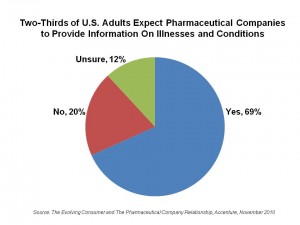

While two-thirds of American adults use the internet (including social media) to seek health information, only 11% use a pharmaceutical company website most often. It is intriguing that 2 in 3 adults who seek information about health care online are looking for information on illnesses and conditions from a pharmaceutical company. But the pharma company website isn’t the top-of-mind, go-to place. In fact, 2/3 of health citizens whose households use prescription drugs say their trust in medications is not heavily influenced by advertising by pharmaceutical companies.

While two-thirds of American adults use the internet (including social media) to seek health information, only 11% use a pharmaceutical company website most often. It is intriguing that 2 in 3 adults who seek information about health care online are looking for information on illnesses and conditions from a pharmaceutical company. But the pharma company website isn’t the top-of-mind, go-to place. In fact, 2/3 of health citizens whose households use prescription drugs say their trust in medications is not heavily influenced by advertising by pharmaceutical companies.

These insights into the new pharmaceutical consumer come out of The Evolving Consumer and The Pharmaceutical Company Relationship, a survey from Accenture published November 2010.

It isn’t like pharma companies haven’t been spending money on Rx promotion: direct-to-consumer spending by pharmaceutical companies reached about $5 billion in 2008, according to the Congressional Budget Office study published in December 2009.

But the impact of this spending on health consumers appears to be eroding: only 28% of health information seekers ask their doctor about a drug after seeing an ad (whether in print, radio, internet, or TV). And only one-half say they’ve an increased awareness of symptoms and treatments via pharma advertising. One-half of the health information seekers find pharma advertiisng “helpful,” with 37% finding it “confusing,” Accenture discovered.

One area of medicine consumption that continues to gain traction is consumers’ use of generic drugs. One-half of consumers in the survey see no difference between brands and generics; one-quarter perceive a difference.

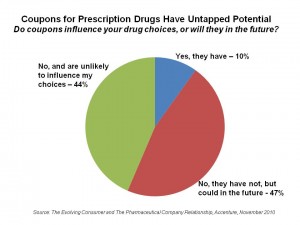

One common promotional tactic in pharma is the use of coupons: however, 48% of consumers who are in prescription drug-using households have not seen any Rx coupons. 39% have seen them but not used them, and only 13% have used them.

Accenture conducted this survey in August-September 2010 among 852 U.S. adults. Someone within the respondent’s household was currently taking prescription medications.

Health Populi’s Hot Points: In the post-recession shopping environment, value is part of American households’ spending paradigms. Accenture found that 46% of drug consuming householders agree that branded prescription drugs are “luxury purchases.”

Health Populi’s Hot Points: In the post-recession shopping environment, value is part of American households’ spending paradigms. Accenture found that 46% of drug consuming householders agree that branded prescription drugs are “luxury purchases.”

Consumers have adopted couponing as a household financial management strategy in big numbers. Coupon use is up – 5% up for print coupons, 25% increase for electronic, and 100% lift for social coupons (such as BuyWithMe, eWinWin, and Groupon), according to the Altimeter Group.

Here’s an opportunity for pharmaceutical companies to leverage in the current low-trust, low-value for branded pharma environment: while only 13% of health consumers say they’ve used coupons for purchasing prescription drugs, nearly 50% say they have seen, not used them, but would be open to doing so in the future, illustrated by the second pie chart.

The new pharmaceutical consumer is as value-conscious in health as she is in other aspects of her life, post-recession. She is looking for information on health issues from pharmaceutical companies, but isn’t tapping into pharma company websites first. Between creating usable, engaging content (unbranded, in this case), coupled with compelling purchasing programs that promote value in both the purchase (price) along with consumption (with educational programs and online and mobile tools for health management), the pharma industry can respond to patients’ demands for health engagement.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.