March 8 is International Women’s Day. In the U.S., there remain significant disparities between men and women, in particular related to financial well-being.

March 8 is International Women’s Day. In the U.S., there remain significant disparities between men and women, in particular related to financial well-being.

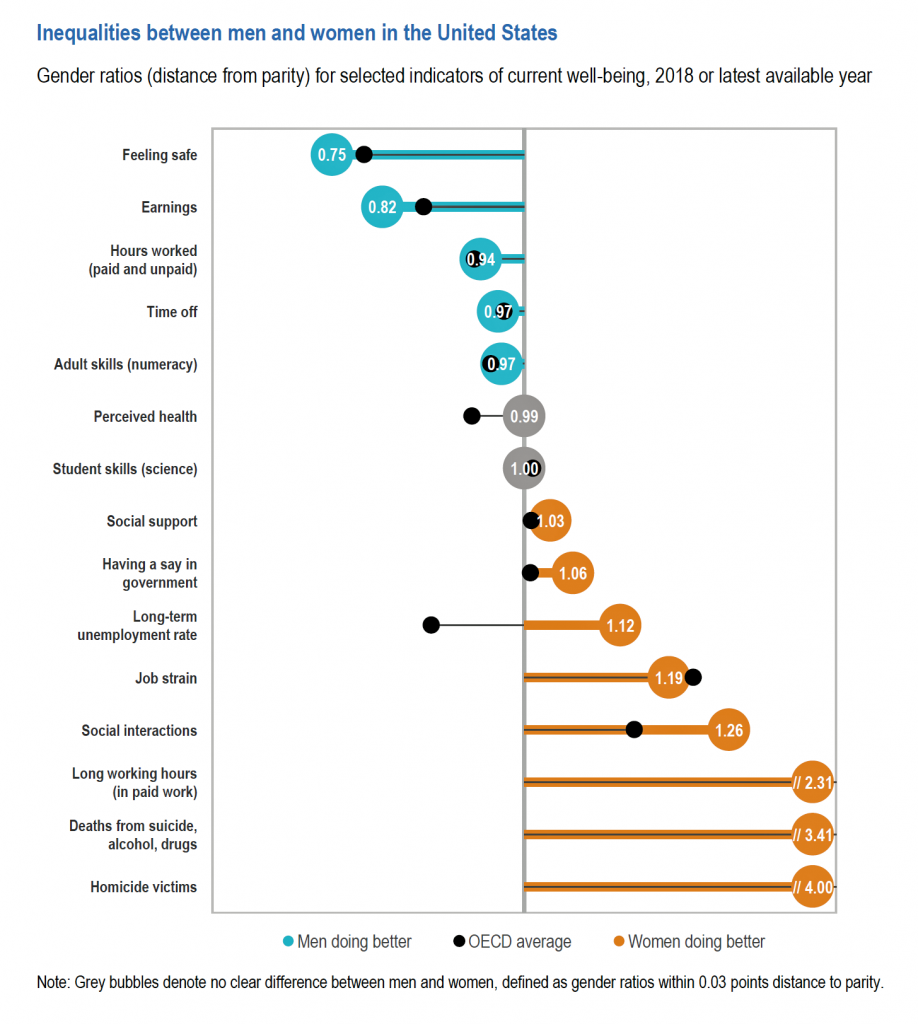

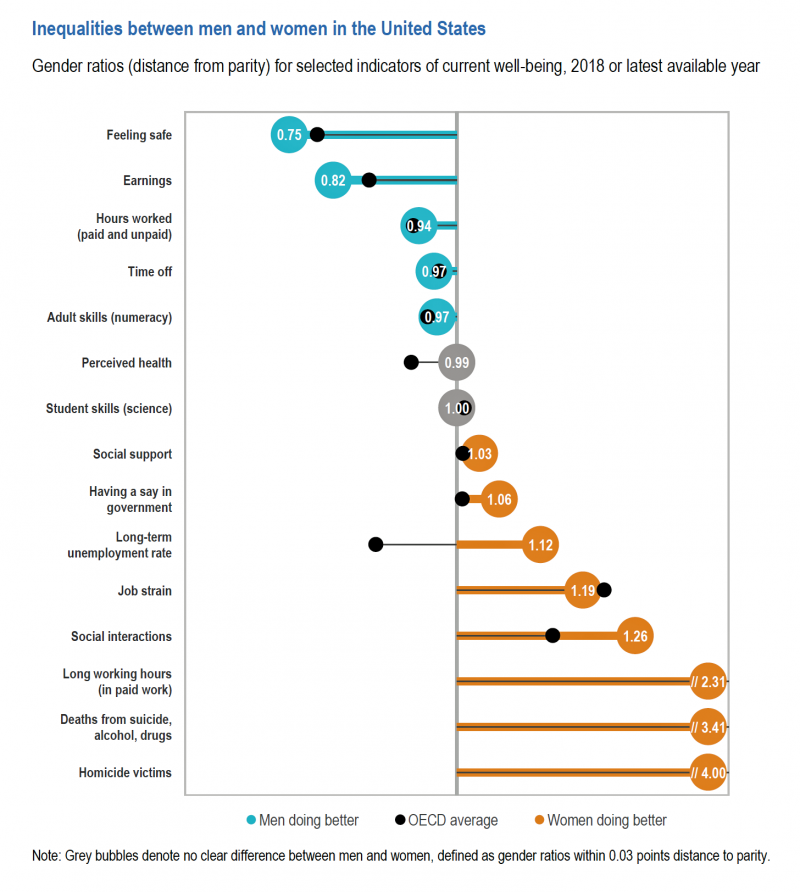

The first chart comes from the new OECD “How’s Life?” report published today (March 9th) measuring well-being around the country members of the OECD. This chart focuses on women versus men in the United States based on over a dozen key indicators.

Top-line, many fewer women feel safe in America, and earnings in dollars and hours worked fall short of men’s incomes.

This translates into lower socioeconomic status for women, which diminishes overall health and well-being for women in America.

Health is wealth and wealth, health, for people living in the U.S.

Globally, women’s financial security is a concern — which starts in youth and continues through her life cycle. In the U.S., only 25% of women workers believe they’re on track to achieve their retirement income needs, based on research reported in The New Social Contract: Achieving retirement equality for women from the Transamerica Center fo r Retirement Studies.

r Retirement Studies.

What underlies the fact that American women’s financial health ranks below that of men’s? It’s the cascading, time-compounding impact of women receiving lower wages in their lifetime, coupled with the fact that women have also spent more on health care and for certain consumer goods.

The latter has been referred to as a “pink tax,” where similar products consumed by men and women have historically. Been charged differential higher prices (think: a pink shaving razor or women-branded deodorant). The good news is for CPG, some companies such as Boxed are “rethinking pink,” explained by the company here — with the goal of eliminating pricing-bias due to gender differentiation in products.

The former issue of higher health care costs was begun to be addressed by the Affordable Care Act, which embedded many preventive health care services for women into the law’s list of essential medical care.

