“The surge in HDHP enrollment is causing patients to become consumers of healthcare,” begins a report documenting the rise of patients making more payments to health providers. Patients’ payments to providers have increased 72% since 2011. And, 78% of providers mail paper statements to patients to collect what they’re owed.

“The surge in HDHP enrollment is causing patients to become consumers of healthcare,” begins a report documenting the rise of patients making more payments to health providers. Patients’ payments to providers have increased 72% since 2011. And, 78% of providers mail paper statements to patients to collect what they’re owed.

“HDHPs” are high-deductible health plans, the growing thing in health insurance for consumers now faced with paying for health care first out-of-pocket before their health plan coverage kicks in.

And those health consumers’ expectations for convenience in payment methods is causing dissatisfaction, negatively affecting these individuals and their health providers’ bottom lines. But if providers adopt more streamlined, retail-type payment modes that consumers experience in other buying situations, the practice can become more efficient, lower administrative costs and collections, and improve patient satisfaction.

This report, Trends in Healthcare Payments, Fourth Annual Report: 2013, was published by InstaMed in April 2014. InstaMed is a health payments network, processing billions of health care payments a year for over 1500 hospitals, 60,000 practices, and works with over 3,000 payers. So the company is the middle-man connecting patients transacting payments with providers and analyzed data from over $85 billion worth of healthcare payments in their network, processed between 2011 and 2013. InstaMed also gauged 100,000 health providers’ feelings about these transactions, mostly medical practices and clinics, and other providers in ambulatory surgery and physical therapy, among others.

This report, Trends in Healthcare Payments, Fourth Annual Report: 2013, was published by InstaMed in April 2014. InstaMed is a health payments network, processing billions of health care payments a year for over 1500 hospitals, 60,000 practices, and works with over 3,000 payers. So the company is the middle-man connecting patients transacting payments with providers and analyzed data from over $85 billion worth of healthcare payments in their network, processed between 2011 and 2013. InstaMed also gauged 100,000 health providers’ feelings about these transactions, mostly medical practices and clinics, and other providers in ambulatory surgery and physical therapy, among others.

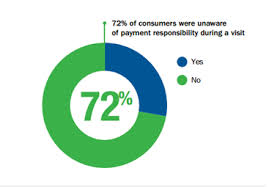

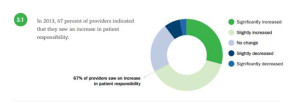

Total annual transactions for payment plans increased by 284% between 2011 to 2013. As patients’ payment burden continues to grow, they are looking for ways to budget health care costs through paying over time, and especially, automating that payment as people do with other monthly bills. Furthermore, 72% of patients don’t know what their payment responsibility is during a visit, as the first graphic shows.

Total annual transactions for payment plans increased by 284% between 2011 to 2013. As patients’ payment burden continues to grow, they are looking for ways to budget health care costs through paying over time, and especially, automating that payment as people do with other monthly bills. Furthermore, 72% of patients don’t know what their payment responsibility is during a visit, as the first graphic shows.

Tools are evolving to help consumers gain more control and transparency over these responsibilities. The PokitDok platform, for example, enables consumers looking for health services a marketplace to search which helps people first identify a provider in their area delivering that sought-for service, and then serves up a mutually-agreed upon price between the consumer and the provider. This service can be used in concert with insurance or via cash payments, which can fetch discounts with providers who receive payment through PokitDok. Here’s an entertaining video that explains this innovative tool:

Another tool that helps patients pay for services in a modern mode is Wellero. Consumers can download the Wellero app for free (currently available on Apple or Google operating systems) and payers and providers can link with Wellero to enable consumer payments via the platform. Wellero works with Cambia Health Solutions, the Blue Cross and Blue Shield brand covering the Pacific Northwest/Intermountain region. Through Wellero, a consumer can find a doctor in-network who’s part of her insurance plan; receive an invoice at the point-of-care for all services received; see how much of the cost the insurance company will cover; get a discounted cash price if paying on the day of service; and process the payment via the mobile phone app. Wellero plans to expand to other health insurance companies and continues to expand providers accepting payment via the consumer app.

Another tool that helps patients pay for services in a modern mode is Wellero. Consumers can download the Wellero app for free (currently available on Apple or Google operating systems) and payers and providers can link with Wellero to enable consumer payments via the platform. Wellero works with Cambia Health Solutions, the Blue Cross and Blue Shield brand covering the Pacific Northwest/Intermountain region. Through Wellero, a consumer can find a doctor in-network who’s part of her insurance plan; receive an invoice at the point-of-care for all services received; see how much of the cost the insurance company will cover; get a discounted cash price if paying on the day of service; and process the payment via the mobile phone app. Wellero plans to expand to other health insurance companies and continues to expand providers accepting payment via the consumer app.

Health Populi’s Hot Points: Early in my career, I participated in ANSI data standards meetings to help drive consensus toward electronic data interchange in health care. As a health economist and long-time advisor to the U.S. Healthcare Efficiency Index project, managed by CAQH, I advocate for mass adoption of digital payments by payers and providers to drive paper out of U.S. health care and build a 21st century health system. Yet there are still providers who expect to receive paper checks from payers, and payers who continue to cut those checks. This week, Aetna moved toward pressing all providers to accept electronic payments.

Most consumers, though, don’t write checks anymore: 79% of U.S. consumers pay bills online. And, 79% of consumers would also like to transact payments on their payers’ and providers’ websites, according to InstaMed’s research.

As InstaMed writes at the start of their report, patients are becoming consumers. If consumers are to pay out-of-pocket, they will expect to transact with a modernized health system.

PokitDok and Wellero join a growing roster of companies looking to fill in the gaps for consumers seeking a positive retail experience with health care. There are many others taking advantage of this expanding opportunity. Tomorrow’s Health Populi will round up this week’s Season of Healthcare Transparency theme with prospects for the next 1-3 years: chaos, and creation.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...