When high-deductible health plans became part of health insurance design in America, they were lauded as giving patients “more skin in the game” of health care payments.

The theory behind consumer-directed care was that patients-as-consumers would shop around for care, morph into rational consumers of medical services just as they would do purchasing autos or washing machines, and shift the cost-curve of American health care ever downward.

That skin-in-the-game has been a risk factor for .some patients to postpone care as well as take on medical debt — the strongest predictor of which is dealing with multiple chronic conditions.

“The link between sickness and debt is a defining feature of American health care,” The Urban Institute has said based on its look into credit records and demographics of U.S. patients.

“U.S. counties with the highest share of residents with multiple chronic conditions, such as diabetes and heart disease, also tend to have the most medical debt. That makes illness a stronger predictor of medical debt than either poverty or insurance,” we learn from a detailed study asserting that 100 Million People in America Are Saddled With Health Care Debt, published in Kaiser Health News.

This research is part of a collaboration program called Diagnosis: Debt from Kaiser Health News (part of the Kaiser Family Foundation) and NPR. This round of research also includes data from The Urban Institute and the JPMorgan Chase Institute.

Noam Levey wrote the detailed analysis in KHN.

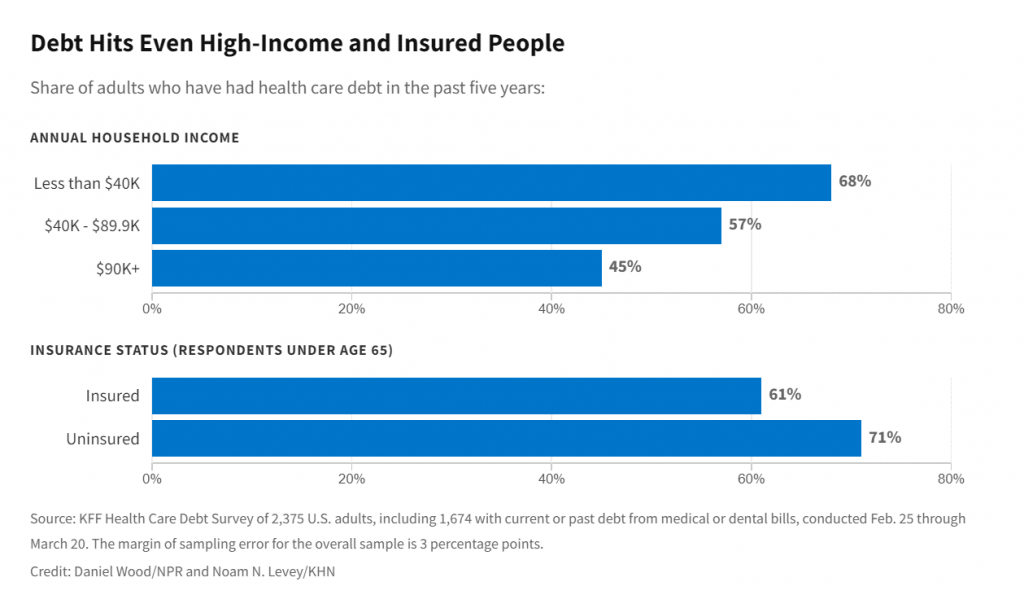

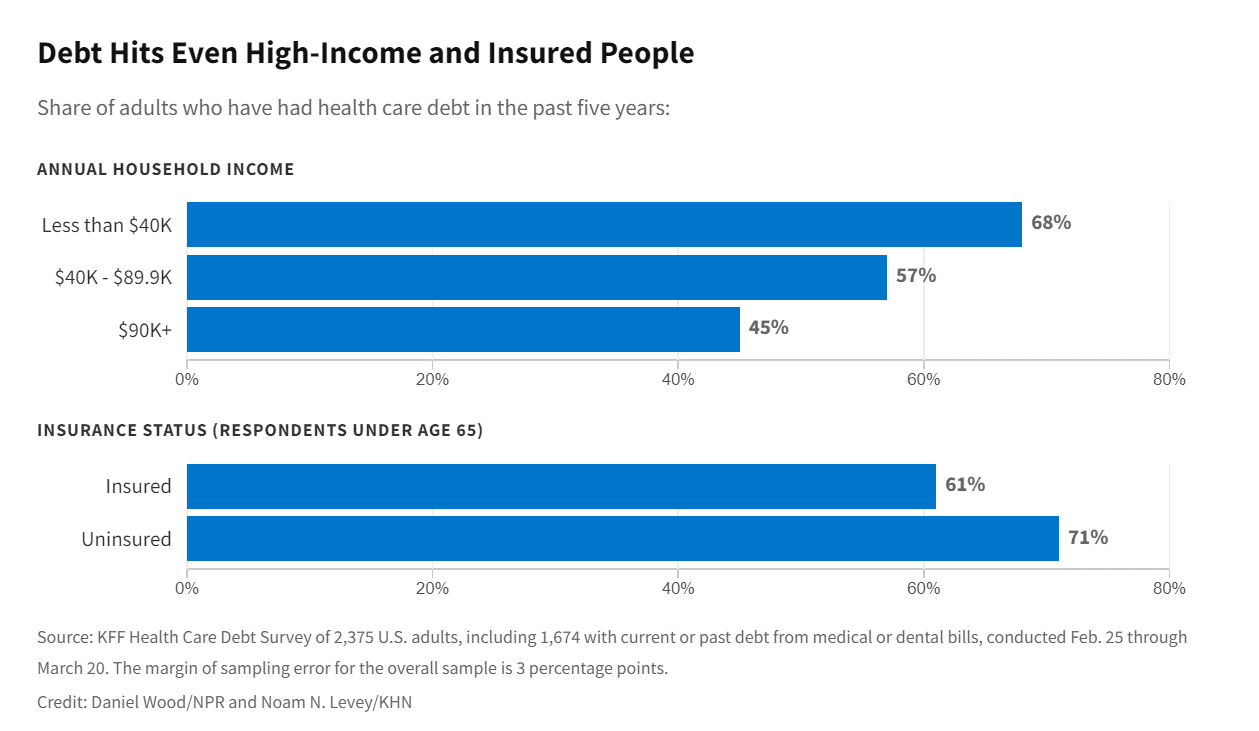

Note that nearly 1 in 2 of high-income Americans, earning at least $100,000 a year, had had health care debt in the past five years, shown in the first chart from the Kaiser Family Foundation Health Care Debt Survey.

Even with the passage and implementation of the Affordable Care Act in 2010, health care has turned out to be not-so-affordable nor accessible for U.S. health citizens.

“For many Americans, the law failed to live up to its promise of more affordable care,” Levey wrote in KHN. “Instead, they’ve faced thousands of dollars in bills as health insurers shifted costs onto patients through higher deductibles.”

