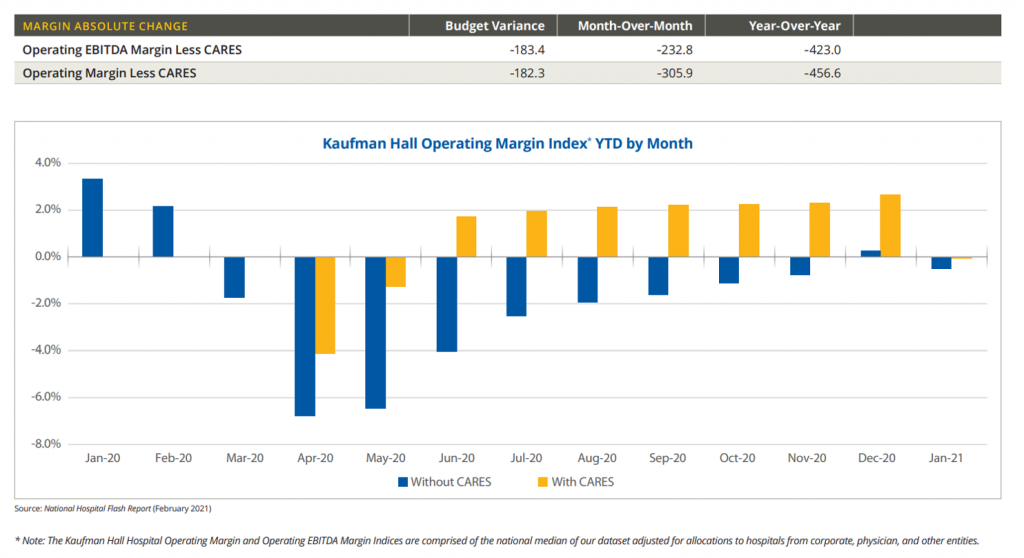

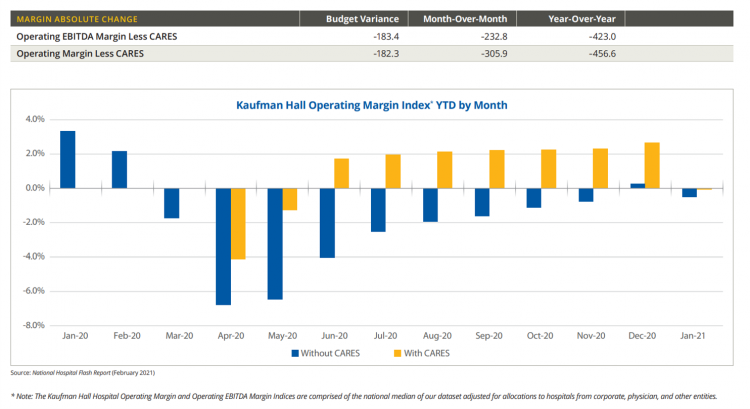

U.S. hospitals’ operating margins went negative in January 2021 after turning north for the first time in December 2020 since the start of the coronavirus pandemic, according to the February 2021 Hospital Flash Report from Kaufman Hall, commissioned by AHA, the American Hospitals Association.

U.S. hospitals’ operating margins went negative in January 2021 after turning north for the first time in December 2020 since the start of the coronavirus pandemic, according to the February 2021 Hospital Flash Report from Kaufman Hall, commissioned by AHA, the American Hospitals Association.

The first chart illustrates the importance of CARES Act funding to keep hospitals financially afloat during the public health crisis through most of last year.

The start of 2021 was difficult for hospitals and health systems, Kaufman Hall explains, with falling outpatient revenues and increasing expenses resulting in that below-the-line blue bar for January 2021’s operating margins.

Simply put, the arithmetic for most hospitals that still get paid via fee-for-service (FFS) is that Revenue = (Volume x Unit Price) Less Expenses.

Simply put, the arithmetic for most hospitals that still get paid via fee-for-service (FFS) is that Revenue = (Volume x Unit Price) Less Expenses.

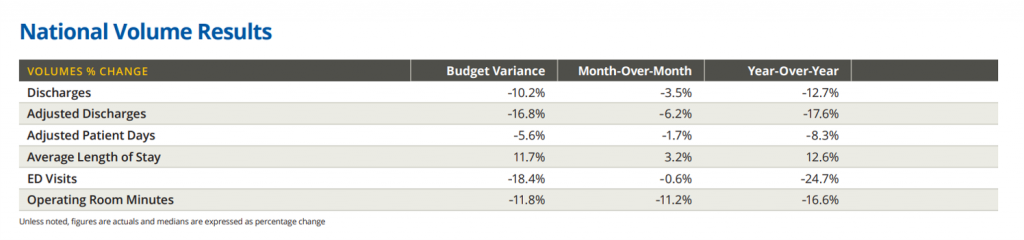

Beginning with volume, or utilization, the second table shows that hospital discharges fell by nearly 13% year-over-year in January 2021, emergency department visits dropped nearly 25%, and operating room minutes, 17%.

