With U.S. health consumers spending $45 billion out-of-pocket for prescription drugs in 2011, pharmaceutical products are morphing into retail health products.

As such, as they do with any other consumer good, consumers can vote with their feet by walking away from a product purchase or making the spend based on the price of the product and its attributes, along with whether there are substitutes available in the marketplace.

When it comes to prescription drugs, it’s not as clear-cut, according to the Centers for Disease Control‘s analysis of data from the 2011 National Health Interview Survey titled Strategies Used by Adults to Reduce Their Prescription Drug Costs, an NCHS Data Brief.

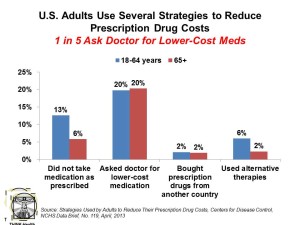

1 in 5 consumers ask doctors for cheaper meds, as shown in the chart. 13% of people under 65 don’t take their Rx as prescribed, and 6% use alternative therapies. These forms of self-rationing away from the more expensive branded Rx are more pronounced among people under 65 except for asking doctors for lower-priced medications — with 1 in 5 older people doing this as well as those under 65.

Thus, the presence of Medicare Part D prescription drug coverage doesn’t mitigate that behavior for the same percentage of older Americans.

Underneath these trends, 11% of people under 65 delayed filling a prescription, 9% took less of the medicine than prescribed, and 8% skipped doses to save money.

The kind of insurance a consumer has influences their Rx self-rationing behavior. 19% of people with commercial insurance ask for lower-cost meds, versus 15% on Medicaid and 24% of the uninsured. 9% of privately-insured people didn’t take a prescription as directed, compared with 14% of those on Medicaid and 23% of the uninsured. 12% of the uninsured use alternative therapies compared with 4% of those with commercial insurance and 5% of people on Medicaid.

Only 2% of U.S. adults self-import prescription drugs.

Health Populi’s Hot Points: This is another wake-up call for branded pharmaceutical manufacturers, and all bio/life science companies, to understand that after FDA approval, prescription drug formulary inclusion, and physician-prescriber acceptance, there’s a fourth hurdle of concern: the patient, who makes the final decision as the ‘real’ consumer of the drug.

With 1 in 5 asking physicians to recommend a lower-cost medication, it’s not just generics that are being suggested. For someone being recommended a statin, for example, a physician/prescriber may refer the patient to red yeast rice, from which high cholesterol managing patients may benefit with sustained use. Or, the doctor will recommend a period of trying out diet and exercise, enabling a patient with a mobile health app or two to track daily behaviors such as calorie-counting and exercise.

Pharmaceutical companies who don’t pay attention to increasingly-engaged consumers put themselves at further risk of alienating the end-users of their products. Consumers’ role in medication must be considered along the value-chain, from initial evaluation of portfolio strategies ruling new research ‘in’ or ‘out’ for R&D, through FDA approval processes, commercialization, marketing, and promotional strategy development. The consumer’s impact may vary depending on the condition at every point in this value-chain — but the fact remains that the patient is wielding growing power as a retail health consumer at the end of this value chain. The life science company that can figure out the consumer nuance throughout the chain will benefit from such engagement, beyond the pill.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...