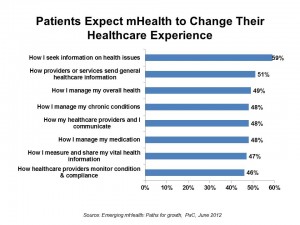

Half of patients globally expect that mobile health will improve health care. These health citizens expect that mobile health will help them manage their overall health, chronic conditions, how they manage their medications and measure and share their vital health information. Welcome to the new mobile health world, a picture captured in PwC’s report, Emerging mHealth: Paths for growth, published in June 2012 and written by the Economist Intelligence Unit.

Half of patients globally expect that mobile health will improve health care. These health citizens expect that mobile health will help them manage their overall health, chronic conditions, how they manage their medications and measure and share their vital health information. Welcome to the new mobile health world, a picture captured in PwC’s report, Emerging mHealth: Paths for growth, published in June 2012 and written by the Economist Intelligence Unit.

Patients’ views on mHealth are bullish, and while most doctors and payors share that vision, they also expect mHealth to come into focus more slowly, recognizing the institutional, cultural and technological barriers preventing robust implementation of mobile health programs — especially in developed countries where entrenched resources and incentives already drive workflows and payment. Ultimately, it’s not the technology that’s keeping mHealth adoption back.

That’s why PwC says to watch the emerging markets as trailblazers in mobile health, like India, developing Asia and in many countries in South America.

For patients, mHealth means greater consumer control and a migration away from physician-directed care. Patients’ views on mHealth focus on beneficial impacts on personal convenience, cost and quality of health care. 44% say the use of the mobile phone in health will help them monitor wellness such as weight, diet and exercise, and 43% look for better contact with their healthcare provider. Another 42% say accessing call centers, advice lines and emergency services define mHealth.

For physicians, mHealth represents a different, more challenging and potentially less desirable paradigm: only 27% of doctors told the EIU/PwC that they encourage patients to use mHealth applications to be more active in managing their health. 42% of doctors said that mHealth will make patients “too independent.” Even younger doctors are worried about the potential for patient independence, PwC writes.

Still, “necessity is the mother of adoption in mHealth,” PwC observes, and this is most true in developing nations with very limited and stressed healthcare resources. There the search for quality and efficiency are key incentives for doctors to adopt mHealth. And payors in these countries are keen to align payment for adopting mHealth tools that help get expertise to patients living far from urban medical centers and experts.

Ultimately PwC identifies six factors for success in mHealth:

- Interoperability, where devices share data with other applications — especially, electronic health records

- Integration, with the mHealth tools seamlessly fitting into existing workflows

- Intelligence, offering problem-solving tools in real-time for informing and nudging patients’ behaviors

- Socialization, allowing stakeholders to share advice, support, recommendations

- Outcomes, measured to prove ROI in terms of cost, access and quality

- Engagement, where patients are engagement in health and value and respond to feedback based on data shared in the mHealth ecosystem.

Methodology: the Economist Intelligence Unit conducted surveys in ten countries including Brazil, China, Denmark, Germany, India, South Africa, Spain, Turkey, the UK and the US. 1,027 patients were interviewed about mHealth, along with 433 doctors and 345 health executives in these countries.

Health Populi’s Hot Points: A quote from Steinar Pedersen, CEO of Tromsø Telemedicine Consult (TTC), offers a crystal-clear view on what’s holding up mHealth adoption, pointing out that we’re in the hype cycle stage right now: “You have a research environment that products papers, a business environment that products expectations, and a healthcare environment that creates healthcare. So far they have not met. This will happen, but how long it will take I’m not sure.”

Patients are the additional, central element that counter the physician force in mHealth: the difference between them “is the center of the battlefield” over mHealth, according to Steinar Pedersen of TTC. This is a shifting balance of power, with payors encouraging patients to become more engaged in their health care through the use of mHealth applications. Doctors see the most promise in receiving data to monitor patients and using mHealth tools to help drug adherence and health-related communications. For payors, new plans for mHealth include medical professionals receiving data as part of patient monitoring and drug-adherence, along with video consults, patient access of medical records, and analysis of health and wellness data gathered by patients’ own mobile devices (such as FitBit’s, WiThings devices, and the like). There isn’t a huge gap between doctors and payors seen in these data.

But for patients vis-a-vis the health care ecosystem, there are a couple of chasms: first, it’s their desire for self-management and control; second, there’s a greater awareness of mHealth technology and services in emerging countries versus developed ones. 59% of patients in emerging markets are using at least one mHealth application or service, compared with 35% in the developed world. And there are greater expectations for mHealth in the developing compared with the developed world.

The report concludes with the sobering reality that even when patients adopt mHealth tools, there is a high drop-out rate where behaviors are not sustained over time. 61% of patients surveyed by the EIU said they discontinued using mHealth services within six months, and 70% stopped using the devices that automatically sent data to health providers.

So as much as 50% of patients might “say” they want to use mHealth services, the follow-up questions must be: “Why?” and “For how long?” Understanding what value patients directly derive from mHealth services, along with getting their input into designing the tools, will help them sustain their use of mHealth and get to better health.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.