The resulting revenue results among U.S. hospitals were that gross operating revenues fell nearly 5% year-on-year, with inpatient revenue fairly flat at 1.3% growth and outpatient revenue declining over 10%.

The resulting revenue results among U.S. hospitals were that gross operating revenues fell nearly 5% year-on-year, with inpatient revenue fairly flat at 1.3% growth and outpatient revenue declining over 10%.

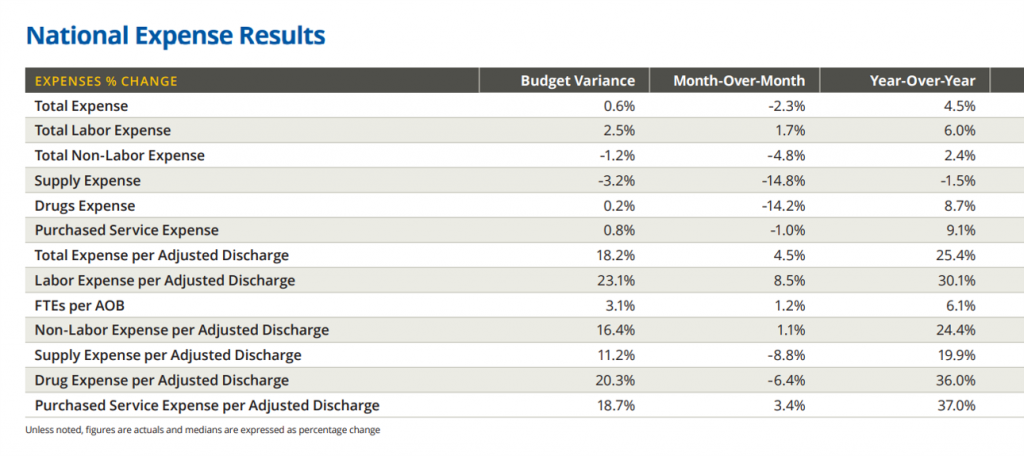

A major contributor to hospitals’ fiscal declines came via expenses rising double-digits per discharge: 25.4% for total expenses, and 30% for labor expense per adjusted discharge.

Non-labor expense per discharge rose 24%, supplies by nearly 20%, and drug expense per adjusted discharge, 36%.

“The January performance results reflect the continued burden on U.S. hospitals and health systems, and emphasize the importance of remaining vigilant in combating the virus and moving these vital institutions toward recovery,” Kaufman Hall warns.

The Flash Report samples data from over 900 U.S. hospitals representing a cross-section of all hospitals geographically and by bed size, as well as by teaching status and critical access.