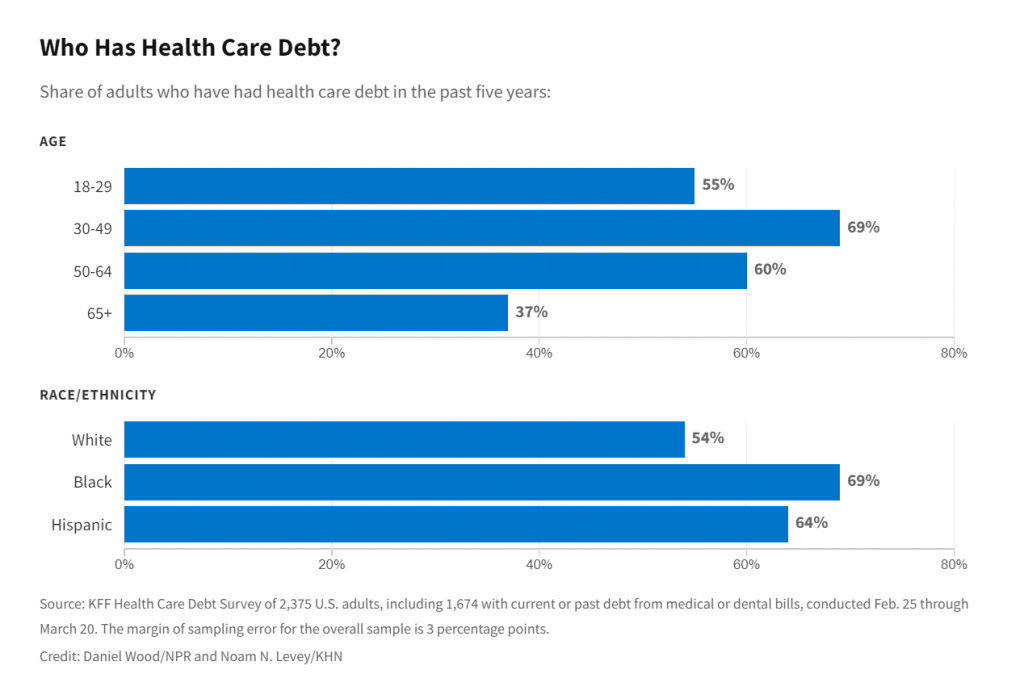

The KFF Survey wondered, “Who has health care debt?”

Medical debt crosses age groups and race/ethnicity: while two-thirds of people who are Black and Hispanic in American had medical debt in the past five years, over one-half of White patients did, too.

By age group, people 30 t0 49 years of age were more likely to have fallen into medical debt: think Sandwich-generation adults with children and aging parents, seriously financially stretched and stressed.

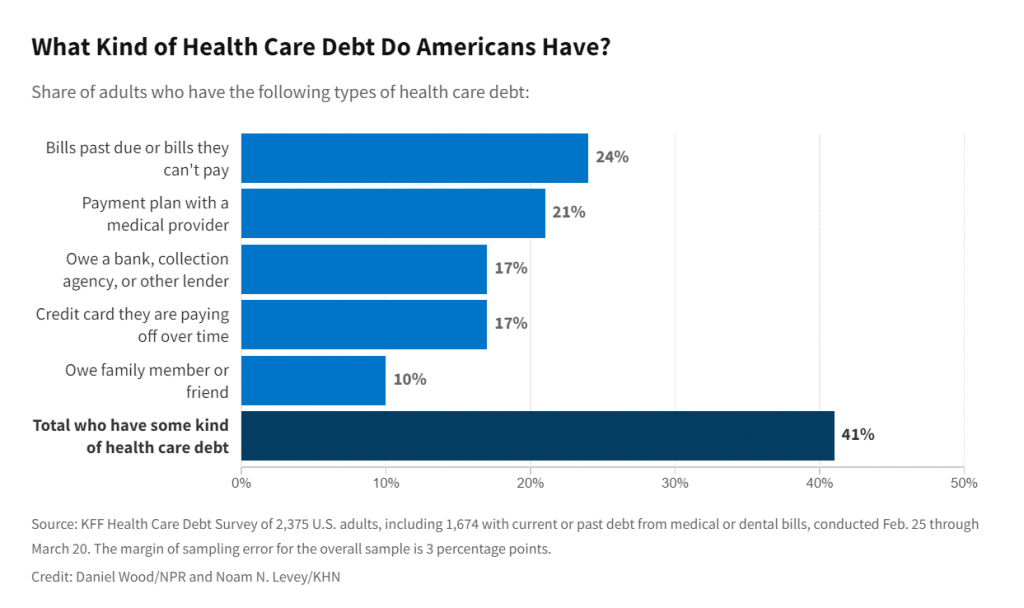

Here’s an additional detail showing the mainstream, Main Street nature of medical debt in the U.S.: in 2021, 58% of debts in collections were for a medical bill, according to the Consumer Financial Protection Bureau (almost 4x as many debts as telecomm bills, #2 in the list of most prevalent forms of debt in the U.S.). I explored the details of the CFPB study on medical debt here in Health Populi earlier this year.

