While venture funding for digital health technology declined globally by 35% in the first three quarters of 2022 compared with 2021, this marks a “return to normal” based on the assessment in the Global State of Digital Health Report from FINN Partners and Galen Growth, published today and launched during the HLTH 2022 conference.

The report analyzes data from over 12,000 digital health ventures tracked by Galen Growth’s HealthTech Alpha platform.

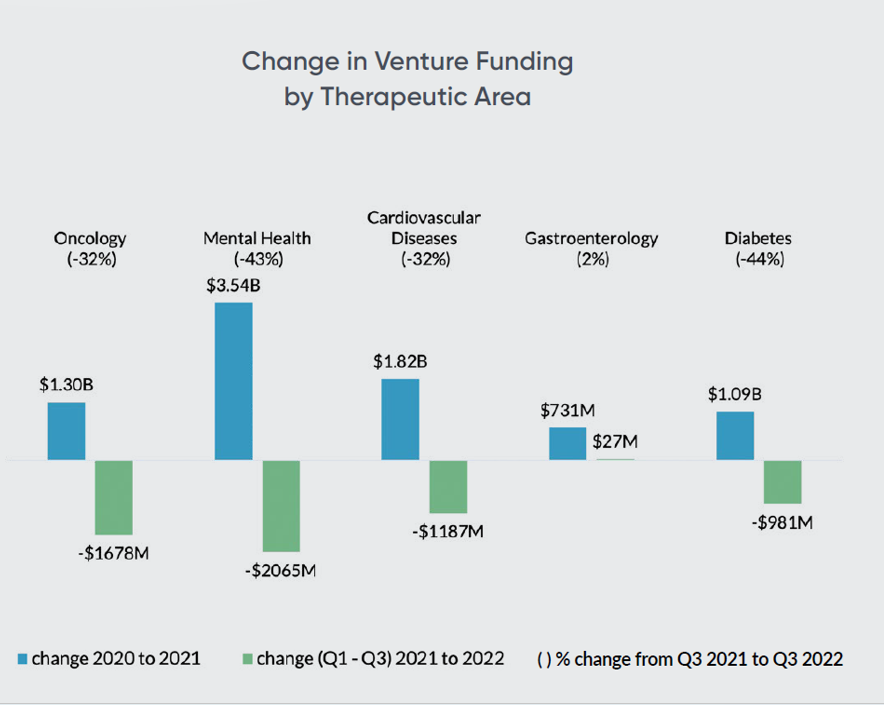

The first chart illustrates the change in venture funding by therapeutic area, showing downturns in four of the five areas called out except for gastroenterology.

Even with the 32% drop in oncology investments, the therapeutic area retains the top position for most-invested space, followed by mental health and cardiovascular disease investments.

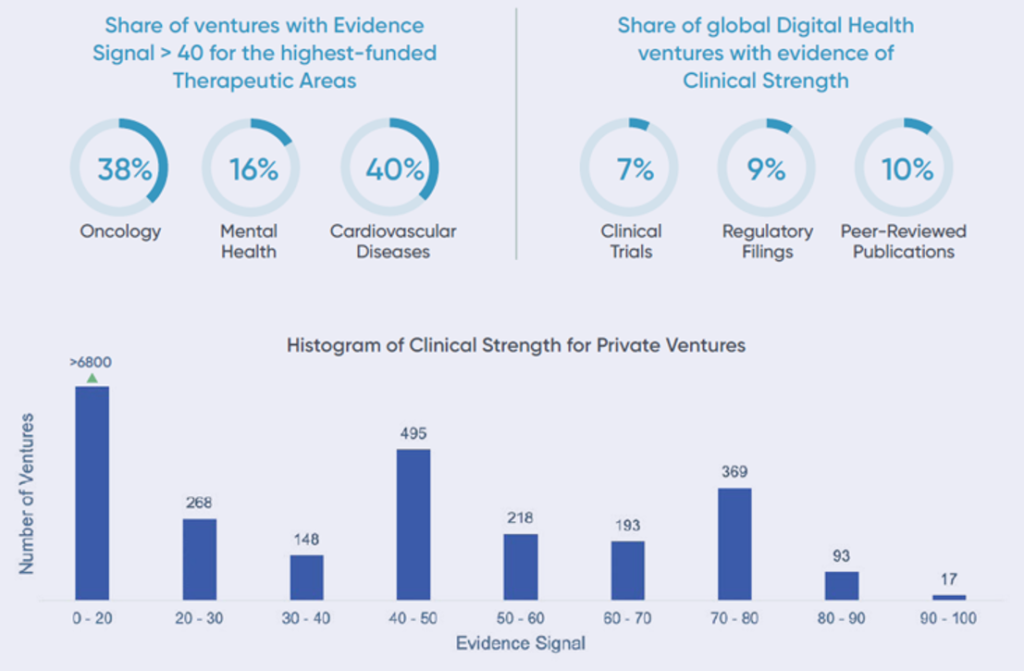

One of Galen Growth’s unique lenses in their ongoing research is their attention to the detail of the clinical evidence supporting digital health innovations. In Galen Growth’s methodology, evidence of clinical strength is based on the venture’s clinical trials, peer-reviewed publications, and regulatory filings.

