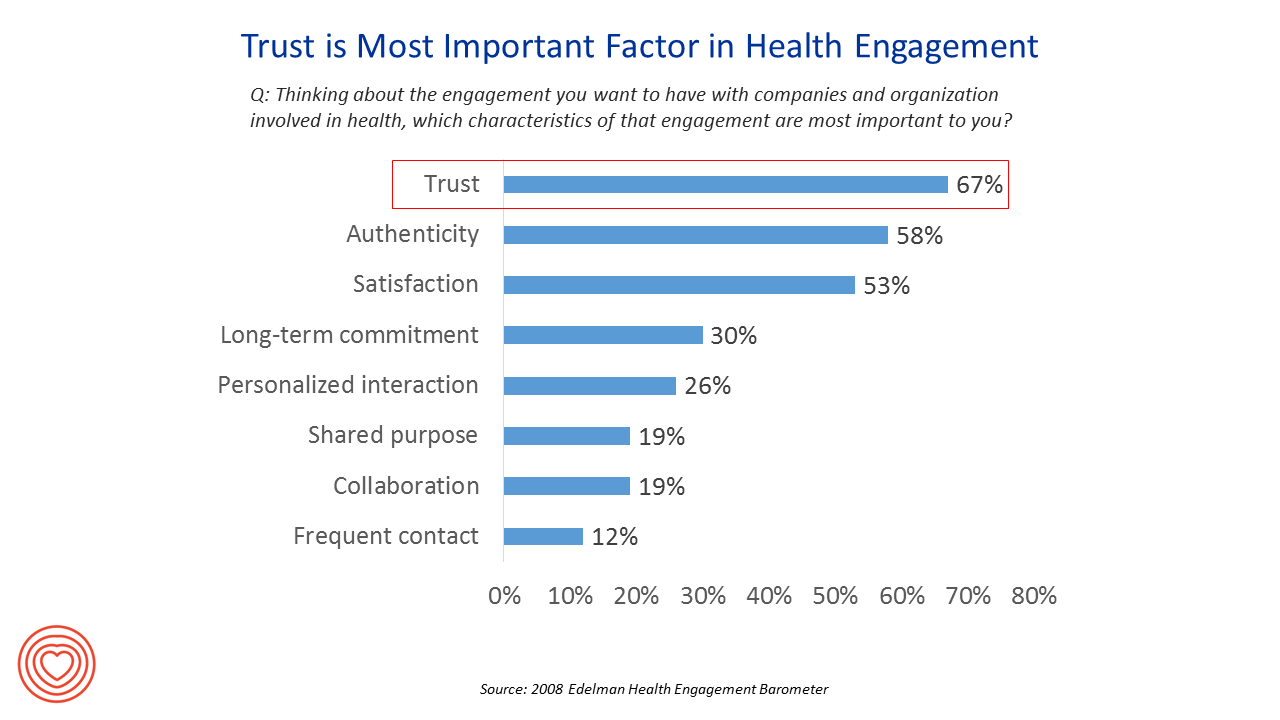

Trust underpins consumers’ engagement in health, the 2008 Edelman Health Engagement Barometer found, shown in the bar chart.

Making the case for enhanced consumer engagement in healthcare, Clarity Insights looked at Personalizing the Health Management Experience in a recent white paper and observed that, “Two-thirds of consumers are more likely to trust and engage with brands that allow them to customize and share personalization and contact preferences.” Customized services that can build that trust include relevant health education, preventive care, convenient self-service, and informed decision-making that can support (desired) personal behavior change.

As patients continue to morph into health consumers with greater financial skin in the payment game, transparency strengthens trust, Change Healthcare’s work on the future of innovative healthcare shopping notes. “By acting as a guide for members, health plan providers facilitate trust-building transparency,” Change Healthcare believes. Savings and simple, user-friendly tools that help consumers clearly understand accurate costs is a top-demand that, when supplied, helps people gain trust with healthcare stakeholders.