The nature of medical debt can vary, most commonly being bills that are past due or that people can’t pay (24% of medical debt), payment plans with a provider (21%), owing a bank/collection agency/lender (17%), or paying off a credit card for the debt (17%). Furthermore, 10% of medical debt holders owe a family member or friend for a personal “medical loan.”

Health Populi’s Hot Points: Considering medical debt tops peoples’ phone bill debt and other forms of indebtedness in the U.S., we are faced with health citizens in America facing household spending crowded out with inflationary prices for food and energy, gas tank fills and college costs.

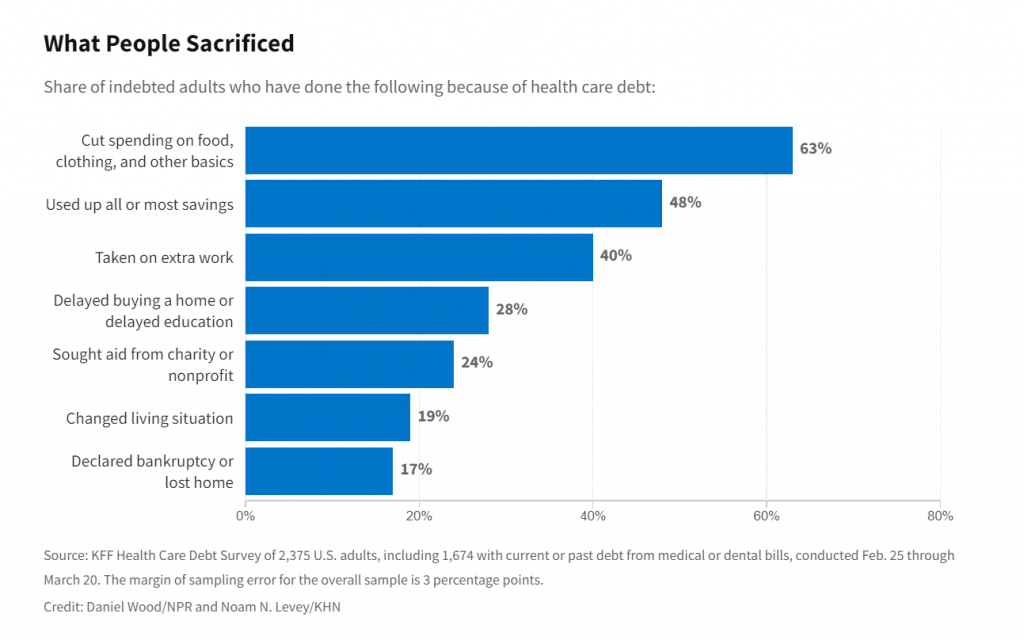

The last chart from the KHN-NPR research shows us what American patients have sacrificed due to health care debt, based on peoples’ responses as of February-March 2022.

The list of sacrifices ranked:

- Spending cuts on food, clothing, and other basic needs, among 63% of those with debt

- Using up most or all of savings, for 48% of those in debt

- Taking on extra work, 40%

- Delaying buying a home or education, 28%

- Seeking aid from charities or nonprofit organizations, by 24%, and

- Changing living situations for 19% of those in debt.

Finally, 17% of those in debt in America declared bankruptcy or lost their home.

I’ll be discussing the topic of patients-as-payers of medical bills with a team from GoodRx on Wednesday 22nd June at 2 pm EST in a live webcast. You can sign up to attend the session here, and learn more about the consumer in the current inflationary, post-pandemic era — and the context and implications for pharmaceuticals and medication adherence.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...