The company’s recent report on Clinical Strength in Digital Health Evidence found that the growth of evidence for “clinical strength” was growing at a 5-year 40% compound annual growth rate — four-times the growth of new ventures.

The Global State of Digital Health report found that cardiovascular diseases ventures had the greatest share of ventures with a stronger evidence signal (40% of ventures), closely followed by oncology (38% of ventures). Only 16% of mental health ventures yielded evidence signals over 40, the benchmark shown in the second chart from the report.

The dramatically declining investment era for digital health has been accompanied by “slashing valuations for thousands of ventures,” in the words of the report.

Marta Gaia Zanchi’s quote shown here captures the current environment quite insightfully — beginning with her observation that, “2022 is shaping up to be a very long decade.”

What this next-normal for digital health requires is to understand that the investors in and users of the innovations will act “Missourian” in spirit — that is, they will adopt the position of “Show Me” the clinical evidence.

This quote from the report on Digital Health acting as “the bridge” notes that investment decisions must differentiate “entrepreneurial exuberance” from clinical effectiveness.

In 1996, Federal Reserve Chairman Alan Greenspan coined the term “irrational exuberance” to explain an over-valued stock market…which preceded the impending dot-com bubble.

“Entrepreneurial exuberance” used here feels just-right in where-we-are-now in the digital health economy.

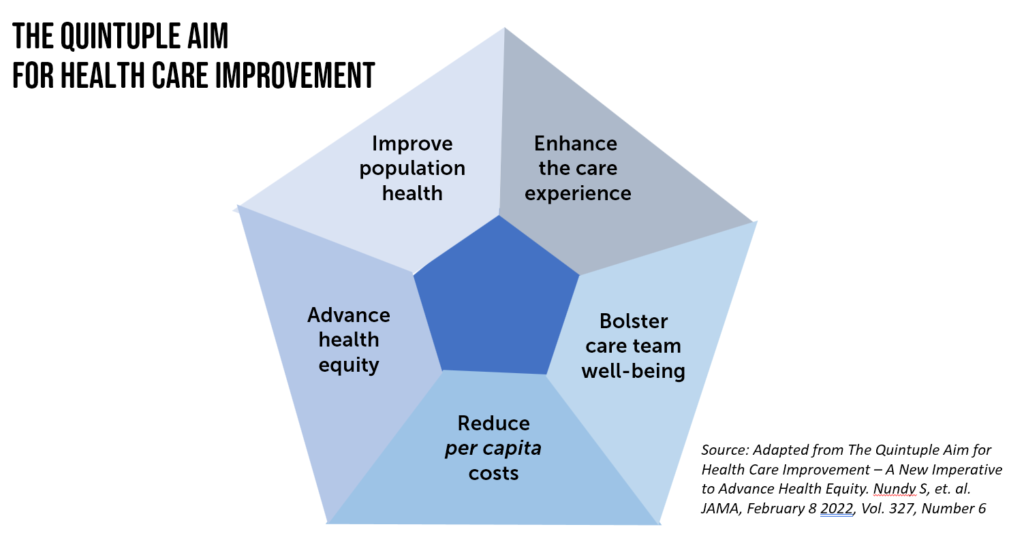

In a clinical excellence framework with more rationalized exuberance, the new-new digital health things should be underpinned by clinical evidence and excellence and — if they are very, very good things — they will address the Quintuple Aim by,

- Enhancing the care experience

- Driving health outcomes

- Reducing costs per capita (per patient)

- Supporting and bolstering clinicians’ well-being, and,

- Attending to the determinants of health to reduce health inequities and disparities.

As Dr. Nundy and colleagues who explained this new imperative of the Quintuple Aim in a February 2022 issue of JAMA concluded, “the pursuit of health equity ought to be elevated as the fifth aim for health care improvement, purposefully including with all improvement and innovation efforts a focus on individuals and communities who need them most.” They rightly point out that accelerating value-based payment in under-resourced communities would help align payment to greater social and medical needs.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...