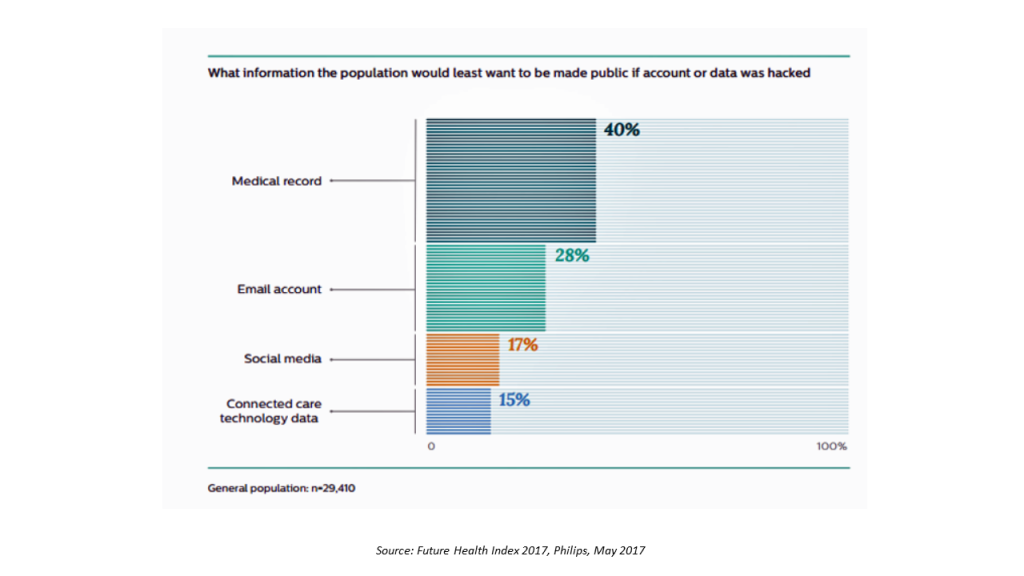

Finally, another key aspect of trust for health consumers is believing that healthcare providers are ethical data stewards of personal health information (PHI) — that is, that doctors and hospitals keep PHI secure and private with sound practices for managing hacking risks. The Philips Future Health Index 2017, published earlier this month, found that 55% of global health consumers say their personal health data is the most important to keep out of the public eye, compared with e-mails, information on social media accounts, and even connected care technology data (e.g., blood pressure, blood glucose readings). On the upside, 44% of consumers trust the healthcare industry the most with their data, versus 35% of people who trust banking, 20% the insurance industry, and only 5% for retailers. It’s important to note that the level of trust for healthcare providers with personal health data is highest among countries with the greatest connected-health penetration, such as in Singapore (51%) and Sweden (55%), compared with the U.S. (39%).

Finally, another key aspect of trust for health consumers is believing that healthcare providers are ethical data stewards of personal health information (PHI) — that is, that doctors and hospitals keep PHI secure and private with sound practices for managing hacking risks. The Philips Future Health Index 2017, published earlier this month, found that 55% of global health consumers say their personal health data is the most important to keep out of the public eye, compared with e-mails, information on social media accounts, and even connected care technology data (e.g., blood pressure, blood glucose readings). On the upside, 44% of consumers trust the healthcare industry the most with their data, versus 35% of people who trust banking, 20% the insurance industry, and only 5% for retailers. It’s important to note that the level of trust for healthcare providers with personal health data is highest among countries with the greatest connected-health penetration, such as in Singapore (51%) and Sweden (55%), compared with the U.S. (39%).

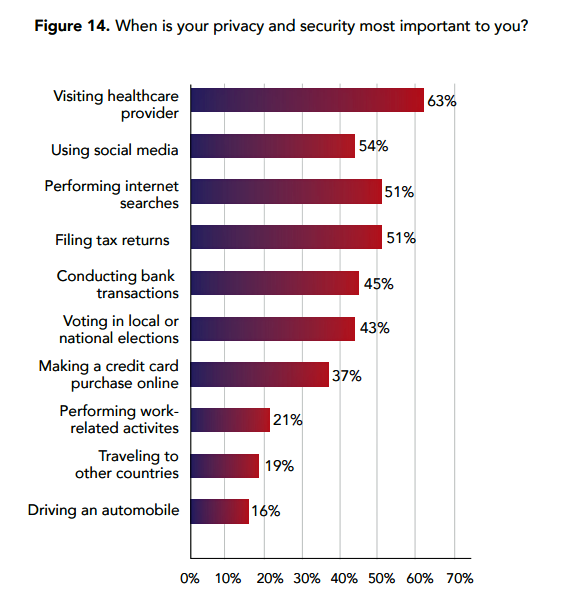

Consumers say that their information privacy and security is most important when visiting a healthcare provider, versus using social media, searching the internet, filing taxes, conducting bank transactions, or voting. This important finding comes from a study from Centrify and Ponemon Institute on the impact of data breaches on reputation and share value, noting that big data breaches at Anthem, Premera Blue Cross, and Banner Health have shaped health consumers’ pragmatic views on personal health data. Healthcare information breaches comprised 34% of all data breaches last year, the report said.

Consumers say that their information privacy and security is most important when visiting a healthcare provider, versus using social media, searching the internet, filing taxes, conducting bank transactions, or voting. This important finding comes from a study from Centrify and Ponemon Institute on the impact of data breaches on reputation and share value, noting that big data breaches at Anthem, Premera Blue Cross, and Banner Health have shaped health consumers’ pragmatic views on personal health data. Healthcare information breaches comprised 34% of all data breaches last year, the report said.

Health Populi’s Hot Points: Two key themes emerge from these new research findings via Change Healthcare, Clarity Insights, Edelman and Philips: first, people need tools and navigation to help manage consumer demands; and second, transparency and trust in personal health data along with clarity on personal healthcare cost burdens stewardship are part of the new healthcare trust equation. Healthcare providers, plans, payors, and suppliers (notably, pharma, as called out by the Edelman Trust research) must design trust into healthcare consumer journeys along the value chain, from research and “shopping” through to use of a product or service and “after-market” care.

Scouting Health, a program of the Robert Wood Johnson Foundation, is exploring how providers can continue to inspire and build trust with patients. In addition to trust, the project is also investigating how clinicians engage on health care costs, supporting caregivers, and integrating health care across peoples’ community touch points. I’d argue that these latter three areas will also be trust-builders between the healthcare system and health consumers.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...