Consumers who are well-covered by health insurance are in favor of talking about costs with their doctors. This research finding illustrates the fact that price transparency in health care isn’t just the concern of un- and under-insured people, but that shining the light on the price of health care is everybody’s business.

Consumers who are well-covered by health insurance are in favor of talking about costs with their doctors. This research finding illustrates the fact that price transparency in health care isn’t just the concern of un- and under-insured people, but that shining the light on the price of health care is everybody’s business.

But it’s also the case that most physicians aren’t yet involved in these health-financial conversations with their patients.

Two studies presented at the recent 2013 annual meeting of the American Society of Clinical Oncology (ASCO) learned that patients are keen to know more about health care costs from their doctors. One study, by Dr. Zafar et. al., looked into 300 patients with cancer with an average out-of-pocket spend of $592 per month, 17% of whom said that level of spending cause “overwhelming” financial distress on their family. The other paper, from Drs. Rajguru and Cetnar et. al., learned that even the best-insured patients wanted to engage in a cost discussion even though they may not be responsible for the ultimate payment for the care. “Patients do want to consider value even if they will not directly bear the cost,” Dr. Cetnar said.

Further spotlighting the growing role of transparency in health, HealthSparq held a webinar in November 2013, The Healthcare Transparency Revolution: How the Call for Greater Cost and Quality Transparency will Affect Health Insurance Plans. Kicking off the session with the big statistic that $36 billion in costs could be saved annually if consumers had more transparent access to the price of health care (via a Thomson Reuters study published in 2012), HealthSparq talked about several types of transparency tool capabilities emerging in the market, including:

- Patient reviews

- Cost estimators

- Provider search

- Patient communities.

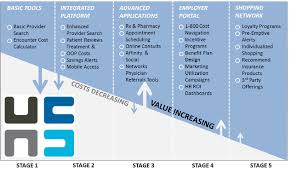

The adoption of transparency in health care will happen in phases, which HealthSparq seeing staged as illustrated in the diagram. In the earliest wave of transparency, consumes are offered basic provider search and an encounter cost calculator – generally available to most health plan members in the current market. The second stage of transparency adoption adds in patient reviews, savings alerts, and mobile access. While mobile access is fast-growing, patient reviews are available in places like Angie’s List and Yelp, but there aren’t standardized places for patients to opine on treatment yet. More advanced tools are available in Stages 3, 4 and 5, like appointment scheduling and online clinical consults (Stage 3), and more granular applications further in the evolutionary path toward full transparency.

Based on HealthSparq’s survey with Cicero, the applications health plans expect to implement soon beyond provider search are mobile access (36%) and out-of-pocket cost calculators (33%). Patient reviews are least-popular, with 56% of health plans with “no plans” to implement peoples’ reviews of health providers and services.

Health Populi’s Hot Points: If one thing is clear from the seven weeks that have passed since the launch of the Health Insurance Exchanges, it’s that people who seek to engage with the health system via online tools are getting more savvy as online consumers: they have moved up their learning curves through other vertical markets engaged in on a daily basis, and most especially retail from purveyors from A to Z (think: Amazon to Zappos).

To that point, health care needs to learn from these companies in terms of user-centered design, engagement and price transparency.

These retailers are also darn good at providing personalized shopping experiences. But health plans told HealthSparq personalized shopping is nowhere near the top of evolving toward transparency tools. In fact, it’s the least likely feature to be implemented with 55% of plans saying they have “no plans” to implement personalized shopping.

So the retailization of health care won’t happen anytime soon — at least from mainstream health insurance plans. This gives an opportunity to younger plans, like Oscar in New York, to leapfrog ahead of more established plans to attract people who want this level of service and retail experience.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful.

I'm in amazing company here with other #digitalhealth innovators, thinkers and doers. Thank you to Cristian Cortez Fernandez and Zallud for this recognition; I'm grateful. Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.

Jane was named as a member of the AHIP 2024 Advisory Board, joining some valued colleagues to prepare for the challenges and opportunities facing health plans, systems, and other industry stakeholders.  Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.

Join Jane at AHIP's annual meeting in Las Vegas: I'll be speaking, moderating a panel, and providing thought leadership on health consumers and bolstering equity, empowerment, and self-care.