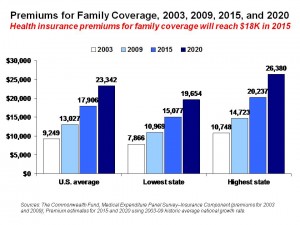

As household incomes in the U.S. have been, at best, stagnating in the past several years, the cost of health insurance premiums rose three times faster between 2003 and 2009. By 2015, the average premium for a family of four will reach nearly $18,000, according to The Commonwealth Fund.

As household incomes in the U.S. have been, at best, stagnating in the past several years, the cost of health insurance premiums rose three times faster between 2003 and 2009. By 2015, the average premium for a family of four will reach nearly $18,000, according to The Commonwealth Fund.

State Trends in Premiums and Deductibles, 2003-2009: How Building on the Affordable Care Act Will Help Stem the Tide of Rising Costs and Eroding Benefits from the Fund calculates that deductibles per insured person in the U.S. increased an average of 77% between 2003-09.

In a related analysis, the Fund forecasts the impacts of the Affordable Care Act (health reform) on people between 50 and 64 years of age. This cohort has experienced the highest rates of long-term unemployment in the U.S. 8.6 million Americans in this age group don’t have health insurance. The Commonwealth Fund forecasts that most of these people will benefit from the implementation of the ACA, immediately and in 2014 when additional people will gain access to health plans. The Fund notes that 1 in 2 uninsured women in this age cohort haven’t had a mammogram in the past two years. Furthermore, 7 in 10 un- and under-insured Boomers have problems dealing with medical bills and mounting medical debt.

Health Populi’s Hot Points: The American Dream has traditionally been defined as working to buy a house and a secure future for one’s family. The American Dream for the 2010s is working for secure health care. Health consumes and ever-increasing portion of household income.

Many news stories published this week, at the end of 2010, are focusing on the imminent retirement age of Baby Boomers turning 65: “Baby Boomers to Hit Retirement Age Short on Savings,” says the Boston Herald. “Baby Boomers Face Retirement Crisis,” according to WMTW in Portland. “Stay on the job, Boomer,” recommends the New York Post. And, a survey from the Marist College Institute for Public Opinion finds that 71% of Americans believe people should work beyond retirement age.

Taken together, The Commonwealth Fund’s analyses point out one of the positive impacts of health reform: that as Boomers must work longer to bolster incomes and savings, they will need access to health plans that cover preventive care and keep out-of-pocket costs at a manageable level for people who have under-saved and postponed seeing a doctor, getting necessary tests, and engaging in preventive diagnostics.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.