9 in 10 hospitals and health systems prioritize improving the consumer/patient experience, but only 30% of providers are building these capabilities. This consumer experience gap was found by Kaufman Hall in their survey research published in the report, 2017 State of Consumerism in Healthcare: Slow Progress in Fast Times.

Digital health innovations will play big roles in supporting that consumer health experience for most health providers: 58% prioritize offering digital tool and information for consumer engagement, and 56% of providers look to develop a range of virtual/telehealth access points.

But it appears that while healthcare providers’ spirits are willing, their flesh (that is, actions) are weak.

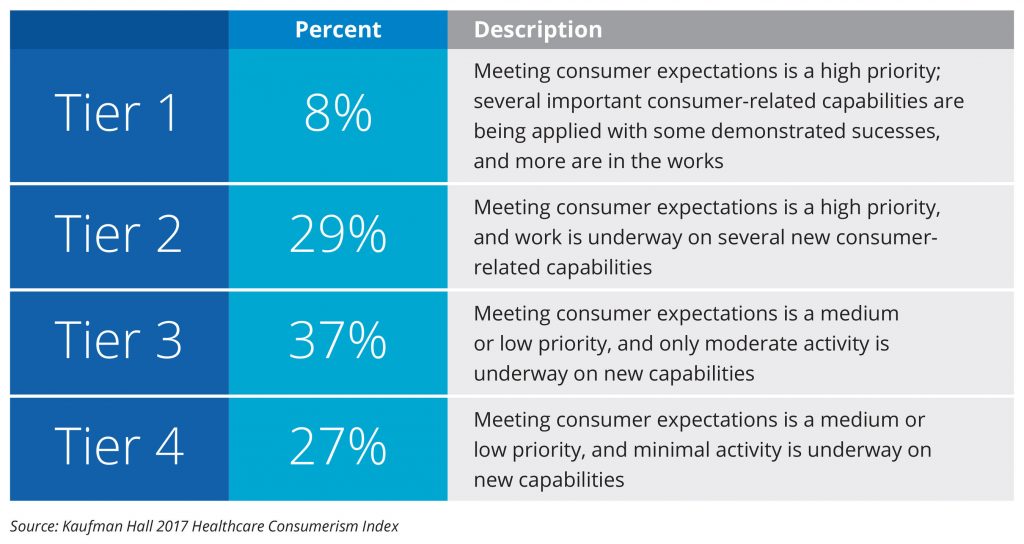

The four-tiered chart quantifies this: only 8% of healthcare providers make meeting consumer expectations a high priority, implementing consumer-facing programs. The plurality of providers sit at the third tier, with only “moderate” activity focused on healthcare consumers.

“Consumer access is a work in progress,” Kaufman Hall concludes. Organizations have a narrow view of consumer experience, largely disconnected from providers’ overall strategy and mission.

These results are based on Kaufman Hall’s 2017 Healthcare Consumerism Survey, conducted among over 125 hospital and health system organizations. The Indexing by tier is based on four factors: ability to develop consumer insights from various methods; enhancing access to care through different “front doors” beyond the doctor’s office or hospital ER, like retail clinics and SMS texting; addressing consumer experience, such as reducing wait times and improving websites’ UX; and, furthering price transparency and other price-related analyses.

Health Populi’s Hot Points: Health systems are out-of-sync with consumers, Kaufman Hall says, when it comes to peoples’ expectations for convenience, access, and pricing.

Take non-traditional access points, such as retail clinics, urgent care centers, freestanding imaging centers, and virtual visits. The most available of these four alternative care sites is urgent care, provided by about one-half of healthcare systems. Other lower-cost, more convenient locales are served up by less than one-third of providers.

Two-thirds of providers currently offer online patient portals — surprisingly low because every hospital should have an EHR implemented, with a bundled portal to enable patients’ access to their personal health information (even if poorly designed). Virtual visits are offered by only 27% of providers, and messaging between patients and providers by 43%.

Given the growth of patients bearing more out-of-pocket costs and first-dollar spending under high-deductible health plans, it’s also disappointing to see low activity on the pricing front: 72% of providers lag in Tier 4, the lowest level on the Index. Underneath this statistic, note that 59% of health systems respond via phone to price quote requests “within a defined period of time;” 22% list prices on websites; 20% offer an online price estimation tool; and 18% aren’t offering price transparency help in any way.

We’ve been scenario planning about the evolving landscape for consumer-facing retail health for several years. The Kaufman Hall survey bolsters our forecasts for continued growth of health care options for engaged and activated health consumers seeking accessible care outside of the legacy healthcare system.

Remember, healthcare providers: health consumers are Amazon Primed these days.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.