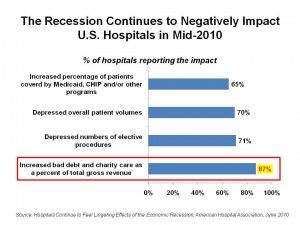

Bad debt and charity care as a proportion of hospitals’ total gross revenue increased for 9 in 10 hospitals in the U.S. according to the American Hospital Association’s press release, Hospitals Continue to Feel Lingering Effects of the Economic Recession.

Today’s macroeconomic news that U.S. economic growth slowed in the first quarter of 2010 doesn’t bode well for hospitals or for patients, for whom the so-called “jobless recovery” in the nation creates financial insecurity and, more specifically, health care insecurity.

Hospitals’ other negative economic impacts include depressed numbers of elective procedures (suffered by 72% of U.S. hospitals), depressed overall patient volumes (felt by 70% of hospitals), and increased percentage of patients covered by Medicaid, CHIP and/or other programs (reported by 65% of hospitals).

3 in 4 hospitals, therefore, report reduced operating margins, and one-half have seen falling non-operating income from investments, as individual Americans have also experienced.

Finally, 44% of hospitals say they have less access to capital. This phenomenon results in nearly all hospitals not restoring cut services/programs, 89% not adding back staff or increasing hours, and 67% not starting or finishing up capital projects. Overall, 73% of hospitals have delayed capital investments.

Health Populi’s Hot Points: The AHA survey is important news for anyone concerned about the state of the U.S. economy overall — not just that for the hospital sector of the nation. That’s because U.S. hospitals generated $2 trillion (with a ‘t’) worth of economy activity in the country in 2008, and provide over 5.3 million jobs — the second-largest source of private sector jobs.

Furthermore, the economic impact of hospitals in their communities has a ripple effect on other jobs locally, as hospitals support nearly 1 in 9 jobs in America.

Beyond the jobs-impact — which is significant in and of itself — consider the direct impact on hospital operations, programs and innovation. Lack of access to capital means that institutions cannot bring on new technology and services that are coming onto the market — from new-new digital imaging modalities and personalized medicine developments, to adding needed staff in specialties and expanding primary care networks. These innovations will be important as 30+ million Americans receive health insurance coverage via PPACA. Coverage does not equal access: if there isn’t sufficient capacity to absorb newly-insured patients, then PPACA won’t meet its objectives.

Furthermore, the AHA points out that hospitals will also be expanding their use of electronic health records (EHRs) to be able to benefit from financial incentives from ARRA stimulus funds included in the HITECH Act. With 44% of hospitals reporting a decreased access to capital, hospitals with large proportions of patients funded by Medicare and Medicaid (with lower reimbursements per patient than commercial payers provide) could have trouble buying into the very incentive program their Medicare and Medicaid participation enables them to participate in.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...