In the past year, the growth of prescription drug utilization and spending has much to do with the use of GLP-1 agonists to treat diabetes and obesity, along with immunology therapy, and lipid meds, along with specialty medicines now accounting for over half of spending — up from 49% in 2018.

This update comes from The Use of Medicines in the U.S. 2024 from the IQVIA Institute for Human Data Science. The annual report details trends in health services utilization, the use of prescription drugs, patient financing of those costs, the drivers underpinning the medicines spending, and an outlook to 2028.

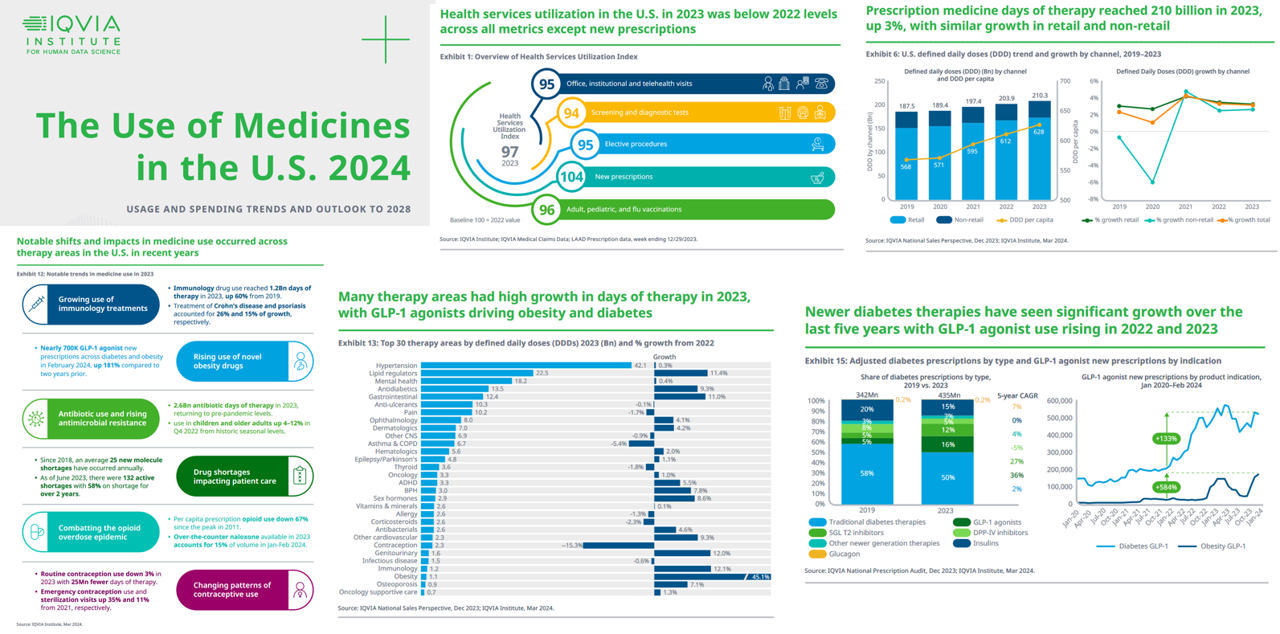

You’ll find 80 pages of Rx research goodness in the report, too many details for me to summarize in one HP post. I’ve pulled out five key exhibits that tell a story of how U.S. health care evolved in the past year, including IQVIA’s look to 2028: these trends include some under-utilization of services below expectations, growing prescription drug use, six key shifts across all therapeutic areas, the expanding demand for novel immunology medicine and decline in traditional contraceptives, and the phenomenal growth in adoption of the GLP-1 agonists.

1. Health services utilization in the U.S. is below 2022 levels for all aspects of care — except for new prescriptions written.

In the pandemic, IQVIA developed a useful index that looks across five types of health services utilization and tracks trends for each, with a composite overall score as a tool for comparison calculated to be 97 in 2023.

As the graphic illustrates, the index for new prescriptions in 2023 was 104, thus four points above the 100 mark. The other four types of utilization measured fell below the 100 line, including vaccinations at 96 (for adults, pediatrics, and flu); office, institutional and telehealth visits at 95; elective procedures at 95; and, screening and diagnostic tests the lowest at 94.

2. Prescription medicine days of therapy reached 210 billion in 2023, up 3%, with similar growth in retail and non-retail.

New and continuing chronic prescriptions were 3% to 4% greater in 2023 than pre-pandemic. While patients starting new therapies slowed in 2020, they are back up and new chronic Rx’s 4% over the expected 2023 baseline.

Acute Rx’s increased to 4% above 2019 (pre-pandemic) levels, in large part due to historic high levels seasonal respiratory illnesses as the pandemic emergency cooled.

By payor, prescriptions per enrollee-member increased fastest for Medicare, as volume grew three times faster than enrollment as members were using more prescriptions — about 35 per enrollee in 2023. By contrast, Medicaid enrollment declines in 2023 saw Rx’s per enrollee up from 9 prescriptions to 10 in 2023. In the commercial payment sector of health plans, the number of prescriptions per enrollee fell from 23 to 22.

3. Shifts and impacts in medicine across therapy areas in the U.S.

IQVIA notes six big shifts in medicines use in 2023:

- Growing use of immunology treatments up 60% from 2019 – with treatment of Crohn’s disease and psoriasis up 26% and 15%, respectively

- Rising use of novel obesity drugs which is the GLP-1 story I’ll relate to the next graphic, below.