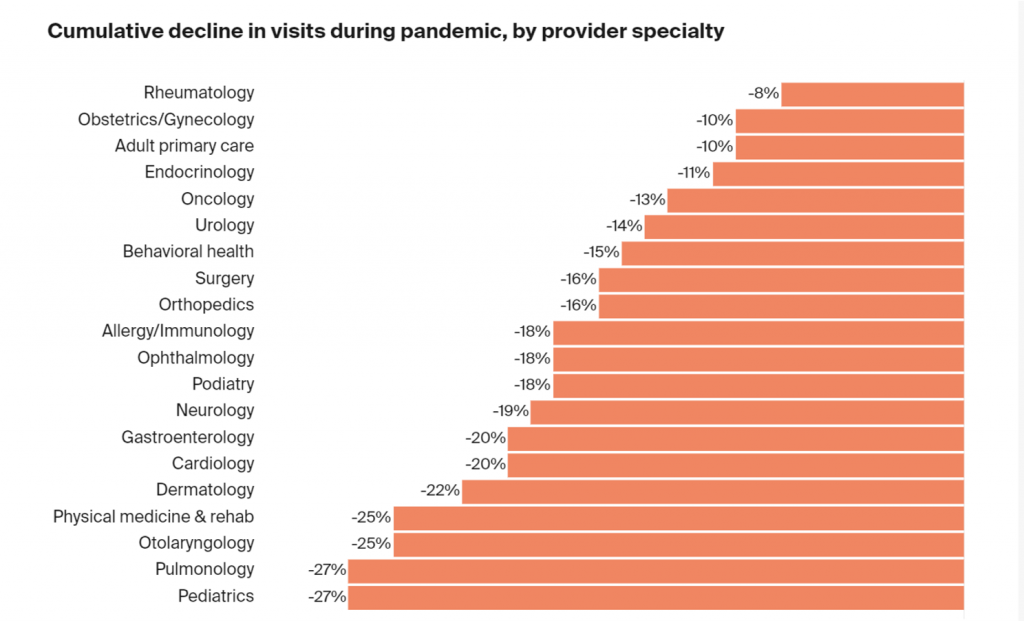

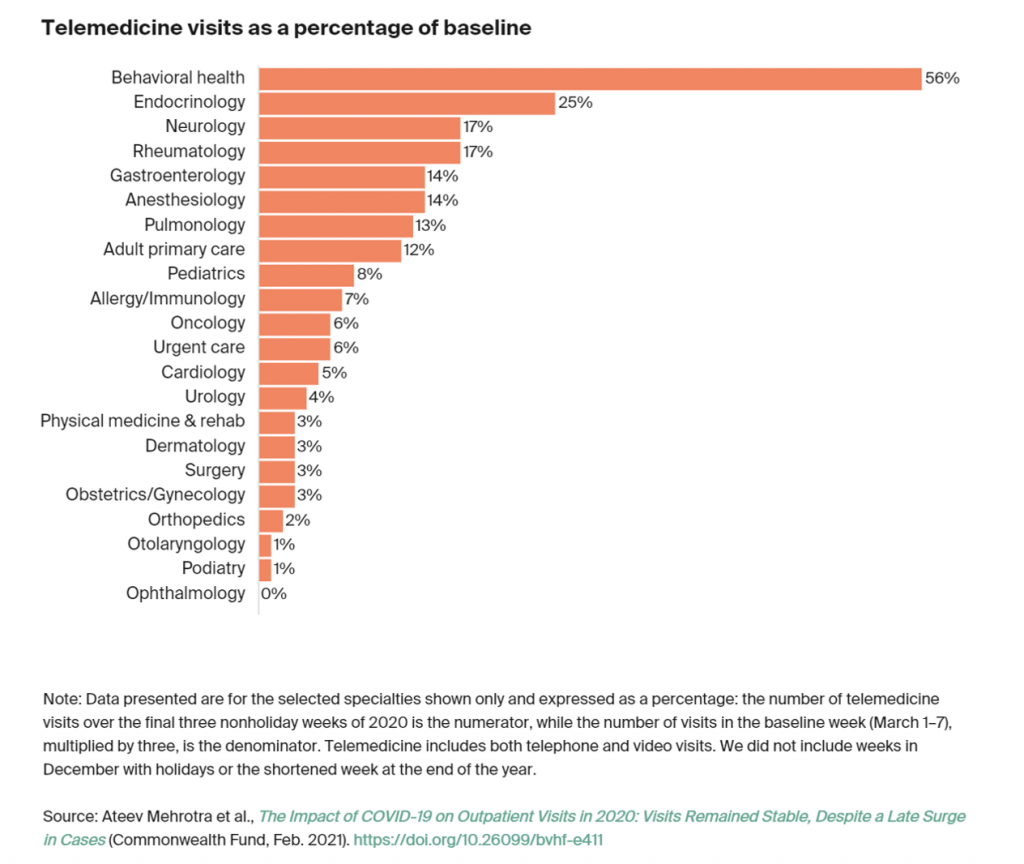

Health Populi’s Hot Points: Data from the Commonwealth Fund, published this week, looks at the state of outpatient visits in the U.S. during the pandemic. This chart from the study shows certain specialties took especially large volume hits during the pandemic, most notably pediatrics and pulmonology with a decline of 27% of visits, physical medicine/rehabilitation and otolaryngology losing 25% of visits, cardiology and gastroenterology with a fall of 20% of visits for each specialty, and others losing in the teens percentage-wise.

Health Populi’s Hot Points: Data from the Commonwealth Fund, published this week, looks at the state of outpatient visits in the U.S. during the pandemic. This chart from the study shows certain specialties took especially large volume hits during the pandemic, most notably pediatrics and pulmonology with a decline of 27% of visits, physical medicine/rehabilitation and otolaryngology losing 25% of visits, cardiology and gastroenterology with a fall of 20% of visits for each specialty, and others losing in the teens percentage-wise.

The Commonwealth Fund has been tracking outpatient care volumes during the pandemic, finding a change in November and December 2020: namely, a significant fall in children’s health visits to pediatricians’ offices, and uptick in telehealth and virtual care encounters.

“Over November and December, the nation witnessed an unprecedented rise in COVID-19 cases. Coming on the heels of the holiday season, this COVID-19 surge affected nearly all states, exacerbating several challenges already facing care providers: treating patients exposed to the virus or infected by it; managing patients with non-COVID-19-related illnesses; keeping providers and staff healthy; and ensuring the financial viability of their practices,” the Fund’s report observed.

The Fund would have expected visits to increase in these colder winter months, calling out a drop in expected encounter levels from previous winter experience.

The growth of telehealth for behavioral and mental health is shown in the last chart from the Commonwealth Fund’s research. This 56% statistic is based on telemedicine visits (including both telephone audio and video visits) as a percentage of baseline.

Specifically, the researchers based this number on the final three nonholiday weeks of 2020 in the numerator, with the denominator as the number of visits in the baseline week of March 1st through 7th times 3. [This methodology is described in the Note beneath the bar chart)].

It has become quite clear that virtual care platforms have kicked on to meet patients’ and providers’ needs to meet up when the COVID-19 virus has spiked over the course of 2020.

In the context of hospitals’ falling finances for the past year, it is incumbent on many institutions in the sector to plan a future that’s omnichannel healthcare – a continuity-of-care strategy from home and community health to inpatient care when appropriate, and then back into the community for rehabilitation, self-care, and ongoing wellness.

For other hospitals, the solution may be to double-down on inpatient and critical care as a Center of Excellence, for a specific specialty or combinations that create synergies of care that can scale require capital investments and innovations.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...