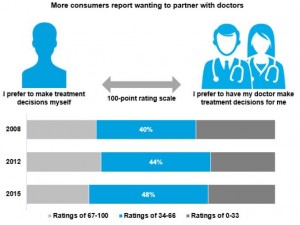

A growing desire for shared decision making with doctors. Increasing trust and consumption of health care information online, in social media, and report cards. Reliance on technology for monitoring health adn wellness, and medical conditions. Together, these three signals converge, illustrating a growing sense of consumer engagement among U.S. patients, found in the 2015 Deloitte Center for Health Solutions Survey of US Health Care Consumers.

In Deloitte’s research summary, the title states that “No ‘one-size-fits-all’ approach” will work, given diversity among American health consumers. The sickest health consumers, Deloitte notes, have higher levels of health engagement and index higher on the 3 signals.

Deloitte describes consumer health engagement across five dimensions:

- Taking steps to monitor and improve personal health

- Looking for information to learn about health concerns and treatments

- Taking cost and quality into consideration

- Partnering with doctors for shared decision making

- Adhering to recommended treatment (say, medication adherence).

It’s no surprise that higher income consumers are more health-engaged compared with lower-income consumers, and younger consumers are also health-engaged.

Although Deloitte finds growing consumer engagement, the pace of change is slow-going. There are factors that could turbocharge change, Deloitte expects: getting more personalized with patients through “layering and tailoring” information and tools for specific consumer segments, for example.

But just offering technology isn’t enough to “move the needle” on health engagement, Deloitte says. There are other factors and offerings that help consumers embrace health care, such as marketing, customer service, and technical support.

A few of the most interesting findings are that:

- Use of doctors’ websites and portals has grown, but health plans sites are more utilized

- 33% of consumers use technologies allowing them to access health data from the health system (such as portals)

- 21% of consumers overall are using social media for health (37% of Millennials)

- 1 in 4 consumers has looked at a healthcare scorecard, again with younger people using performance indicators cmpared with 12% of seniors

- The search for cost information is growing, especially among the young (about 1 in 4 people)

- Most people are keen to communicate electronically with doctors, but few have done so. Among all types of electronic communications, the highest use has been with secure messaging, texting, or email with 21% of patient-cosumers having done so.

Health Populi’s Hot Points: While the signs of growth among consumers engaging in health are clear, they’re slow-moving and not translating for every one in the same way. People managing chronic conditions will, naturally, have different health and wellness priorities than folks who haven’t spent much time within the healthcare industrial complex, the traditional health system of hospitals, doctors, and pharmacies (as consumers of prescription drugs).

It’s the issue of cost that unites 58% of U.S. consumers, among the largest majorities across issues measured in this report — where 58% of consumers feel doctors should provide and explain the total cost of a treatment, procedure, or test before decisions are made. That’s health economic shared decision making, going beyond simple tratment decisions. Here, consumers are calling on doctors to be their health-financial counselors as well as their clinical consultants.

That data point illustrates that it’s not just consumers who are growing new muscles in the value-driven, high-deductible health payment environment; physicians, too, will be stretching, and challenged to respond to consumers’ financial questions. As I wrote here in a recent Health Populi post, consumers are looking to doctors to play the role of health economists.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...