“Women’s workforce participation and access to career opportunities have soared in recent decades,” asserted Catherine Collinson, CEO and president the Transamerica Institute. “However, the gender pay gap persists. Combined with women taking time out of the workforce for parenting and caregiving, it undermines their ability to achieve a financially secure retirement and increases the risk of living i n poverty.”

n poverty.”

The bar chart clearly speaks to the issue of lower wages setting the stage for women to save less. Once this sets in motion at the beginning of a young woman’s career, she can’t benefit as much from riding the time-value of money over years of saving.

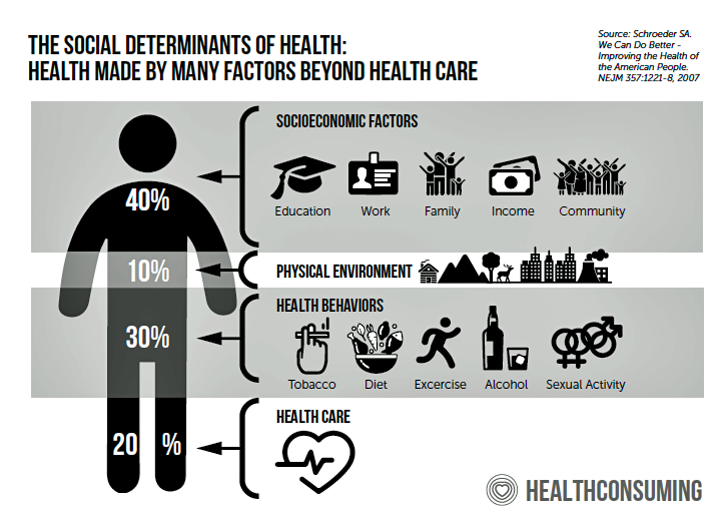

Health Populi’s Hot Points: In the world of social determinants of health, it’s our socio-economic status (SES) that portends our overall health and well-being. One’s SES is baked with education, a good job (especially with health benefits), access to healthy food, and other ingredients that bolster our financial health. For women as they more often than men play the role of Chief Household Officer — for home-making, -keeping, and childrearing — these factors play heavily into women’s socio-economic status and health care inequity.

Now consider “Jane’s” story here:

For more insights into finance and women, visit BMOforWomen.com.

In conclusion, I’ll point to two more current terrific campaigns that speak to women’s empowerment, one with some mirth and one that’s incredibly practical.

First, Orangetheory disses the 23-hour International Women’s Day day due to daylight savings time timing…cutting the day “short” by one hour, from 24 to 23 hours.

Second, the point about women’s wages is, well, the major point with this #AskForARaise project. This chatbot campaign makes the case via three rather different messages.

This project garnered many Cannes Lion awards and mentions for social impact, creative, etc.

Pick the one you like best. I know what I have in mind, learning from the OECD findings.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...