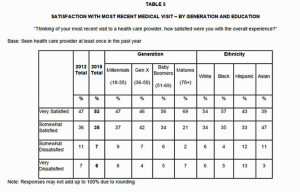

9 in 10 adults in the U.S. have visited a doctor’s office in the past year, and over half of these patients have been very satisfied with the visit; 35% have been “somewhat” satisfied.

Being a highly-satisfied patient depends on how old you are: if you’re 70 or older, two-thirds of people are the most satisfied. Millennial or Gen X? Less than half.

What underlies patient satisfaction across generations is the fact that younger people tend to compare their health care experience to other retail experiences, like visiting a bank, staying at a hotel, or shopping in a department store.

These insights come from the Harris Poll conducted in September 2015, and discussed in its press release, Satisfaction with Doctor Visits on the Rise.

The rankings of consumers’ retail experiences compared with health care experiences rank as follows, in terms of the percent of consumers satisfied (NET = “very satisfied” + “somewhat satisfied”):

- Last visit to a restaurant = 91%

- Last online purchase = 89%

- Last visit to department store = 88%

- Most recent visit to health care provider = 88%

- Last visit to a bank = 87%

- Last stay at a hotel = 78%

- Last car purchase = 76%

- Last interaction with health insurance company = 63%

- Last visit to mobile phone store = 59%

A variety of factors bolster consumer satisfaction with visits to health care providers. These experience factors include doctor’s overall knowledge, training and expertise, attested by 83% of patients. In second place, must lower, is the doctor’s ability to access your overall medical history, with 65% of consumers. Time spent with the doctor is cited by 58% of patients, followed by ease of making an appointment (49%), efficient and simple billing process (45%), ability to communicate with the doctor outside of the appointment by phone or email (44%), time spent in the waiting room (43%), convenient location (40%), minimized paperwork (32%), and appearance and atmosphere of the doctor’s office (31%).

Not surprisingly, the value placed on each of these traits varies by generation: Millennials seek greater conveniences like easier billing processes, appearance of the office, and time spent in the waiting room. Matures (70 and over) more likely seek doctor’s ability to access the medical history, time spent with the doctor, and the doctor’s overall knowledge and expertise.

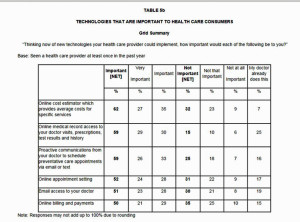

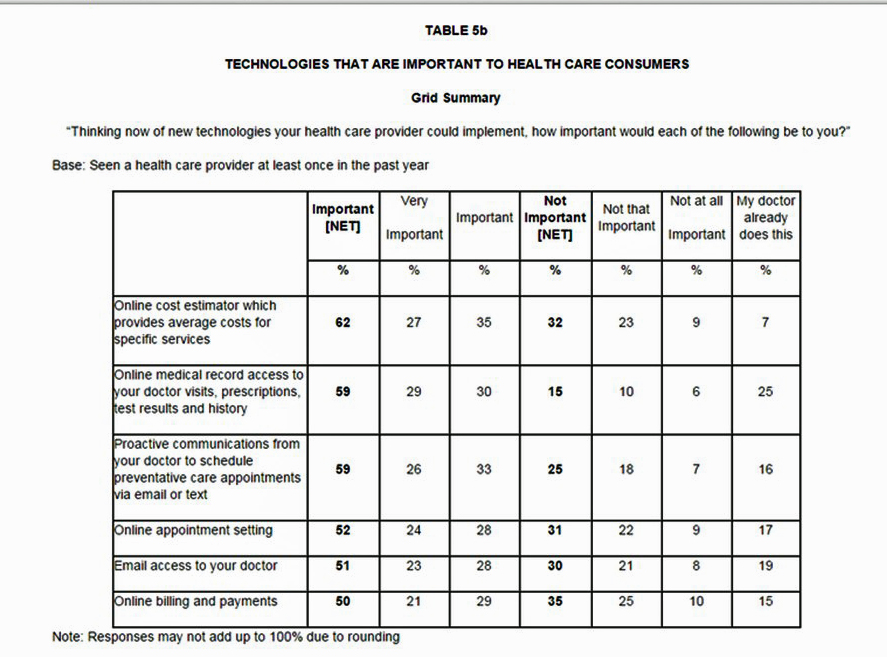

At least one-half of all health care consumers are looking for technologies that help them with administrative and financial aspects of the doctor’s visit. These include online cost estimators which give the patient an idea of the cost for services ahead of time (valued by 62% of people); online medical record access (for 59%), proactive communications from the doctor to schedule preventive care, via email or text (59%); online appointment scheduling (52%); email access with the doctor (51%); and online billing and payments (50%). Again, these tech-demands vary by generation, with majorities of people under 50 looking for all the tools to be available. For the Matures, over 70, the most desired tech tools are access to online medical records and proactive communications from the doctor for preventive reminders.

Consumers are now interested in new options for healthcare services in shopping environments, and Harris polled various services offered in retail health settings. The most likely services consumer would use were getting flu shots, visiting with cold or flu symptoms, caring for a cut or puncture wound, examining a rash, all noted by at least 50% of consumers. By generation, Matures would most likely go retail for flu shots, and Millennials for every service offered in retail.

Health Populi’s Hot Points: The so-called consumer-directed health plan era (CDHP) ushered in health insurance programs where plan members were exposed to more financial skin-in-the-game in the form of greater out-of-pocket costs and premium share. The latest iteration of CDHPs are high-deductible health plans, most often coupled with health savings accounts. The theory underneath this plan design was that, in the past, third-party payment shielded consumers from behaving as “consumers” — that is, shopping for the “best” health care in their community in terms of value (price and quality). However, in the early phase of CDHP adoption, people have been prone to self-ration care — delaying recommended tests, needed physician visits, postponing medication refills, splitting pills when not instructed by prescribers, and avoiding dental visits.

But in 2016, we see plan members beginning to mature as health consumers, shopping around especially for new retail health formats that share characteristics with other retail experiences, both offline (say in slick coffee shops, helpful department stores, and value-priced Big Box self-serve settings) and online (need I utter the one word: “Amazon?”). [As an aside, here’s a great smart take on Amazon being the new single largest search engine for all-things-shopping].

The Harris Poll’s finding that, across generations, retail clinics and shopping venues are now seen as a viable alternative settings to the traditional physician visit makes this point. Under value-based health care payment for providers, more of them should welcome collaborations in these convenient, lower-cost settings, ensuring quality and privacy/security of peoples’ personal health information.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors.

Interviewed live on BNN Bloomberg (Canada) on the market for GLP-1 drugs for weight loss and their impact on both the health care system and consumer goods and services -- notably, food, nutrition, retail health, gyms, and other sectors. Thank you, Feedspot, for

Thank you, Feedspot, for  As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...

As you may know, I have been splitting work- and living-time between the U.S. and the E.U., most recently living in and working from Brussels. In the month of September 2024, I'll be splitting time between London and other parts of the U.K., and Italy where I'll be working with clients on consumer health, self-care and home care focused on food-as-medicine, digital health, business and scenario planning for the future...