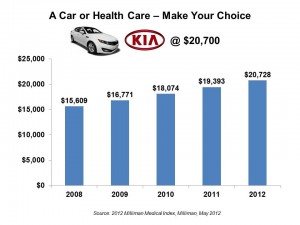

The saying goes, “you pays your money and you makes your choice.” In 2012, if you have a bolus of $20,700 to spend, you can choose between a health plan for a family of four, or a sedan for the same family.

That’s the calculation from the actuaries at Milliman, whose annual Milliman Medical Index is the go-to analysis on health care costs for a family of four covered by a preferred provider organization plan (PPO). While the 6.9% annual average cost increase is lower than the 7.3% in 2011, it is nonetheless, a record $1,335 real dollar increase at a rate that’s exactly 3 times the rate of inflation (Consumer Price Index, at 2.3% April 2011-April 2012).

The employee’s share of cost grew 7.2%, greater than last year’s trend of 6.9% year on year. This increase should be kept in the context that workers’ average wages grew about 2.6% in 2011. Most health economists agree that wage growth has not kept pace with health care cost increases; where wages have gone up, they have largely been eaten up by health costs borne by employees, and then some.

In 2012, the employee contribution will total 42% of the health plan cost, comprising $5,114 contribution to health insurance and $3,470 out-of-pocket costs. This is separate from other health arrangements such as health savings accounts which would add to the employee’s OOP burden.

Milliman’s key takeaways for the 2012 MMI are that:

- Outpatient health care cost increases grew at under 9%, lower than the past four years. Still, outpatient costs have the highest rate of increase compared to other components of health care. comprising $3,699 in costs.

- Hospital inpatient care costs per day grew 7.6%. This is the largest cost component coupled with physician care. Hospital costs are $6,531 worth of health spending for a family of four on average.

- Pharmacy costs grew 7.3%, moderating (relatively) due to growing availability of generic Rx substitutes. However, watch for specialty drug costs to drive spending upward going forward. Pharmacy costs account for $3,056 in spending for a family of four in 2012.

- Physician costs grew 5% in the year, accounting for $6,647 worth of health spending for the family.

Health Populi’s Hot Points: I wrote about the rough equivalency between health plan costs and cars here in Health Populi in May 2011. Thanks, Milliman, for picking up on my auto price metaphor (you can’t ring the Detroit roots out of this girl).

Health Populi’s Hot Points: I wrote about the rough equivalency between health plan costs and cars here in Health Populi in May 2011. Thanks, Milliman, for picking up on my auto price metaphor (you can’t ring the Detroit roots out of this girl).

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...