Two in 3 employees (62%) can’t estimate how much their employers spend on health benefits. Of those who could estimate the number (which is, on average, about $12,000 according to the 2012 Milliman Medical Index), most weren’t very confident in their guess. Some 23% calculated the monthly spend by employers was less than $500 a month — less than 50% the actual contribution.

Two in 3 employees (62%) can’t estimate how much their employers spend on health benefits. Of those who could estimate the number (which is, on average, about $12,000 according to the 2012 Milliman Medical Index), most weren’t very confident in their guess. Some 23% calculated the monthly spend by employers was less than $500 a month — less than 50% the actual contribution.

Thus, most U.S. health consumers don’t fully value the amount of cash their employers spend on their health care, according to a poll from the National Business Group on Health, Perceptions of Health Benefits in a Recovering Economy: a Survey of Employees.

Beyond this math, insured workers aren’t confident in their ability to shop for any insurance on their own. To them, ability to buy a plan on a health insurance exchange is not a welcome scenario.

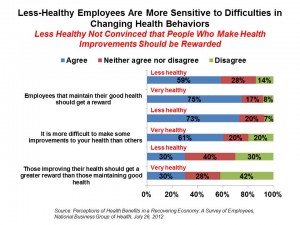

While wellness programs are generally valued by employees, less healthy workers are very sensitive to their ability to change health behaviors, as the chart illustrates. 75% of very healthy workers believe that employees that maintain good health should receive a reward, compared with 59% of less healthy workers. Employees generally oppose linking the cost of their health plan to wellness program participation or improved health, the survey says. The key data point here is that over 80% of insured employees believe in offering a financial reward to employees that meet specific health goals — but only 29% believe in charging employees more for health coverage if they don’t meet health goals.

NBGH polled 1,545 consumer respondents who had health insurance through their employer or union, worked with a large company (at least 2,000 employees), were involved in health decisions in their homes, and were between ages 22 and 69.

Health Populi’s Hot Points: The health insurance marketplace is moving in the direction away from patriarchal defined benefit to more defined contribution, consumer-facing and -responsible high-deductible health plans. As workers are paying more out-of-pocket already, they’re still not getting more health plan or health finance literate.

Still, 64% of workers say that the health benefit is the most important benefit provided by employers, based on the survey result. A distant second is the retirement plan, cited as #1 by 21% of workers.

Workers continue to highly prize the health benefit. Employers must educate employees in the subject of Health Plan 101, communicating (in an engaging way) the value of the benefit, how to best use it — especially in terms of high-deductible plans and how prevention and early diagnosis can save resources over the long haul. There is growing evidence that health consumers aren’t rationally using HDHPs and CDHPs, forgoing necessary care to ‘save’ funds.

As NBGH recommends, “Employers also need to make a case for the importance of wellness programs and lifestyle changes and how poor health not only hurts the people directly affected but also drives up everyone’s costs, making care increasingly unaffordable.”

It takes a village to bend the cost curve, and the employee-health consumer plays a starring role, via health engagement.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.