While most players in health care see potential ROI through investing in health informatics, there’s a supply-side problem in the market in two ways: a labor shortage of health IT talent, and a dearth of clean and comprehensive data needed for specific objectives. Even with sufficient budgets, health care providers, plans, and pharma companies say, these two limiting factors prevent fully realizing the promise of health data.

Deloitte and AMIA polled health providers, plans and life science companies on the state of informatics in health care, the results of which are summarized in The 2012 Deloitte-AMIA Health Informatics Industry Maturity Survey. This is the first year that Deloitte and AMIA have worked together on this survey.

For purposes of this study, Deloitte defines health informatics as a field that, “studies and uses health information, computing and communication technologies, encompassing computer, health, cognitive, social and management sciences for the effective organization, analysis, management, and use of information in health-related processes.”

It’s health informatics that enables the data gathered in electronic health records to be made liquid and useful.

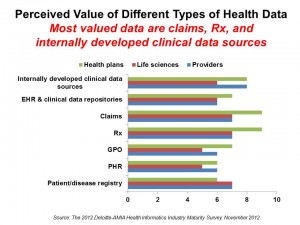

The most valuable types of data across the three health industry groups are internally developed clinical data, claims data, and prescription data. Health plans are most keen on claims and Rx data; providers on internally developed clinical data sources; and life science companies, claims, Rx, and patient and disease registry data, as shown in the graph.

Deloitte-AMIA surveyed 97 organizations including 73 providers, 17 life science companies (8 pharma, 4 medical device/tech, 5 “mixed”), and 7 health plans (all HMOs) between February and April 2012.

Health Populi’s Hot Points: Although they are traditionally bastions of clinical trial data, life science companies are less mature compared with providers and health plans when it comes to an overall health informatics strategy and vision — and less open to sources of external data that could be useful for patient-centered care and clinical research.

The high value placed on external data sources is an important finding in this study. There are many novel sources generating patient-level data in the health ecosystem, and new opportunities to creatively analyze this information for the benefit of both individual patients and large public health purposes. Health data, both Big and “small,” benefit from investments in health informatics. But the lack of sufficient trained workers to deal with health data is an obstacle requiring greater attention and resource. That hospitals in particular believe they’re sufficiently resources for health informatics is a market dis-connect: health providers are competing with banks and other (non-health) industry sectors for this talent pool. Were wages and benefits sufficiently high to attract these workers away from other sectors, then health care would have access to them. On the academia side of the supply side equation, too, more training programs are popping up at universities beyond community colleges. In the past year, health informatics programs have emerged at Northeastern in Boston, Temple University, and Drexel University, among many others.

If you have health-oriented students in your social and familial circles, and they have a bent toward IT, do discuss this emerging field with them. It will represent a full-employment act for some time.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...