Cost-competitiveness is driving overall consumer satisfaction with pharmacies in 2010, 2.5 times the importance that cost had in 2009. But even so, customer service and convenience still trump price in the pharmacy.

Cost-competitiveness is driving overall consumer satisfaction with pharmacies in 2010, 2.5 times the importance that cost had in 2009. But even so, customer service and convenience still trump price in the pharmacy.

For brick-and-mortar pharmacies, the key factors driving consumer satisfaction are:

- Prescription order and pick-up process (convenience)

- The condition of the store

- Cost competitiveness

- Non-pharmacist staff

- The pharmacist.

In 2010, cost competitiveness accounts for 24% of overall satisfaction among brick-and-mortar Rx shoppers; that number was 9% in 2009.

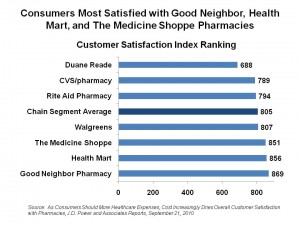

The retail pharmacy chains garnering highest satisfaction nationally are the Good Neighbor Pharmacy, Health Mart, and The Medicine Shoppe Pharmacy, all awarded J.D. Power’s 5 circles in their “Power Circle Ratings” among consumers. Walgreens, the next most popular chain, garnered only 3 circles, average for the Rx chain segment.

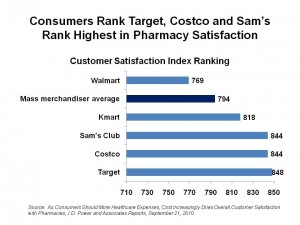

Among mass merchandisers, the Rx customer satisfaction winners are Target, Costco, and Sam’s Club, all winning five circles in J.D. Power’s scoring. This is Target’s fourth consecutive year in the top spot among the mass retailers. Interestingly, Sam’s Club’s sister store, Walmart pharmacy, scored the lowest among the mass merchandisers, with only 2 circles.

Among mass merchandisers, the Rx customer satisfaction winners are Target, Costco, and Sam’s Club, all winning five circles in J.D. Power’s scoring. This is Target’s fourth consecutive year in the top spot among the mass retailers. Interestingly, Sam’s Club’s sister store, Walmart pharmacy, scored the lowest among the mass merchandisers, with only 2 circles.

In addition to analyzing bricks-and-mortar stores, J.D. Power looked at mail order, and increasingly popular channel for Rx distribution especially for chronic care medications. Kaiser Permanente Pharmacy won the top spot among mail order competitors, followed by Express Scripts and Humana RightSourceRx. The behemoth Medco ranked below the average for the segment.

J.D. Power, the expert on consumer satisfaction surveys, published this fourth annual U.S. National Pharmacy Study released September 21, 2010. The survey was conducted among 12,300 customers who filled a new prescription or refilled an Rx in May-June 2010.

Health Populi’s Hot Points: Health consumers face increasing co-payments, coinsurance, deductibles and premium sharing for health care in 2010 and will confront more out-of-pocket outlays in 2011 based on benefit consultants projections for next year. As employers and plan sponsors allocate more financial responsibility for health to consumers, these purchasers are looking at price — finding some relief in purchasing generic prescription drugs, which mail order pharmacy channels bank on. However, when it comes to consumers buying prescription drugs through retail pharmacies, whether chain or mass merchandiser/Big Box store, they’re looking at both cost and service. While cost is quickly increasing as a key driving force for pharmacy satisfaction, consumers are also looking for more services from the pharmacy and pharmacist. The pharmacy and trained staff (both pharmacist and non-pharmacist) are becoming a key touchpoint for health consumers in the U.S. Target, Costco and Sam’s Club are well-positioned to leverage this role when it comes to service and convenience. Walmart will have to work harder on that score, beyond the price-satisfaction the chain no doubt provides customers.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.