- Antibiotic use and rising antimicrobial resistance, a return to pre-pandemic levels with use in children and older adults up in the past year.

- Drug shortages impacting patient care are a new-normal to deal with in U.S. health care, noting that as of June 2023 there were 132 active shortages — 58% of which were in shortage for over 2 years.

- Combatting the opioid overdose epidemic has some good news emerging from the medicines sector, with per capita prescribing of opioids down 67% since its apex in 2011. And,

- Changing patterns of contraceptive use show routine contraception utilization down by 3% in 2023, and at the same time, emergency contraception use and sterilization visits up 35% and 11%, respectively. [What percent of these changes were due to the post-Dobbs SCOTUS decision and State-level policy decisions, we do not yet know].

4. Many therapy areas had high growth in days of therapy in 2023 led by GLP-1 agonists driving obesity and diabetes.

As the bar chart clearly tells us from the 3rd line on the bottom of the graph, obesity leads the top 30 therapy areas by growth from 2022. For defined daily doses, the league table leads with hypertension, followed by lipid regulators, mental health, anti-diabetics, GI and pain.

In addition to obesity therapy (discussed next), immunology medicine use grew substantially in the past year as IQVIA observed more patients across a broader range of autoimmune and inflammatory diseases gained access to new medicines.

The largest decline in medicines, looking at the left-shift categories in the chart in dark blue, was contraception — falling 15%. IQVIA found that more traditional forms of contraception declined in use with on-demand and permanent surgical options expanding — “partially offsetting the need for routine contraception,” IQVIA notes. This includes men taking steps with procedures like vasectomies.

5. Newer diabetes therapies, notably the GLP-1s, saw “significant growth” in 2023.

This year, one of the most critical thinkers about statistics and life, Professor Scott Galloway, offered his forecast for 2024 including a major tea-leaf reading that the GLP-1 agonists would be a more impactful trend in 2024 than Gen AI would be.

And here we see in IQVIA’s two charts the declining share of traditional diabetes therapies with growing new prescriptions for GLP-1 agonists — a 5% share in 2019 and a 16% share in 2023. The 5-year compound annual growth rate for this group of medicines was 36% compared with 2% for the traditional diabetes therapies.

The right-hand line chart illustrates the hockey-stick growth of GLP-1 for both diabetes (on the top lighter blue line) and for obesity (the lower dark blue line). The inflection point for this growth curve was in early 2022 for diabetes and in October 2022 for obesity.

The 2028 Forecast

The bubble chart illustrates net Rx medicines spending growth for leading therapeutic areas, expected to grow between 4 and 7%.

Oncology and obesity will drive significant growth through 2028, IQVIA expects. Oncology is the largest aggregate contributor to net growth in this forecast, with oncology spending reaching $187 bn by 2028. Growth from biosimilars in oncology will slow that growth in the latter part of the forecast toward 2028.

The wild card-to-uncertainty about GLP-1 meds growth will be reimbursement: spending will continue to accelerate “with upside if more widely reimbursed,” IQVIA projects.

Health Populi’s Hot Points: If we didn’t talk about patient-facing costs for medicines, you wouldn’t be on the Health Populi blog. So let’s look at IQVIA’s observations on patient out-of-pocket costs from the 2024 report, with these observations:

- Out-of-pocket costs grew $6 bn in 2023 overall, with most increases in retail drugs consuming a larger share of all payers’ net spending than in 2022.

- Drug companies’ co-pay assistance programs offset patient costs by $23 bn in 2023.

- One-third of branded commercial Rx’s used savings programs in the top 1- therapy areas — obesity topping that list with 63% of Rx’s utilizing copay cards, as shown in the bubble chart here (see obesity in the upper right quadrant).

- Note that more than 92% of prescriptions in the U.S. had final out-of-pocket costs below $20. On the other end of the OOP Rx spectrum, 1% of prescriptions in the U.A. had OOP costs over $125.

- Over one-half of new prescriptions for novel/new medicines go unfilled, and only 31% of patients stayed on-therapy for one year. s

To the wild-card/uncertainty about reimbursement for GLP-1s, Axios posted this story yesterday on Hims & Hers’ stock price — spiking way up to $18.60 as the Yahoo Finance chart graphs.

Barron’s characterized the announcement that the company would offering weight-loss injections for as low as $199 a month via its telehealth platform as Hims “taking on Big Pharma with cheap obesity shots.”

Those “cheap shots” will run about one-seventh of the list price of Novo Nordisk’s Wegovy which is priced about $1,349 a month.

How can Hims & Hers compete at the low price of $199? Because the GLP-1 drugs are in an official drug shortage situation, and Hims can create a compounded version with the same active ingredients as Wegovy and Ozempic. The FDA does not test compounded drugs for efficacy or safety, but allows companies to produce them if there is a shortage of FDA-approved versions of the product.

With some patients lacking health plan approval to get a break on the branded pharmaceutical products, the Hims & Hers plan might be attractive to patients to access lower-cost versions of these popular prescription medicines.

Please visit the full IQVIA paper to understand many more aspects of the prescription drugs market in America in 2024. The handful of slides I curated for this post tell one of many important stories about U.S. healthcare this year and may suggest that it’s all about GLP-1s this year. Like Professor Galloway, five months into this year, I concur that GLP-1s are playing a role at re-shaping not just American health care, but society as well.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...